Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

There is no elevator to success; you have to take the stairs.

—Zig Ziglar

Trump is moving with deft alacrity to re-centre the global world order.

The pearl-clutchers are struggling to keep up with their outrage.

At this trading desk, we’re pleasantly surprised.

Source: The Babylon Bee / X

Beware of an old man in a hurry? Yes, but in this case, his reforms are helping markets move swiftly upstairs. The US is home to the world’s best innovation. It could be about to unleash that like never before.

To date, our global focus has concentrated on Europe, Australia, and to a lesser extent the US. We’re value-hunters. The US is expensive and yields are lower. (New Zealand FIF tax residents tend to like good dividends).

Yet if businesses are able to grow at a much faster clip, this changes the equation.

America is about to wield an axe to crippling regulations and taxes. That axe hasn’t been this sharp for a generation.

Further, our persistent research is revealing there are still pockets of value in the US. Assets that offer capital upside with income.

Clients with available funds will have already seen the start of these allocations added to their portfolios.

It seems we’re not alone in our renewed interest in America:

Source: The Australian / X

Of course, a mercurial leader like Trump also means volatility.

With the threat of tariffs, and the upending of trade patterns, this also creates opportunity. In particular, we have deployed in a very high-yield bargain industrial in South America, amongst other opportunities.

Meanwhile, a cut to the ECB interest rate (as expected) continues to propel growth in our real-estate positions. Europe could start its own transformation process as America inspires change. If so, we could see those markets well in double-digit growth.

We are still waiting for Australia to turn, but also remain confident in the Lucky Country’s ability to renew and transform. Especially following a likely change of government in May.

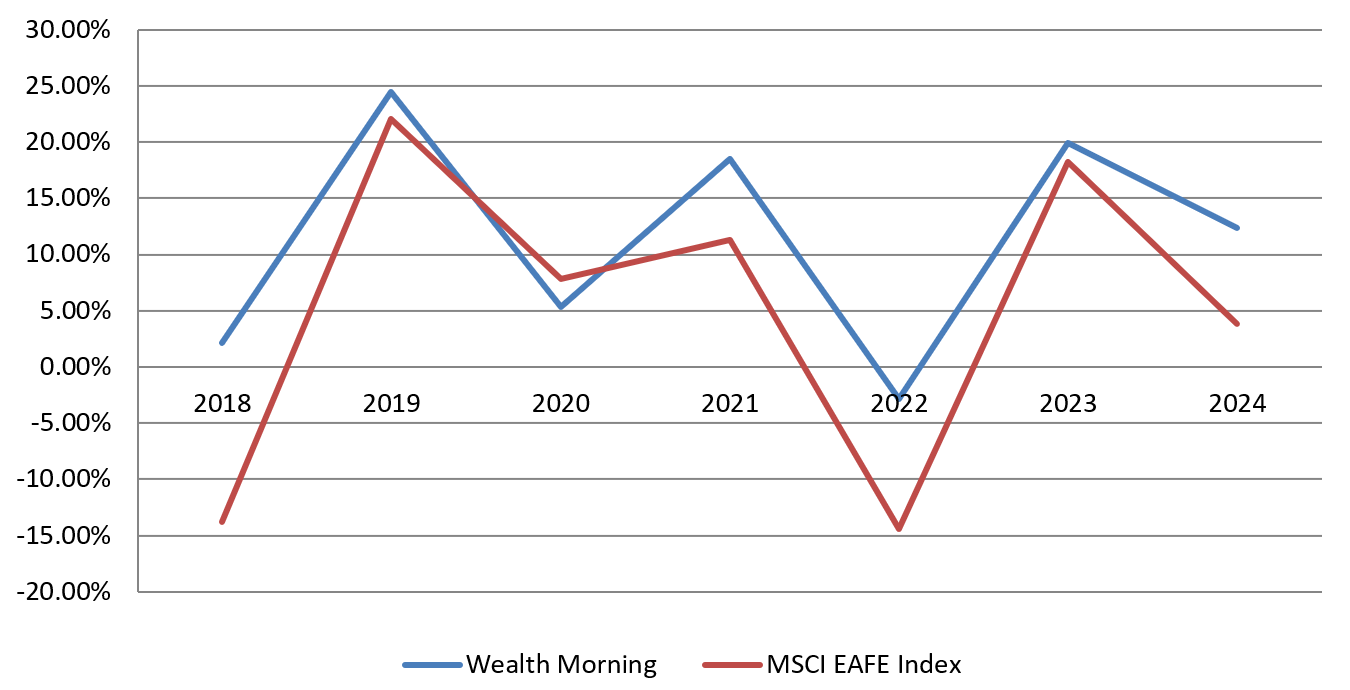

Managed Account performance*

For the month of January 2025, we were up 3.30% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Our MSCI EAFE benchmark was up 5.16%.

Our average annualised return since inception is 14.93% p.a.

Benchmarking

Our final benchmark numbers for last year are now in.

For 2024, the MSCI EAFE Index was up 3.82%. Despite interest rates being slower to moderate, we were still up 12.33%.

Our outperformance over the past 7 years is now around 45%.

With growing allocations in the US, it is important to note that we are starting to diverge a little more from this index. Once this exceeds a set threshold, we will adjust the benchmark to add the MSCI World Index proportionally.

Please see our performance chart for more details.

2025: A Year of Opportunity

Markets are climbing the stairs. Sharp American growth will be a wake-up call for Europe.

It’s a fantastic time to invest. We have plenty of high-value targets for more growth with income.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.