Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

A lion doesn’t concern itself with the opinion of sheep.

―George R.R. Martin, A Game of Thrones

September usually goes dark in the markets.

Since 1945, the S&P 500 has seen an average drawdown of around –0.70%.

This time is different.

On 18th September, the Fed slashed its benchmark rate by 50 bps.

The last time we saw a cut this deep was during the GFC in 2008.

Of course, the initial reaction was one of fear. ‘Is the economy about to tip into recession!?’

This turned out to be more the opinion of sheep. The wider evidence supported a trend of strong growth, with record Q2 GDP in the US.

Lions have been buying.

Source: AI image generated by Freepik AI

History tends to show that, after a major rate cut, stock markets move ahead. Potentially around 20% in the following 12 months — unless there’s a recession.

So, yes, the next 12 months will be crucial. And rate cuts will help, especially with our focus on value real estate.

Despite all the growth and recovery we see, the pessimists are still out in force. But we need them. They help provide dips and opportunity to buy mispriced stocks.

‘The world is in peril. You should go to gold.’

This was the implications of a recent radio money show I heard.

But the world has always been in peril. The Great Depression, World War II, and the Cuban Missile Crisis seem far more perilous than anything we face right now.

Of course, there’s no denying that gold has been a good hedge against inflation throughout history. It has performed well over the past few years.

The problem with it is that investors miss out on the ‘eighth wonder of the world’ —compounding.

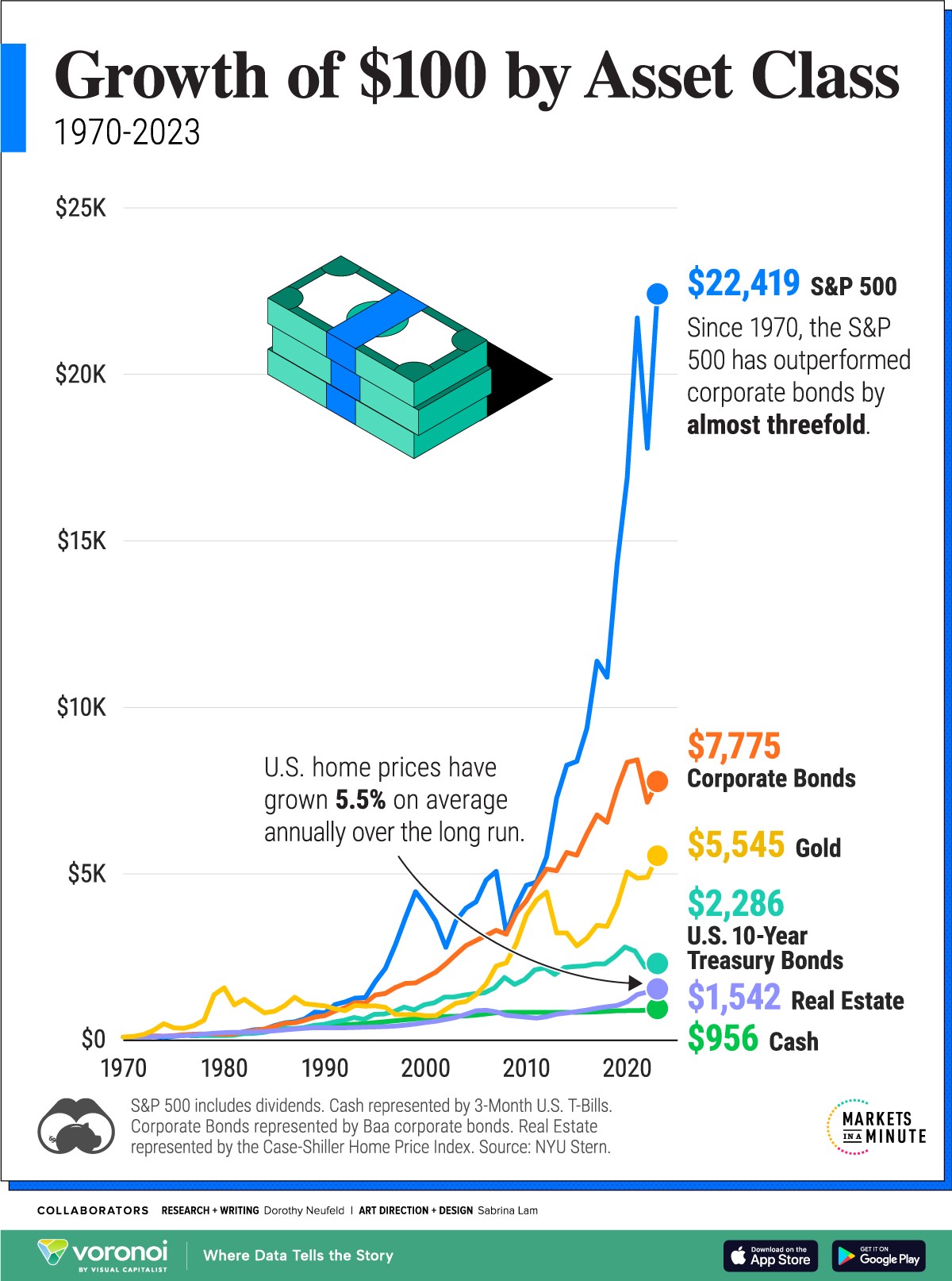

Over time, the performance of gold vs. stocks (and other instruments) can be seen:

Source: Visual Capitalist

This is why, across our portfolios, we do see value in quality dividend-paying businesses, where income can be reinvested and compounded.

Now, the other argument for gold (and Bitcoin too) runs along the lines that money is ‘created out of thin air’. This brings us to the question of what is money?

Essentially, a currency is backed by us all as taxpayers. A reserve currency like the US dollar is backed by the largest and wealthiest repository of them.

Modern monetary policy uses rate hikes and cuts to help preserve the integrity of a dollar. But within that system, there will be periods of inflation and loss of purchasing power over time.

Hence, even more reason to invest in productive assets that can compound across the years.

Money, despite its inherent problems, has given us freedom and opportunity.

Without it, we’d still be locked in a barter system, with all the Cain-and-Abel envies and conflicts that go with that. Without money, we’d end up killing each other.

As that great P.T. Barnum line goes, ‘Money is a terrible master but an excellent servant.’

We think smart application of money is to have it serve you as a tool for financial independence, while managing risk and opportunity cost.

That means facing the ups and downs of the investing journey.

Managed Account performance*

For the month of September 2024, we were up 3.45% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Our MSCI EAFE benchmark was up 1.13%.

Our YTD performance is 13.26% (January to August 2024), or 17.68% on an annualised basis.

Our average annualised return since inception is 14.14% p.a.

Please see our performance chart for more details.

We’re looking ahead at the next stage of the cycle

This was a September to remember.

As more rate cuts come, lions will see more opportunity.

October may see more volatility and chance to hunt.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.