When I was growing up in the 1970s and ‘80s, the median age for women giving birth was in their mid-twenties.

For most of my childhood, Mum was at home.

It was a straightforward life. Go to school. Come home. Have dinner. Watch Knight Rider. Repeat…

The innovative K.I.T.T. of Knight Rider. Source: Silver Blu3 / Flickr

There was the Cold War. But I recall a less anxious time. Most people owned their own home. The personal-computer revolution was filling our futures with possibility.

Today, the median age for women giving birth in New Zealand has reached 31.5 years. The fertility rate is 1.56.

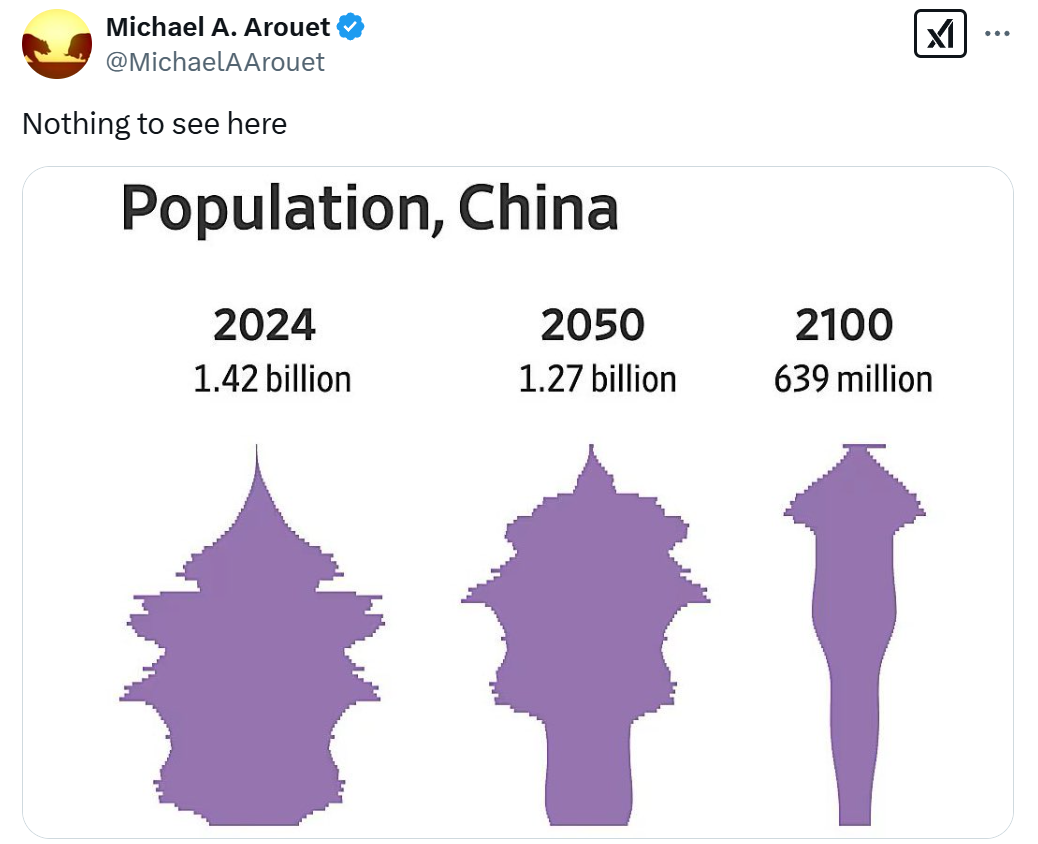

We are not alone. In almost every country, except Sub-Saharan Africa, fertility is below replacement. It is particularly low in North Asia. In South Korea, it fell to a record low of 0.72 in 2023, only recently increasing slightly.

Ultimately, in the absence of immigration, populations will shrink

Source: Michael A. Arouet / X

This demographic destiny has serious implications for economies and investment portfolios.

When the fertility rate was above replacement in the 1970s, this ushered in an age of enormous innovation. Younger populations tend to drive more innovation and spending. The flipside was persistent high inflation during this time.

Starting in the 1980s, two things started to happen:

- Women joined the workforce in much larger numbers.

- Home prices as a multiple of incomes increased a lot.

