The only function of economic forecasting is to make astrology look respectable.

―John Kenneth Galbraith

A funny thing happened to me exactly one year ago.

It was January 2024.

A friend called me up on the phone. He sounded anxious. Jittery.

Over the holidays, he had been watching a lot of economic videos. He had noticed a consistent trend: the analysts seemed to be making terrible forecasts. They were predicting doom and gloom for the year ahead.

Source: Image generated by OpenAI’s DALL-E

My friend was especially unnerved by the rumours of war:

- Some pundits were saying that China was preparing to invade Taiwan. Was conflict in the Pacific imminent? Would this destroy the global economy?

- Meanwhile, other pundits believed there were signs that Russia was on the verge of launching a full-scale assault on Western Europe. Were assets in London and Berlin about to be vaporised under mushroom clouds? Was a civilisational collapse about to happen?

I listened to my friend patiently. I allowed him to vent his despair. To vent his anguish. To speculate about the end of the world:

- When he was done, I had a response for him. I said that the economists were wrong. Completely wrong.

- Yes, these were highly educated experts. Yes, they sounded convincing. However, I cautioned my friend against taking their words as gospel truth.

- One issue here is the Dunning-Kruger Effect. It’s a cognitive bias that seems to affect highly intellectual people like economists. Their qualifications actually mislead them into thinking that they are more capable than they actually are.

- Another issue is angertainment and rage-baiting. The media, as it stands, is not optimised for truth. It’s optimised for engagement. They want our clicks and eyeballs. Badly. This is why they have a habit of making the most outrageous claims.

So, I told my friend that the next big crisis in 2024 would have nothing to do with China or Russia at all. It would actually be something else entirely. Something the economists were not talking about. In fact, something they weren’t even thinking about:

- My reasoning for this? Well, if a geopolitical issue is being talked about so much in the media, then it’s safe to say that it’s already been priced in by the market. And if it has been priced in, then there’s no longer any room for surprise.

- In fact, political leaders will be taking all necessary action to prevent such a negative prediction from coming true.

My friend scoffed. He said I was making a pretty big assumption. What was I basing this on?

- Well, I told him about what I had experienced in the 1990s. Yes, I was young back then. But I remember the media talking obsessively about the Y2K bug and the hole in the ozone layer. The economists said that these two issues would be the biggest problems for the 2000s.

- But, of course, they were totally wrong. What really shook up the world were two astonishing events that came out of nowhere. The terrorist attacks on 9/11, as well as the subprime mortgage crisis that led to the GFC. These ended up becoming the defining moments for the 2000s.

So, really, Y2K and the ozone layer ended up being no big deal. Just media hysteria. Just curious footnotes in history:

- Why? Well, you might argue that it happened that way because people were hyper-aware. Hyper-vigilant. Overprepared for a crisis that never came.

- Therefore, if the economists keep saying there’s a serious problem, then you can bet that it’s not going to be a serious problem for long. Because it’s going to be fixed. It’s going to be priced in by the market.

- Let’s face it: human beings are resilient. They are adaptable. They are problem-solvers by nature. So, when push comes to shove, you can bet that they will take immediate corrective action.

But watch out. Therein lies the contradiction:

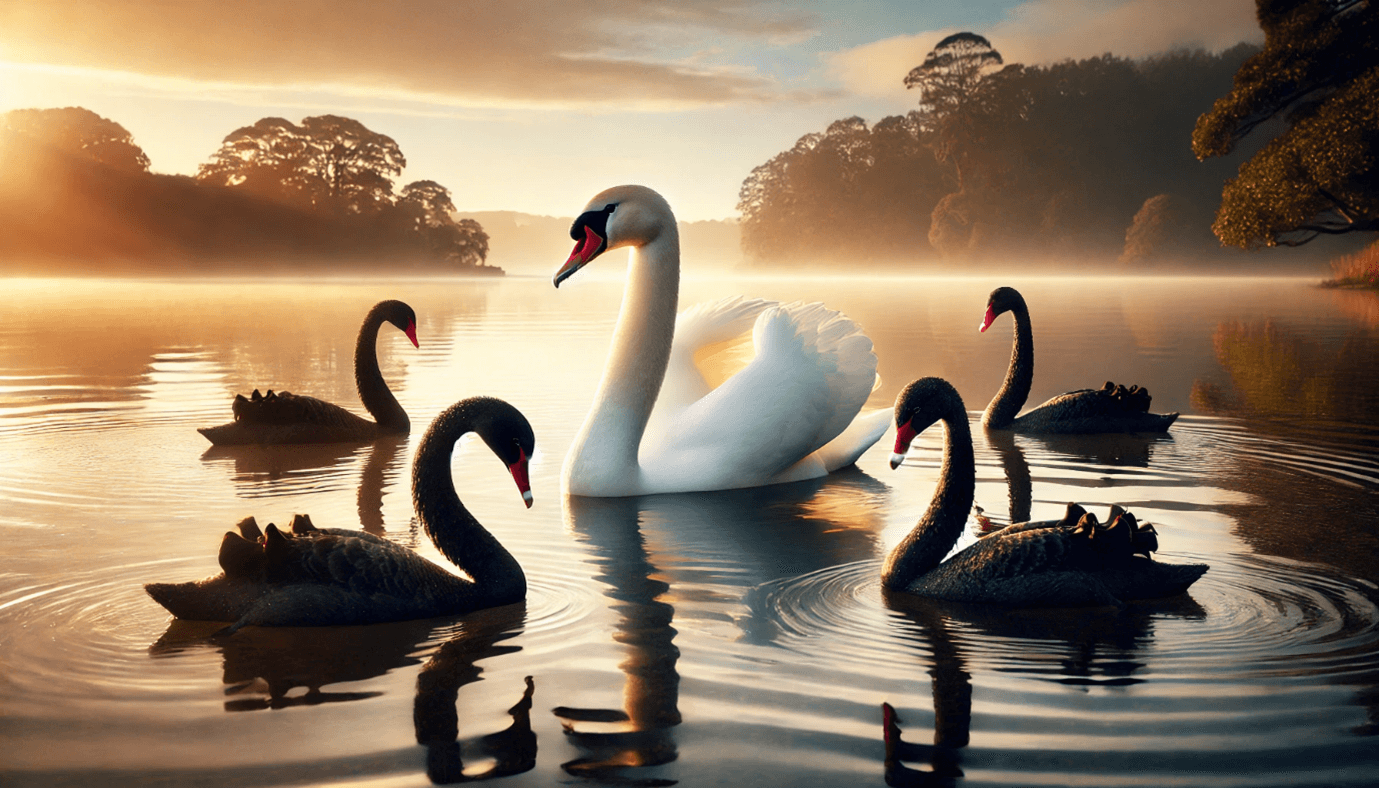

- The actual threats are not the issues that economists keep talking about. Nope. The actual threats are actually the issues that the economists aren’t talking about. The issues they aren’t even aware of. The issues they are completely blind to.

- These are the black swans. The true fear events. They cause a lot of volatility and turbulence. Why? Because the market hasn’t been able to price them in just yet. After all, how can you neutralise a threat that isn’t registering on your radar just yet?

So, the real problems for 2024 would not be China or Russia. They had been so well-publicised already. Indeed, the pundits and analysts in the media have talked these issues to death:

- This meant that the real problems would have to come from somewhere else. But…where, exactly? Well, frankly, I had no idea. No one did. Not even the experts.

- However, I believed that one thing was for sure. When these black swans did appear in 2024, it would feel like a sucker punch. The market would react by flinching. Lurching. Staggering in shock.

- But here’s the good news. That kind of anxiety would prove to be temporary. It would give courageous investors a buying opportunity. If they had the guts to lean into the fear. If they had the vision to look beyond.

So, what really happened over the past 12 months?

Source: Image generated by OpenAI’s DALL-E

So, it’s now January 2025. And guess what? The most pivotal events that we experienced over the past year did come from the black swans. All of them were surprising:

- In August 2024, the market experienced a sudden unwinding of the yen carry trade. The economists failed to predict this. Why? Well, they were too busy looking at China that they forgot all about Japan.

- Then, in November 2024, Donald Trump made a clean sweep at the US presidential election, winning both the electoral vote and the popular vote, shattering the power base of the Democrats. The economists failed to predict this. Why? Well, they were too busy looking at Kamala Harris that they forgot entirely about Trump’s appeal.

- Later, in December 2024, the South Korean president ignited a firestorm of controversy when he declared martial law. The economists failed to predict this. Why? Well, once more, they were too busy looking at China that they forgot all about South Korea.

- Also, in December 2024, the Assad regime in Syria collapsed with stunning speed. The economists failed to predict this. Why? Well, they were too busy looking at Russia that they forgot all about Syria.

