Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

This month, the market was in a holding pattern. Then, as we got closer to the US election, it started to draw down.

The market is pricing a Trump victory. There is upside and downside. Because the market hates uncertainty, sentiment is giving way to the downside.

Source: Image generated by Freepik AI

For investors, this might be an opportunity gap. That may last for a month or two while the election settles and the ramifications hit home.

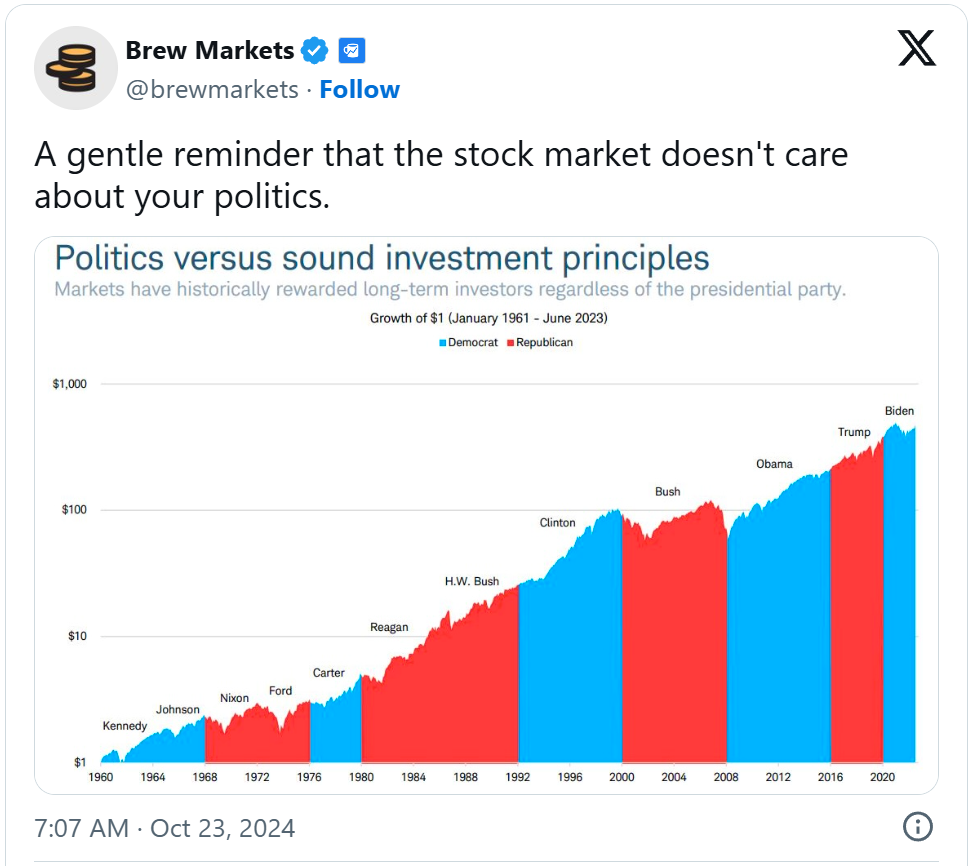

Over the long run, it may not make much difference:

Source: Brew Markets / X

Meanwhile, we can buy the fear.

Then ride the reality.

Realities of a Trump presidency?

On one hand, markets love what he promises: tax cuts and deregulation. Corporate tax for companies producing in the US could come down from 21% to 15%.

On the other, they’re concerned this could be inflationary. Especially when tariffs get added to the mix. We’re already seeing rising Treasury yields in anticipation.

The reality is probably more upside. Tariffs can allow for lower income taxes and boost productivity. Increased productivity tends to lower inflation.

Indeed, in the early days of US economic ascent, tariffs funded the federal government.

As for the Harris option?

Markets may go into mild shock. The betting averages were not delivered!

But things will return to normal. It seems unlikely a divided Congress will allow her to increase taxes. Particularly not the corporate tax rate (which she seeks to lift from 21% to 28%).

Further, she looks set to continue most of the agenda of the existing Biden administration. Stocks are generally quite affable when it comes to avoiding surprises.

Managed Account performance*

For the month of October 2024, we were down 2.57% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Our MSCI EAFE benchmark was down 3.98%.

Our YTD performance is 10.69% (January to October 2024), or 12.83% on an annualised basis.

Our average annualised return since inception is 13.65% p.a.

Please see our performance chart for more details.

Is this an opportunity to show courage?

As I mentioned last month: ‘October may see more volatility and chance to hunt.’

It’s still a good time for lions.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.