Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

There’s been some decent volatility in March. The S&P 500 was down quite a brutal 5.75%.

People have been fretting over their KiwiSaver or managed funds. Yes, if you’re in a growth fund with global shares (which in this part of the world typically means plenty of the big US positions), you’ll have seen that come back…

Source: Google Finance

We have held up well in comparison. (Down 0.79% in March).

Our value focus means we don’t have a lot of exposure to US tech. Our view that this was due for a correction has finally been vindicated. Meanwhile, European and Australian property is looking attractive.

Volatility, of course, provides opportunity. We think the tariff worries are overdone and oversold. We covered this in some detail last week.

For clients with available funds, you will have seen us take positions when the market went dark. Monday 31st was a particularly black day. We were able to lock in some great value!

One question I do get is this:

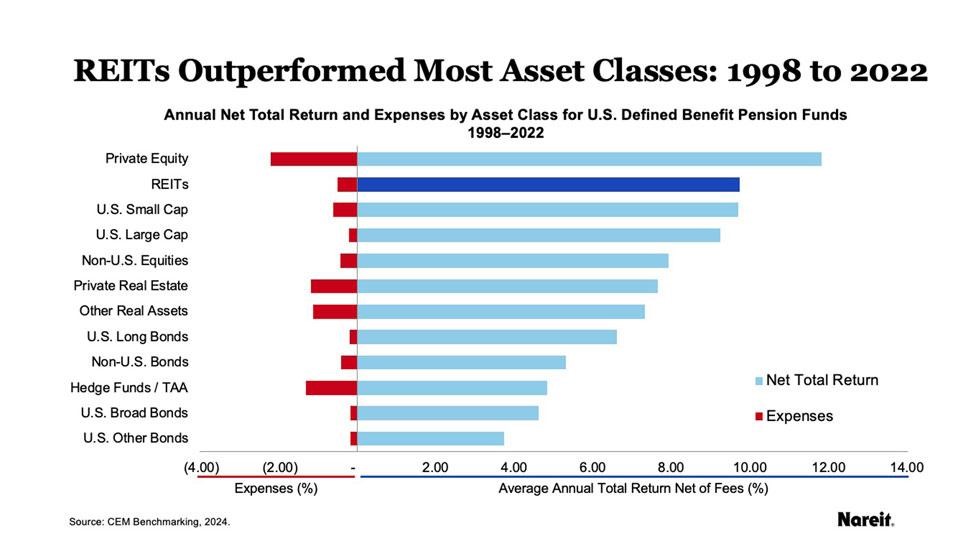

‘Why do you like to allocate quite significantly to listed property companies on the sharemarket with real assets?’

Well, this is a straightforward part of our analysis. We can see interest rates continuing to moderate eventually. We can see quality. And we can still see some value, well below replacement cost.

For patient investors, REITs (real estate investment trusts) can perform very well:

Source: Nareit

Managed Account performance*

For the month of March 2025, we were down 0.79% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Since the start of this year, we are now up 5.36%.

Our average annualised return since inception is 12.66% p.a.

Please see our performance chart for more details.

Benchmarking

Our MSCI EAFE benchmark was down 0.90%.

As mentioned, we are now considering the MSCI World benchmark to take into account our growing US proportion. This benchmark is now 73% US.

The MSCI World benchmark was down 2.58%.

Our blended MSCI EAFE/World benchmark was down 1.24%.

Don’t be afraid of volatility

It allows us to capture value for the long run.

Volatility (especially in March) is quite normal. A rough March often signals a very favourable April.

There are also record levels of investment flowing into the US. The upside of tariffs, which the media has yet to mention, will also be record tax income for further investment or pay down of debt.

Many analysts still see the US outperforming and leading global growth later this year. Though there will be initial shocks as trading partners continue to adjust to a new sheriff in town.

It’s a fine time to deploy cash for long-run wealth.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

Our Exclusive Managed Account Service

Our Exclusive Managed Account Service

Secure Your Place on Our Waiting List Today

Secure Your Place on Our Waiting List Today

Subscribe Now

Subscribe Now Login

Login Quantum Wealth

Quantum Wealth

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.