You already know this.

Some investors are optimists by nature. You will find them constantly reading stories about why the next big bull run is going to happen. They believe this is going to kick off a new wave of prosperity. They want to capture this exciting trend ASAP.

Meanwhile, some investors are pessimists by nature. You will find them constantly reading stories about why the market is about to suffer devastating crash. They believe this is going to deliver a total wipeout. They desperately want to avoid this disaster at all costs.

So…who’s right? Who’s wrong?

Well, I want to cut through the debate. Cut through the noise. Cut through the fear.

Here’s my controversial idea: investing at the worst time in the market is actually better than not investing at all.

Really?

Yes, really.

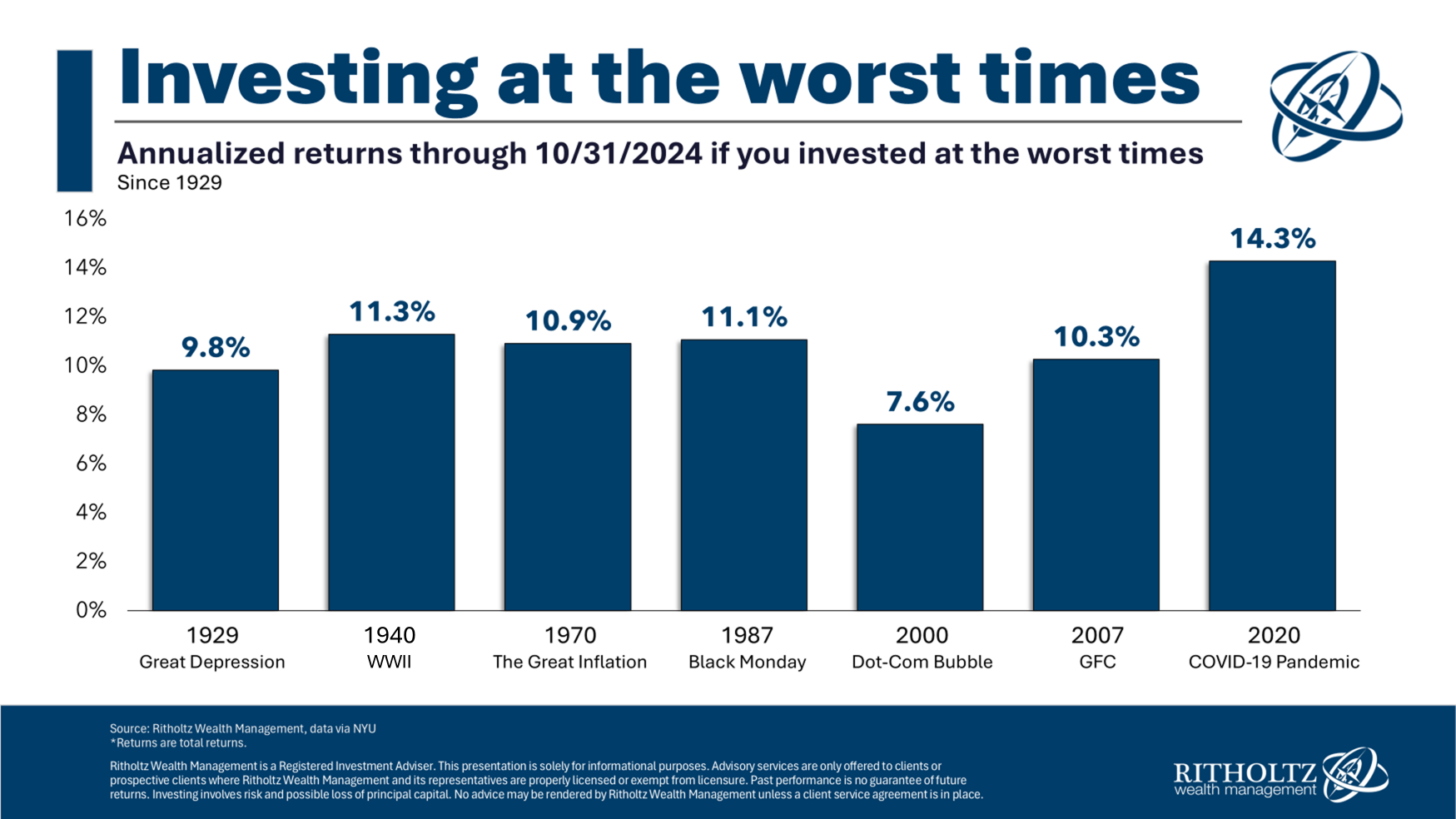

Source: A Wealth of Common Sense

Now, for the sake of argument, just imagine this scenario:

- You’re taking a lump sum of money. You’re investing it at the peak of the market. You’re doing this just one day before historical correction happens. How would you fare over the long run?

