If you’re over 65, I’m sorry. You may want to plug your ears or take out your hearing aids (whichever is easier).

New Zealand has a serious old people problem.

Not that our old people are necessarily bad…it’s just that there’s so darn many of them. Over 600,000 in fact (in 2013).

They love to ramble. They’re always hanging out at the RSA. They’re singlehandedly keeping the newspaper industry alive. And whenever they talk, they seem to compete to see who’s got the most afflictions.

Despite their amusing habits, we love them. They’re important to us. And they’re a respected cornerstone of our whakapapa.

They’ve lived long lives and had careers and families. They’ve worked hard so that they can live comfortably and enjoy retirement.

And the pension system is supposed to help them do that.

Unfortunately, the system has a fatal flaw. Like a tiny crack in a dam, this flaw will worsen and worsen until it all breaks loose.

I’ll explain it in a second, but first, where did this flaw come from?

A history of pensions in New Zealand

Until 1898, New Zealand had no public pensions. Elderly colonisers either supported themselves or were supported by their families. Older Maori were provided for by their whanau.

But it’s not necessarily a good comparison with today.

Back then, only 1.3% of the population were over age 65. Today, that percentage is closer to 15%.

There just weren’t enough people living past 65 to be a significant part of society.

Around the 1890s, life expectancies started to creep towards the 65 mark. That led to discussions on how these older New Zealanders could be reliably supported.

Thus, the Old Age Pensions Act was introduced in 1898.

Under Richard Seddon’s government, this ground-breaking legislation gave a small means-tested pension to elderly people with few assets, and who were of ‘good moral character’.

The pension maxed out at £18 per year (equivalent to $3200 today). And only the poorest qualified. There was still the expectation that most people should be able to support themselves.

Fun fact — New Zealand beat the United Kingdom to the punch by a full decade. The UK didn’t launch their old-age pension programme until 1908.

New Zealand’s Old-Age Pension didn’t really catch on until 1938, when it was upgraded to the Age Benefit. Under this scheme, the age of entitlement was lowered to 60 and the pension was boosted to £78 a year. This is when pensioners started transitioning from a marginalised minority to a favourable economic class.

This programme continued until the 1970s when the Royal Commission on Social Security recommended reforming it. They ramped up the benefits to 80% of the average annual wage.

The income and asset tests previously required for qualification were abolished, and only 10 years of residence in New Zealand was required to qualify. Plus, you didn’t necessarily have to be retired to start getting your pension, you just had to be old enough.

By 1978, the newly titled National Superannuation had become the single largest cost in the government budget and has continued to be a thorn in its side since. [openx slug=inpost]

Retirees of today

That brings us back to the crack in the dam.

Today’s system doesn’t require you to contribute to the pension programme in order to qualify. Nor does it matter how wealthy you are, nor how many assets you own.

If you’re 65 and have lived in NZ for at least a decade, you’ll get the full benefits.

Where is that money coming from? Current tax-payers.

The scheme is quite literally a Ponzi scheme. Taxes paid today are needed to cover benefits earned in the past. And like any other Ponzi scheme, the house of cards starts to collapse if money injections stall.

What happens when the ageing population needs more than taxes bring in?

The scheme falls apart.

If people are living longer, then they’ll need more support. And if they need more support, then the programme needs more taxes. And to get more taxes, it needs the tax-paying population to grow at a faster rate. But it’s not.

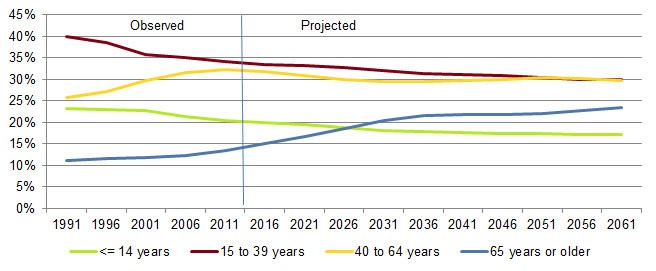

The proportion of older people to younger people is closing in. Check out this projection by the New Zealand Parliament:

|

Source: NZ Parliament |

The blue line is people 65 or older. See how it’s on an upward angle?

The purple and yellow lines are the tax-paying workforce. They’re either plateauing or dropping.

The crack in the dam reaches a critical point when the purple and yellow lines start to cross the blue line. When that happens, the government has three options as I see it:

- Borrow money and raise taxes to keep the pension programme afloat.

- Make it harder to retire by lowering benefits or raising the retirement age.

- A combination of the two.

We already know that the retirement age is going to be bumped up to 67, thanks to Bill English. That’s going to take effect in 22 years’ time. Unfortunately, it might be too late by then.

If you haven’t retired yet, the best thing you can do to start preparing for these kinds of uncertainties is to optimise the retirement account you can control — your KiwiSaver.

Sincerely,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.