A client and friend recently moved to Argentina with his family. He is originally from Europe. Previously, he invested in New Zealand.

These days, he likes to be in the southern hemisphere. It is far away from the conflicts in Europe. Countries like Argentina and New Zealand are rich in natural resources and more sparsely populated.

Argentina has just 17 people per square kilometre. New Zealand 20. The UK, 286.

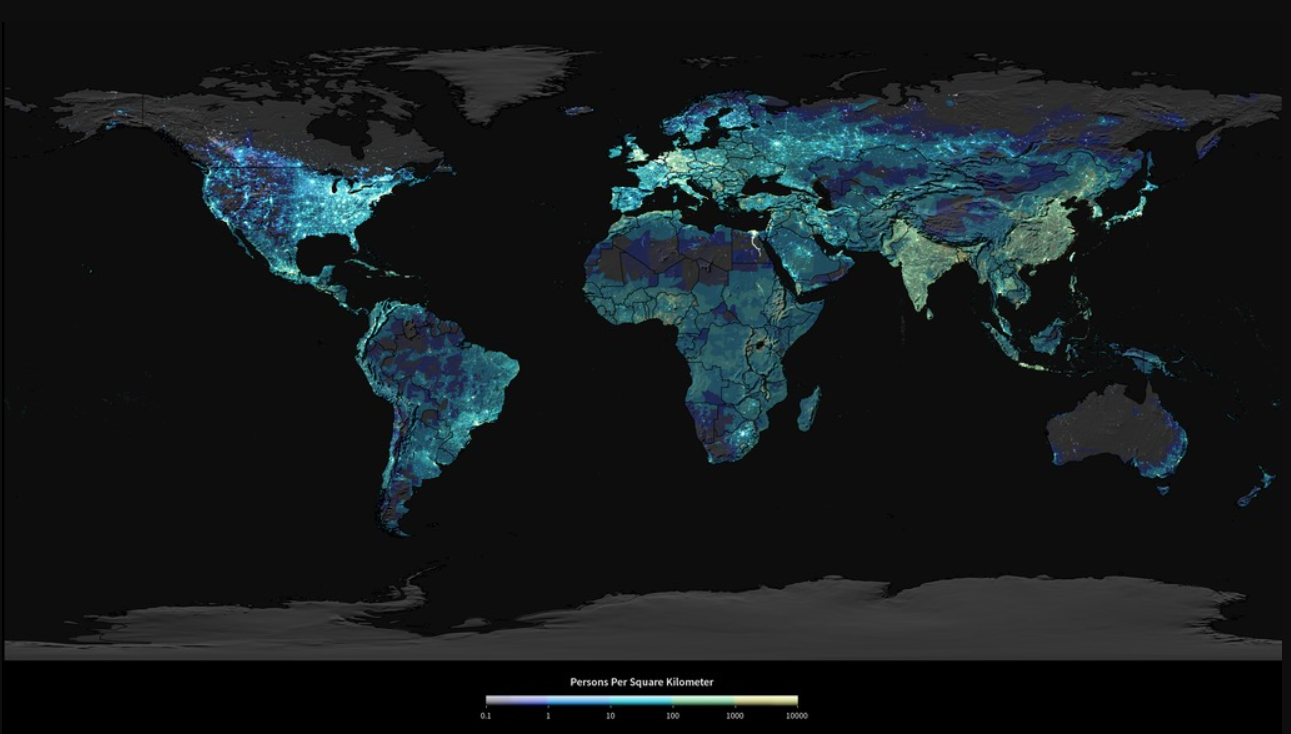

Take a look at this image from NASA, combining population data with night-lights data. The southern countries of Argentina, South Africa, Australiam and New Zealand remain among the last temperate lands that are relatively empty.

Population density at night. Source: NASA Scientific Visualization Studio

Our friend’s experience in Argentina echoes our own in Australasia. Low population density is not great for business. Yet prosperity is possible with plentiful resources and a well-managed economy.

Unfortunately, for the last few decades, prosperity has eluded Argentina. The country has seen chronic inflation. This economic distress comes from the deep-rooted cause of ‘persistent public over-spending financed by money creation’.

An understanding of this is at the heart of the country’s new direction.

Javier Milei was elected in 2023. He received almost 70% of the vote amongst those under 29.