- Well — surprise, surprise — you would actually do pretty well. In fact, the annualised forward returns are always positive.

- If you’re looking for a good case study, you might find it in the Great Depression. Yes, this was a terrifying time. Stocks crashed almost 90%. But even so, the market only took five years to recover to its previous peak. This happened thanks to deflation and dividends.

- This goes to show that even the worst trauma imaginable can be healed and overcome. The market is surprisingly resilient.

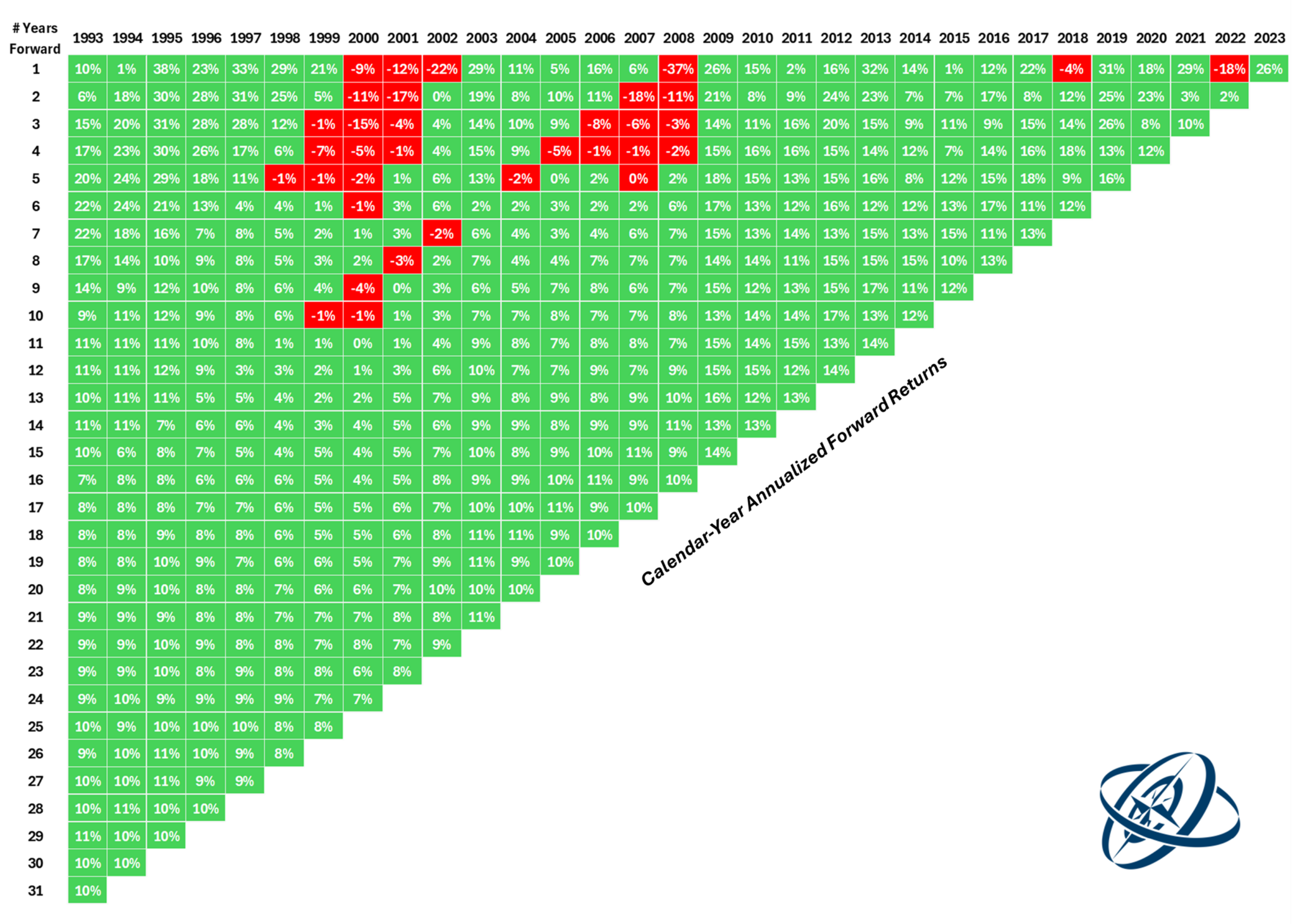

Source: A Wealth of Common Sense

So, what’s the secret behind the market’s long-term performance? Well, it actually comes down to compounding. This is what creates positive forward returns:

- For example, if you had invested a lump sum of money in any year between 1993 and 1997, you would have enjoyed only positive returns. The dot-com bust in 2000 and the global financial crisis in 2007 never affected your original investment at all. There was no red year for you. Only green years throughout.

