If you’re looking for comedy, just pay attention to what the economists say.

They often tell the best jokes.

Especially when it comes to crystal balls.

Here’s a case in point:

- The economists predicted that America had added 155,000 jobs in December 2024. They expected to see a moderation (perhaps a weakening) in the employment market.

- But — oh boy — their forecast was completely wrong. Hilariously wrong. When the actual data for December 2024 was released last week, what we got was a blockbuster report that blew everyone’s minds.

- 256,000 jobs were added. 65% above what the economists had predicted.

- This marks the 48th consecutive month of job growth. Which makes ties it for the second-longest winning streak in history.

- In fact, the unemployment rate is at its lowest level since 1969. Astonishing? Oh yeah.

Source: Apricitas Economics

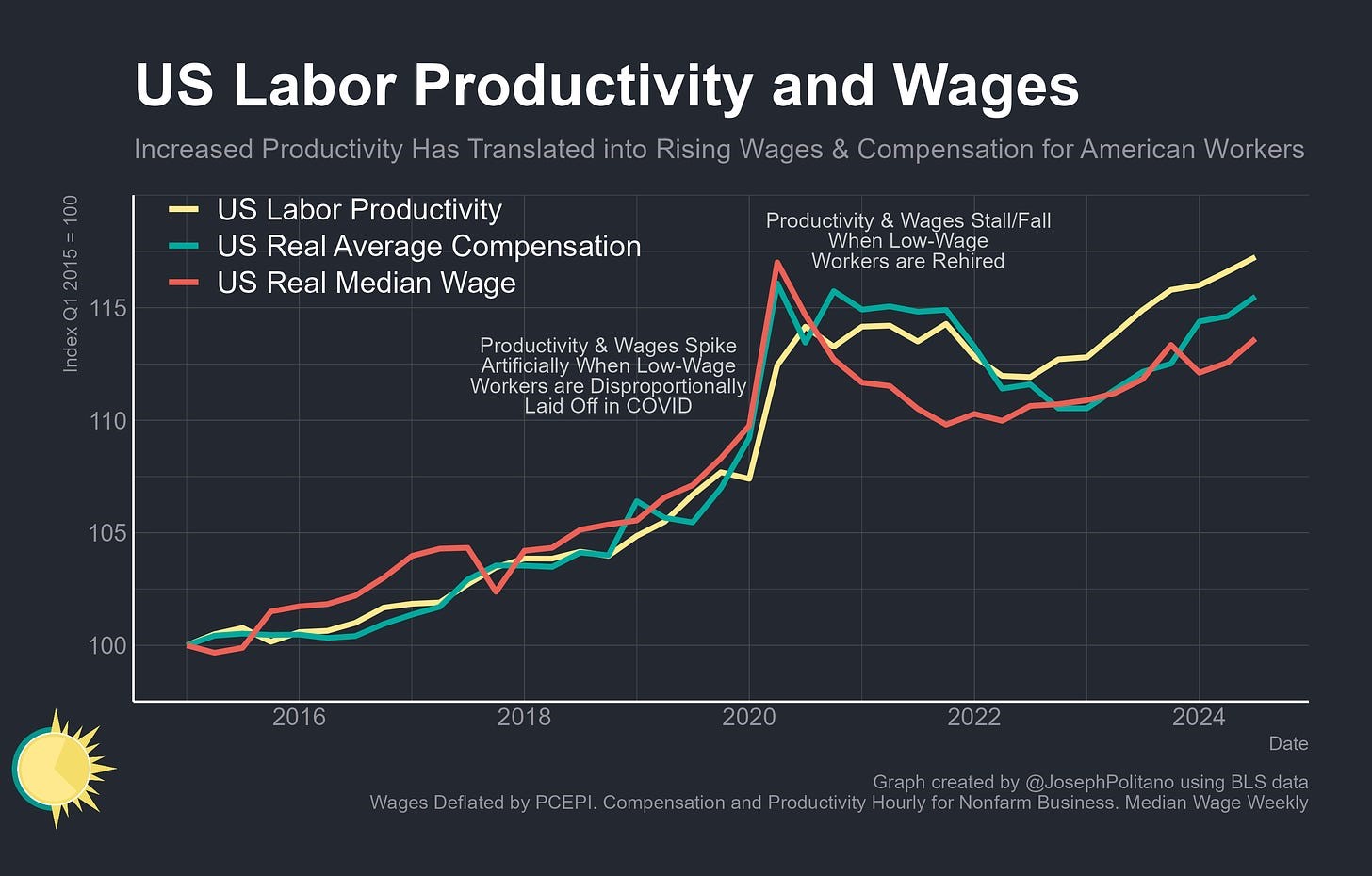

Now, when it comes to jobs, it’s not just the short-term picture for December 2024 that’s impressive. The long-term horizon is exceptional as well. When you look at this, it’s clear that the American growth engine is firing on all cylinders:

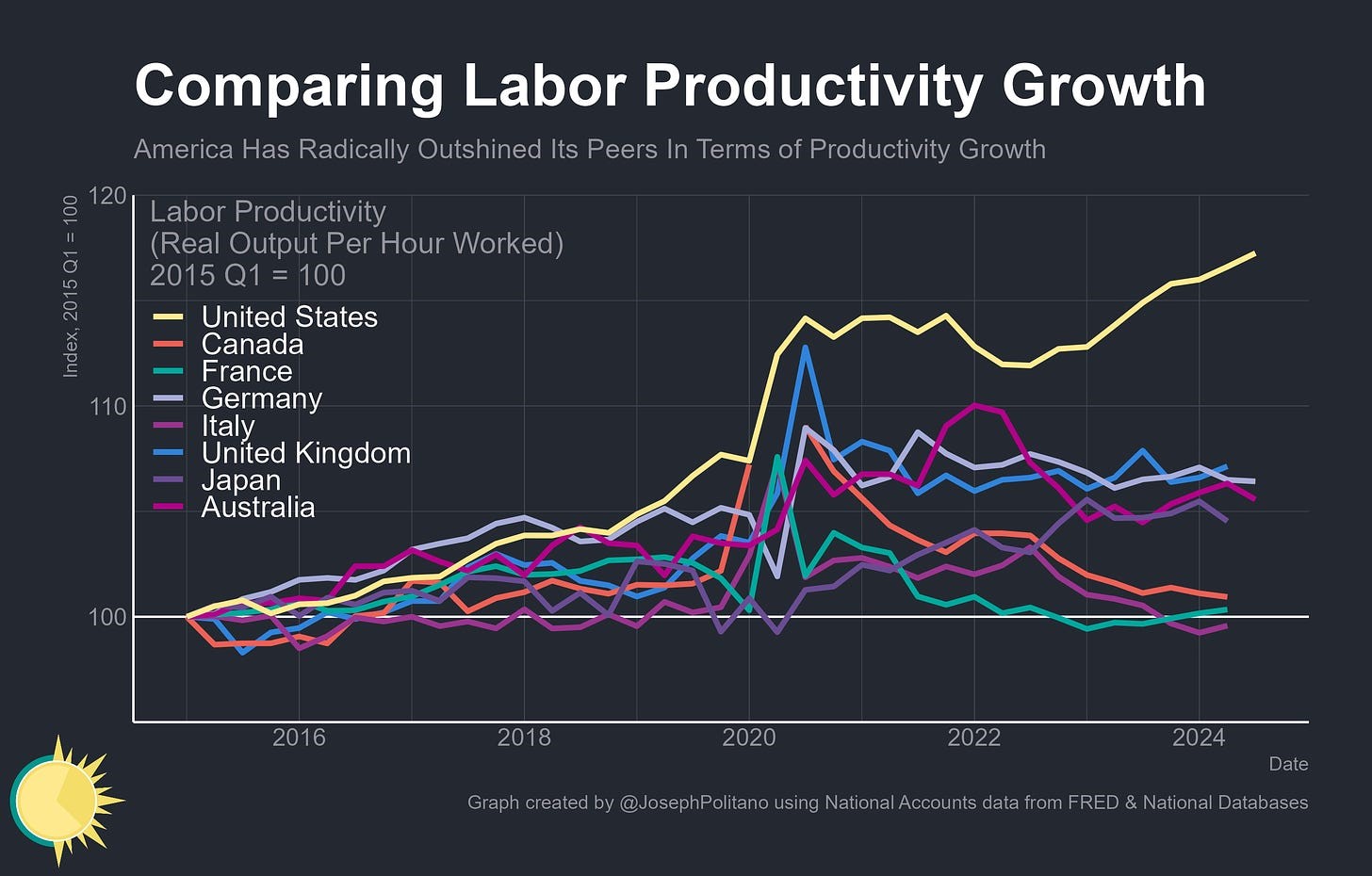

- The post-Covid productivity boom has smashed all expectations.

- The United States has outperformed every other major industrialised nation so far.

- The resilience of the average American worker has been extraordinary.

Source: Charles-Henry Monchau / LinkedIn

Why does it matter? Well, here’s why:

- More productivity creates more wealth.

