Technology changes. Fashion changes. Even language changes.

But you might argue that one thing will never change: human nature.

Indeed, it’s human nature to be greedy.

Source: Wikimedia Commons

We saw this during the Dutch Golden Age:

- Between 1588 to 1672, the Netherlands became the richest and most progressive country in Europe. This was made possible because the Dutch had the largest merchant fleet of the time. This gave them a near-monopoly on trade routes across the globe.

- Interestingly enough, the Dutch also created the first sharemarket in the world — the Amsterdam Stock Exchange. This became a financial hub. Encouraging the free flow of capital and trade. Compounding wealth. Multiplying wealth.

Source: Wikimedia Commons

So, during this time of unmatched optimism, a strange event happened:

- The Dutch became obsessed over tulips from the Ottoman Empire. Seemingly overnight, this flower became a sensation. A luxury item. A status symbol.

- Demand skyrocketed. Growers and traders rushed to cultivate and sell the flower. Everyone began to engage in speculation, using newly developed financial instruments like derivatives, futures, and options.

At its peak, a single tulip bulb could reportedly be sold for as much as six times the annual income of the average person:

- But this obsession could not be sustained. People were borrowing and spending beyond their means. Prices escalated beyond common sense.

- The tulip market reached stratospheric heights before crashing back down to Earth. Confidence fractured. It was over almost as quickly as it had begun.

- In the end, some people got rich off the speculation, but others got burned, losing big sums of money. Economists now widely recognise this ‘tulip mania’ as being the first investment bubble in human history.

Now, what was true in the 17th century is also true in the 21st century:

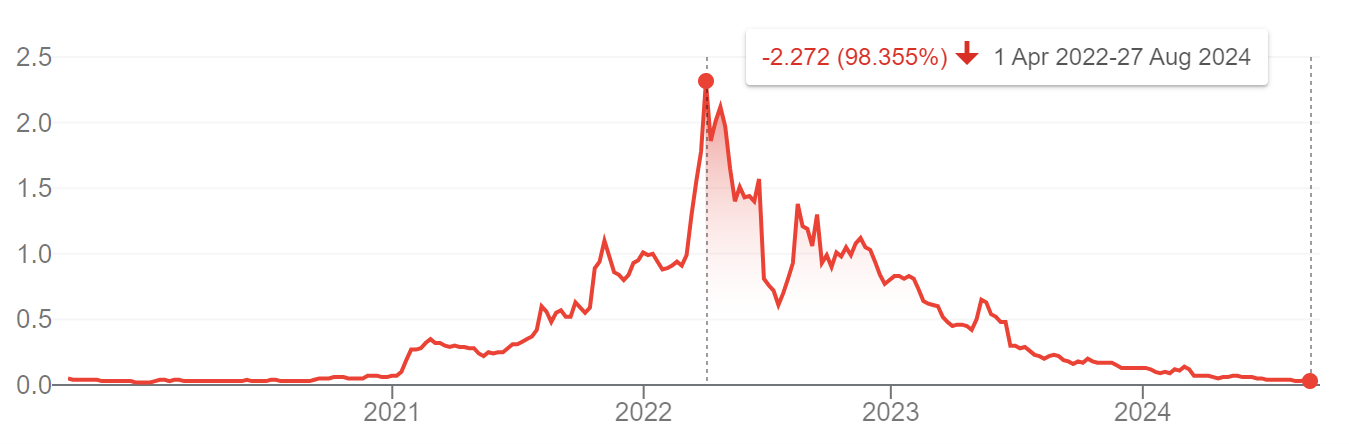

- Between 2021 and 2022, we saw a huge surge of demand for small-cap lithium-mining stocks. Indeed, there was a lot of optimism about the potential to create a revolution in clean energy, mostly tied to electric vehicles and lithium batteries.

- The retail investors on Reddit seemed to be the biggest cheerleaders for this trend: ‘You can’t lose. Trust me, bro.’

- Indeed, for a while, it looked like they were clocking up huge gains. Stock prices were climbing, going vertical. They started calling lithium ‘white gold’. More folks piled in. Prices went higher still. Doubling, tripling, quadrupling.

- Then — uh-oh — the speculative bubble suddenly burst. And we saw these stocks deflating as much as 90% from their historical peak. Seemingly overnight, we went from moonshot to mooncrater. It was painful.

Source: Google Finance

Indeed, it’s human nature to be greedy. It’s also human nature to be fearful. So, here’s the trillion-dollar question now:

- Was the lithium craze just a mirage in the desert? Is it time for battered-and-bruised investors to move on?

- Or…is the worst of the pain already over? Could small-cap lithium miners get a second wind and enjoy a rebound?

- Let’s take an honest and unfiltered look at the situation…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.