Are you a baby boomer?

Well, if you are, lucky you.

You belong to a very special club. The richest, healthiest, most socially mobile generation the world has ever seen.

Does all this sound like an exaggeration?

Well, no, it’s the truth.

In fact, when you look back at the last 5,000 years of our recorded human history, you will see that there has never been an age group as prosperous and productive as yours.

Here is some historical context from A Wealth of Common Sense:

- 1,000 years after Jesus walked the earth the world was barely any richer. It took 500 years for income to double from there. Then between 1820 and 1900, the world’s income tripled. It tripled again in a little more than 50 years. It took only 25 years for it to triple again, and another 33 years to triple yet again.

- Just 200 years ago, 85% of the world’s population lived in extreme poverty. 20 years ago it was 29%. Today only 9% live in extreme poverty while the majority of people (75%) around the globe live in middle-income countries.

- Two centuries ago the life expectancy in The Netherlands, the richest country in the world at the time, was just 40, and in no country was it above 45. Today, life expectancy in the poorest country in the world is 54. There are no countries where life expectancy is below 45.

Well, gosh. We have come a long way, haven’t we?

- Yes, fate and circumstance may have played a role in your life’s trajectory. But that’s not to diminish the power of your own diligence and industriousness.

- You have worked hard. You have planned well. You have accumulated assets.

