Quantum Wealth Summary

- FTX, the world’s second-largest cryptocurrency exchange, has filed for bankruptcy. Reportedly, over $32 billion of wealth has been wiped out overnight.

- However, despite the turbulence of ‘crypto winter’, some contrarian investors have benefited during this time. They are actually up over 130% in gains this past year. They have done this by using a controversial trading instrument to profit from Bitcoin’s pain.

- Is this rebellious strategy a sustainable one? Does it make sense to continue betting against crypto?

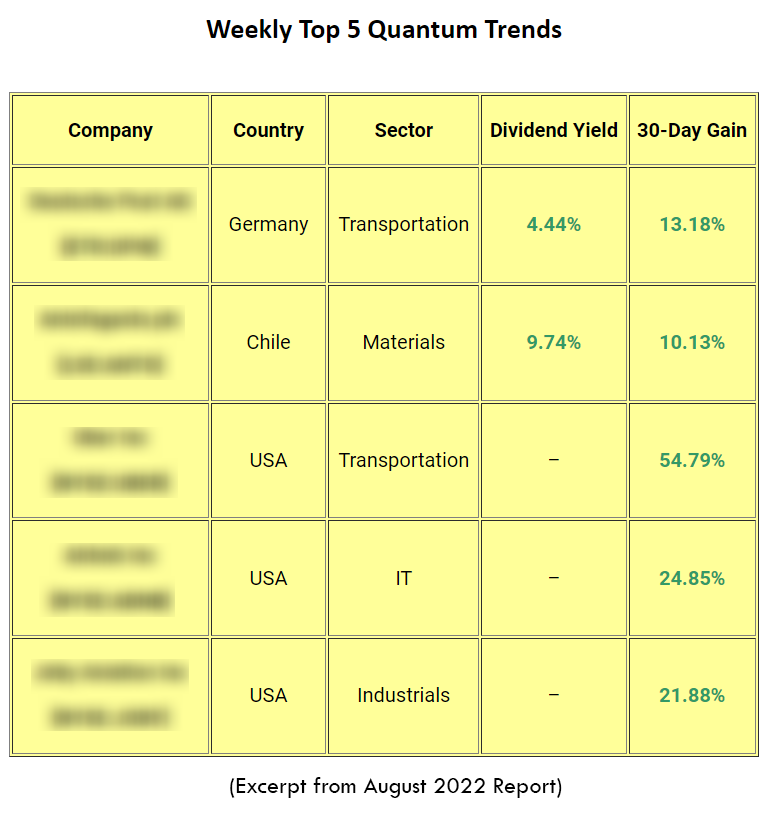

- Protecting wealth matters — and you’ll find this covered in our Weekly Top 5 Quantum Trends. If you’re a serious value investor looking for long-term growth and income, these are urgent global openings that you can’t afford to miss.

This is perhaps the most important question of our time.

Are you investing in an idiot-proof business?

Doing so has been a big part of Warren Buffett’s strategy over the years. He says: ‘I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.’

Buffett certainly practises what he preaches. He invests almost exclusively in ‘boomer stocks’ like Apple [NASDAQ:AAPL], Bank of America [NYSE:BAC], and Coca-Cola [NYSE:KO].

The attraction of these companies? Well, they have relatively simple business models. Easy enough to understand. Easy enough to measure. No confusing techno jargon.

Yes, you could say these companies are boring and conventional. But that’s exactly what Buffett is looking for.

Why?

Well, the reasons are numerous.

It’s about human error. It’s about bad luck. It’s about extreme volatility.

Buffett wants to account for all of these things.

Let’s face it: all businesses will face challenges that can’t be controlled or even predicted. This will happen even despite the best intentions of the people running them. The world, as it stands, is complex and unpredictable enough.

So, what’s the antidote to this problem? Yep, you guessed it. Buffett’s instinct is that a good business should be idiot-proof. As much as humanly possible. Just in case.

Source: Twitter

Now, this brings us to FTX, the second-largest cryptocurrency exchange in the world.

You can’t possibly miss the headlines. FTX is filing for bankruptcy. Investors are out of pocket. Over $32 billion has been lost. The tears and anguish are real.

