Believe nothing you hear, and only one half that you see.

—Edgar Allan Poe

I remember reading Robert Kiyosaki’s book Rich Dad Poor Dad way back in 1997.

At that time, it was all the rage. Everyone was talking about it.

The premise of Kiyosaki’s book was simple.

He explained that assets were responsible for creating wealth, while liabilities were responsible for destroying wealth.

Therefore, if you wanted to be rich, you had to maximise your assets, while minimising your liabilities. That’s the formula for success.

Source: Amazon

Now, if you stop and think about it, what Kiyosaki was teaching was just common sense. But here’s the thing. Common sense is not that common:

- Apparently, a lot of people lack the basics when it comes to personal finance. They need to be coached. Indeed, they are hungry for coaching.

- This meant that Rich Dad Poor Dad was the right book at the right place at the right time. It became a runaway bestseller, moving over 40 million copies.

Obviously, Kiyosaki had struck a chord here. His combination of simple words and vivid metaphors was hugely appealing. It catapulted him to fame:

- At the time, you might argue that Kiyosaki deserved his success. He had written a popular self-help book. It was cheerful. It was wholesome. It was evergreen. Anyone — regardless of social status or skill level — could read his story and enjoy it at face value.

- Of course, critics have attacked Rich Dad Poor Dad for its simplicity. They say it’s the equivalent of Building Wealth for Dummies. There’s not much substance here. No sophistication at all.

- Well, perhaps that’s true. However, Kiyosaki’s simple message has always been his greatest charm. His greatest selling point. This resonates strongly with his fans.

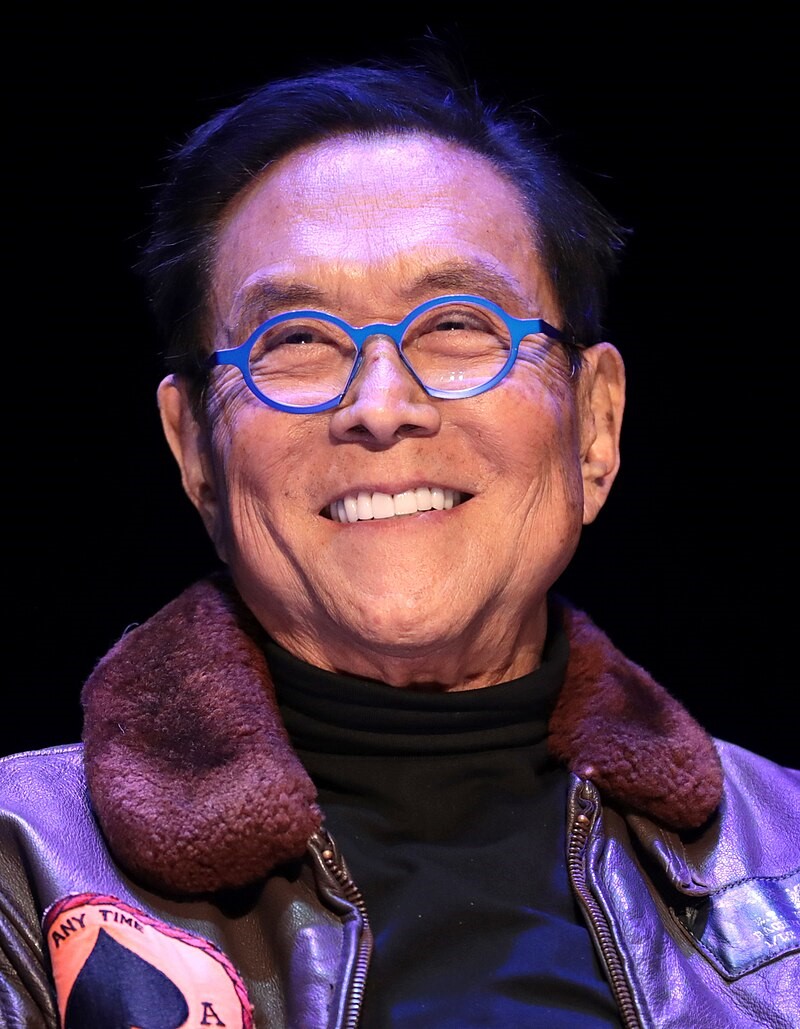

Robert Kiyosaki speaking at an event in Tempe, Arizona.

Source: Gage Skidmore / Wikimedia Commons

However, I observe that a lot has changed since the Rich Dad Poor Dad era. There’s been a seismic shift in mood. Kiyosaki’s storytelling has taken a shockingly dark turn:

- He no longer writes cheerful and wholesome self-help material. Instead, he’s made the transition into doomsday prophecies. Forget optimism. Say hello to pessimism.

- Since 2002, Kiyosaki has issued repeated warnings that a massive crash (what he calls an ‘Everything Crash’) is about to happen.

- Stocks, bonds, property, you name it. Most traditional asset classes are going to be crushed. Pulverised. Wiped out.

- The trauma here will be earth-shattering. Scary stuff? You bet.

Now, in recent years, Kiyosaki has given us very specific dates for this looming disaster:

- He has made predictions for 2011, 2015, 2017, 2018, 2020, 2021, 2022, 2023.

- Of course, none of his prophecies have come to pass. That’s a success rate of zero.

Still, that doesn’t deter Kiyosaki. He still presses on. Boldly. Relentlessly:

- In January 2024, Kiyosaki made a stunning admission. He said that he has amassed a debt of $1.2 billion. But he was relaxed about this: ‘If I go bust, the bank goes bust. Not my problem.’

- Then, in January 2025, Kiyosaki said that the biggest crash in history would happen in February 2025. This event would lead to not just another Great Depression, but a ‘Greater Depression’.

- The tragedy here would be colossal. Infinitely worse than any previous downturn. So, buckle up. Brace for impact. Pray for mercy.

Oh boy. It’s enough to make your head hurt. So…after all that intense emotion…after all that dramatic build-up…February rolls around. What happened?

- Well, the sun continued to shine. The birds continued to sing. It was business as usual.

- Nothing earth-shattering happened. Whew. Thank heavens.

But…wait. Hold on. Not so fast. As February transitioned into March — gasp — something disturbing did happen:

- We experienced a sudden burst of volatility. Donald Trump’s take-no-prisoners approach to global trade was shocking. We heard alarming news about ‘tariffs’ and ‘recession’.

- This has given the market whiplash and nausea. As I write this, the S&P 500 index is down in the red for 2025.

- Apparently, this is shaping up to be the worst start to a presidential term since 2009. Well, good grief. It feels like it’s the season for fear.

Of course, Robert Kiyosaki is not the only prophet of doom around. There’s an entire cottage industry out there. One filled with scaremongers making terrifying forecasts:

- So, it’s worth asking: Are we actually due for the mother of all crashes? Is a Greater Depression about to happen? Should you avoid the market entirely? Or…should you stick to a long-term conviction and hold on?

- Well, if you’re the kind of person who worries about the future, I want to give you 3 Urgent Signals here. If you want a fair discussion about risk versus reward, you need to understand these important developments…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.