At the beginning of November, Bitcoin was trading at a level of around US$13,000 per coin.

Within two weeks, it shot up to over US$18,000.

That’s a surge of almost 40%.

How did this happen? Why?

Here’s the important difference between trading stocks and trading cryptocurrency:

- Some stocks on the market can be volatile, experiencing a price shift of up to 10% a day. If this happens, the company might need to provide a credible explanation to a regulatory authority, explaining the cause of the price change. This is to prevent speculation.

- However, with cryptocurrency, it’s like the Wild West. It’s not regulated, so prices could go up to 20% or more in a single day. There is no authority to deal with this.

This has certainly created more speculative interest in Bitcoin.

What played a part in Bitcoin’s price jump?

There were a few things that happened which likely played a part in the sudden price increase.

First of all, on November 13, PayPal tweeted an important announcement.

The company revealed that US users will now be eligible to hold, buy, and sell cryptocurrency directly through their accounts. PayPal has also increased its weekly purchase limit to US$20,000.

Source: Twitter

Source: Twitter

There are currently around 346 million active PayPal users around the world — with 179 million of them being US account holders.

How significant is this?

- Let’s just assume that only a small percentage of the 179 million US users will actually use cryptocurrency.

- Let’s assume that number is 1% — which is 1.79 million PayPal users using cryptocurrency.

- Keep in mind that the maximum circulating supply that Bitcoin can ever reach is 21 million.

- That’s not a lot to share around.

This gives me a reason to believe that there may be a higher demand for Bitcoin and other cryptocurrency in the future. This is because the market is experiencing an expanding user base with limited crypto supply.

How will a Covid-19 vaccine impact Bitcoin and the wider economy?

Pharmaceutical manufacturers Moderna and Pfizer have also made positive announcements in November. They are rolling out vaccines that are around 95% effective in preventing Covid-19 infection.

A vaccine breakthrough is what everyone has been waiting for. It suggests there’s light at the end of the tunnel for this pandemic.

Will the economy lighten up? Will things start going back to normal?

Yes, possibly — but there is a catch.

- Governments around the world have been borrowing excessively in order to provide stimulus for the global economy.

- This ‘money printing’ has led to low interest rates and an increased money supply.

- The end result could be hyperinflation.

As time goes by, local currencies could experience a devaluation. This means that the prices of products and services may rise sharply. This might encourage people to start hoarding goods, as well as invest in more stable foreign currencies.

Ultimately, people may shift their wealth into Bitcoin because it might act as a better store of value. A possible hedge against uncertainty.

Bitcoin could be protected from inflation because of this important factor:

- Every four years, a block-halving event happens.

- Miners on the blockchain are rewarded with less.

- This keeps the supply of Bitcoin limited and constrained, allowing it to maintain its value.

Ultimately, this might make Bitcoin more desirable than real-world currencies, which may experience devaluation due to an expanding money supply.

Bitcoin is precious because it is scarce. It could be regarded as digital gold.

What does the future look like for Bitcoin in 2021 and beyond?