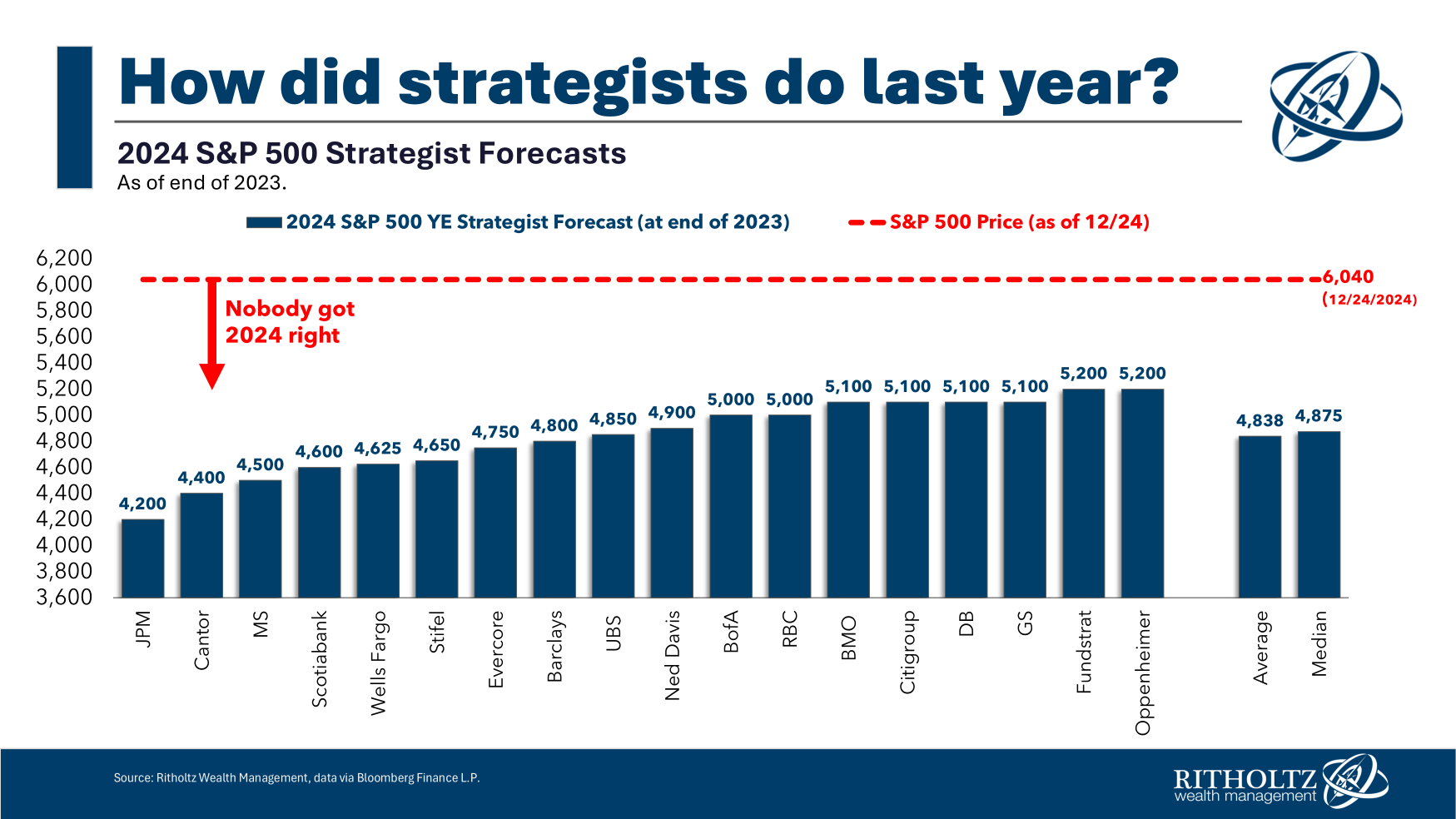

Source: Barry Ritholtz / LinkedIn

But what about the most influential trend for 2024? Well, as it turned out, it wasn’t a black swan at all. It was actually a white swan. A huge one. The S&P 500 finished the year at 5,942 points (over 23% up):

- What is staggering here is that every economist on the planet got their projections wrong. Why? Well, it would seem that they spent so much time looking for the downside that they totally missed the upside.

- Indeed, despite the prophecies of doom, the American economy not only survived 2024, but it prospered beyond expectations.

Fascinating, isn’t it?

- So, here’s my contrarian opinion. I believe that what held true in 2024 will also hold true in 2025. Yes, more black swans will await us over the next 12 months. Yes, they will surprise us. Agitate us. Provoke us.

- However, we shouldn’t let the presence of these black swans scare us away from the white swan. Because what really matters is long-term courage. Long-term vision.

- In the words of Dolly Parton: ‘If you want the rainbow, you have to put up with the rain.’

It’s time to think differently

Successful investors tend to be resilient:

- They are regular folks who have painstakingly built up their wealth instead of inheriting it.

- These people are helping the world to change for the better. They are investing in companies that are creating new jobs, new products, new services.

