It wasn’t very long ago that Europeans believed that all swans were white. A black swan simply did not exist. No one had ever seen one. So this mythic animal was beyond the realm of possibility and imagination.

But all that changed when the first Europeans landed in Australia. To their astonishment, they discovered that, yes, black swans did exist. It was no mere fairy tale.

Source: Belt and Road News

As humanity has evolved, we have encountered many other historical events that have challenged our presumptions of reality. This has given rise to what we now call Black Swan Theory. It can be summed up like this: ‘You don’t know what you don’t know.’

The first black swan event of 2020

It felt like something out of apocalyptic sci-fi, didn’t it?

Covid-19 first emerged in Wuhan, China, before spreading across borders like wildfire. It disrupted trade and tourism. Crippled the global economy. Financial markets nosedived.

The scale and speed of this black swan event was stunning. People were caught off-guard. So they did what came naturally: they panicked.

Source: Forbes

Here in New Zealand, we had our fair share of fear.

- We saw some people switch their KiwiSaver retirement funds from aggressive to conservative, hoping to limit their perceived losses.

- We saw some people suspend their active investing, waiting to see what would happen next.

- We even saw some people sell all their stocks and retreat into the perceived safety of term deposits and bonds.

In hindsight, we now know what they did was wrong. Maybe even disastrously wrong. Because what came next was breathtaking.

The second black swan event of 2020

March 23 was the exact day that the markets hit their lowest point. Then, from there, we saw a sharp reversal of fortunes.

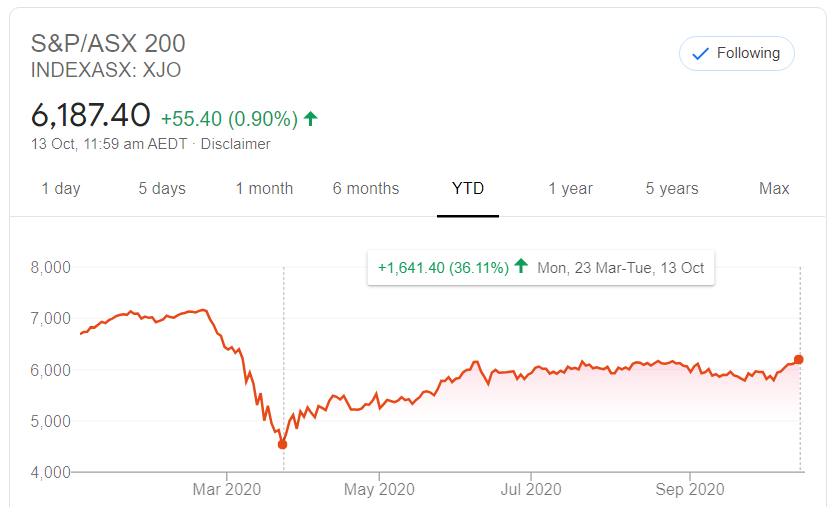

Take a look at these three charts from Google Finance — they reveal what happened in America, New Zealand, and Australia.

Source: Google Finance

Yes, that’s right. The markets rebounded between 30% to 50% because of immediate and decisive government action.

In the aftermath, here’s what we saw:

- The people who switched their KiwiSaver funds from aggressive to conservative largely locked in their losses. They may have enjoyed a slight positive bounce from the all-time low, but not as much as they could have.

- The people who put their investing on pause were somewhat happy when their existing holdings rebounded in value. However, they regretted not taking the chance to invest at a steep discount when they had the chance.

- The people who sold off all their stocks and retreated fared the worst of all. They not only locked in their losses 100%, but they found themselves stuck with inferior returns instead. For example, by December 2020, the average 1-year term deposit rate in New Zealand hovered around 0.89%.

Here at Wealth Morning, we had a front-row seat as we watched Covid-19 unfold. And we encouraged people generally to weigh up the risk factors and buy carefully into the markets, if they could afford it. And those who did it are certainly better off today as a result.

It was all about courage and having an intuitive understanding of this macroeconomic event.

Of course, past performance is not an indicator of future performance. And no one has a crystal ball. But one thing is clear: when you’re mentally prepared for a black swan event, you can position yourself to prosper from it.

Louis Pasteur said: ‘Chance favours the prepared mind.’

So don’t just stare at the white swans. Find the black swans too.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

PS: Our Vistafolio Wealth Management clients have benefited from our long-term investment strategy. We took the black-swan dip as an opportunity to buy into property, infrastructure, pharmaceuticals, tech, mining, and much more. It’s all about being in the right place at the right time. Do you need immediate help to protect and grow your wealth? Do you qualify as an Eligible or Wholesale Investor? Click here to find out more.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.