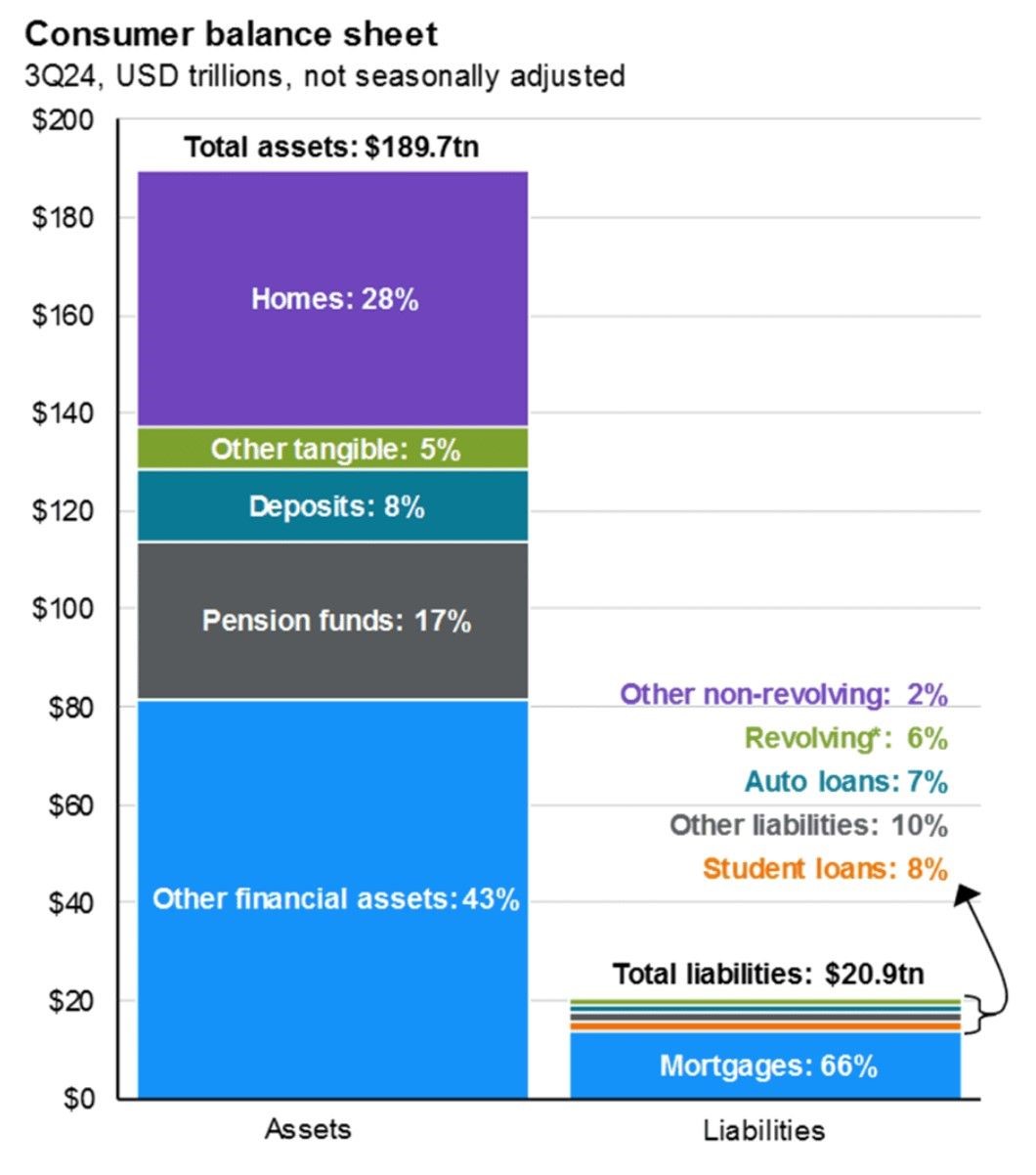

- At the moment, the United States is the biggest consumer market in the world.

- In fact, in 2024, almost 70% of America’s economic activity was driven by consumer spending alone.

- So, I’m willing to bet that as long as Americans have strong jobs (and strong assets), they will continue to spend.

