I left Europe in 2018. There was a feeling that much of the Continent was falling behind. That it was beset by problem after problem.

The debt crisis. The immigration crisis. Brexit. And years of almost no growth.

Fortunately, France and especially Italy have some of the world’s best food and wine. That was the saving grace. But when you’re investing for income with growth, you need more financial opportunity.

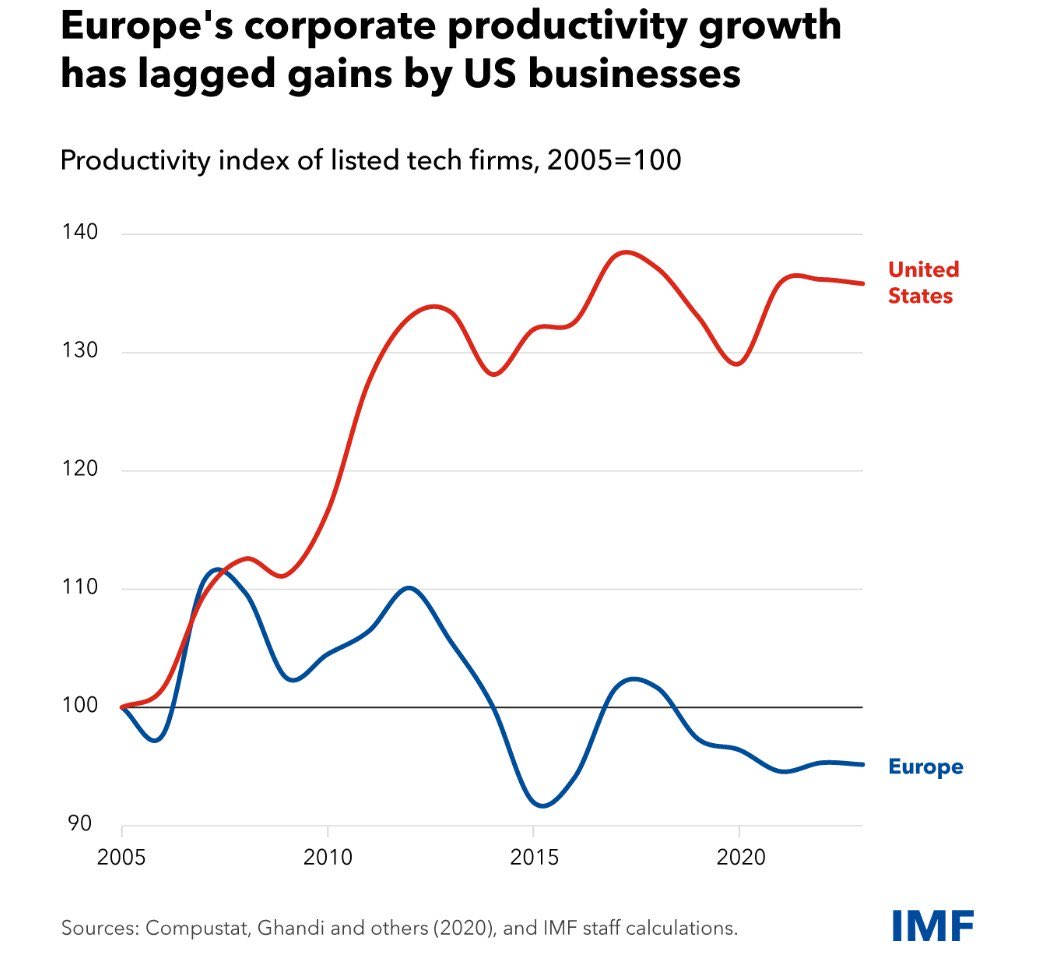

The argument goes that while America innovates, China copies, and Europe regulates.

This risks generalising. China is now innovating and leading in some industries. Europe also has its pockets of innovation and leadership, with countries like Italy introducing low and flat-tax regimes to encourage start-ups. Poland is growing quite fast.

On Via Garibaldi in Turin (Europe’s longest shopping street), my son bought a beautiful painted tile from this street artist.

Source: Author

Soon after, a long queue formed. People wanted to buy his craftsmanship. It was a small reminder of the entrepreneurialism and quality that still exists in Europe.

Of course, on the street, this artist was free to create and earn. For many businesses, the maze of deregulation constrains Europe today as it does Africa.

Trump is set to deregulate and cut tax in America. This will further incentivise growth in an economy that is already the envy of the world.

Will this give Europe the wake-up call that it needs?

Despite Europe’s malaise, there are still some strong businesses sitting at value. The wider EU consumer market is second in size only to the US. And many companies in Europe sit at remarkable value from both a price and dividend view.

I posit that the European countries ripest for turnaround are those who have experienced the worst of economic decline. Young voters are increasingly looking for a Milei-type transformation, as we saw in Argentina.

Southern Europe would be in this category. As would former communist nations like Poland.

Look at Italy, where the tax burden rolls in at a whopping 43.3% of GDP! (It is 26.6% in the US and 33.8% in New Zealand). Simply reducing the size of government and allowing the private sector to innovate could make a huge difference.

Next week, I will head up to Italy again. I will meet an old friend. Visit some company sites. And get a feel for things on the ground.

The source of Europe’s problems

I mentioned it before. Europe is blighted by grotesque overregulation, bureaucracy, and high rates of tax. It is in danger of becoming a heritage park, not an economy.

Yet certain countries, sectors, and businesses could still present dramatic upside…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.