A self-proclaimed anarcho-capitalist — and according to the BBC, ‘a far-right outsider’ — he promised to slash public spending and grift. Following his rallies, where he would turn up with a chainsaw, he gained the nickname the ‘chainsaw president’.

The deep roots of government penetrate every aspect of Argentine life. Armies of people depend on it. So, I have been watching Milei’s progress with interest.

My analysis in April found that New Zealand had a similar percentage of the workforce in the public service following the Ardern regime. To date, a similar level of chainsaw cuts has also been made.

But the real test is what life is like on the ground…

Protest in Buenos Aires over university funding cuts.

Source: Free Malaysia Today / Creative Commons

We caught up the other month with our friend in Buenos Aires.

Is the country improving under the leadership of Milei?

A grandpa, he recently employed a nanny to help with his grandchildren — a boy, almost 2, and a newborn baby.

Their nanny is a 26-year-old Argentine woman from a smaller town. The going rate for her work is around 3,000 pesos per hour (about NZ $5.40).

Back in her family business, she once had thieves threaten to cut her fingers off with a knife during a robbery. These days, she is a black belt in martial arts, voted Milei, and sees more hope for the future.

‘She understands what causes inflation,’ our friend said. ‘She knows it is not capitalism, but the government. Now inflation is going down.’

‘Argentine people are very laid back,’ he goes on. ‘You can feel their genuine warmth. They are always happy to share their stories. And I am sensing now that people feel more positive with this new government and direction.’

Of course, not everyone is happy with Milei. The prosperous lawyer handling his paperwork was less enthusiastic. Because it may soon mean an end to some of the programmes that lawyers and accountants enjoy.

Bureaucracy remains a problem impacting everyday life

‘I almost needed a week’s holiday to arrange a new SIM card for my phone,’ our friend told us. ‘Many things don’t work because it’s too tied up. It’s even worse than back in Europe. People soon give up in business due to the constant rules.’

Their nanny also believes ‘the system is still broken’. She visits Chile, reporting that this country is like England. Things work better. Argentina is more like Italy.

Despite this, Argentina does feel like a country turning a corner. The apartment block where they stay is filled with new migrants from Russia and the Ukraine seeking to escape the war.

‘Here,’ our friend says, ‘you can feel there are all the chances to be rich. The land is full of resources. People are nice. Inflation is coming down, and the economy is improving every day as the reforms begin working. There are no beggars, and the streets of Buenos Aires are clean. It is a place where you don’t see poverty directly — but you know that it exists in outer neighbourhoods and smaller towns.’

I ask him if he thinks Milei will succeed in taking Argentina back to the rich country it once was at the top of the global income league.

‘Maybe it’s impossible because the government is too deep in people’s lives,’ he says. Though he admits he has not been in Buenos Aires long enough to really know.

Opportunities beyond the radar

After listening to our friend in Argentina, I cannot help but feel there is real opportunity here.

In the past year, the S&P Merval (Argentina’s index tracking large and mid-cap stocks) is up over 200%.

Banco Macro [BCBA:BMA], an Argentinean bank, is up over 400% during this time. It offers a dividend of around 8%. And still sits at comparative value with a P/E of around 10.

Source: Google Finance

Unfortunately, for investors looking at these opportunities now, the main run-up has already occurred. Since Milei entered power in October 2023.

Further, it’s important to realise that when considering rises like that of Banco Macro, this is expressed in local currency. The inflation rate in 2023 was 211%. In 2024, it is expected to close the year at an annualised rate of around 123%. So, the real return is of course much less.

Even a dividend of 10% makes little headway when inflation is over 100%. And in a country with a central bank rate of 40%, a P/E of around 10 is not cheap, considering the wider economic uncertainty.

Good fundamentals are overshadowed by macro risks

This is the problem when investing in a potentially re-emerging economy like Argentina.

Should Milei continue to work his chainsaw and bring inflation down, we may see further exciting growth. Should he come up against inseverable ropes of bureaucracy, he may fail to make more meaningful progress.

Argentina is a fascinating case. It reminds us how entrenched bureaucracy, overspending, and money-printing can become. And how damaging.

Of course, where there is determined reform, there is also opportunity.

Are you a wholesale or eligible investor looking to manage risk in the global markets?

Our individually managed accounts could be for you.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.