Over the past decade, the Kiwi property market has minted many millionaires.

In fact, from 2013 to 2023, New Zealand appears in the top-10 fastest-growing millionaire populations in the world. Our millionaire population grew 48% (ahead of Switzerland and Australia at 38% and 35%).

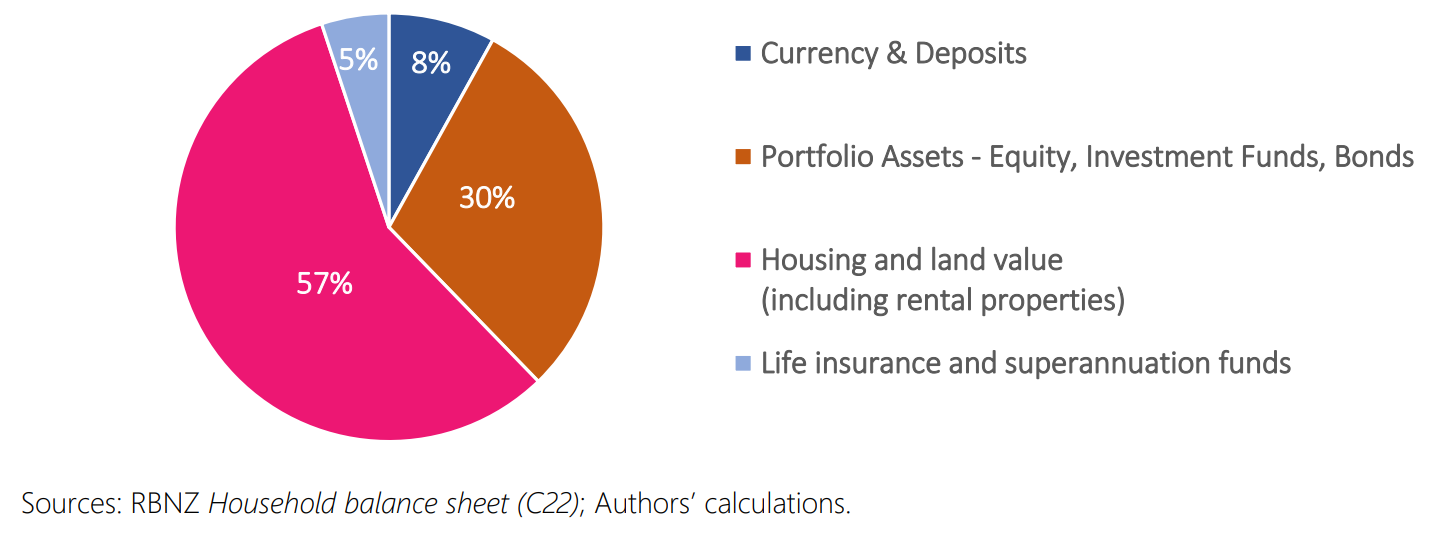

If you look at where most New Zealanders hold their wealth, almost 60% of all household assets were in housing and land in March 2021 (before the peak of the housing market):

