Monday, 7th April felt like Covid.

John and I were trading the European markets. Daylight savings had ended here in New Zealand. Darkness comes earlier.

China had announced what many feared. Tit-for-tat retaliation against the Liberation Day tariffs of the Trump administration.

It takes nerve to buy into panicked markets as the world enters unchartered waters. Many traders were hitting the sell button to cover margins.

At that point, we had no idea what was kicking off. The start of an all-out market crash? Or a correction to digest the uncertainty?

Author, Wealth Morning trading desk

The next morning, I spoke to Paul Brennan at Reality Check Radio. Whatever was happening, I wanted to present some calm rationale for the listeners.

I knew it wasn’t the end of the world. It was just the start of a new cycle. There would be opportunities for brave investors.

The next question, then, is this…

Where are those opportunities likely to be?

Game theory means rational actors have a vested interest to lower their barriers and negotiate with the Dealmaker in Chief (aka Trump).

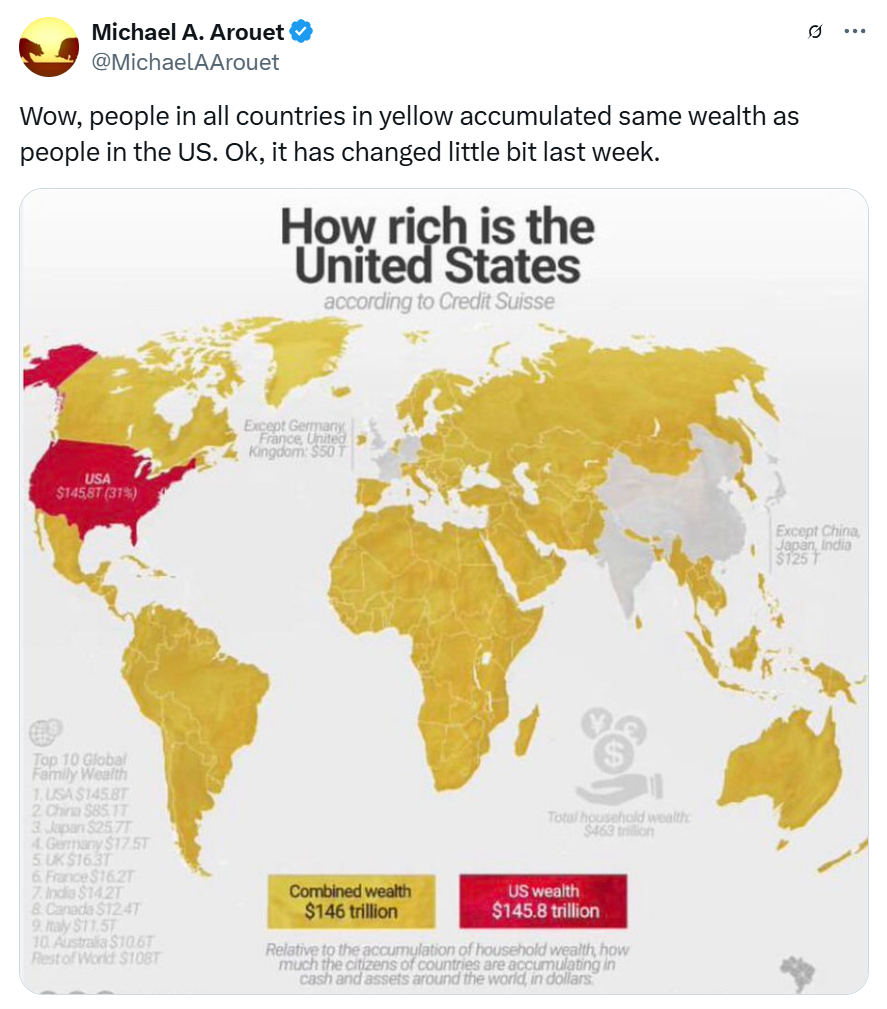

Some wag once said that if you could buy an elephant with no money down, Americans would buy one. The reality is that economic freedom and pioneer migration has created the world’s wealthiest market.

Source: Michael A. Arouet / X

When countries get rich, they tend to stay that way — with a few notable exceptions. (Argentina comes to mind, though it is embracing prosperity policy again.)

What about the melt-up in Treasuries?

