Shocking. Scandalous. Offensive.

Howard Stern is one of the most notorious names in American radio.

Now, if you’ve ever listened to one of his shows, then you already know what he does.

He will say things that are so rude, so foul, that they actually push the limits of what you might consider decent in the public space.

I dare say, his colourful vocabulary would make your 15-year-old daughter blush — and make your 85-year-old grandma go pale.

Source: Wikimedia Commons

Howard Stern has been in the habit of stirring up outrage since the 1980s:

- Over the years, the Federal Communications Commission has slapped his radio show with 15 separate fines.

- There are ‘seven dirty words’ that the FCC does not like — but Howard Stern keeps breaching these guidelines with glee. Again and again.

- As I understand it, Stern has received more fines from the FCC than anyone else in America. It’s quite a record.

Howard Stern’s wicked reputation hasn’t harmed him. In fact, it may have done exactly the opposite. Here’s an anecdotal statistic:

- The average person who likes Stern will listen to his radio show for one hour and 20 minutes every day.

- Meanwhile, the average person who hates Stern will listen to his radio show for two hours and 30 minutes every day.

- Well, good grief. If they hate Stern, why do they listen to him so much? Well, the most common answer is this: ‘I want to see what he’ll say next.’

Source: Image by Gerd Altmann from Pixabay

Now, what is true of Howard Stern might also be true of Donald Trump:

- It doesn’t matter what your political orientation is. I’m willing to bet that you’re hanging on Trump’s every word. This is especially true if you’re an investor.

- After all, if there’s one thing that Wall Street fears more than interest-rate hikes, it’s tariffs. And if there’s one person who loves talking about tariffs, it’s Donald Trump.

- By my calculation, it’s only been 56 days since Trump entered the White House. But, already, he’s given the market the equivalent of a horror-movie jump scare.

This month, stocks are experiencing wild price swings. Hysterical emotions are in overdrive. The headlines are screaming bloody murder:

- If you hate Trump, you might already be thinking of stockpiling canned food. Hoarding toilet paper. Hiding your cash under a mattress.

- I understand your sentiment. But hold up. Before you do any of that, you need to consider this: the volatility might be overdone. The fear might be oversold.

Yes, of course, Donald Trump loves a good headline. The more dramatic, the better. But some context is important here:

- If history has taught us anything, it’s that his trade wars often start at DEFCON 1. Then they get walked back after some negotiation.

- You just need to think back to Trump’s first term in office (2017 to 2020). Back then, his tariff threats sent stocks into a tailspin, only for them to recover just as quickly.

- On reflection, was that just angertainment? Perhaps a recap of The Art of the Deal? Perhaps a replay of The Apprentice?

So, let’s take a deep breath here. We need to remind ourselves that staying invested in the stock market isn’t just about picking winners. It’s also about having the emotional fortitude of a monk in a hurricane:

- Yes, the stock market hates uncertainty. And, yes, tariffs create plenty of uncertainty. But the market is dynamic. Resilient. It tends to adjust once the dust settles. The key here is for us to recognise the cycle and not get caught up in the hysteria.

- It’s worth remembering that we’ve actually been here before. The pattern of behaviour is recognisable. First, Trump makes a bold statement on trade policy. Then the market freaks out. Then backroom negotiations happen. Then — eventually — we get a resolution.

- Lather, rinse, repeat.

