Human nature is a strange thing, isn’t it?

When we love someone, we will go out of our way to say good things about them. In our eyes, they can do no wrong. This is known as the ‘halo effect’.

Meanwhile, if we hate someone, we will do the exact opposite. We will go out of our way to say bad things about them. In our eyes, they can do no right. This is known as the ‘horn effect’.

In other words, we may perceive someone as angelic or devilish, depending on our own cognitive bias.

But here’s the thing: our perception actually has very little to do with reality.

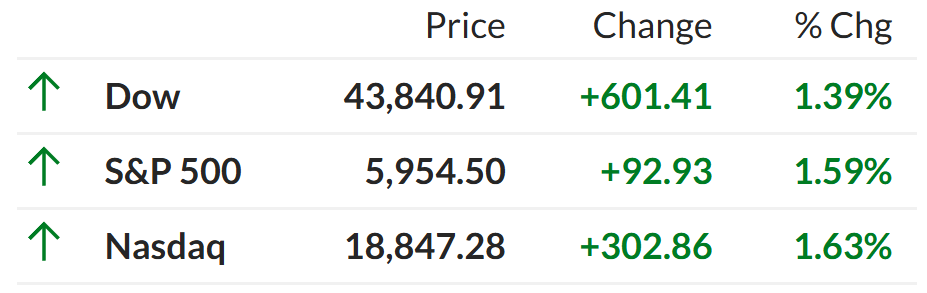

Source: MarketWatch

What happened on Friday, February 28th is the perfect example of this:

- A fiery argument erupted in the White House’s Oval Office.

- Volodymyr Zelensky had his point of view — which he pushed very strongly.

- At the same time, Donald Trump and JD Vance also had their points of view — which they pushed very strongly.

- So, who exactly was the good guy here? Who was the bad guy? Or…was the situation just too confusing?

- Well, regardless of viewpoints, one thing is clear: this outburst made for some damn good television. We got angertainment. We got rage-baiting. We got emotional bluster.

For me, what is striking is how the American market reacted to this:

- In the immediate aftermath, stocks dived into the red. Fear surged. Volatility spiked. It felt as if this was the end of the world.

- But…then…the mood suddenly reversed. Stocks rallied into an upswing. And by the end of the trading session, the market had closed strongly. All indexes were up in the green.

- Astonishing? Oh yeah. You betcha.

American indexes at the close of trading on February 28, 2025. Source: MarketWatch

Right now, I can tell you about the three types of investors who were present during this event:

- Type #1 were the investors who gasped and panicked. They sold out at the first opportunity. So, they locked in their losses. This meant that they were worse off at the end of the trading session than they were at the beginning.

- Type #2 were the investors who frowned but didn’t panic. They chose to hold on. Therefore, they lost nothing despite the price swings. They were better off at the end than they were at the beginning.

- Type #3 were the investors who smiled with glee, then charged headlong into the fire. They began buying into the market despite the fear. So, it stands to reason that they probably gained the most. They were considerably better off at the end than they were at the beginning.

Of course, given that this fog of war was unfolding in real time, it was hard to separate emotion from reality:

- Even now, when I look at social media, I can see wildly conflicting opinions. Some people are backing Zelensky. Others are backing Trump and Vance.

- It’s impossible to escape the halo effect, as well as the horn effect. Maybe a reality-distortion field is already in place. Exerting its own gravitational pull on our minds. Warping our opinions.

- So, what is the actual truth here? Well, quite simply, it’s this: what we saw happen in the Oval Office was actually a combination of The Apprentice and The Art of the Deal.

- The brinkmanship here may have been theatrical. This was about shock and awe. Why? Well, to apply pressure. To gain leverage. To secure concessions. Indeed, all that tense talk about ‘holding cards’ and ‘playing cards’ was revealing, wasn’t it?

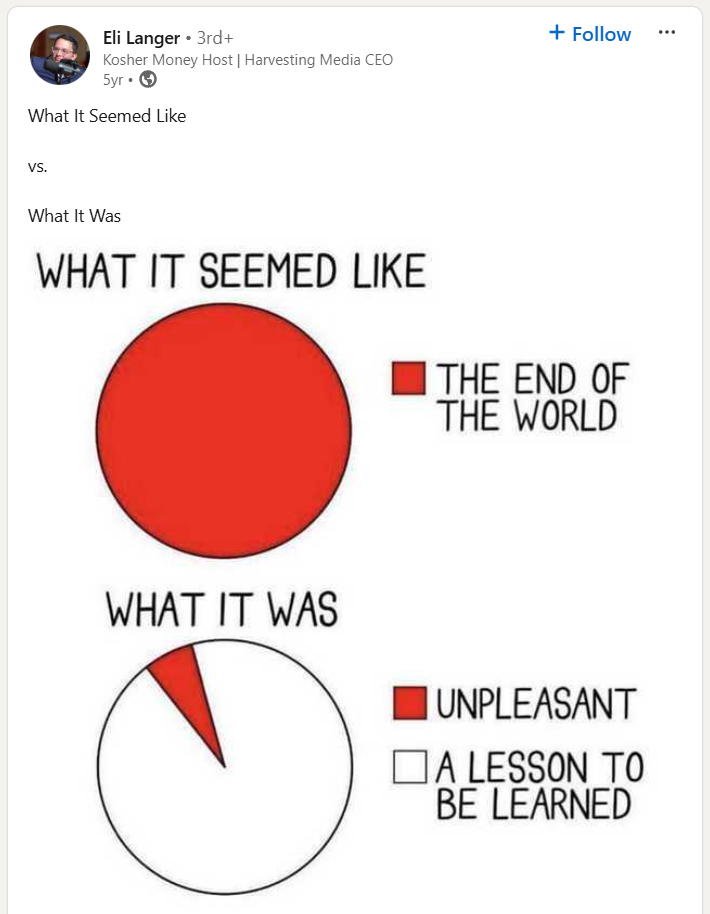

Source: Eli Langer / X

Certainly, dramatised fear can be hugely addictive:

- This is why people watch horror movies. This is why people ride rollercoasters. And this is why the media coverage of what happened in the Oval Office has generated such a frenzy.

- However, just stop and think about it. What if we fast-forward to the future? Well, in one year’s time, it’s possible that most of us will barely remember the outburst in the Oval Office. At that point, it might just feel like a blip on the radar. A passing black swan. A casual afterthought.

- Indeed, what feels emotionally magnified in the short-term may end up feeling emotionally minor in the long-term. This is especially true if our Dealmaker in Chief — Donald Trump — negotiates a settlement to the Russia-Ukraine war.

- You have to remember: like any good reality TV show, a season finale to wrap up this extraordinary storyline is already looming. The drama. The action. The suspense. It’s all building up to a nail-biting crescendo. Are you not entertained?

It’s good television, yes. But let’s look beyond the emotion. Let’s look beyond the bluster. As rational investors, we need to understand the big picture here:

- Has the fear been oversold? Are the short-term jitters actually creating long-term value? Are we avoiding noisy distractions and keeping our eyes fixed on the end goal?

- In the words of Peter Lynch: ‘The real key to making money in stocks is not to get scared out of them.’

Let’s face it: being rational is never easy. And yet it’s never been more essential:

- The 24/7 news cycle is designed to quicken heart rates and raise blood pressures. It indoctrinates us with stress. It overloads us with angertainment.

- But here’s the good news: while we can’t control what the media says, we can certainly train ourselves to control our reaction to it.

- This is about patience. Resilience. Endurance. If we have these qualities, then we can outlast the jittery news cycle.

- Indeed, surviving the short-term is the key to prospering in the long-term.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.