- Likewise, if you had invested a lump sum of money in any year between 2009 and 2017, you would have enjoyed only positive returns. The minor market dip in 2018 and the larger market drawdown in 2022 never affected your original investment at all. Again, there was no red year for you. Only green years throughout.

- However, even if you made a mistake and invested just before a market correction — well, it’s actually no big loss in the long run. You will get to green eventually, and your forward returns will look surprisingly strong from that point on. The power of compounding will work its magic.

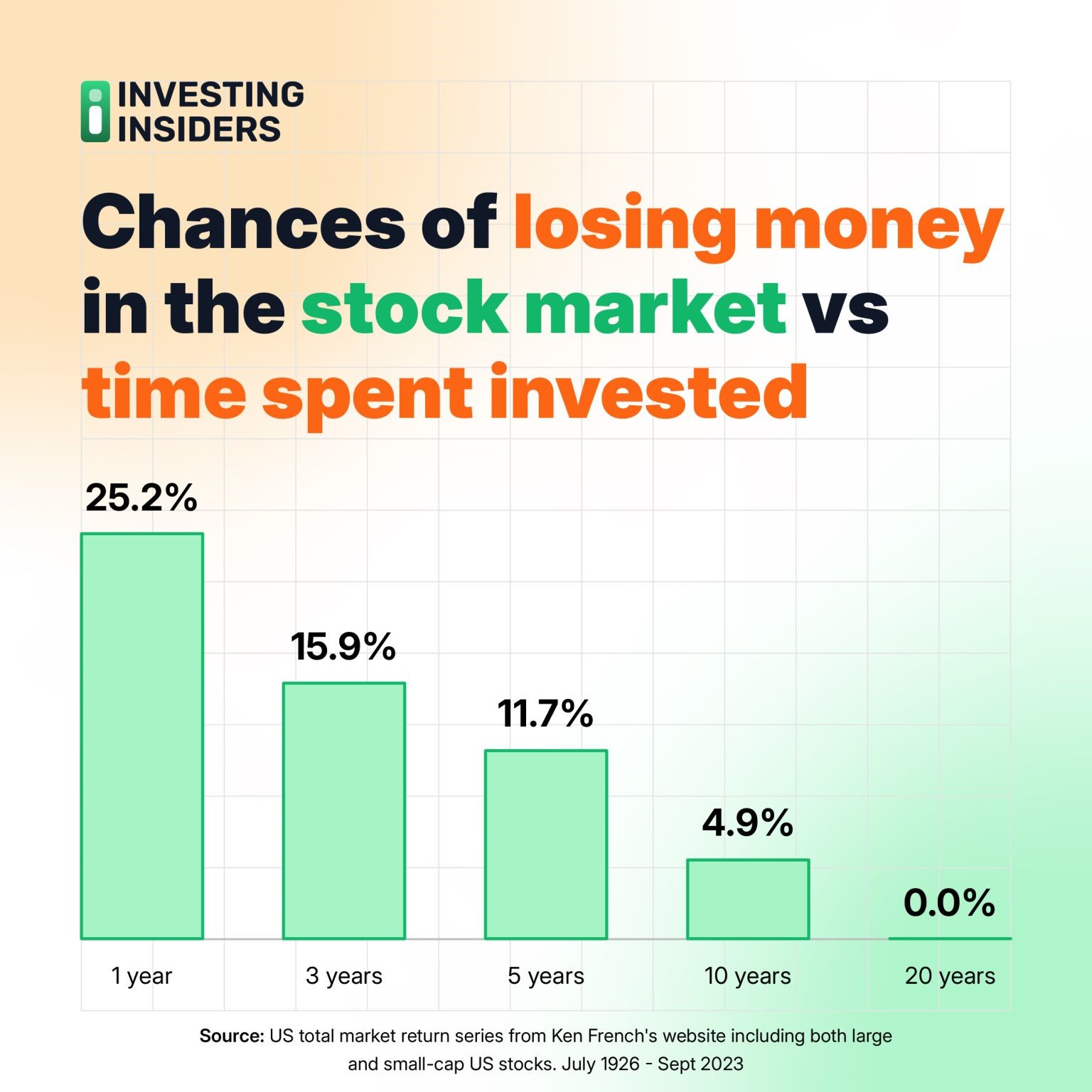

Source: Antonia Medlicott / LinkedIn

Now, of course, past performance is no guarantee of the future. An individual investor’s mileage is going to vary, depending on how they choose to invest:

- However, I’m willing to bet that, over the long run, the optimists are going to have the upper hand. The weight of history seems to be on their side.

- Indeed, what the evidence appears to show is that time spent in the market is better than timing the market. Being committed is better than being fussy.

- In the words of Robert Schuller: ‘Tough times never last. Tough people do.’

It’s time to think differently

Successful investors tend to be resilient:

- They are regular folks who have painstakingly built up their wealth instead of inheriting it.