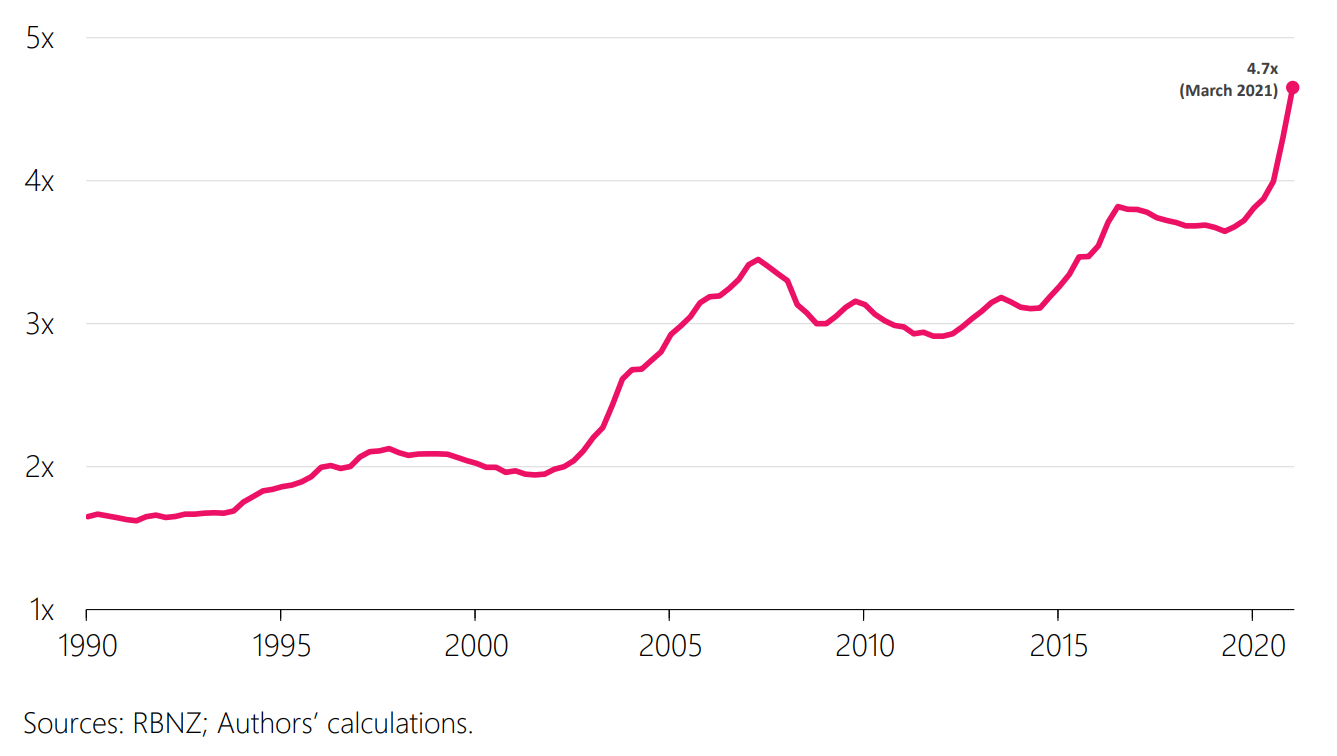

Since the early 2000s, housing has risen to become almost 5x the value of the country’s GDP:

By way of comparison, in the US, that multiple is only around 1.9x.

Americans have grown much more wealth in equities. 30% of Americans now own a stock portfolio worth more than USD $500,000. This wealth increase has come even as interest rates rise.

Over the past five years (May 2019 to May 2024), New Zealand home prices have far lagged the S&P 500 (which was up over 80%).

On average, Kiwi properties have increased 5.5%. This includes peak-to-trough drawdowns in 2023 of 19% in Auckland and 25% in Wellington.

Residential property has delivered much better over a 10-year period. Over that time frame, prices have about doubled.

Today, New Zealand home prices (by multiple of median household income) are still among the most expensive in the world. Auckland homes still sold for 8.2x the median income in 2023, when affordability is generally considered to be around 3x.

Are things about to turn?

The 2024 edition of the Demographia International Housing Affordability survey devotes a section to the proposed reforms by the National/ACT/New Zealand First coalition:

- They cite research showing that urban growth boundaries alone add a staggering NZ$600,000 (US$370,000) to the cost of land for houses on Auckland’s edges.

- Going for Housing Growth will seek to ensure abundant developable land within and around cities, preventing the artificial scarcity that drives up prices. This is in contrast to housing affordability policies that are limited to densification strategies.

- A key part of “Going for Housing Growth” is to require local authorities to immediately zone for 30 years of housing growth. This prevents using sequential development, which would perpetuate the tight land market created by containment policies.

- To finance infrastructure needs, the Coalition will utilize the funding mechanism (Special Purpose Vehicles or SPVs), as authorized by the 2020 Infrastructure Funding and Financing Act. This allows developers or public agencies to finance infrastructure costs, repaid by beneficiaries over a period of up to 50 years.

- This model, often known as Municipal Utility Districts (MUDs) has been proven in Texas and Colorado, with their municipal utility districts. This takes away the burden of infrastructure finance from local authorities.

In this research, we will argue why — with these announcements to ‘flood the market’ with housing — the future for residential-property investment may look very different.

We’ll also consider what this means for investors and where brighter opportunities may exist.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.