Over 10 years ago, I invested about $15,000 in Spark [NZX:SPK] shares.

Today, that’s worth around $11,000.

Source: Google Finance

It has paid decent dividends over the years. But this investment feels beached.

Worse, the malaise feels like the wider New Zealand economy right now.

In 2024, our real GDP shrank 0.2% (for the year ending 30 June 2024). Meanwhile, the US grew 2.8% on a real GDP basis.

Since the beginning of this year, the NZX 50 is down around 5%.

The global strategy we manage for our wholesale clients (exclusively invested outside of New Zealand) is up over 6%.

It feels like the New Zealand economy is moving in the opposite direction of America, Europe, and even Australia.

Can we pinpoint the sources of the malaise? That could help us understand the change of direction needed…

New Zealand is a desirable location to invest wealth, but not necessarily in business

An American multimillionaire migrant recently invested $26 million in two Herne Bay villas.

Sunset at Herne Bay. Source: Chris Gin / Flickr

Yes, houses, not businesses.

New Zealand is a challenging place to build a large business. It’s a small market. Regulation, compliance, and the ensuing costs strangle productivity. The 28% company tax rate is well above the OECD average of 23.9%.

The NZX seems to be going backward. There has been a dearth of new listings.

Demographics are going in the wrong direction, and attracting quality migrants is competitive

We have an ageing population. The numbers of over-65s are expected to increase 60% over the next 20 years. This will place pressure on pension and healthcare entitlements.

With fertility running at well below replacement (1.6 vs. 2.1), the country has limited options: Reduce entitlements, increase tax (and further impair the economy), or attract enough skilled migrants.

Since other developed countries face the same quandary, there is now a race to attract global wealth and talent.

New Zealand needs to position itself as a haven for skill and investment.

An enviable lifestyle, along with no capital gains or inheritance tax, means it’s already a favoured destination. Investor visas are priced well ahead of similar arrangements in Europe — where high taxes and open borders remain a concern.

The main issue is the ability to grow a successful business once in New Zealand. This comes back to tackling the headwinds of a small market, high business taxes, and regulation.

Tentative leadership and the tyranny of the minority

The 2023 coalition government came in with high expectations, but has been slow to deliver.

In fairness, parts of the public service and media have been against them from the outset. It appears the previous government locked in a Marxist or ideological contingent.

The current ‘Management by Objectives’ approach doesn’t seem to be working. More of a wholesale cleanup and reboot is needed.

Then there is the added concern of equality. Many migrants I’ve spoken to are in favour of initiatives that ensure equality regardless of ancestry. After all, that is the foundation of a fair society where everyone can reach their potential.

The wider population also appears to be in majority-support of that equality. But if you follow the media or even the National Party’s argument on the Treaty Principles Bill, it is too ‘divisive’.

We need to see a strong leadership position on free enterprise, family integrity, and personal responsibility. Not pandering to whatever radical minority voice that claims a hapless media.

Expensive housing and the radicalisation of young voters

We have still failed to tackle our housing crisis. The ‘Going for Housing Growth’ programme does offer some hope, but will take time to realise.

The reality is that when you have homes that cost 9x household income — as well as an education system and media infested in part by progressive Marxism — you brainwash younger people into believing the only solution is to strip the rich.

Source: Michael A. Arouet / X

A more courageous solution is needed to avoid funding ideology in education, and to avoid funding it in public media.

The export base is too concentrated, and strategic alliances lack clarity

Around 25% of our exports go to China (down from almost 32% in 2021).

This country was a growth machine for much of the 2000s. It is now faced with trade headwinds, a fertility rate of around 1, and negative net migration.

It has further tested defence alliances with live-fire exercises in the Tasman Sea, as well as agreed resource arrangements with the Cook Islands.

While China is an important trading partner, New Zealand is in a difficult position, considering its traditional alliance with Australia and the US. It may be high time to reconsider the ANZUS arrangement that was suspended in the 1980s.

Investors should seek optionality

The world is an uncertain place. There are no guarantees on tomorrow. Diversification is the only free lunch.

Investing in developed markets around the world and key growth sectors can help investors protect their wealth in uncertain times.

