Think back to when you were younger. Did you have some really good years?

Years filled with achievement and hope?

From 1992 to 1993, I finished high school in Taranaki. I sold a small computer accessories business I’d built up over mail order. I won a scholarship with Ernst & Young to help fund my finance degree. And I bought a VW Beetle.

Source: Photo by Janis Zv / Pexel

It was a great time to move to Auckland. The city was beginning a rapid phase of growth. I finished uni with a house deposit.

After years in financial markets, I’ve since learnt what makes your best years.

A willingness to embrace and adapt to change.

Several years ago, we stayed at chateau in France. The lake was frozen over. My 8-year-old son pointed to the swans frozen in place.

‘When the ice melts, will they fly away again?’ he asked.

I had to tell him. No, they would never fly again.

‘Now, that’s a good lesson,’ I mused. ‘You have to keep moving. Don’t get stuck.’

2025 is a year on the move. Here’s why it’s going to be a golden year:

1) America is coming back

The US makes up almost half of global stock market capitalisation. It’s the leader of the free world. Yet, for the past four years, it has cast woke shadows.

Well, socialists, next year, MEI will be the new DEI.

The free market needs Merit, Excellence, and Intelligence to succeed. Not Diversity, Equity, and Inclusion — which was just Marxism disguised as kindness.

Markets like nothing better than tax cuts and deregulation. A 15% corporate tax rate (for US-based businesses) and DOGE (Department of Government Efficiency) promises to unleash new incentive and opportunity.

Europe’s younger voters are starting to come out in force to demand such change too. People are tired of the Left telling them how to run their lives while denying them opportunity outside the swamp.

2) Liquidity is coming back

People keep telling me that Trump, Israel, Russia, or some other unpredictable actor is going to hurt the market.

I go back to the closest point of nuclear war. The Cuban Missile Crisis of October 1962.

Source: Jeni Kirby History / Public Domain

1962 was a year of stock-market drawdown.

But most of the drawdown occurred before October, as the market corrected from a bumper ’61. In fact, following the crisis and its resolution, a raging bull market took off — lasting until 1969. That was driven by low interest rates and rapid economic growth.

These days, in our credit-based economy, markets focus on liquidity. Interest rates are coming down. For businesses and households, this means cheaper capital.

3) War could resolve?

When you’re investing in Europe, the horrific grind across Ukraine has weighed on risk.

Putin has praised the resurgent Trump as ‘intelligent and experienced.’

Of course, this was in the context of finding a solution to the crisis.

Such solution could be elusive.

The US has been the biggest donor of military aid, at 43% of the total. The next largest is Germany at 12%.

Yes, the size of that aid has leverage. But if a peace deal is imposed on Ukraine that sees loss of territory for security guarantees, that is not the promised ‘peace through strength’. Rather, it leaves the world vulnerable to other sovereignty conflicts, such as Taiwan.

We discovered with declassification 25 years later how the Cuban Missile Crisis resolved. Not only was it the promise by the US not to invade Cuba. They had also agreed to remove nuclear missiles from Turkey.

War is too complex for markets to price. Markets operate mainly on numerical measures, such as interest rates. Besides, if there was an event like nuclear catastrophe, markets would close anyway.

Yet there’s more upside for resolution in Ukraine now. Not only due to a new US administration, but in the strained economy of Russia. The ruble is now at its lowest value in two years despite interest rates hitting 21%.