- In fact, if there’s a problem out there, you can bet your bottom dollar: there’s already an entrepreneur working hard at figuring out a creative solution for it. And that, in turn, will generate even more wealth in the long run.

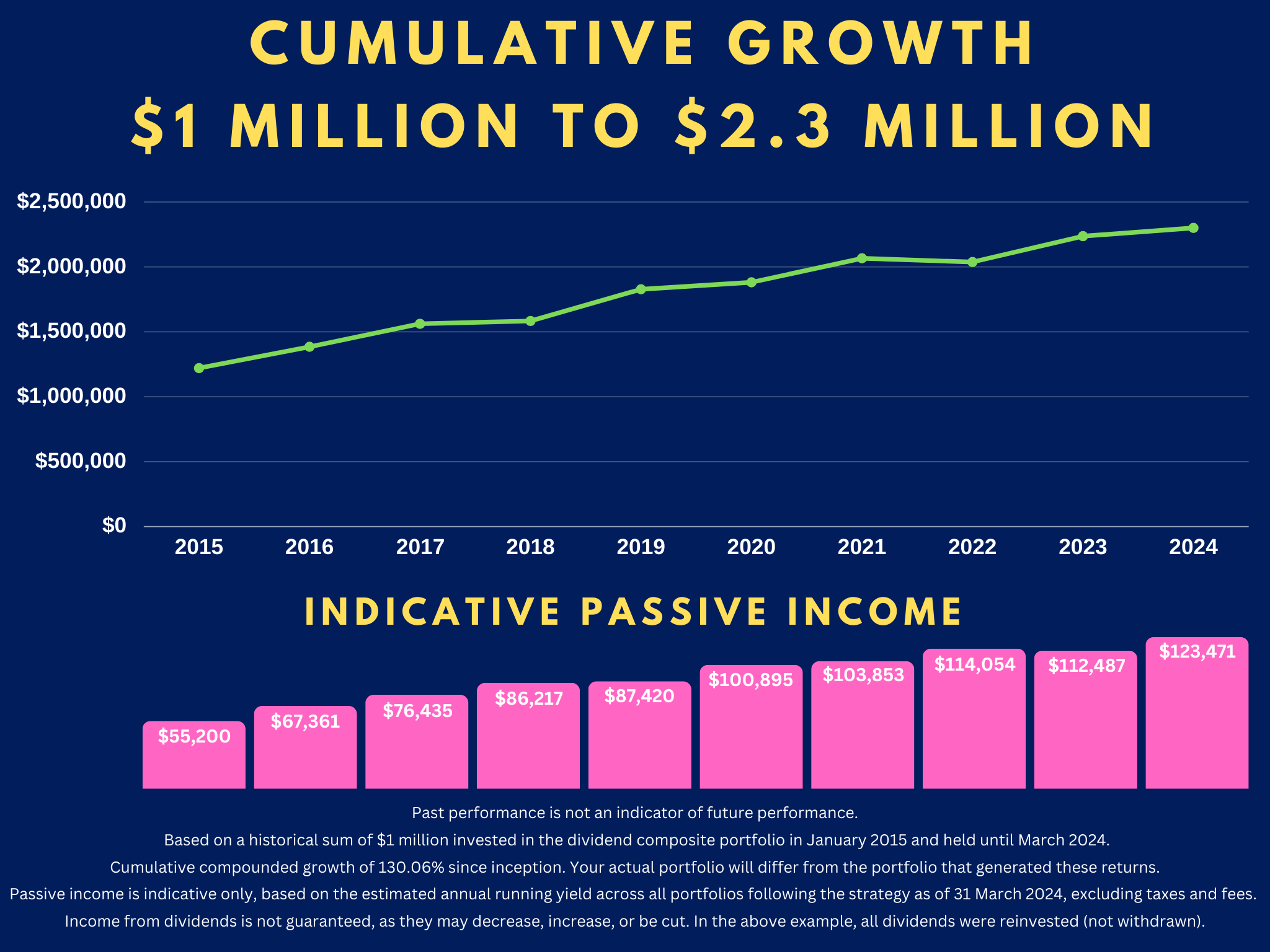

At Wealth Morning, we run what may be the only active night-trading desk in New Zealand for our Eligible and Wholesale Clients:

- Every week, we aim to buy into exceptional companies in Australia, Europe, and America.

- Our focus is on sectors that offer the perfect balance of growth and income.

- Our mission? To capture pockets of outstanding opportunity where we can.

- Where others see doubt, we see clarity — and we aim to use it as a springboard to build a better future.

Are you interested?

🎯 Click here to book a consult with us and find out more about our Quantum Income Strategy.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.