Source: Bloomberg

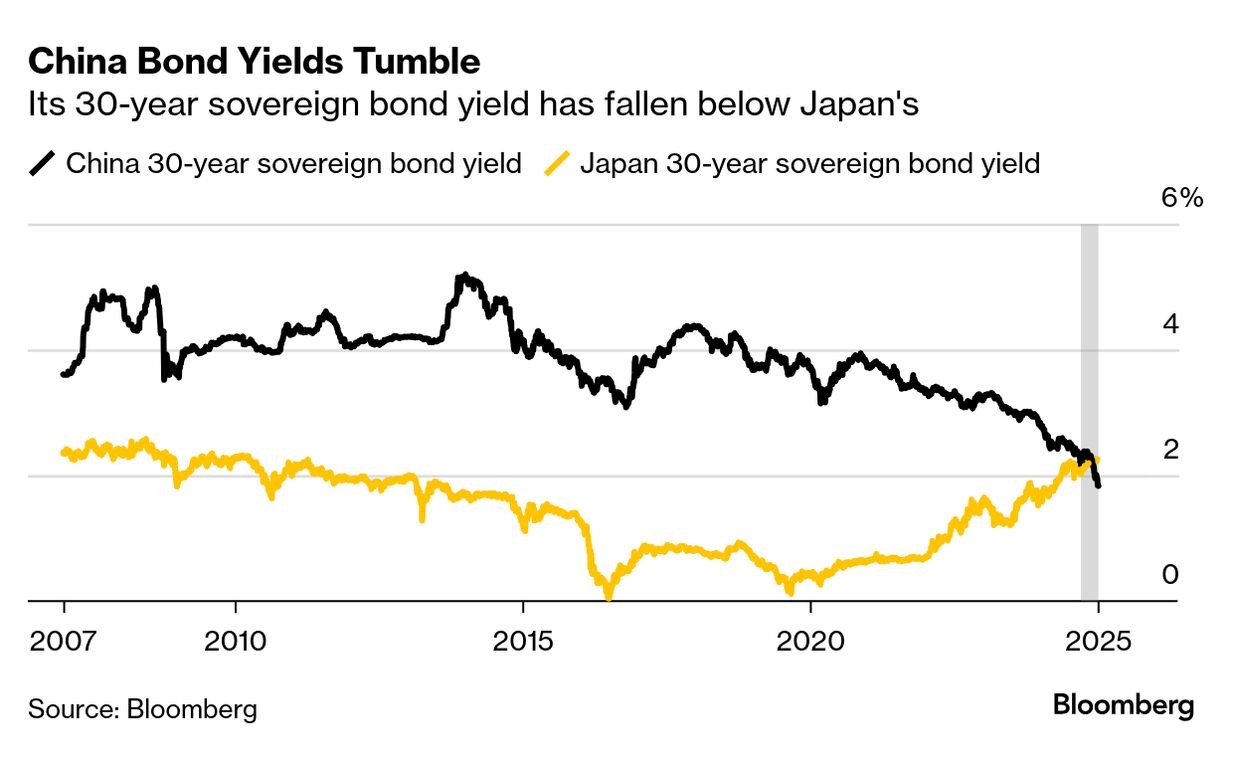

Is America’s success creating inflationary pressure? Yes, sure. But in my opinion, it’s actually better than deflationary pressure:

- Just look at the situation in China. The nation’s bond yields are in freefall, collapsing to record lows. There are growing fears that a deflationary spiral could be taking hold in the Chinese economy.

- How serious is this? Well, in March 2024, the Chinese government was desperate enough to try something radical. They launched a trade-in programme. Promising to subsidise up to 20% of the price of new household appliances like refrigerators, dishwashers, and microwaves.

- Their goal? To encourage Chinese consumers to loosen their wallets. Start spending. Start buying.

- Has this intervention worked? Well, no. In December 2024, the country’s consumer price index rose just 0.1%. This represents the fourth straight month of decline. Worse still, factory-gate prices have fallen for 27 months in a row.

- The Chinese Dream has become the Chinese Nightmare.

So, what will the situation be for the rest of 2025?

- Well, ideally, we want inflationary pressure in the United States to moderate a little — while in China, consumer and price growth actually needs to strengthen.

- This would be the Goldilocks equation. Not too hot. Not too cold. Just right.

However, for the immediate future, my best guess is that American consumers will continue to have the upper hand. Why? Well, I believe what it comes down to is optimism, which Chinese consumers lack:

- Yes, the Chinese government is rolling out monetary easing and fiscal stimulus. They want to re-inflate their economy. Badly. But the problems they are facing are stubbornly entrenched. This is the inherent flaw of communism — and it won’t be easy to fix.

- So, ultimately, this is more than just a question of mood. This is actually a question of economic security.

- The next 12 to 18 months will be critical for China’s fortunes. Will Chinese consumers sink or will they swim?

