The Trump market bump mainly happened in the US. Meanwhile, European and Australasian markets nervously retreated.

The fear is inflation will come back due to tariffs. The Fed (and other central banks) will have to raise rates again.

Last week, yield-sensitive stocks drew down. At our trading desk, we were glad for the chance to buy some value.

The media is seldom right about how things will end up. They are rarely traders, let alone large holders of company stock. Yet even before the US election, they were grinding away:

Source: AP News — 16 October, 2024

Oh, the experts! The ex-high school prefects who know better than everyone else. The economists with their far-seeing predictive power!

Remember that old study where Oxford economics students, former finance ministers, company chairmen, and London dustmen were asked to predict when Singapore’s GDP per capita would overtake Australia?

London dustmen. Source: Gary Knight / Flickr

The dustmen and company managers won hands down.

Perhaps you’ve heard the old joke?

‘An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.’

To be fair, it’s difficult to predict complex forces. But we can assess value in the numbers today.

Most of the inflation we’ve seen came from monetary overshoot following the socialist pandemic response. Around the world, those people are being voted out.

The Trump ticket won on promises to combat the cost-of-living crisis and get inflation down. Inflation is a country killer. No politician — particularly businessman turned politician — wants to see its furnace.

That is not to say there won’t be a short-term hump, that there won’t be uncertainty. There will be. Also, we don’t know how long this will oscillate for.

But here’s a critical look at the forces at play:

While campaigning, Trump proposed a 60% tariff on goods imported from China and a 10% to 20% tariff on goods from other countries.

Various American companies have said they will pass those tariffs on to the consumer.

Won’t that have a lasting inflationary impact?

Yes and no.

It assumes that the tariffs are a done deal rather than — and more likely — a negotiated process.

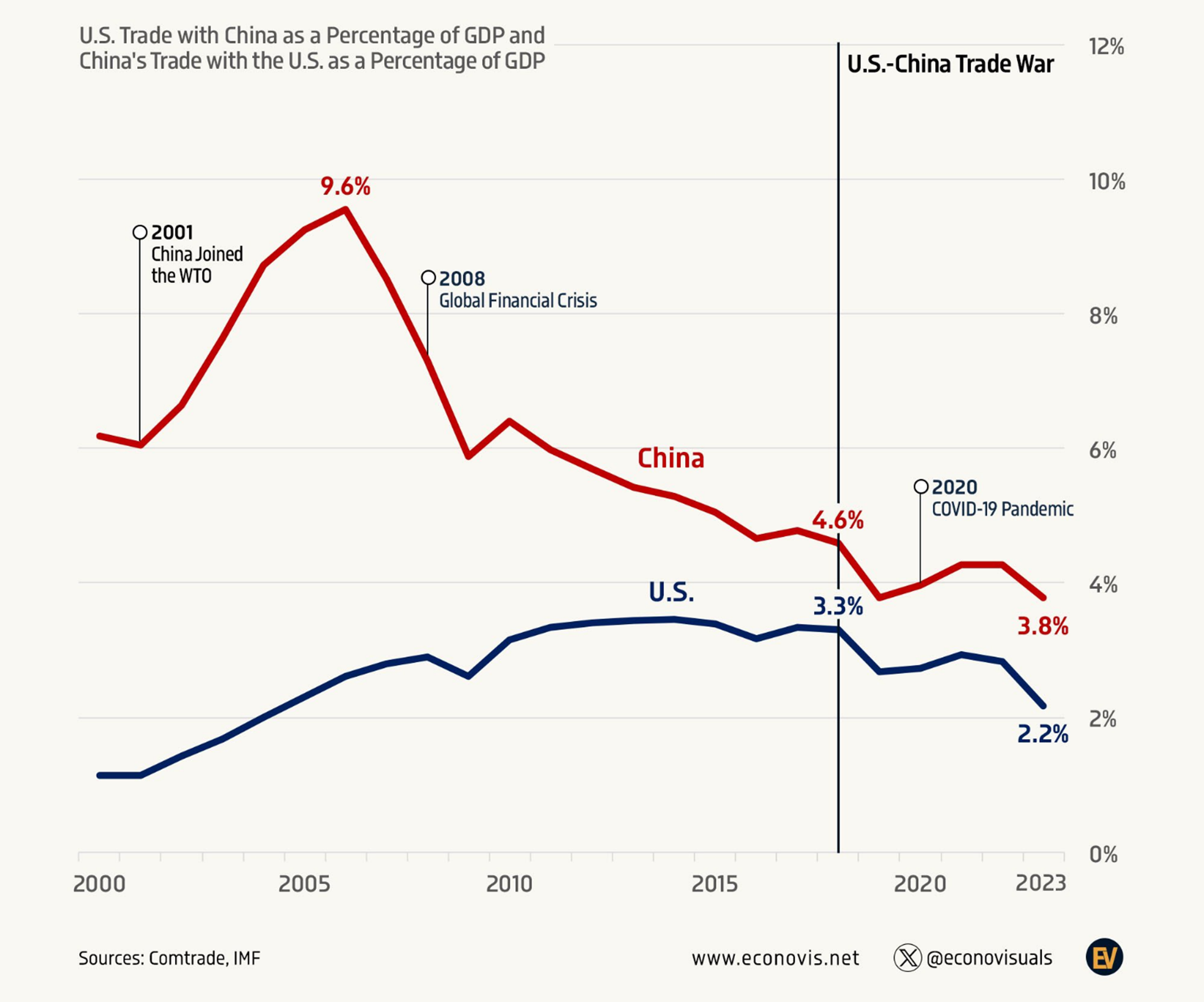

It assumes that trade with China is a very meaningful component of GDP. (It is not, really):

Source: Michael A. Arouet, Econovisuals / X

Further, it ignores long-term deflationary impacts:

- US industrial base is rebuilt, reducing costs.

- Tariffs allow income or sales taxes to be reduced.

- China has more excess supply and prices fall.

- Europe is forced to become more competitive.

Tariffs are nothing new. They provided up to 95% of federal revenue until the federal income tax began after 1913. For over a century, the federal government was mainly funded by tariffs averaging 20%.

I see more deflationary (than inflationary) forces from Trump promises:

- Reducing the size and expenditure of the federal government.

- ‘Drill baby drill’ – increasing oil supply.

- Increasing housing supply by opening up federal land.

- Ending large-scale migration and deporting illegal migrants.

- Potential resolution of the Ukraine conflict.

We only have to look back at Trump’s first term. The period from 2016 to 2020 was not inflationary at all. Inflation averaged about 1.7%. This was in spite of ongoing media claims that tax cuts, deficits, and a tariff-based trade war with China would be inflation rocket fuel.

So, no, I’m not too worried right now. We don’t yet have clear visibility on how the policies will land anyway.

Negative media on Trump and his administration is just par for the course. Most of them failed to predict his win.

I note that The Economist predicted that Trump would only get 262 electoral votes, while Harris would get 276. This proved to be completely inaccurate. In the end, Trump actually got 312 electoral votes, while Harris got 226.

So, how can we expect the media to predict the unknown quantities of how the economy will respond over the long run?

As market traders, we will continue to focus on value.

Most of the companies we invest in around the world will do just fine, regardless of who is in the American White House.

Hold the course. Respond to value. Invest for long-term growth and income.

Are you a wholesale or eligible investor looking for opportunity in the global markets?

Our individually managed accounts could be for you.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.