I have a good friend from Taiwan.

Last I saw her, I asked her about the situation with China.

She shrugged her shoulders. ‘It’s been like this forever. I don’t see it changing.’

She lives in Europe now but has family on the island-nation in the South China Sea.

I’ve also spoken to other Taiwanese people. Despite sabre-rattling from their larger neighbour, they do not see an immediate threat of invasion.

Indeed, China itself appears to have pinned its ultimate hopes on ‘peaceful reunification’.

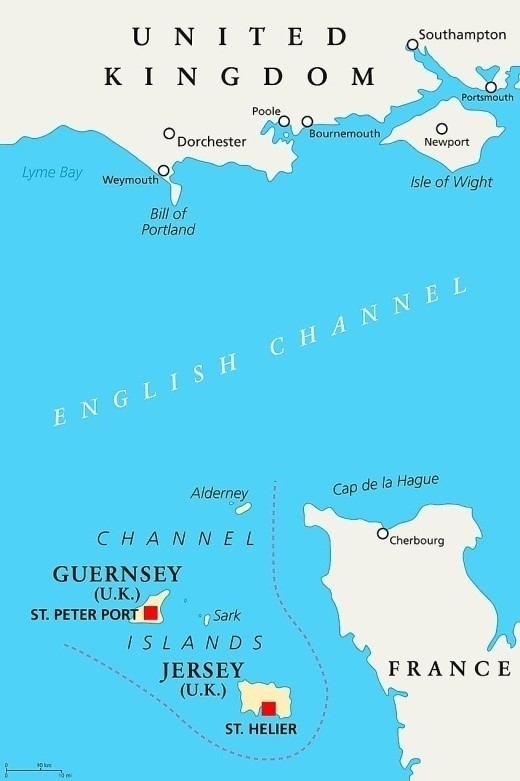

Perhaps my view on the status quo is also influenced by my years living in Jersey. It is both a British Crown Dependency and part of the British Isles. But it is not part of the United Kingdom. It is a self-governing territory with its own financial, legal, and judicial systems. Jersey has the power of self-determination.

While there may be recognition of a country being distinctly related to or even part of another, the concept of self-governance derived through history is generally accepted.

In the case of Jersey, self-governance has been essential to the island’s success in the finance industry as an independent jurisdiction. It also provides considerable liquidity to London.

Had it been absorbed into the UK, it would more likely have operated as a sort of distant Isle of Wight.

Map showing Jersey and Guernsey (both erroneously labelled UK), along with Isle of Wight, UK, to the north. Source: World Atlas

Note: the Isle of Wight has a GDP per capita estimated at £21,946 and unemployment at 7.5%.

Jersey: £45,320 and unemployment at 4.7% on last estimates.

Similarly, Taiwan appears to have benefited enormously from self-governance. Its GDP per capita is around 3x that of China’s. It has developed a competitive advantage in the global manufacture of semiconductors.

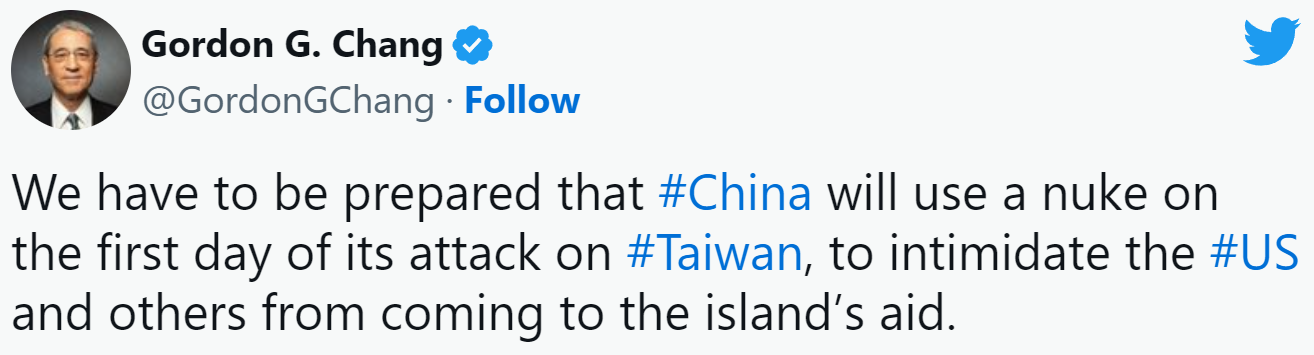

Unfortunately, many commentators in the media do not see the Taiwanese situation as peaceably.

Indeed, some opinions are alarming. Like this one:

Source: Twitter, 27 April, 2023

The lessons from World War II are not to appease. To prepare for war. To ready for the worst possible outcome. That terrible conflict has made us all more wary, paranoid, and cynical.

Further, it pays to keep in mind who you are dealing with. Self-governing norms are unlikely to have any credence within the ideology of the CCP (Chinese Communist Party).

But what does the possible risk of conflict over Taiwan mean for investors?

One possibility is a blockade by China to force Taiwan to come to the table.

The Rhodium Group, a think tank that specialises in economic research related to China has warned ‘that more than $2 trillion in global economic activity could be disrupted if China attempts to blockade Taiwan’.

This is not necessarily paralysing for the US, with a GDP of more than $23 trillion. But it does reinforce the need to address critical supply chain reliance. And in the case of New Zealand, severe disruption of significant exports to China and Japan.

A good investor prepares for a rainy day. And for a bloody day.

Let’s take a look at how smart investors might add a little protection to their portfolios…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.