Around the world, nations are moving closer to having Central Bank Digital Currencies.

A few months ago, I was interviewed by Reality Check Radio on this subject.

I explained my concern that these currencies could disrupt demarcation in the financial sector.

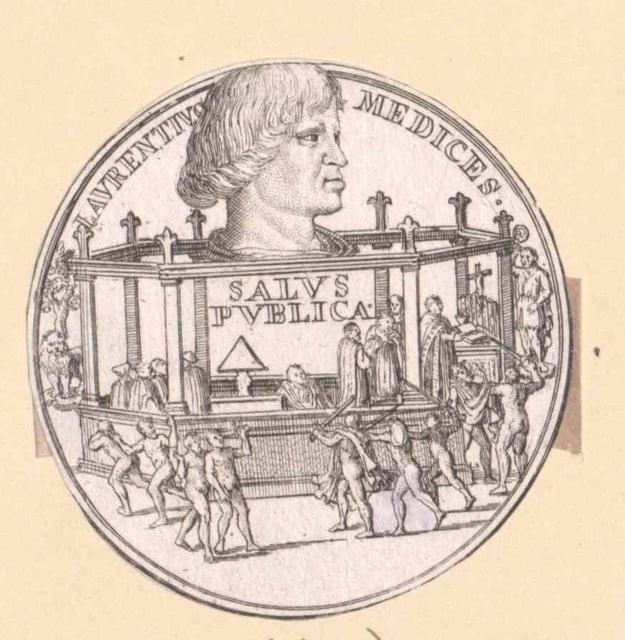

Medici engraving. Demarcated banking, as we know it, has been around since 1397.

Source: Public Domain

The more I think about CBDCs, the more I see risks for banks:

- With the issuance of CBDCs to private citizens, central banks will presumably need to provide accounts to hold them.

- ‘Customers’ of such CBDCs will then expect an interest rate to be paid. Otherwise, why hold your money in a CBDC account?

- To generate interest payments, the logical path is for the central bank to then provide a CBDC-lending service.

- Well, the central bank is now, for all extensive purposes, a regular bank.

- But it does not face the same cost structures, and of course, it is also the regulator of all banks in the economy.

Well, I’m not saying this is going to happen. I’m just trying to flowchart the logical progression, possibilities, and risks.

Now, I must declare a bias. In my portfolio and the wholesale portfolios we manage, we invest in banks around the world.

At the right time, at the right price, they can make fantastic investments. They are the centre of the economy. They often have great cash flow. And can be good dividend payers. If you get their shares when they’re undervalued, or about to take over another bank…well…you know how it goes.

So, yes, I like banks. We need more of them. We need more banking competition. The more banks compete to lend to grow businesses, farming, and enable housing, the better.

Banking in Germany and the US

In countries like Germany and the United States, which have among the largest numbers of banks — this demarcated system is integral to the strength of their economies.

- There are 4,577 banks in the US (as of 2024).

- There are 1,403 banks and credit institutions in Germany (as of 2023).

The Mittelstand are the small and medium-sized businesses that have driven German export success for many years. They attribute much of their success to the flexibility and lending support from local German banks.

The scale and diversity of the US banking system provides enormous liquidity to the world’s largest and most innovative economy.

It is no surprise that these two giant banking nations do not seem particularly enthused with the idea of a CBDC.

Germany will probably get one by default. Due to the creation of an electronic euro by the European Central Bank.

The surveys I’ve seen in Germany suggest many people are opposed to that. This is unsurprising, given their history with inflation and horrible government.

In August 2024, Bloomberg reported: ‘Digital Euro Has Germans Fretting Their Money Won’t Be Secure.’

Instead, Germans seem to be increasing their use and holding of cash in wary anticipation. To try and protect themselves.

The threat to banking

In 2023, the Federal Association of German Community Banks (BVR) found that the introduction of a digital euro ‘could have devastating consequences for the German banking industry’:

If every person converted €3000 to the central bank digital currency (CBDC), only 56 out of 714 institutions would meet the legally required liquidity buffers. This would mean that banks would have to seek alternative, more expensive funding sources.

In other words: Germany could lose some of its retail banks. More than 650 banks could be under threat due to the coming euro CBDC.

Bank accounts in the US are federally protected up to $250,000 per depositor. While each of the 4,577 banks retain their independence, and often, regional focus.

This system works well. Even when a couple of banks got into trouble there last year, depositor monies were quickly reinstated via other banks.

Now consider one country that has only six retail banks: Papua New Guinea.

That country is further along than most with a CBDC. It is already nearing pilot stage.

It seems that when you have few banks, then the state moves in.

Better to create an environment where you can have many and varied banking operations. And instead put resources into protecting depositors only when the worst happens.

The Bank of Dave

To me, it would make far more sense for central banks and governments to encourage retail banking competition by reducing regulation. To allow for more banks. More demarcation. More decentralisation. More opportunity for ordinary people to save, invest, and borrow money in their local community.

A film based on the real-life experiences of Burnley self-made millionaire David Fishwick,

who struggles to set up a community bank to help the town’s local businesses to thrive.

Source: Wikipedia

The Bank of Dave is a great movie about an ordinary guy who started a much-needed banking operation in his local community.

It is literally a David and Goliath story of man versus the state. In this case, after much battling, Dave built a bank. And his community was all the better for it.

Centralising banking with CBDCs will only make it more difficult for existing banks. It will likely make it more difficult for new banks to form. ‘Why do we need more banks when you can just put your money with the central bank?’

No, we don’t want one bank or currency to rule them all. We want free and independent banks who understand their local community. This is what is needed for a free, open, and diversified economy to flourish.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.