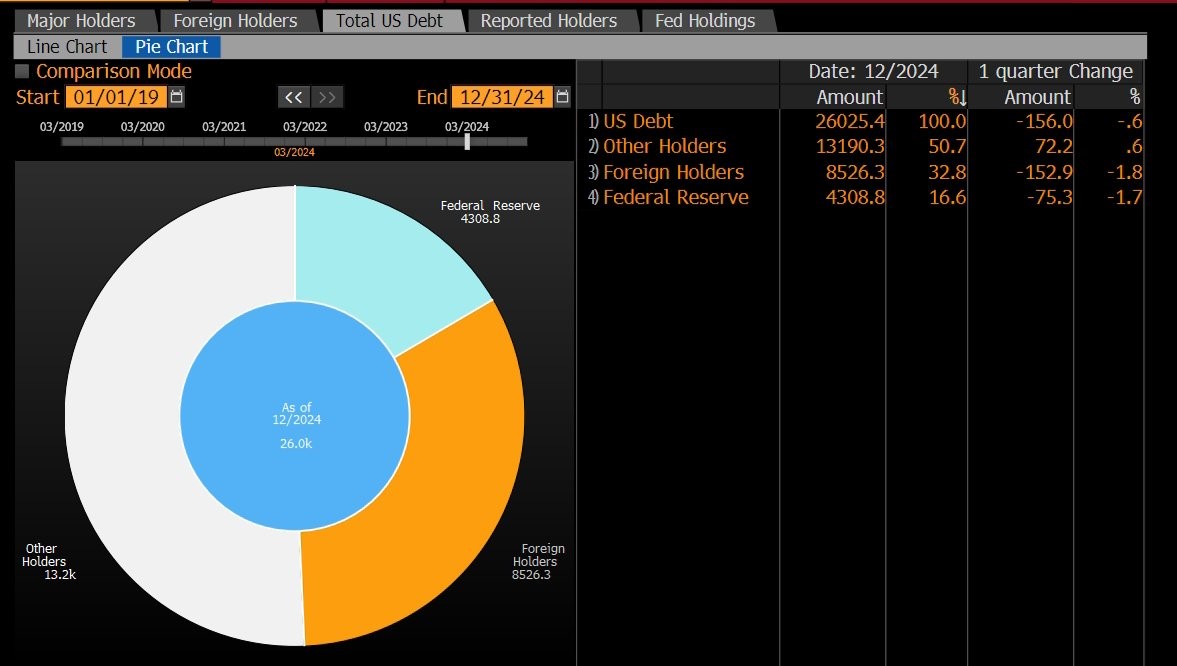

In April, bond prices did jump. Some said China was selling Treasuries to try and punish America. ‘Because it owns most of the US debt.’

This doesn’t stack up. As Daniel Lacalle points out, most US debt is held by US institutions (‘Other Holders’).