Of course, affluence increased. At the same time, following the sexual revolution, society became more ‘progressive’. Marriage rates fell. And so too did fertility.

Author and fertility researcher Louise Perry has found the biggest cause for declining birth rates is affluence.

Much of that affluence has come about through rising home prices and higher household incomes made up of two working partners. This has become the norm. People compete in a limited housing market based on the power of dual incomes. Bank lending further leverages this.

What about inflation?

Declining populations are deflationary. Less people. Less demand. Less spending.

Older populations tend to have lower rates of innovation.

Yet some analysts believe that as the population ages, inflation remains present.

- Lower levels of innovation mean fewer ways to do things faster, better, and cheaper.

- A smaller workforce has to support a larger cohort of seniors.

- Older people are living longer and staying longer in their homes.

- The confluence of less labour supply, with steady demand for services, supports inflation.

My view is this is probably temporary. I’ve seen villages in rural Italy and France where homes and land can be bought for nix as the last remaining school closes. While the bar remains open, you can buy a cappuccino for €1.70.

Once a population really starts to shrink, prices do fall away.

Remember: it wasn’t so long ago that Europe was heading towards negative interest rates to support their economies.

Portfolios without population growth

With low rates of growth, it becomes very hard for listed companies to grow their earnings. Ultimately share prices cannot grow without underlying income or asset growth.

Population decline is the most pernicious threat facing investment portfolios.

Worse, when countries meet the demographic crunch, they are faced with hard choices: Increase tax on working people and businesses to pay for pension and healthcare entitlements. Roll those entitlements back. Or print money.

Given the experience of Covid, most governments are not going to resort to printing money. At least not for any length of time. It’s unsustainable. It could mean the end of their First World economies.

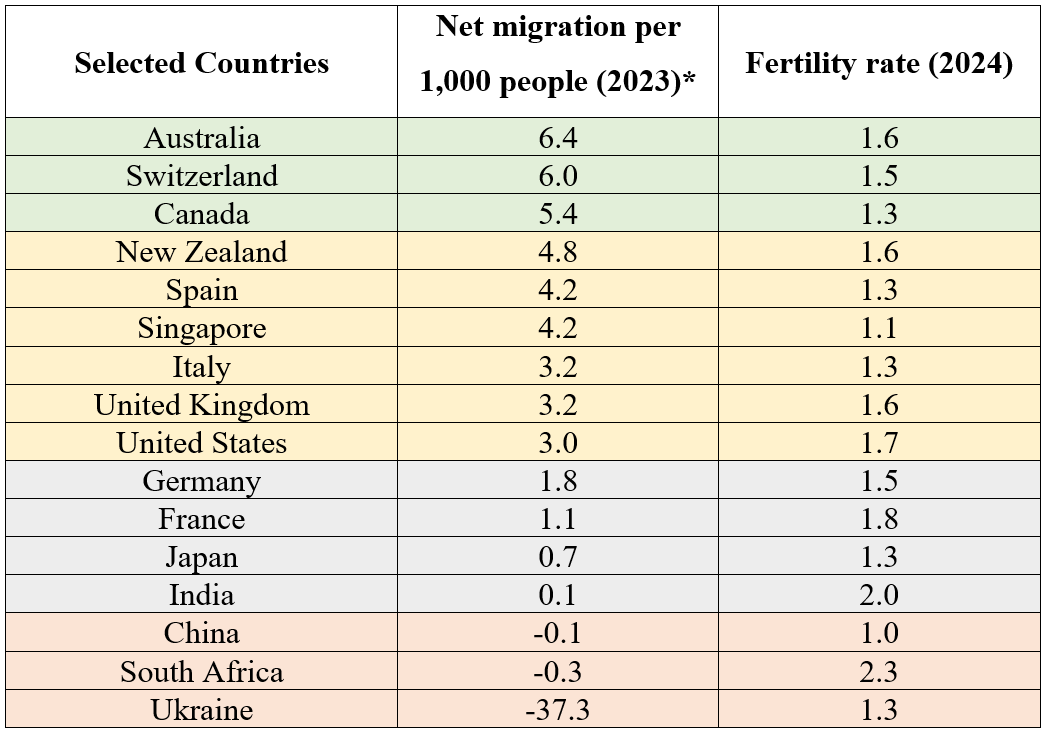

Instead, what we’ll likely see are attempts to support economies with ultra-low interest rates and immigration.

