I like real property. It’s tangible and is the bedrock for other economic activity.

What a lot of investors don’t realise, is that some of the best quality property is available on the sharemarket. Sometimes at a great discount. We’re seeing that in this uncertain economy.

Mount Taranaki. Source: Flickr / russellstreet

Growing up in Taranaki in the 1980s and ‘90s, I watched Mum and Dad build several homes.

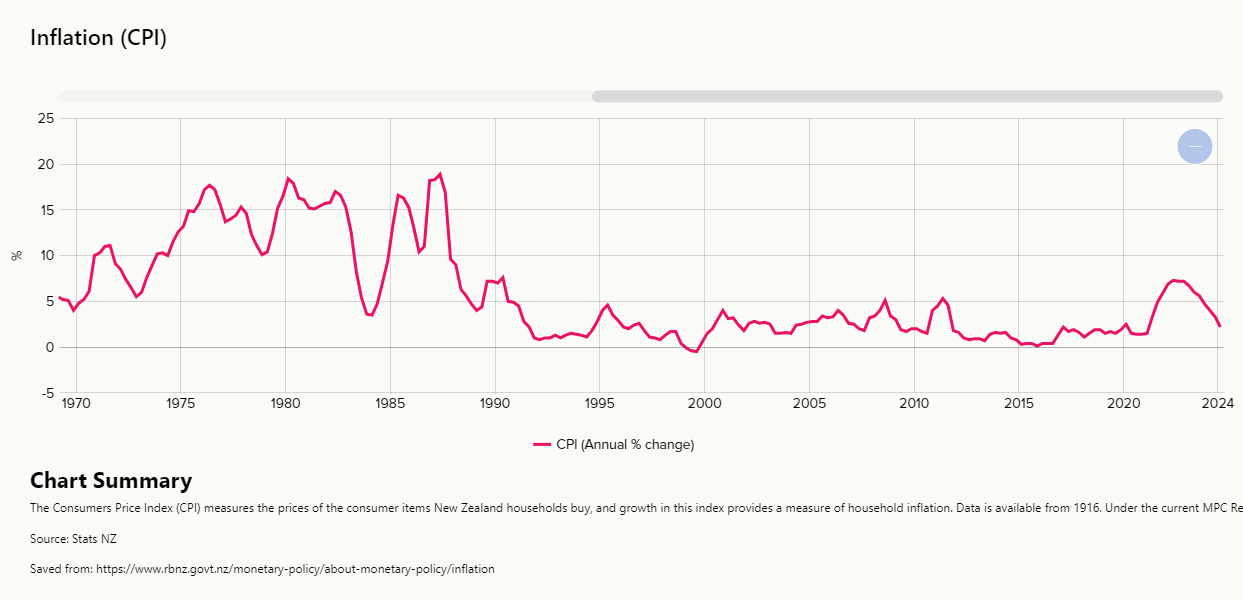

It wasn’t an easy time economically. Inflation reached 18.9% in 1987. Many local stocks were ridiculously priced with P/E ratios of 50 or more.

The sharemarket crashed. Mortgage rates hit 20%. I remember money being very tight.

The 1989 Reserve Bank Act was successful in breaking the back of inflation. It was copied by other countries around the world.

Inflation never got as hot again until it reached 7.3% in June 2022. That was on the back of Covid disruption and overcooked monetary policy. The last time it was this hot was June 1990 (7.6%).

Property risk

Borrowing cost wasn’t the only risk my parents faced in building a new home. Soon after we moved to New Plymouth, they found a quiet cul-de-sac with a nice piece of vacant land. About 800 square metres, I guess.

They built a beautiful new home with timber ceilings and a double garage underneath. I helped my father build fences around the property. We played cricket in the street with the neighbouring kids.

Then a couple of the other houses in the cul-de-sac came up for sale. There was talk that Housing New Zealand — as it was known back then — was going to buy them. The Labour government had a policy of integrating state houses in areas that were privately owned.

My mother was prescient, wanting to sell our house before it was fully finished. But we ended up holding on. Then rival gang members moved into the state houses, and the street changed. Initially, they seemed protective of other neighbours. But then came the parties, the fights, dogs trained to fight, and reluctantly at times, the police.

I did an early-morning paper round. One morning, there was blood on a picket fence, probably from a fight the night before. But my constant worry was the loose dogs.

My parents had very different worries. As things worsened, like a lot of the other residents, they wanted to sell and get out. But when prospective buyers drove into a street with broken down old cars, loose dogs, and gang members; their appetite drained away.

Perhaps I overstate things. Though one thing is certain: the property caused enormous financial loss.

I became very interested in business. At the age of 15, I was selling practice exam papers at school and supplying soft drinks and Moro bars at the cross-country. By 17, I had bought my first shares, going on to scoop some of the opportunities that followed the ‘87 crash.

For me, investing is an equation…

Finding opportunity while managing risk

A lot of risk you can’t predict. Nobody would have thought the government would buy some houses in a nice street. Then let them out to perilous tenants. But the great thing when investing across businesses on the sharemarket is you can diversify your risk.

In this post, I’m going to look at the outlook for the global economy and New Zealand. What opportunities is that presenting. Where are the risks?

I’m going to look at how the real-estate cycle might be changing.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.