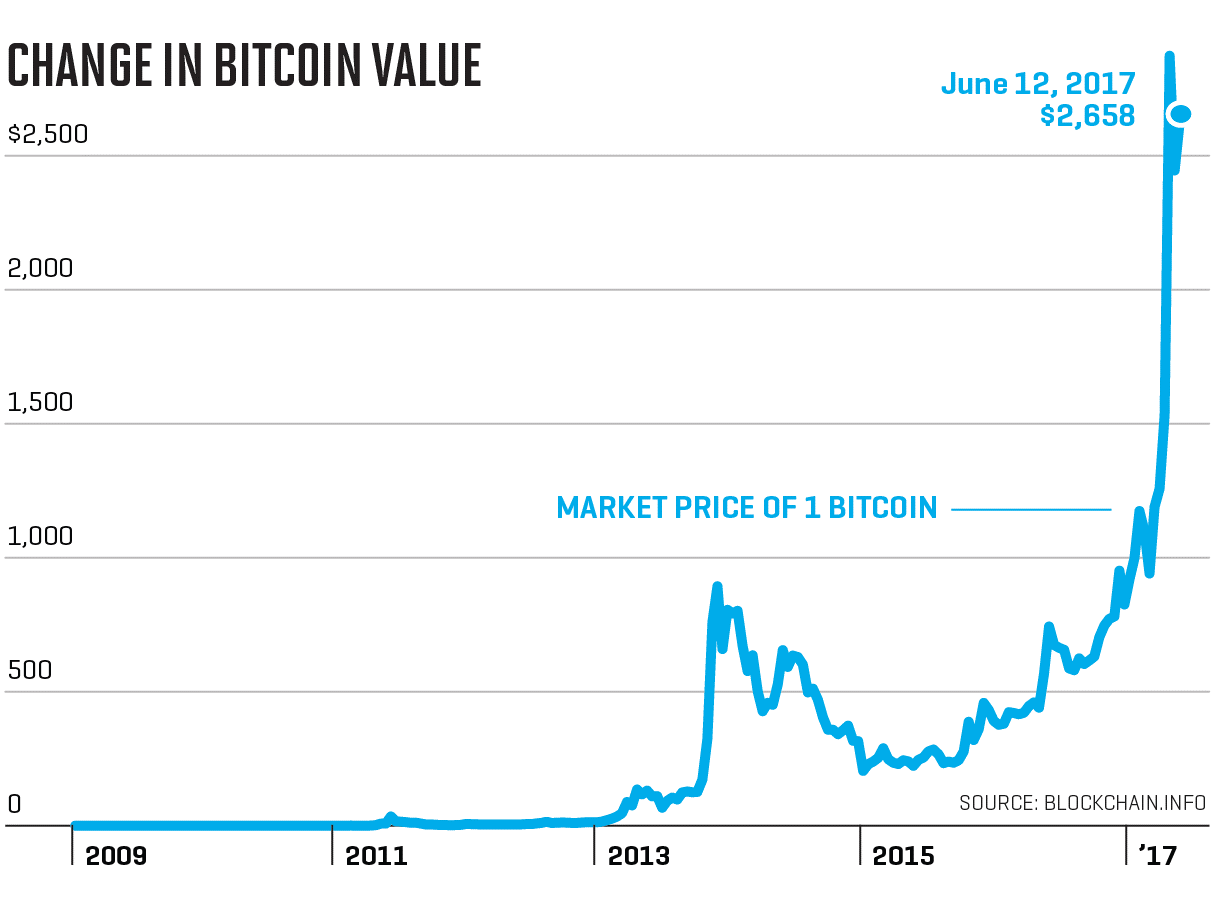

We have seen the value of Bitcoin go through phases of big highs and big lows.

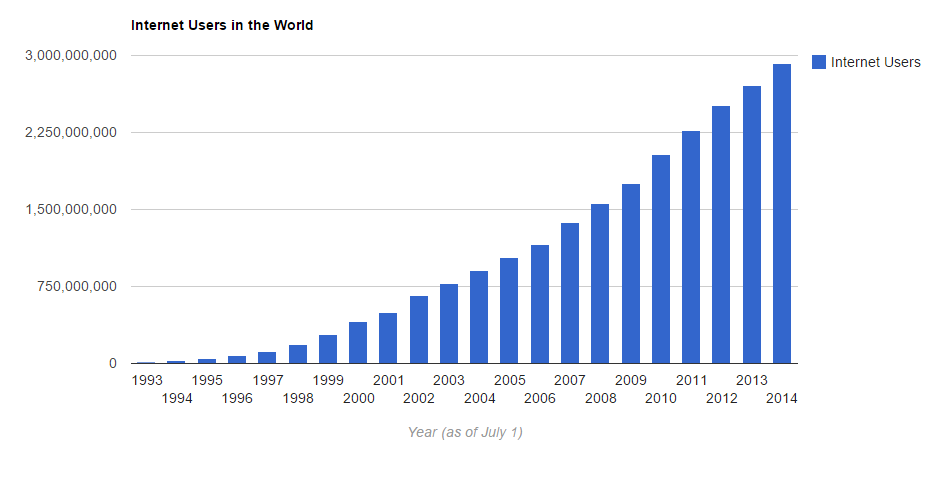

To use an analogy, the Bitcoin timeline may be similar to the rise of the internet.

Source: Knew The News

Source: Fortune

You might be asking yourself why I’m comparing Bitcoin to the internet, when they are two different things.

There is a good reason for this.

The internet was also perceived as an exotic novelty in the beginning. Many people turned a blind eye to the internet — even though it had the potential to change the world.

Bitcoin might just be in a similar position. It was initially ignored — but it is slowly rising in popularity and gaining mainstream acceptance. Already, we’re seeing more and more companies adopting Bitcoin as a legitimate payment option.

As this upward trend continues, could Bitcoin use be as influential as the internet itself? Could it be as significant?

I will be continuing to watch these exciting developments with much interest.

Regards,

Alistair Bilkey

Analyst, Wealth Morning

(Disclaimer: this material is provided for example purposes only. It should not be construed as investment advice. The opinions expressed are the personal views and experience of the author, and no recommendation is made.)

Important disclosures:

Alistair Bilkey owns Bitcoin.

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.