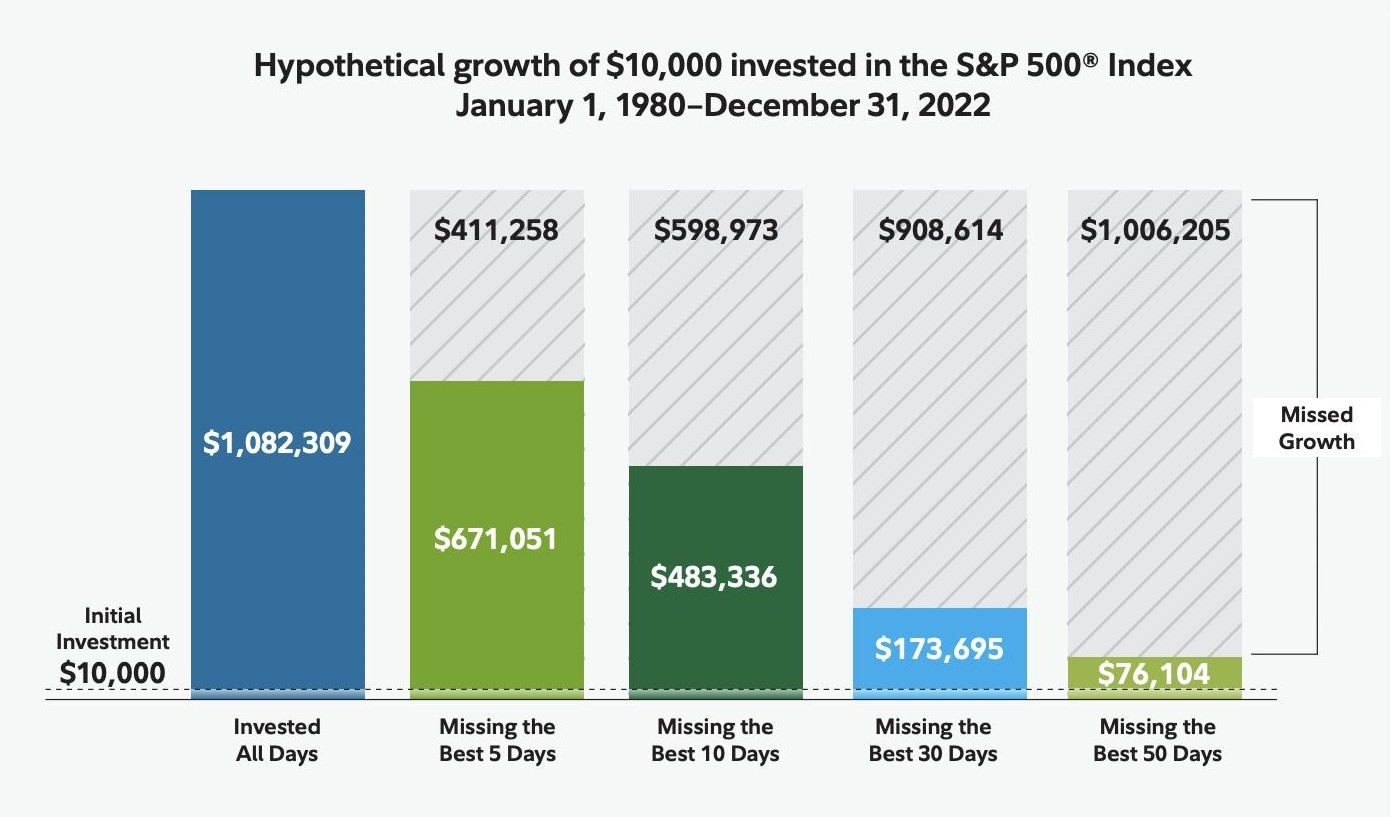

As investors, do we want to secure market gains? Yeah, absolutely. But to do so, we have to be willing to endure some market pain:

- Of course, no one likes turbulence. But if we allow volatility to shake us out of our stock positions, we risk missing out on potential rebounds.

- Historically, selling out at the wrong time can be costly. The wealth gap here is surprisingly huge.

Source: Fidelity Investments

So, what matters the most? Well, it’s actually not the sensational headlines that play with our emotions. It’s actually our time horizon, as well as our own discipline:

- Just think about it. What happens when we buy into the stock market? Well, what happens is that we’re capturing a slice of our favourite businesses. And by doing so, we are capturing a slice of their future fortunes.

- This means that every investment decision we make right now is actually the story of today multiplied by the potential of tomorrow.

Of course, if you’re reading terrifying news headlines, I totally understand how easy it is to panic:

- You sweat. You hyperventilate. You get tunnel vision. Your heart pounds like a jackhammer. Your brain freezes up.

- You think to yourself: ‘This time is different. The world is totally screwed. Humanity is finished.’

