Sex, scandals, hush money, and secret tapes.

Nothing like a little American politics to start your day off right.

Less than 48 hours ago, CNN attained audio recordings from a Michael Cohen/Donald Trump meeting that paint the American president in a not-so-pretty light.

In the recording, you hear Trump and his lawyer, Michael Cohen, discussing making a payment to a man named David. It’s assumed that David refers to David Pecker, long time friend of Trump and chair of the AMI, who owned the exclusive rights to a story about an affair that Trump may have had with Playboy model, Karen McDougal.

What’s interesting is that the story never ran…suggesting that Trump may have been successful in arranging something.

At this point, it’s hard to tell if this is a reelection-killing scandal or just your normal media clap trap.

All I know is that Trump needs better lawyers.

Another Cohen, Sacha Baron Cohen, made waves this week when his new show, Who is America?, aired. Under the disguise of an anti-terrorism expert, Cohen duped a legislator from Georgia into ‘using the n-word to ward off a kidnapper and baring his buttocks to scare off terrorists.’

Ridiculous. Offensive. The show ended the legislator’s career almost instantaneously.

Other interviewees like Sarah Palin and Dick Cheney have to be squirming in their seats.

It just goes to show how quickly it can all fall apart…which leads me to today’s question — if society collapsed tomorrow, how would you fare?

Apocalypse now

Would you have what it takes to survive?

That was the question asked of Dr Douglas Rushkoff when he met with five ultra-wealthy hedge fund managers.

‘Which region will be less affected by the coming climate crisis: New Zealand or Alaska? Is Google really building Ray Kurzweil a home for his brain, and will his consciousness live through the transition, or will it die and be reborn as a whole new one? “How do I maintain authority over my security force after the Event?”’

The ‘Event’?

It’s the catastrophic collapse of society as we know it…whether by environmental effects, social unrest, nuclear explosion, unstoppable virus, or Mauldin’s train crash.

It’s the reset that levels the playing field.

Well, mostly.

There exists a unique group of people who spend a lot of time and lot of money getting ready for this kind of ‘Event’. Where I’m from, we call them ‘doomsday preppers’.

They take it seriously. Guns. Food Rations. Bunkers. Training.

There was even a TV show about them for a while.

It’s a natural urge — the instinct of survival.

Not that you lack that instinct if you don’t ‘prep’. It’s just that you prioritise your present needs over the chance that the world does indeed fall apart one day.

That’s normal too.

You skimp on that life insurance policy because you’re as fit as a fiddle.

You eat that second steak and cheese pie even though it probably knocks a few days off your lifespan.

You buy that bach instead of filling up your emergency fund.

Everyone makes trade-offs. These ‘preppers’ just choose to trade their present earnings off for future security. Just like insurance.

(By the way, if you’re not from New Zealand, a bach is a holiday home.) [openx slug=inpost]

Prepping for investors

Today, I want to talk about financial ‘preppers’.

They might not be preparing to live underground, but they are preparing for a catastrophic eventuality.

They’re employing strategic tactics to make their money as invulnerable as possible.

They’re hoarding cash, bonds, and precious metals.

And if they’re in the stock market, they’re in defensive positions.

In our network here at Money Morning New Zealand, we have a few of these so called ‘preppers’.

Bill Bonner is one. Vern Gowdie is another.

In a recent article for Markets & Money in Australia, Vern said:

‘Unfortunately, our economic winning streak has set us up for a massive failure.

‘What’s going to make this worse is that we do not have the skills to cope with failure.

‘Wholesale job losses. A sustained and severe downturn in our beloved property values. Foreclosures. Business closures. Bankruptcies.

‘The flipside of prolonged success is not going to be pretty.

‘Adjusting to changed conditions is not going to be easy.’

It’s the idea that everything good must come to an end…and things have been good for a long while now.

And we’d tend to agree.

You might think that the government’s got our backs. They’ll douse us with a dollop of QE if it comes down to it. Too big to fail, right?

Relying on the state to dig you out when things get heated is a dangerous idea.

Just ask any average American. They lost an average of $66,200 worth of investments per US household, and their homes dropped in value by an average of $30,300. And that’s with federal assistance like TARP.

5.5 million Americans lost their jobs, and those who kept theirs lost an average of $5,800 in income.

So if you want to put your trust in the feds, go ahead. But if you have an ounce of doubt that you could get short-changed if a crisis hits, consider how well you’re prepped for the Event.

Survive and protect

So what does a prepper portfolio look like?

Well there’s normally the double pillars of cash and gold. Maybe some bonds. Maybe a little in stocks to cancel out the effects of inflation.

With this kind of mix, you could sleep well at night (in your bunker) knowing that your wealth was diversified.

Now, you wouldn’t be making much, but you wouldn’t be losing either.

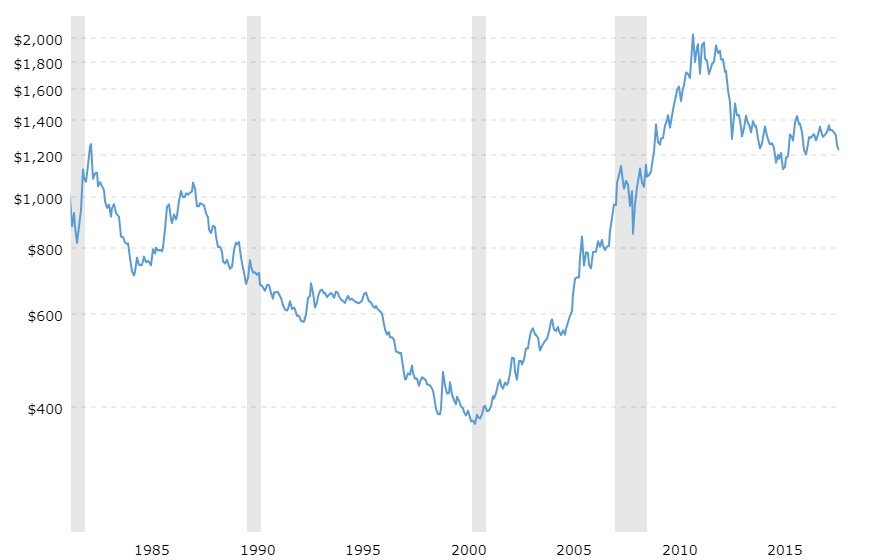

In fact, gold has stayed pretty flat since Bretton Woods with the greatest downtrend leading up to the dotcom bubble.

|

Source: Macro Trends |

Of course, you might argue that you could have made more money off the New Zealand stock market at any time after the ’87 crash, but that simply gives credence to Vern’s premonition.

‘The flipside of prolonged success is not going to be pretty.’

Now, maybe you don’t want to look like an idiot in front of your friends. Everyone’s making money hand over fist while you’re sitting steady with gold. That can’t feel good. I get it.

But if you’ve seen The Big Short or read the story of Noah, you’ll know that sometimes it pays off to go against the grain.

In the financial world, that might mean holding a little gold or cash.

Best,

Taylor Kee

Editor, Money Morning New Zealand

PS: If you worry about surviving a major crash, you’re not alone. We’ve heard from readers wanting to learn more about the best way for Kiwis to prepare. So we’ll be delving further into this topic in the coming weeks.

PPS: If you have something on your mind, send us a note at [email protected].

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.