4) The global order is not going anywhere

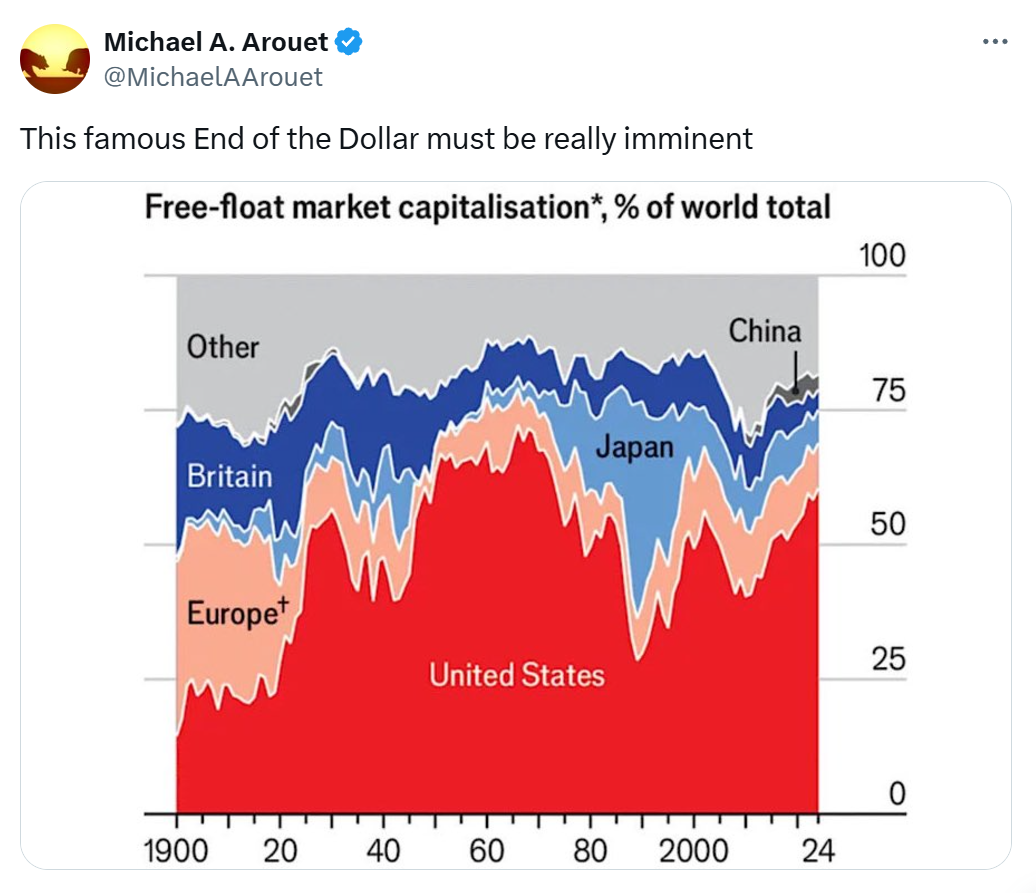

Give me a dollar every time you say the US dollar is over. That BRICs is going to build their own currency to end its domination.

Source: Michael A. Arouet / X

Who wants to be stuck with a declining ruble? A yuan subject to communist manipulation? Or a hybrid with Brazil, South Africa, and some scratchings of gold?

These latter two were to be the countries of tomorrow. Tomorrow has yet to come.

Merchants, traders, and investors the world over seek a safe currency. One supported by the world’s largest repository of taxpayers from a free but well-regulated nation.

Much of the vaunted move away from the US dollar has been to the euro. Of course, it would be good to have a counterweight to American economic power. But so far, the move to the euro has only been at the margins.

The imminent collapse of the US dollar is not here yet. The debt burden is being tamed with rapid GDP growth. It’s business as usual in America.

The best time to buy quality assets is now

It always has been.

While some US tech looks frothy, rebalancing is revealing value in real estate, financials, industrials, and certain opportunities for Trump 2.0.

Europe is due for change. Change is where opportunity lies.

As I write, the New Zealand Labour Party looks to be cooking up some new taxes. According to one source:

The membership is essentially divided into two camps, with one side keen to see a capital gains tax, while the other a wealth tax.

A winning strategy? This would be devastating for a remote economy like New Zealand.

Yes, Australia has CGT. It was introduced in 1985. Assets owned before the introduction are not subject to CGT. Home affordability is worse than here. Those old enough to have legacy assets have done rather well.

And that’s the problem. It takes years to build any meaningful revenue from such a tax.

Meanwhile, a wealth tax would strip capital from this country faster than Chippie quaffing a sausage roll.

Capital appreciation is one of the main routes Kiwis build wealth in a small economy. Burn that path, and you’ll see what Cuba with dairy looks like.

Change is always with us, good and bad. It’s not the change that matters. It’s how you move, flex, and prosper regardless of it.

Quantum Wealth Report

Next week, we’ll be switching to holiday publishing.

We’ll be taking a break from our regular dispatches on Monday, Friday, or Saturday for a few weeks.

You’ll still see in-depth news for our premium subscribers.

If you’d like to read in more detail about market trends that could really impact your wealth, I encourage you to subscribe to our premium news.

Wishing you safe and happy holidays with your most important investment of all. Your family and friends.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.