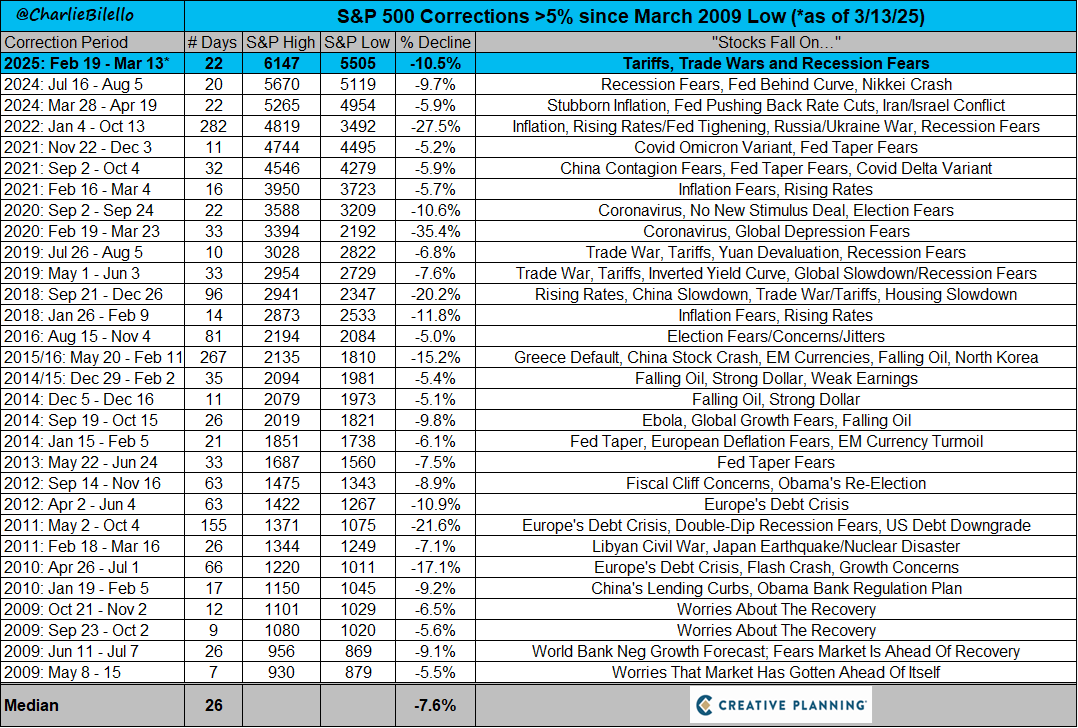

Source: Charlie Bilello / X

Apocalyptic fear can be overpowering, isn’t it? However, I think it’s worth pointing out that such anxiety is nothing new. It’s always been there:

- Over the past 16 years, we have experienced 30 corrections where the market fell more than 5%.

- Do you remember the Ebola virus outbreak in 2014? Or…the Greek debt crisis in 2015? Or…the devaluation of the Chinese yuan in 2019?

- These events felt incredibly magnified at the time. They hogged the headlines. The analysts on Wall Street couldn’t stop talking about them. Because of 24-7 social media, these events felt more real than real. In fact, they felt hyperreal.

- But today? Well, today, these events barely register in our collective memory. It’s as if they never even happened at all. In fact, you might struggle to remember why these fleeting events provoked such strong emotions in the first place.

- In the words of William Shakespeare: ‘Much ado about nothing.’

- But what’s fascinating here is how the market reacted to the bad news. During each and every event, the market digested the fear. Then it adapted bounced back. It would go on to march higher.

Perhaps there’s an important life lesson in this. It’s about maintaining a sense of proportion. An anchor of sanity:

- We human beings are problem-solvers by nature. No obstacle keeps us pinned down for too long. So, unless the fundamentals of capitalism have suddenly stopped working, it helps to have faith. It helps to believe that a solution will be found.

- This means that if we’re playing the long game, we should take the short-term noise in our stride. We can take comfort in the fact that this isn’t the first time that the market has grappled with economic challenges.

- The market tends to survive. It tends to adapt. Life moves on.

