I heard a former actuary on the radio the other day. He was suggesting the global financial system was in peril due to ‘unsound money’.

Naturally, he was involved in the giving of wholesale advice on how to protect your wealth with gold bullion.

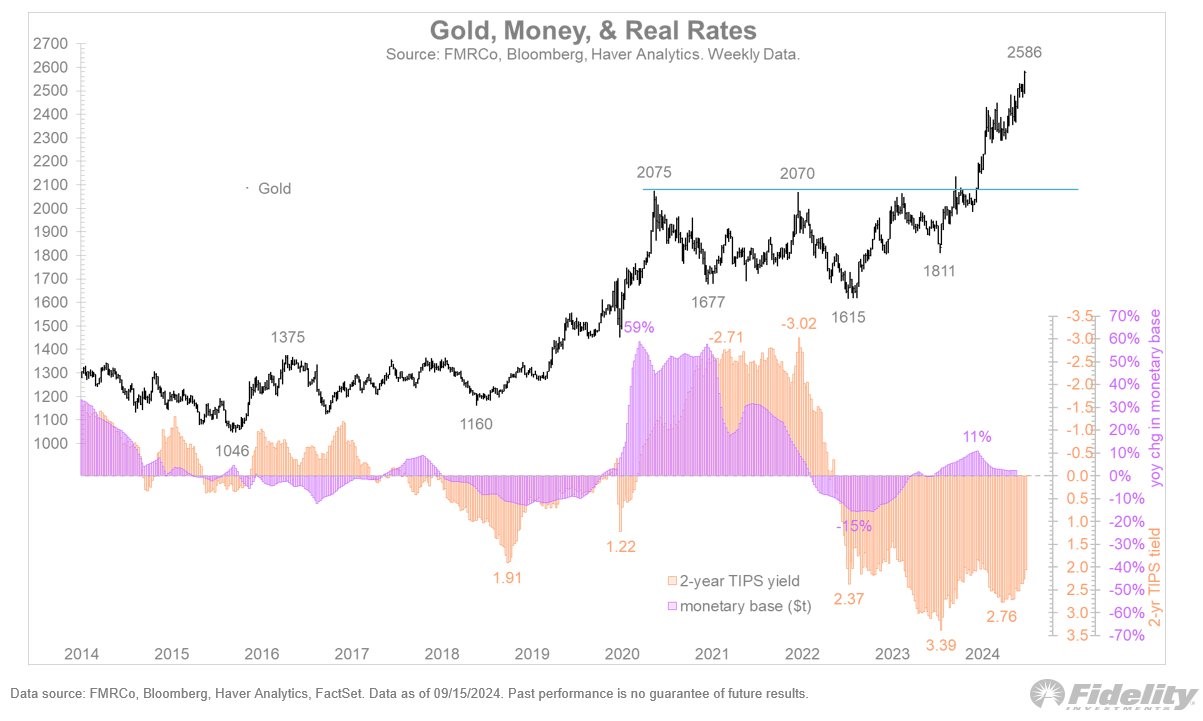

Well, gold has not been a bad investment, particularly during cycles of liquidity support:

Source: Jurien Timmer / X

Yet, as a stock investor, I agree with Warren Buffet: ‘Gold is a way of going long on fear.’

Personally, I hold very little of it. Why would I hold $500,000 worth of gold, for instance, when I could diversify that across productive assets? There’s this vital concept in economics:

Opportunity cost

As an example, for our wholesale clients, we invest in a farmland stock in Australia:

Source: LinkedIn / Google Finance

Yes, it has had ups and downs. But consider the power of just one Company generating wealth from productive assets:

- Capital growth since 2014: 186%.

- Annualised capital growth: ~18.6%

- Current dividend yield: ~5.87%

If you had reinvested the average dividends of around 5% a year, you would have added significant compounded growth.

Using a compounding calculator, $500,000 invested in the above scenario in 2014, could be worth over $3 million today.

You would have also provided your capital for food production, as opposed to burying it in a vault.

Speaking of the vault: over the same period, the gold price has gone from USD $1,300 an ounce to over $2,500.

That’s a gain of over 92%.

But there’s little to no opportunity to earn income from gold. You miss out on the most powerful force in finance; compounding.

So, on the above calculations, $500,000 in gold in 2014 would today be worth around $960,000. Well shy of the $3 million the compounded dividend scenario could have given you.

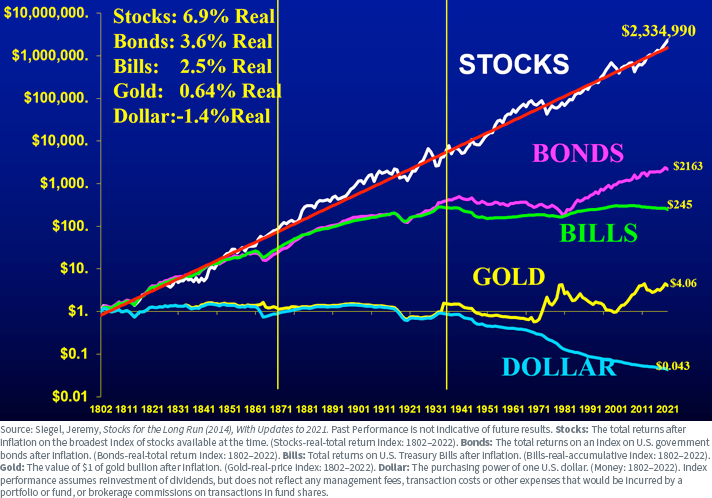

Over a very long time, the performance of gold vs. stocks (and other instruments) can be seen clearly:

Source: Invest in Assets / X

Uncorrelated assets?

Of course, those who invest in gold or Bitcoin will say that this provides them protection or ‘insurance’. Because these assets are uncorrelated with public stock markets.

Back in 2016, when I began working for the world’s first regulated Bitcoin fund, I believed this too.

Financial markets could implode. But Bitcoin and gold would be safe.

Then 2020 and 2021 hit. You know what happened. Both the supposed uncorrelated assets experienced some drawdown too.

As my colleague John Ling recently reminded me:

‘The fundamental issue is always the same…

‘We usually value gold in USD. We usually value Bitcoin in USD, too.

‘If you could only exchange gold for gold — or if you could only exchange Bitcoin for Bitcoin — would it be as attractive?’

The reality in times of crisis is this. People become concerned about what they can exchange for necessities.

So, if you can’t get the benefits of compounding or passive income from gold, where might the opportunities in equity markets be now?

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.