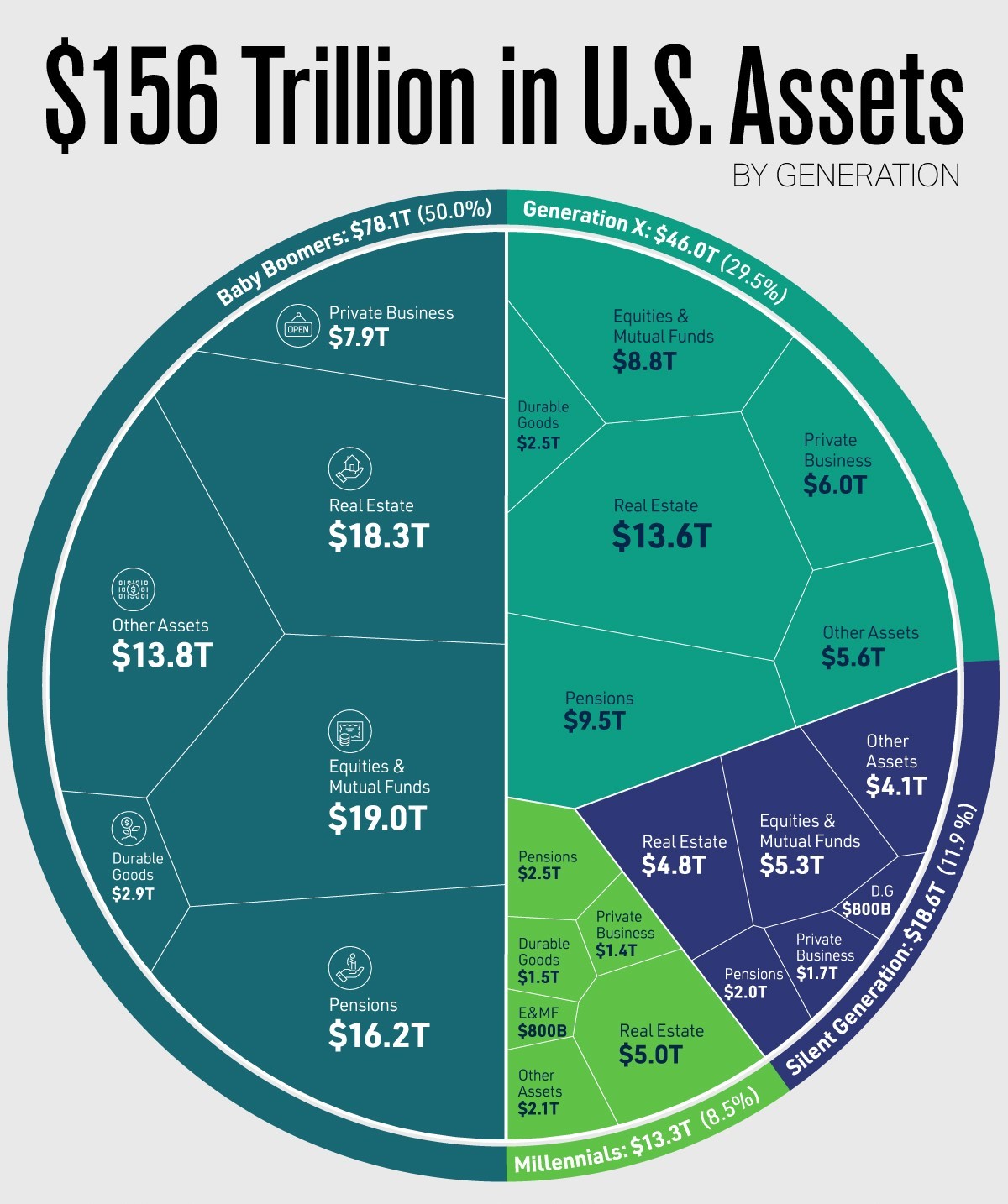

- In the United States alone, baby boomers hold over $70 trillion worth of wealth. Here’s what the big picture looks like:

Source: Visual Capitalist

It’s very impressive. So, this begs the question: who exactly is a baby boomer?

- Well, a baby boomer is someone who was born between 1946 and 1964.

- In 2023, this means that the youngest baby boomer is now 59 years old, while the oldest is 77.

- Across all segments of our economy, baby boomers have played an outsized role. From Main Street to Wall Street; from home ownership to stock ownership; their success is deeply woven into the fabric of our society.

So, why exactly are baby boomers so influential?

- Well, to begin with, they have inherited a solid pedigree from their parents — the Greatest Generation; the World War II generation. These folks survived enormous hardship, fought for liberty, and laid the foundation for the world as we know it today.

- Therefore, the baby boomers have taken up that baton of security and stability. They have run the race passionately. And in doing so, they have spearheaded astonishing improvements in civic rights, social capital, and technological progress.

- Naturally enough, this has allowed the baby boomers to become the most prosperous and productive generation ever.

Source: Verywell Mind

But right now, we’re facing a turning point. The next page of our story beckons. This is because the biggest wealth transfer ever is about to happen:

- Approximately 10,000 baby boomers in America are retiring every day.

- In the coming years, over $70 trillion worth of wealth will be transferred to the younger generations. Warren Buffett calls them ‘the luckiest crop in history.’

- The scale of this event is astounding. Never before has so much prosperity been transferred from one age group to another.

In the words of Peter Parker’s gentle Uncle Ben, ‘With great power comes great responsibility.’ Here’s why the impact of this wealth transfer will be huge:

- Baby boomers are increasingly focused on estate planning. They want to make sure that their assets will be protected and transferred in a safe way. To do this, they are setting up trusts and wills. They are using hedge funds. No stone will be left unturned.

- Baby boomers are also wise enough to know that mentorship will be vital in this process. Around dinner tables, many serious discussions are happening as we speak. Baby boomers are imparting urgent wisdom to their heirs, teaching them the skills to handle money in a healthy way.

- Baby boomers also understand that there will be far-reaching consequences for society as a whole. This wealth transfer will create quantum shifts in economics, politics, and philanthropy. The ripple effect of all this will only amplify with each passing year.

So, ultimately, what will happen next? What is all this building up to?

- Well, it’s about the legacy of choice. The power of social capital. The blessing of financial freedom.

- You see, for most of human history, wealth management was a very elitist domain. Reserved only for royals and aristocrats. But now — thanks to the baby boomers — those gilded doors are being thrown open. This arena will become more democratic, more accessible, than ever before.

- This means that the heirs of this wealth transfer could very well receive the greatest gift of all — the ability to shape their destiny in ways that their forebears could scarcely dream of.

- But…will the younger generations be worthy of this awesome privilege? Will they use this golden opportunity in a conscientious way? Well, that’s a $70 trillion question, isn’t it?

- Of course, the next chapter of the story is still being written. It remains a work in progress. But one thing is for sure: the journey ahead will be transformative. More things could happen in the next 20 years than the last 200.

It’s time for you to prepare for a new era

Are you a baby boomer?

Well, if you are, lucky you.

You belong to a very special club. The richest, healthiest, most socially mobile generation the world has ever seen.

Right now, you are already preparing for the biggest wealth transfer in human history. The responsibility that you have is a sacred one. You will bestow upon your heirs not just material assets, but positive values that will stand the test of time.

Intergenerational wealth protection is critical here:

- Chances are, you currently have most of your asset base locked up *only* in New Zealand and Australia.

- This is a formula that you’re familiar with. A formula that you’re comfortable with. It has made you richer than your parents’ generation.