Our Quantum Income Strategy

So, what are smart investors looking for in 2025?

- Better prospects for capital growth.

- A stronger stream of passive income.

- Diversified wealth protection.

You could achieve all this when you choose to buy into global assets on the stock market:

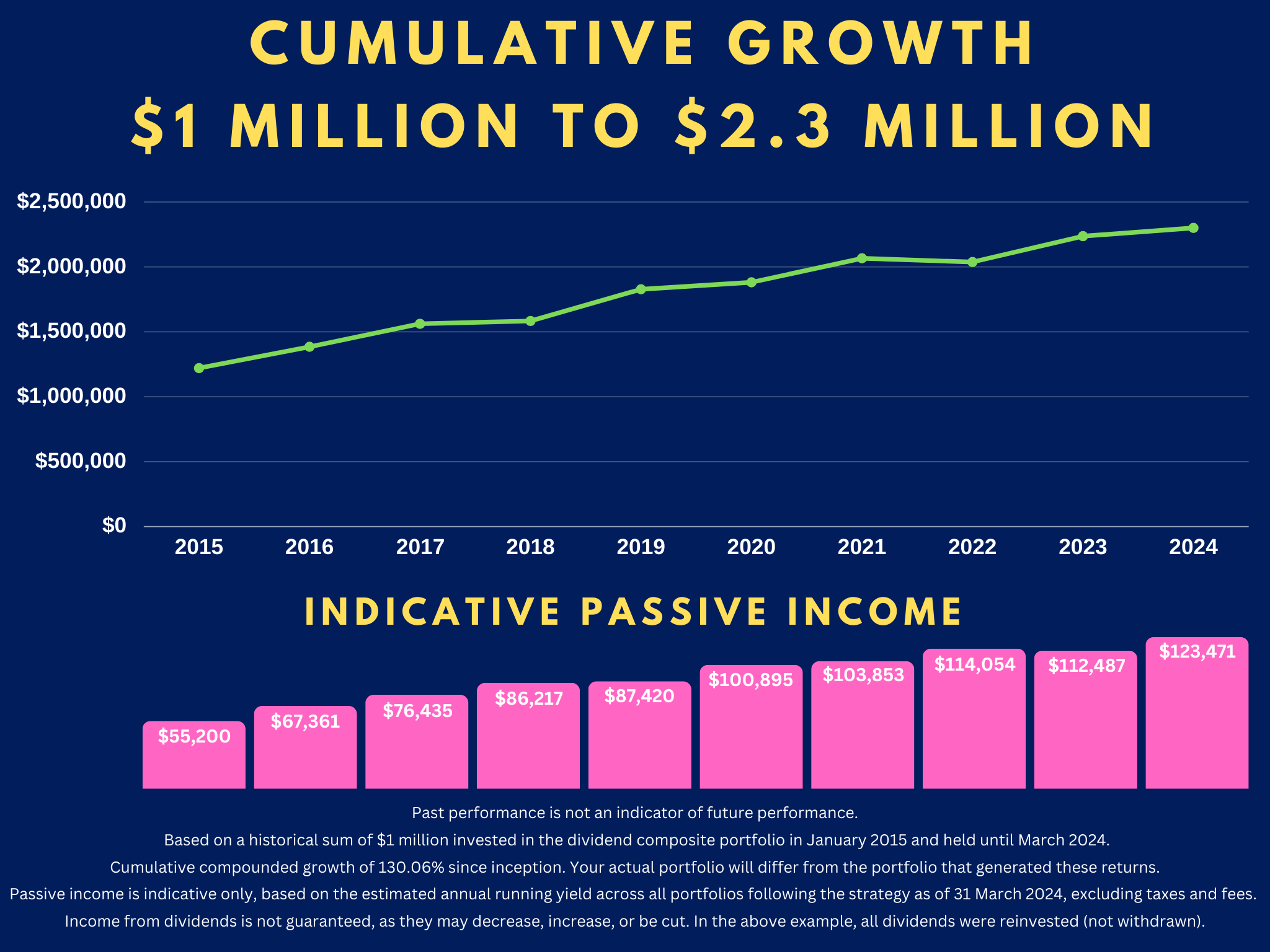

- This is what we’re focused on with our Quantum Income Strategy.

- If you qualify as a Wholesale or Eligible Investor, we can help you set up and manage a global brokerage account.

- We are already hunting for investment targets in Australia, Europe, and America. We are especially keen on resilient sectors like property, infrastructure, and energy.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions):

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2025 and beyond.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.