How much do you know about Malta?

I wouldn’t be surprised if the answer’s ‘not much’ — it’s a mysterious little nation.

But of all the fascinating countries in the world, I think Malta would have to be my favourite.

Isolated and tranquil, it’s host to some of the oldest free-standing structures of the world and the earliest inhabited ‘cave of darkness’.

It also doesn’t have any property taxes. Yippee!

And its beaches are oases of sparkling aqua waters and endless white sands.

No wonder over 1.6 million tourists travel there every year. And yet only its citizens are allowed to park in the capital Valletta’s special green spots.

Some of the most picturesque scenes from cinematic history have been shot there, from The Gladiator and Troy to The Da Vinci Code and Game of Thrones.

The Maltese language itself is unique. It sounds like a curious combination of elegant Arabic, French and Italian.

And finally, Malta’s known to have a spiritual air to it. In fact, many pilgrims consider Malta to be a sacred spot, due to its beautiful honey-stoned temples, nature reserves and ancient religious relics.

The ‘Blockchain Island’

But what many don’t know about this pristine nation, I suspect, is its unofficial status as ‘the Blockchain Island’.

And this is why Malta is a crypto enthusiast’s paradise (and why it’s my favourite).

Crypto investors flocked there in droves last year for a massive blockchain summit, and it’s fast becoming known as a global crypto hub.

Now just last week, the Malta Financial Services Authority (MFSA) has issued a cybersecurity consultation on cybersecurity on the blockchain industry.

If one of Malta’s biggest financial authorities is looking into making crypto safer and more secure, it’s obvious this little nation is in it for the haul.

In the past, Maltese politician Roberta Metsola has spoken highly of blockchain’s decentralised model, claiming that it ‘provides more security’, and is ‘essentially about increasing trust’, and delivering ‘more peace of mind’.

No other country seems to embrace crypto so openly…so what’s going on in the rest of the world?

(And can I move to Malta already?)

Well, not so fast.

Let me explain…

After all the hype in 2017, many people thought blockchain had gone and died an early death last year.

But this couldn’t be further from the truth.

Blockchain has actually infiltrated the global economy in a really big way. Just not in the ways some of us expected.

The financial industry no longer fears blockchain tech

Its biggest sector right now? The financial industry.

Which is logical but is still strange in a way.

You might remember this was the industry that initially feared powerful technologies like crypto and blockchain.

But now they’ve done a 180 and are now beginning to embrace it as the way of the future.

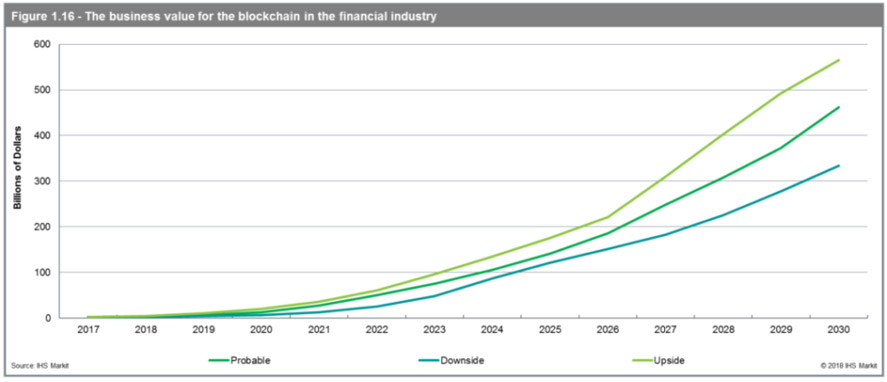

A startling new report from IHS Markit predicts that the finance industry blockchain market will reach $462 billion by 2030.

At this stage, it’s pretty clear that the global financial market will continue to be the biggest market to use blockchain technology.

Check out this chart:

|

Source: IHS Markit |

Now it seems obvious.

We’ve seen story after story of banks and fintech institutions using blockchain to improve their businesses.

And the number of blockchain projects in this sector is only growing.

Cross-border payments, share trading and syndicated lending could all be successfully enabled by blockchain.

But blockchain will also help businesses save more money by increasing the efficiency of internal transactions due to its publicly accessible ledger system.

Just today the press reported a small Aussie broker firm — Halifax — which went broke just before Christmas, may have lost up to $25 million of customer funds by mixing it up with their own funds.

Blockchain technology solves that easily.

Financial institutions that are either in the process of adopting blockchain right now or actively looking into it include GM Financial (General Motors’ financial arm), and even the Bank of China.

How it’s unfolding in Australia

So what about Down Under?

Are we behind or ahead in the blockchain revolution?

Well, a Treasury review is currently considering how to regulate the ‘wild west’ of blockchain start-ups.

Although the review undeniably looks at the risks, it’s also looking at the opportunities.

To me, it’s clear.

The world is finally starting to mobilise. More and more nations and financial institutions are embracing what blockchain has to offer.

One question remains: how quickly will blockchain now take over the rest of the world of business?

Good investing,

Ryan Dinse

Ryan Dinse is a contributing editor at Money Morning New Zealand. He has worked in finance and investing for the past two decades as a financial planner, senior credit analyst, equity trader and fintech entrepreneur. With an academic background in economics, he believes that the key to making good investments is investing appropriately at each stage of the economic cycle. Different market conditions provide different opportunities. Ryan combines fundamental, technical and economic analysis with the goal of making sure you are in the right investments at the right time.