Attracting good-quality, skilled migrants is competitive. So, we also see countries like Italy and Hungary providing incentives for families to have more children.

The reality is that progressive people living in urban centres, on average, have few children.

Conservative, Christian, and rural people tend to have a lot more.

By definition, the future of leading Western countries is to become more conservative over time. And more dependent on planned immigration. We are starting to see this in election results, with swings to the right all over the world.

Investing for the future

The demographic crunch is frightening for investors.

We do not invest in countries like China where there is population decline and little-to-no immigration.

Inflation is not our number-one concern.

We rely on the companies we are investing in to grow their earnings and asset values.

So, we look for the ability to maintain some population growth while fostering innovation.

That means singling out developed countries where people want to move to.

The US, the UK, Australia — and to a lesser extent New Zealand and Western Europe.

Invest where there can be growth.

Have children. Encourage your children to have children. Support the village of the wider family.

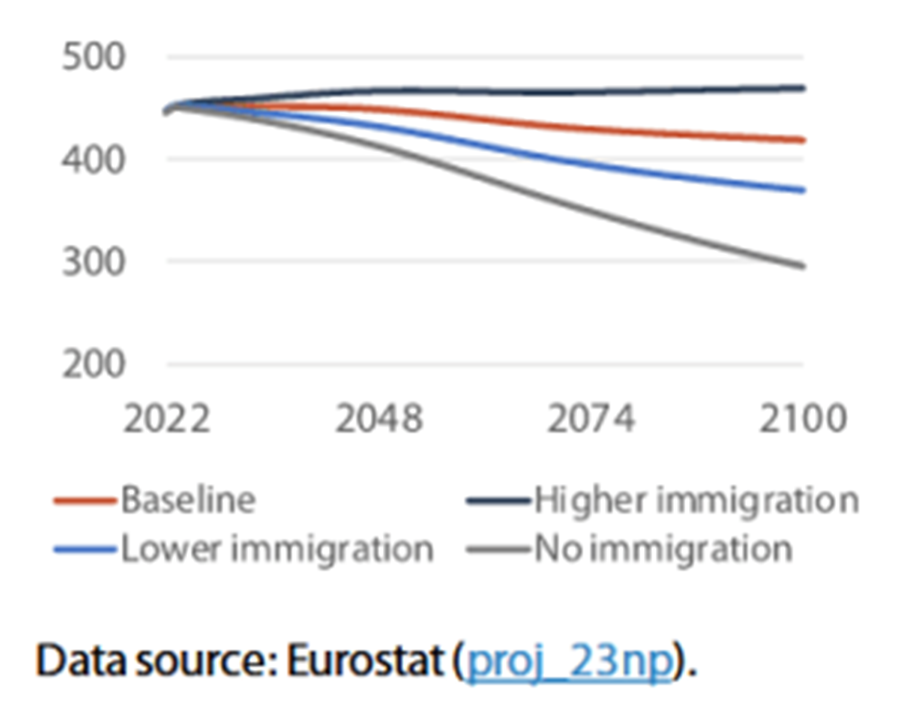

Meanwhile, with fertility below replacement (2.1), growth will need immigration. This is the outlook for Europe:

Source: European Parliamentary Research Service

Increasingly, we’ll see competition for the world’s best and brightest.

When it comes to looking for markets to invest in, we like countries where people want to go, even break into — as opposed to those they want to leave or break out of.

* The net migration rate does not distinguish between economic migrants, refugees, and other types of migrants; nor does it distinguish between lawful migrants and undocumented migrants.

The success of these immigration programmes will come down to the host country’s ability to integrate them.

Multiculturalism hasn’t worked so well. Yet multiethnic nations — where people of many different ethnicities sign on to shared cultural values — can work.

Governments need to incentivise families, while attracting the best and brightest from those shedding people.

Smart investors will sniff out the growth opportunities.

Are you looking to invest for the future?

We build diversified and income-rich portfolios for our Eligible and Wholesale Clients.

Do you have previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.