Have you heard of the story of the blind men and the elephant?

Well, this is an ancient tale.

It’s a classic parable that dates back over 2,000 years.

Source: Image generated by OpenAI’s DALL-E

The story goes like this. A group of blind men encounter an elephant. But this animal is strange to them. They have never met one before. So, to make sense of this unfamiliar creature, they start laying their hands on it:

- One man touches the elephant’s trunk. He says, ‘It’s like a snake.’

- One man touches the elephant’s tusk. He says, ‘It’s like a spear.’

- One man touches the elephant’s ear. He says, ‘It’s like a fan.’

- One man touches the elephant’s side. He says, ‘It’s like a wall.’

- One man touches the elephant’s leg. He says, ‘It’s like a tree.’

- One man touches the elephant’s tail. He says, ‘It’s like a rope.’

Yes, on an individual level, each blind man is right. However, objectively speaking, each blind man is also wrong:

- So, here’s where the problem starts. The men compare their observations of the elephant. But they find that the differences are shocking. So, they get into an argument. Each of them insists that they must be correct.

- But, of course, the experience of each blind man is subjective, isn’t it? This is why each of them gets a flawed understanding of the same reality.

Source: Image generated by OpenAI’s DALL-E

Now, what was true 2,000 years ago is still true today:

- Certainly, there’s been a lot of debate about why economists keep making doomsday projections that turn out to be false.

- For example, in October 2022, Bloomberg said there was a 100% probability of a US recession within 12 months.

- Also, in November 2022, The Economist said a global recession was inevitable in 2023.

- However, as the months and years have rolled on, such predictions have failed to come to pass. In fact, quite the opposite has happened. America has entered a new golden era. A new productivity boom.

- This means that the courageous investors who remained in the market experienced gains. Meanwhile, the fearful investors who sat on the sidelines lost out. Big time.

It’s an interesting situation, isn’t it? A Wholesale client of mine was quite blunt when expressing his feelings about this:

‘These economists are supposed to be highly educated geniuses who know everything. But how can such smart people be so stupid?’

Yes, this is a valid question. How on earth could this happen?

- Well, perhaps the truth is that economists are like blind men. They are struggling to understand the elephant that represents the American economy. Their limited observations are always going to be fragmented.

- However, is it possible to look beyond subjective interpretations? Get a proper bird’s-eye view of the economy? Maybe even a god’s-eye view?

