Shortly after the pandemic, Auckland’s most famous restaurant closed its doors for good.

It had been serving Tony Astle’s French-inspired cooking for 49 years.

The establishment has special memory for me. A date night with my now wife. And a special anniversary dinner before we moved overseas. (John Key was in the restaurant that night.)

Source: Antoine’s Restaurant

Many lucky Aucklanders will remember ringing Antoine’s bell to enter. Often greeted by Tony’s late wife, Beth.

On my occasions, I ordered the Duck à l’Orange. A generous serving with exquisite Grand Marnier sauce. Apparently, this was on the menu for 49 years.

So, it was with great interest when Tony’s book, Let Them Eat Tripe, was released this year.

Before and after Black Monday

As an investor, I found his retelling of his business before and after the 1987 sharemarket crash revealing.

Up until Black Monday, he was doing a booming trade. Tips would sometimes equal the laden bills themselves. The restaurant’s chauffeur-driven Rolls-Royce was available to regular diners.

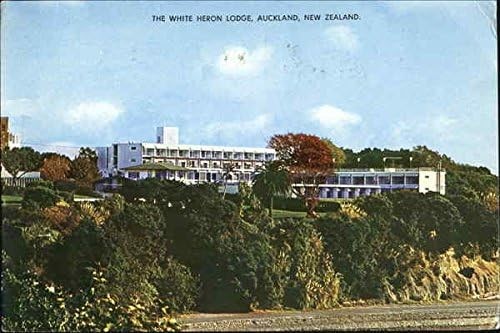

Stars like Elton John would stay at the nearby White Heron Hotel, a bastion of luxury. Then they’d head to Antoine’s for long, sumptuous dinners.

1960s postcard of The White Heron. Source: Amazon

Then there were the excesses at Antoine’s.

Hundred-dollar bills were occasionally found discarded in the bathroom. Having been used to snort cocaine. Following Black Monday, these became five-dollar notes.

How quickly things change.

When I visited the now-demolished White Heron in the late 1990s, it had become a sort of backpackers. And a pretty ragged-looking one at that.

Antoine’s in the 2000s was a much-reduced operation from what it once was. It only did evening meals. Tony cooked with the help of just a few part-time staff.

The 1987 sharemarket crash

The 1980s (before ‘87) was a wonderful time. I was just a boy then, but have fond memories of visiting a prospering Auckland. Parnell Rise was lined with late model Mercedes.

Black Monday put paid to all that. The New Zealand market was hit more than any other.

This country still bares its scars. I still speak to investors who remember its pain and aftermath with trepidation. The very mention of it invokes Macbethian despair.

I began investing on the NZX several years later at the age of 17.

With the benefit of what I know now, it is no wonder many investors lost their shirt in 1987. A good number of NZX market darlings had P/Es (price-to-earnings ratios) of over 50. The actual nature and quality of their businesses was speculative at best.

This still influences me to this day. I’m very hesitant to buy expensive or hyped stocks. Once the P/E gets into double digits, there has to be an absolutely compelling growth story. Instead, in our wholesale practice, we prefer to scrounge away. Finding discounts, property, value, and hidden gems others may have missed.

Markets move fast

Markets are made up of millions of participants, yet they can turn on a dime.

It never ceases to amaze me how one day things are booming, prices are rocketing — and then the next, the balloon deflates. Yet, most times, there is some part of the market that holds its own.

Right now, we’re seeing expensive US technology stocks drop precipitously. Some were riding on unsustainable P/Es. A correction was due.

Meanwhile, some of the value we bought in Europe last year is starting to shine. One of our Italian bank stocks — UniCredit [BIT:UCG] — is up nearly 60% in a year and paying a dividend of nearly 5%.

But we probably bought this at a P/E below 7. Then, it showed value with margin of safety.

UniCredit HQ, Milan. Source: Author

There are lessons in markets and the hospitality that surrounds their prosperity.

Antoine’s did a roaring trade in the 1980s. By the 2000s. it was more a niche player amongst those like your author who appreciate classic cuisine.

The White Heron is long gone. I suspect its charms crumbled away quite quickly after 1987. But the site has found new life with luxury apartments developed there.

You have to keep moving. The mind works best like a parachute — open.

Like Antoine’s, many businesses may boom and then become shadows of their former selves. One of the many interesting observations of the book is Tony’s regret that he was always a tenant at 333 Parnell Road.

Had he owned the building, the valuation of his concern might have been quite different.

Which reminds me why I like businesses that own undervalued property.

But enough. It’s time to find somewhere else that cooks duck as well as Tony did.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.