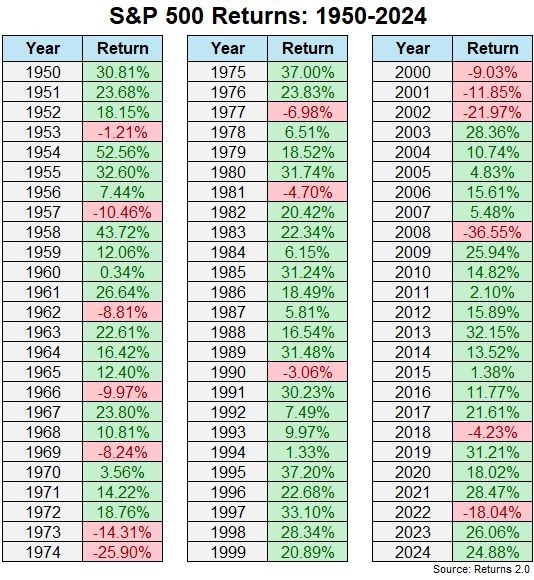

Source: Ben Carlson / LinkedIn

I have noticed that the best investors are those with strong stomachs. They don’t react to every headline. They have developed a strategy. They stick to it:

- Whether it’s dollar-cost averaging, value-investing, or simply holding a diversified portfolio, what it really comes down to is discipline.

- Of course, it’s true that the market is a drama queen. But that doesn’t mean that we have to participate in the drama.

- Benjamin Graham (the mentor to Warren Buffett) had a very good view on this. He said: ‘In the short run, the market is a voting machine, but in the long run, it is a weighing machine.’

- I love this quote because it says something profound about human nature. Yes, the stock market will always find something to panic about. If it’s not tariffs, it’s interest rates. If it’s not interest rates, it’s inflation. If it’s not inflation, it’s the fact that someone, somewhere, said something offensive. The cycle never ends.

- But panic doesn’t last forever. Emotional gridlock must eventually give way to real progress.

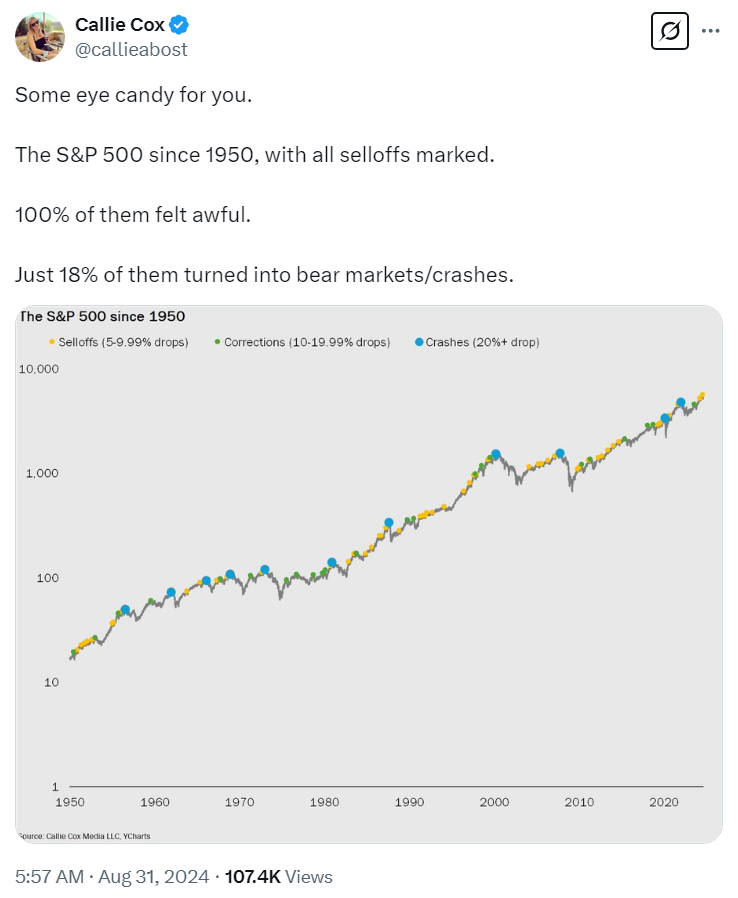

Source: Callie Cox / X

So, what is our job as investors? Well, our job is to be the calm in the storm. Trust our research. Trust our conviction. Build a well-diversified, intelligently-managed portfolio:

- Yes, politicians may tweet. Markets may tremble. Headlines may scream.

- But at the end of the day, it’s really the disciplined folks with rock-steady nerves and diamond hands who will prevail.

- In the words of Charlie Munger: ‘The big money is not in the buying and the selling but in the waiting.’

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.