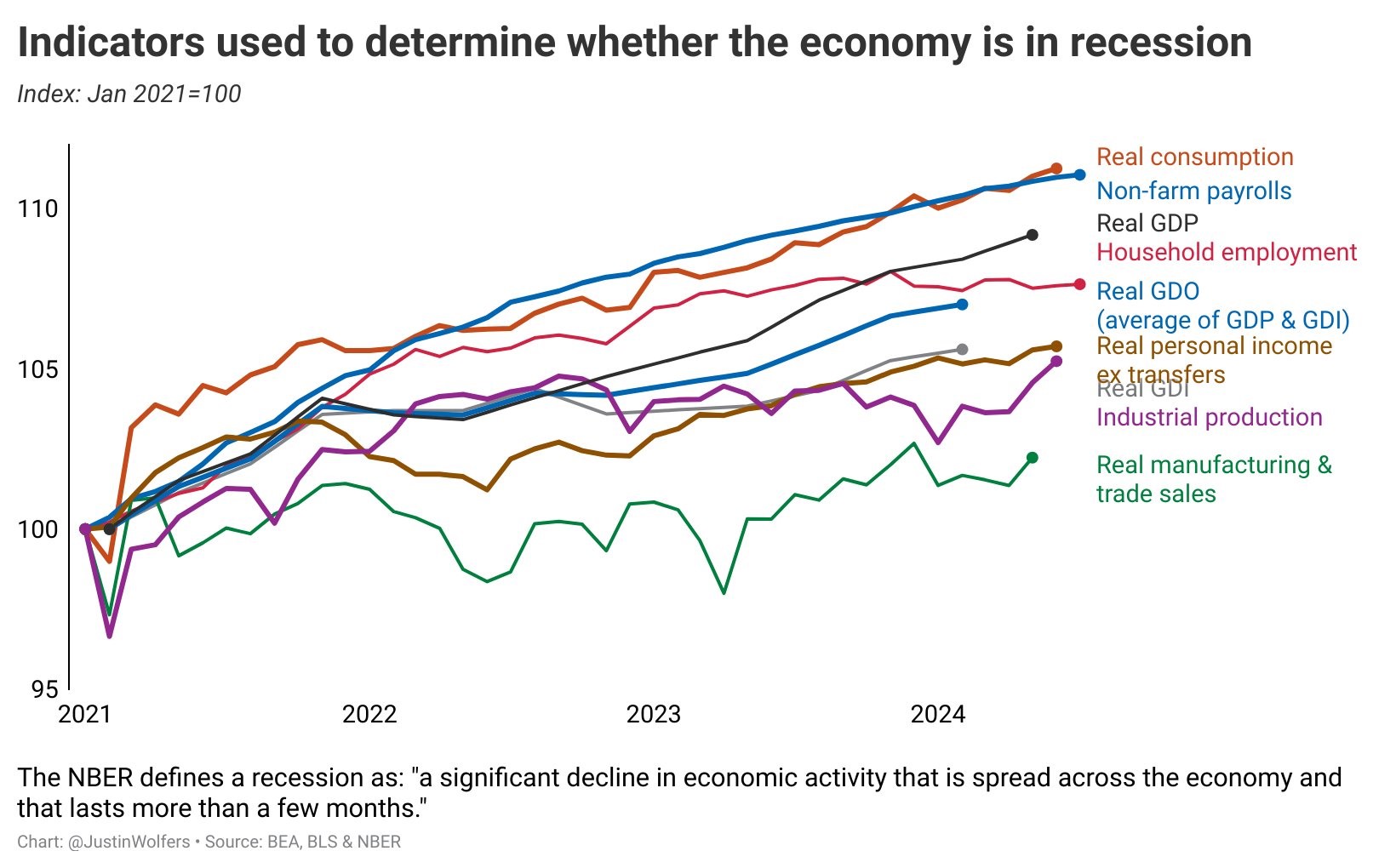

Source: Justin Wolfers / X

Well, there are nine major indicators that can be used to understand the economic health of America:

- So, here’s what I think happened here. The economists who believed that disaster was looming were looking only at one indicator: real manufacturing and trade sales. Yes, this indicator did look weak. It experienced a dip in 2022.

- However, by being so obsessively microscopic about this, the economists failed to look at the eight other indicators. These indicators remained strong. In fact, they got stronger over time.

Indeed, that’s the problem with making economic forecasts. You’re only as good as the model you’re using. British statistician George Box once said: ‘All models are wrong, but some are useful.’

- For this reason, the accuracy of economists is often hit and miss. In fact, it’s mostly miss. Research done by Berkeley Haas has revealed that economists are only correct 23% of the time. Well, good grief. That’s pretty lousy, don’t you think?

- What makes it worse is that we are living in a world where angertainment and rage-baiting has become the norm. Our media is hungry for eyeballs. So, they fish for eyeballs.

- This is why you keep seeing stories about armchair experts yelling about an economic collapse. But ask yourself: are they merely blind men trying to wrestle with an elephant?

Source: Dividend Growth Investor / X

So, as an investor, you have to be brave enough to develop your own conviction. And you have to be sensible enough to see the big picture:

- Believe it or not, this is not a matter of intelligence. This is a matter of emotional temperament.

- Indeed, your long-term success in the market will depend on your ability to move beyond short-term jitters.

- Because let’s face it: economists with negative views are dime a dozen. You should always take what they say with a pinch of salt.

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.