Source: Daniel Lacalle / X / Bloomberg

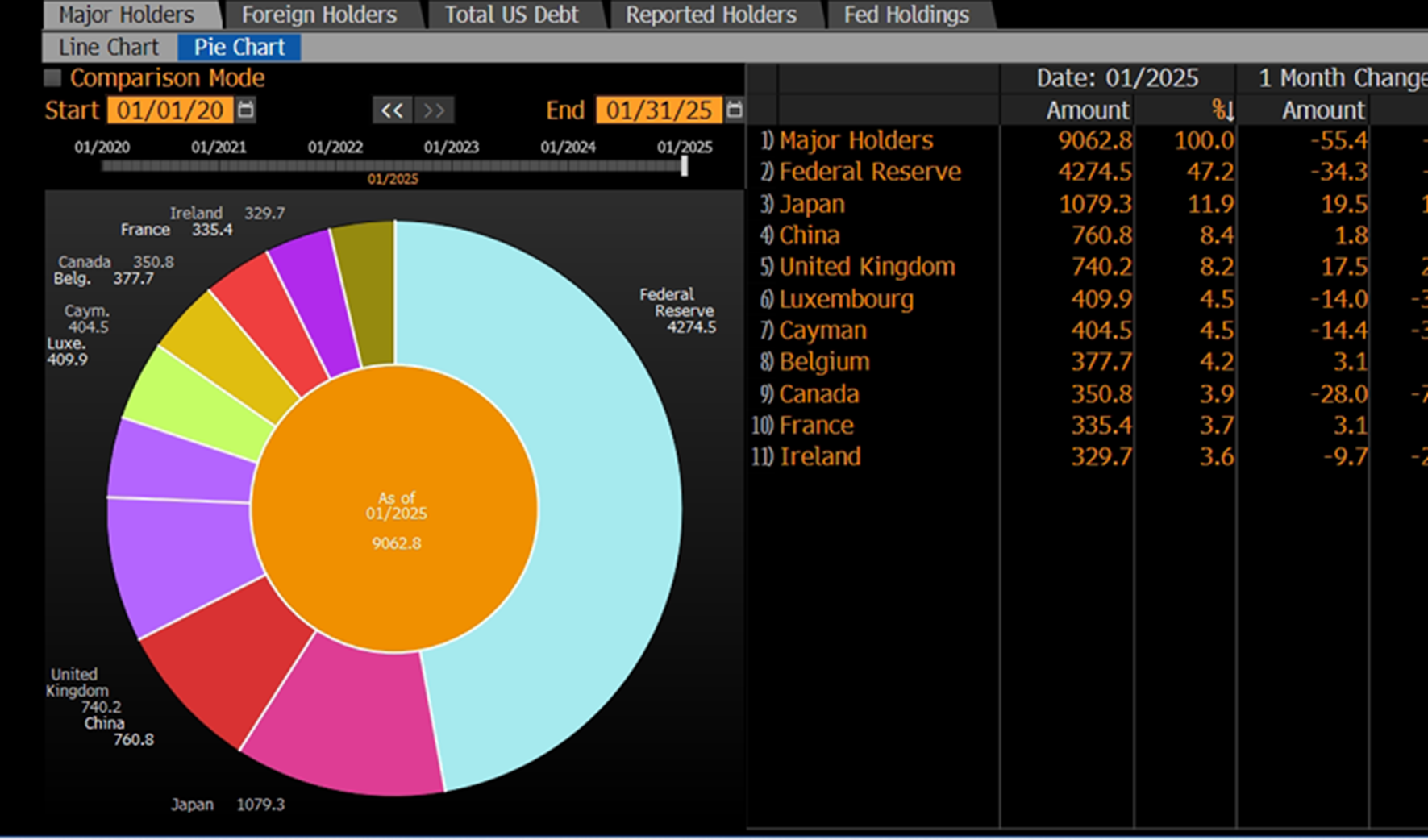

Of the ‘Major Holders’, China has less than Japan, and about the same as the UK.

Source: Daniel Lacalle / X / Bloomberg

The more likely explanation for the melt-up is that sudden market volatility meant traders were scrambling for liquidity. They had to sell Treasuries to cover margin positions.

Since then, liquidity has come back to the market big time.

This is not our first trade war

Markets sold off on the first one back in 2018.