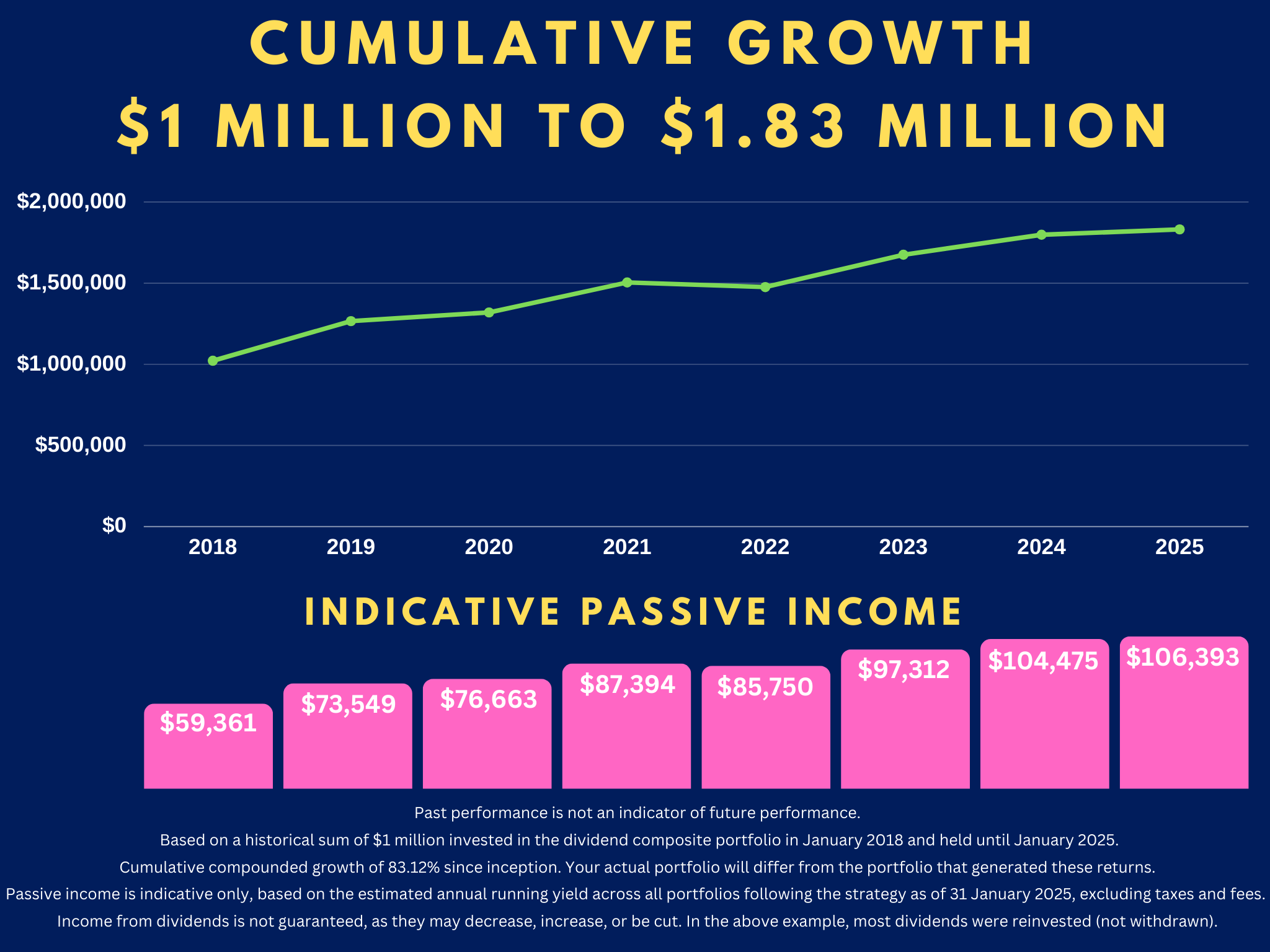

Are you looking for global diversification?

We build diversified and income-rich portfolios for our Eligible and Wholesale Clients.

Do you have previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.