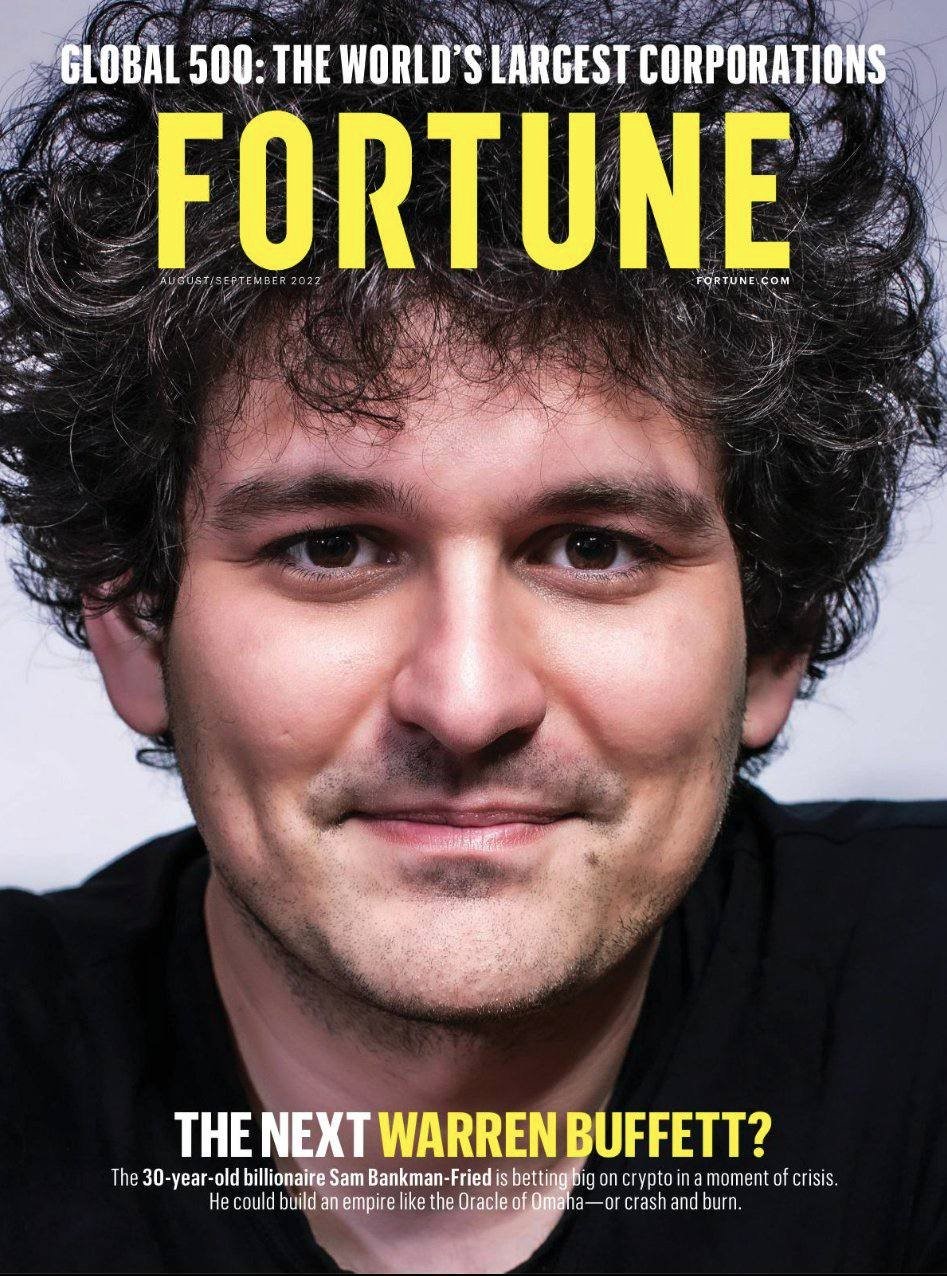

The mainstream press is ready and willing to crucify FTX’s founder, Sam Bankman-Fried. They seem to relish mocking him for his missteps. His misdeeds. But I don’t want to rehash that negativity. I think it’s been overdone.

Instead, I’m going to say something contrarian here. Sam is clearly no idiot. I’ll say it again: he’s clearly no idiot. As an MIT graduate and the son of two professors, he is incredibly smart. He obviously understands concepts like blockchain, DeFi, and Web3 better than most of us do.

Sam built his fortune — which reportedly peaked at $26 billion before the FTX collapse — by mastering the art of arbitrage. He made serious money by identifying the price differences in crypto assets being sold in various countries. He saw this opportunity, and he was smart enough to capitalise on it. He was the right person, in the right place, at the right time.

But here’s the fundamental problem: cryptocurrency has a very low margin of safety. Little room for error. Which means, if you deal with crypto, you are living on the razor’s edge.

Certainly, you need to be highly skilled with technology. You have to be comfortable with wild swings in price. You need to have a bold, imaginative mind.

Without a doubt, Sam Bankman-Fried had all these qualities. But even so, his FTX business still fell over, big-time.

Yes, you could argue that even smart people make mistakes. It’s only human to do so. But what is remarkable is how unforgiving the world of crypto is. The stakes are that much higher. The punishment is that much harsher.

Even geniuses are not spared; let alone mere mortals.

This is all part of a prevailing trend known as ‘crypto winter’ — which has seen over $2 trillion lost this past year.

Bitcoin, the granddaddy of cryptocurrency, has fallen steeply from its November 2021 peak of $64,000 to around $16,000 today.

Naturally enough, a string of crypto companies has run into trouble.

Celsius. Voyager. Three Arrows.

And now…FTX.

All this has happened primarily because interest rates are going up. Debt is getting more expensive. The easy money ain’t so easy anymore.

However, despite the turbulence, some contrarian investors have benefited during this time. They are actually up over 130% in gains this past year. They have done this by using a controversial trading instrument to profit from Bitcoin’s pain.

Clearly, even in a fearful climate, some people will still win. But is this rebellious strategy a sustainable one? Does it make sense to continue betting against crypto? Or will crypto eventually reverse course and make a comeback?

Let’s dig in and find out…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.