- But are you missing out on global diversification? Are you missing out on the opportunity to futureproof your wealth? Do you have the knowledge and confidence to spread your holdings across at least seven different industries on three continents?

- Be warned: the last thing you want to do is fumble the last stretch of this race. You’ve already done a fantastic job carrying the baton this far. However, the final leg of the journey — arguably, the most decisive part — will require more prudence and care.

- Your children and grandchildren’s future will depend on what you decide to do next. The clock is already ticking.

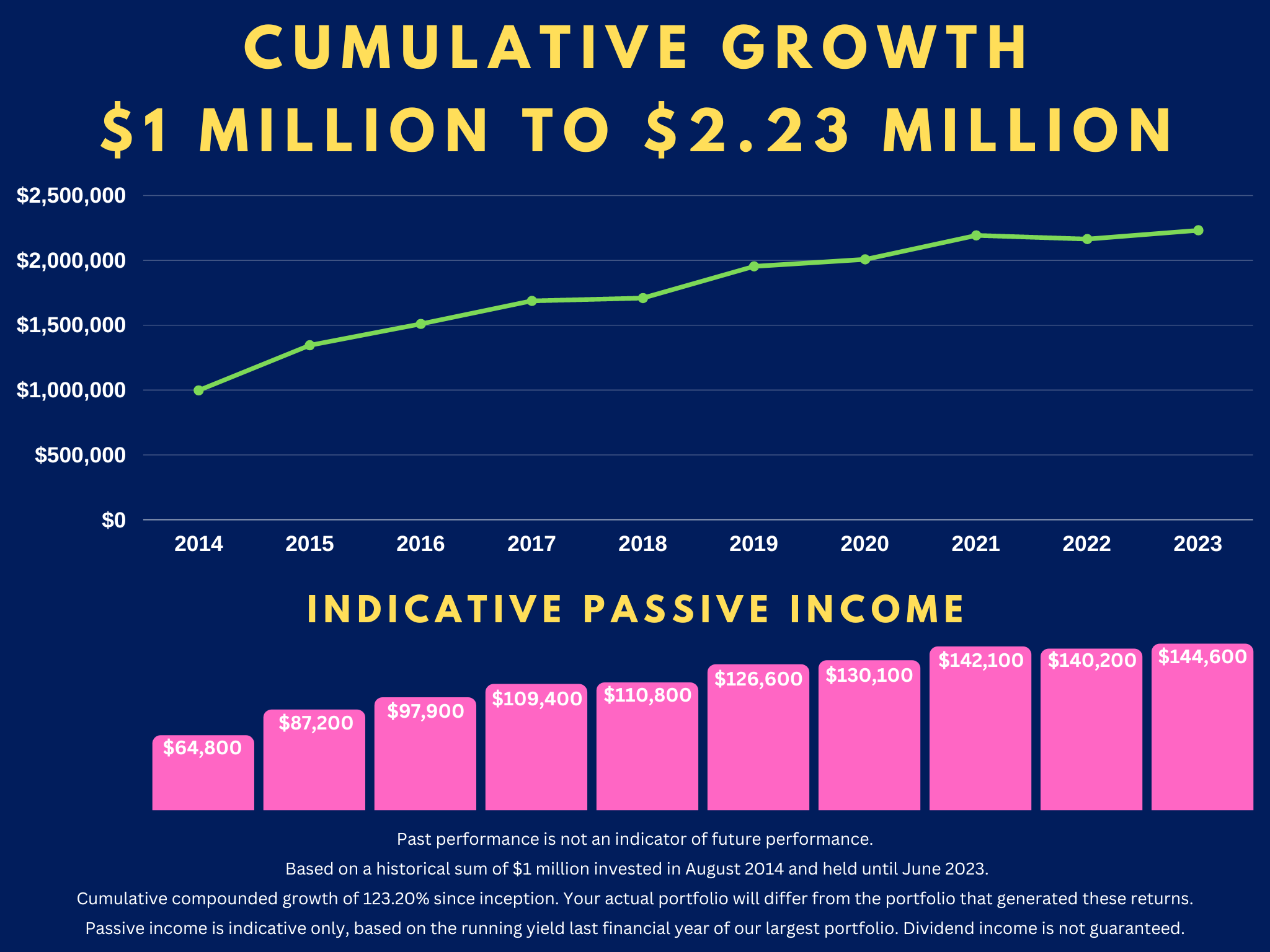

Right now, our Wealth Morning Managed Accounts are designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth:

- For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are opening for limited consultations on our Managed Accounts Service. (Available until Friday, 1 September).

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.