- These people are helping the world to change for the better. They are investing in companies that are creating new jobs, new products, new services.

- In fact, if there’s a problem out there, you can bet your bottom dollar: there’s already an entrepreneur working hard at figuring out a creative solution for it. And that, in turn, will generate even more wealth in the long run.

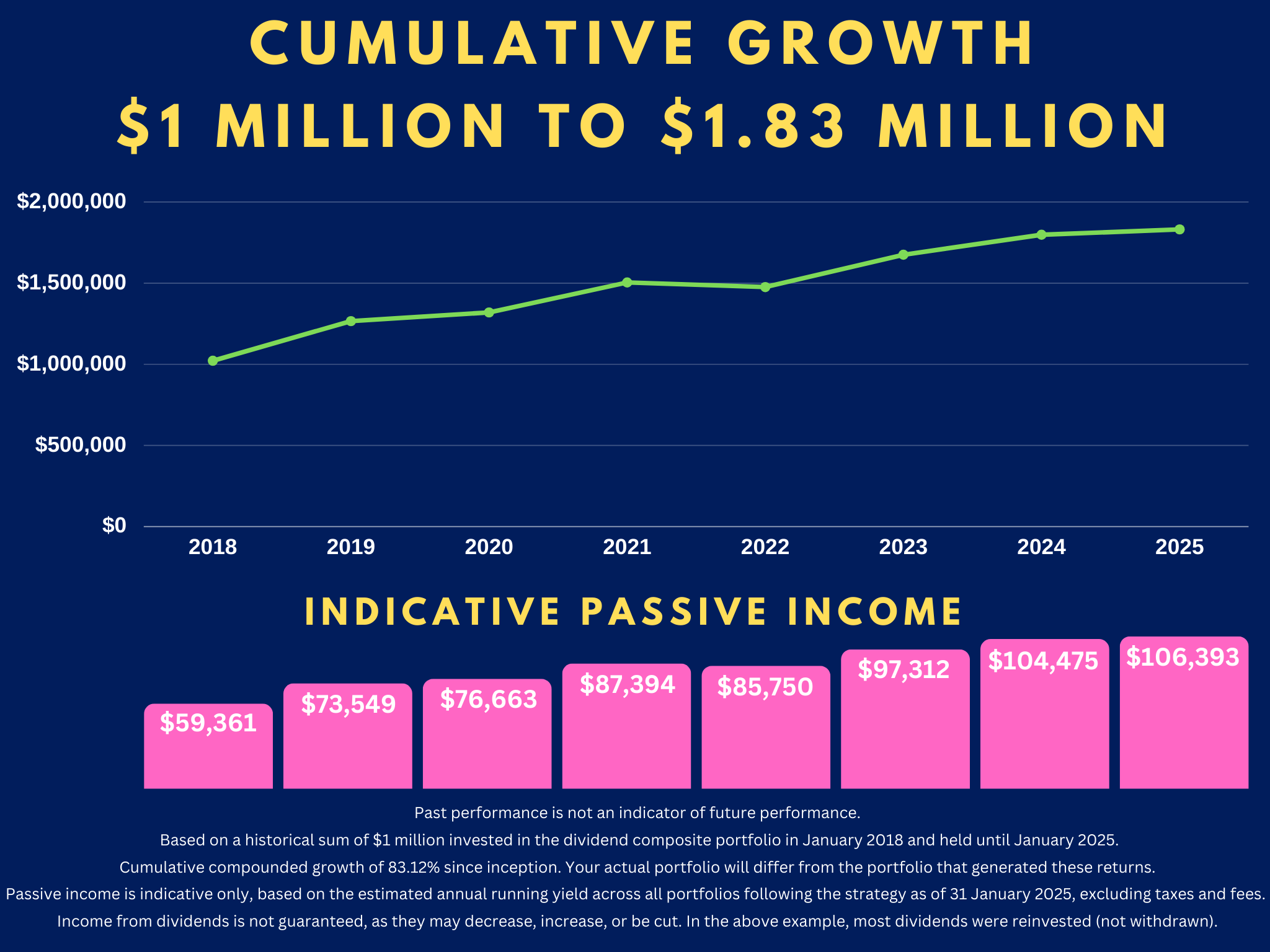

At Wealth Morning, we run what may be the only active night-trading desk in New Zealand for our Eligible and Wholesale Clients:

- Every week, we aim to buy into exceptional companies in Australia, Europe, and America.

- Our focus is on sectors that offer the perfect balance of growth and income.

- Our mission? To capture pockets of outstanding opportunity where we can.

- Where others see doubt, we see clarity — and we aim to use it as a springboard to build a better future.

Are you interested?

🎯 Click here to book a consult with us and find out more about our Quantum Income Strategy.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.