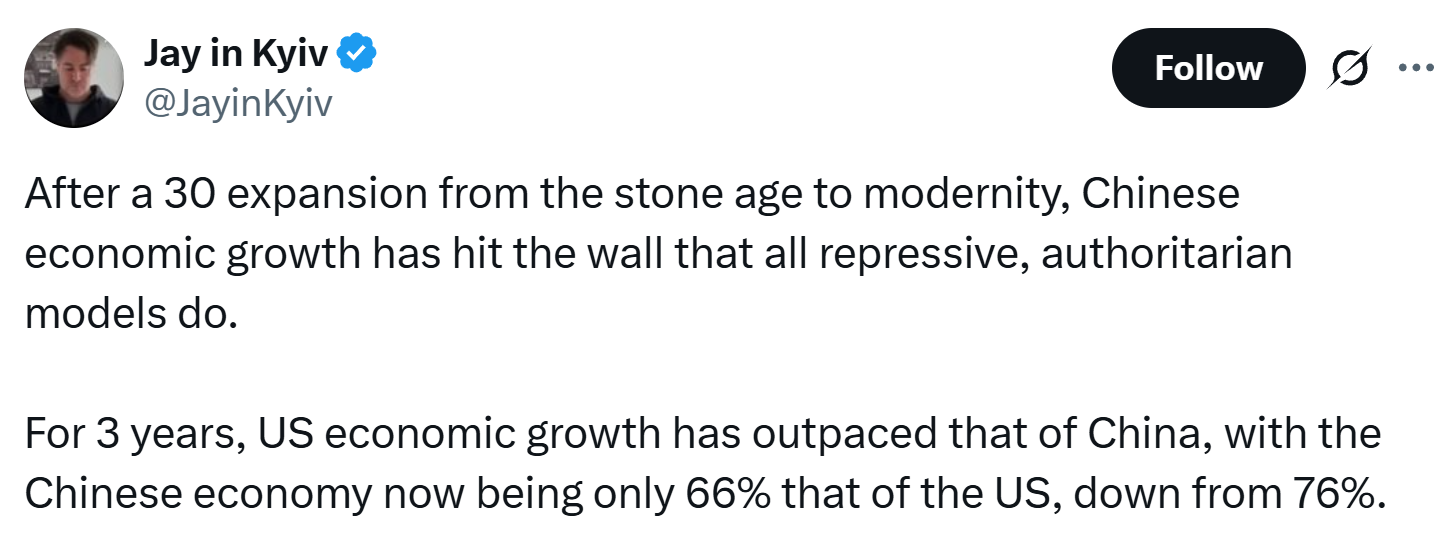

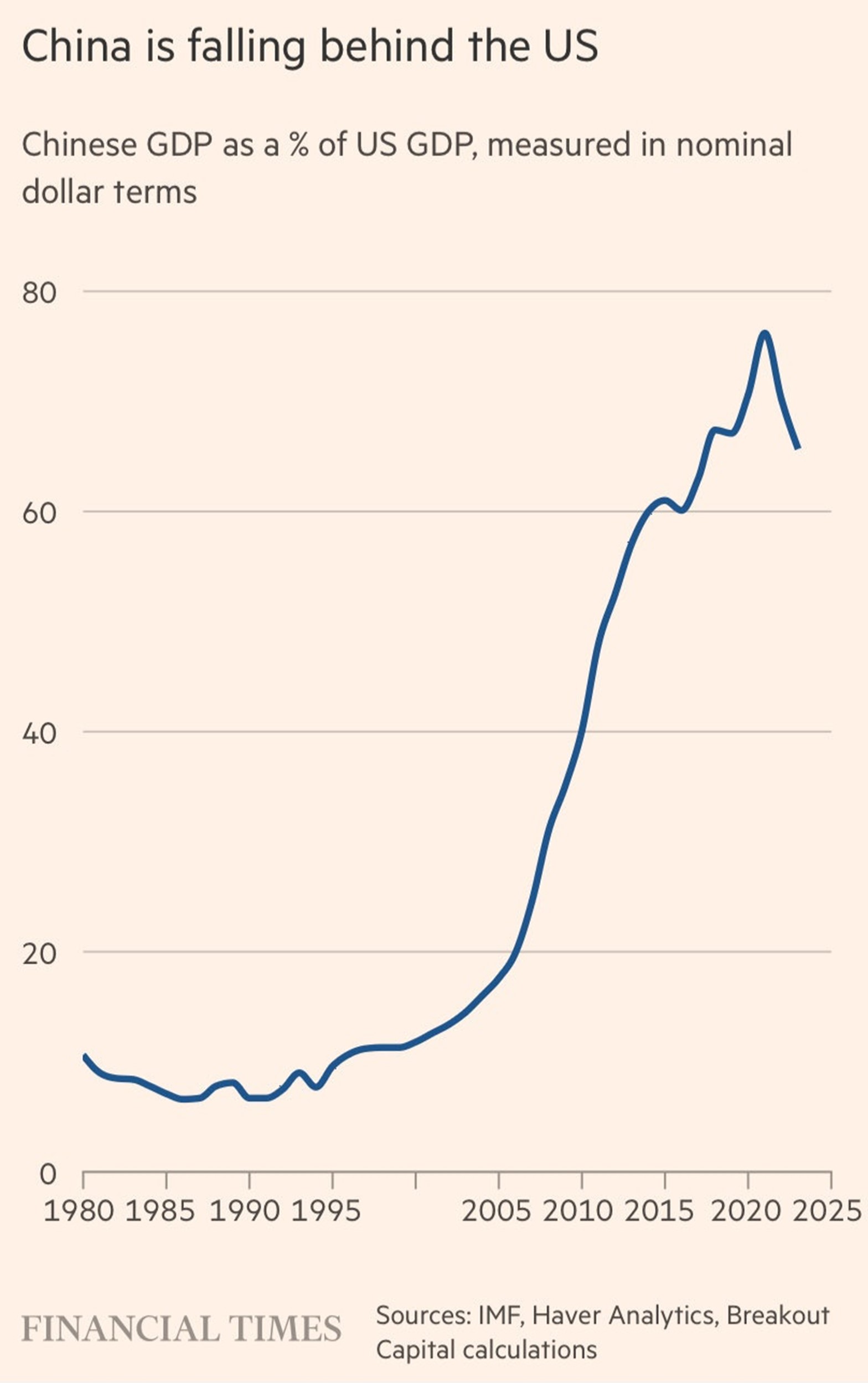

It is no surprise the Americans are prepared to risk escalating this again in the case of China. The result last time was that China’s GDP shrank in relation to the US:

Source: Jay in Kyiv / X

Beyond the initial shock of global tariffs, there is now some upside:

- Negotiations are running at pace to open up more trade opportunity around the world. Tech investor Cathie Wood sees that tariff ‘shock therapy’ could clear the way for freer trade and economic stimulus.

- Rebuilding of the American industrial base is the cornerstone of Trump’s policy. This offers investment inflow (more liquidity) and improved supply resiliency. It reduces geopolitical risk.

- Tariffs and impediments to global trade do create increased recession risk. This increases the likelihood of interest-rate cuts.

- Should the tariffs produce meaningful revenue, the US government will be well-positioned to stimulate and strengthen the economy with tax cuts and debt reduction.

For our wholesale investors, we remain focused on a value strategy

Our goal is to achieve growth with dividend income. This helps our clients build a passive income stream to achieve lifestyle goals.

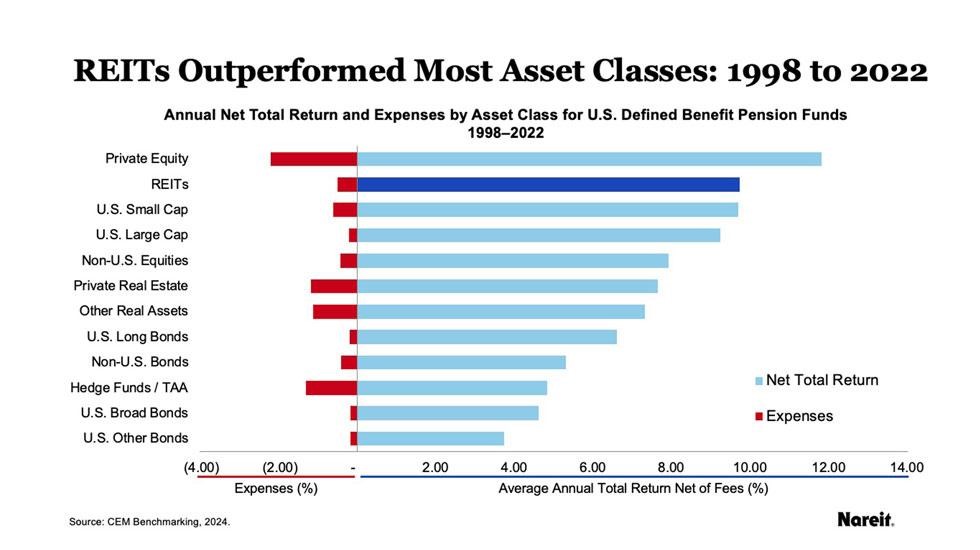

As liquidity improves and further interest-rate cuts seem likely, listed real estate continues to provide good pickings globally.

For patient investors, REITs (real-estate investment trusts) can perform very well.

Source: Nareit

Meanwhile, increased risk in global markets means NZD tends to get sold off

This is why it can be wise to diversify into larger economies and opportunities beyond New Zealand.

It was interesting to watch the euro become a safe haven when peak fear hit America. For New Zealanders with listed assets in Europe, the currency alone helped to insulate wealth and increase real dividend income.

Will there be a new world order?

There has been some dramatic reporting along the lines that the US has lost credibility; that tariffs are a protectionist overreaction, damaging America more than others.

Granted, the speed and gravity at which they’ve been applied is risky.

On balance, America is less dependent on trade than almost every other country. This trade war may help it increase investment, reduce dependencies, and in the long run increase the value of its equities.

Further winners will be those who succeed in trade negotiations. We have our fingers crossed for a comprehensive agreement between the US and the EU.

Exciting times to be fishing overseas. Embrace the opportunity.

Wishing all our clients and readers a blessed Easter break.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.