Those who have knowledge don’t predict. Those who predict don’t have knowledge.

—Lao Tzu

The world is filled with experts. Pundits. Forecasters.

Their role, really, is to provide snappy commentary. This is especially true each time the media needs to validate a certain point of view.

But here’s the thing. These forecasters with snappy comments are actually no better at predicting the future than a chimpanzee throwing random darts at a board.

For example, here’s one of the most spectacular misfires of all time:

- In 1843, Henry Ellsworth was the Commissioner of the United States Patent Office. He submitted a report to Congress, where he said: ‘The advancement of the arts, from year to year, taxes our credulity and seems to presage the arrival of that period when human improvement must end.’

- It’s quite elegant language. But let me translate Ellsworth’s words into modern simple English for you. Here’s what he’s actually saying: ‘Human innovation is happening at such an astonishing speed now. It feels like we’re going to run out of creative juice. In fact, I believe we may be reaching the point where everything that can be invented has already been invented.’

- Ah, yes. Fascinating. So, why exactly did Ellsworth feel this way? Well, I can imagine that his logic went like this: the 19th century was the century of technological marvels. From the telegraph to the light bulb; from the internal combustion engine to the electric motor; the scale of human innovation was breathtaking.

- So much was happening in such a short span of time. This felt abnormal. Freakish, even. So, perhaps it was reasonable to believe that we had reached the peak of human potential? Perhaps we couldn’t progress that much further? Maybe the end was in sight?

- And then, of course, along comes the 20th century. With a knowing grin, the 20th century looks at the 19th century and says: ‘Well, hold my beer. You ain’t seen nothing yet.’

Now, in retrospect, it seems foolhardy to bet against human creativity and resilience. But guess what? It’s still happening, even in our modern day and age. Here’s another classic misfire:

- In 1995, Robert Metcalfe — the brilliant engineer who helped invent Ethernet — had a very grim prediction. He wrote a column in InfoWorld magazine, where he said: ‘Almost all of the many predictions now being made about 1996 hinge on the Internet’s continuing exponential growth. But I predict the Internet, which only just recently got this section here in InfoWorld, will soon go spectacularly supernova and in 1996 catastrophically collapse.’

- Metcalfe certainly wasn’t alone in his opinion. In 1998, Paul Krugman, a brilliant economist, was also pessimistic about the Internet’s chances. He said this: ‘The growth of the Internet will slow drastically, as the flaw in Metcalfe’s law — which states that the number of potential connections in a network is proportional to the square of the number of participants — becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.’

- Well, whoops. We’re in 2024 now. The Internet has not only survived, but it has actually taken root and flourished. It has become more important to our lives than either man could have imagined.

Source: MarketWatch

Now, given their lousy track record at predicting the future, you might think that the prophets of doom would have learned to calm down a little bit by now. But, hey, old habits die hard. Pessimism is a hard addiction to shake:

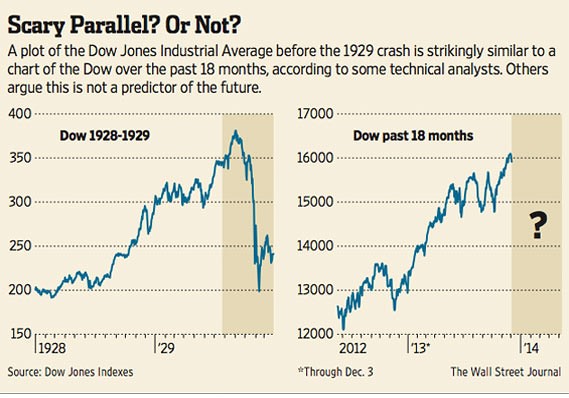

- For example, in 2013, some analysts made a scary prediction about the stock market. They said that we were on the verge of 1929-style crash. They predicted that this shock event would happen in 2014. A devastating loss of 90% was looming.

- To make their case, these analysts overlaid two historical graphs of the Dow Jones. Comparing the past to the present. Drawing a parallel. Pseudo-science.

- But, of course, nothing happened in 2014. The sun was still shining. The birds were still singing. And since then, the Dow Jones has gone on to rise over 170%.

Nonetheless, the prophets of doom will keep plying their trade. In 2024, a certain economist has been making a sensational claim:

- He says that a terrifying crash is about to happen soon. He predicts that the S&P 500 will fall by 86%, while the Nasdaq will fall by 92%.

- The real-estate sector won’t be spared either. He predicts that housing will suffer a drawdown of between 50% to 80%.

- Should you believe him? Well, consider this: he has been making this exact same prediction for 15 years now. He keeps saying that a major economic depression is about to happen. He keeps asking people to flee the market.

- However, his track record hasn’t been great. In fact, anyone who listened to his advice in March 2009 would have missed out on a 700% gain for the S&P 500, from trough to peak.

So, being eternally pessimistic doesn’t work out too well over the long-term:

- Legendary investor Peter Lynch puts this into perspective: ‘Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.’

Join us for our Coffee & Capital event

Source: Image by Engin Akyurt from Pixabay

Ultimately, investing is about optimism. It’s about looking forward. It’s about believing that steady progress is always happening:

- For example, here’s a fascinating statistic. There are over 580 million entrepreneurs on Earth. They make up just 7% of the world’s population — but these folks have an outsized impact, stretching far beyond their small numbers.

- These people act as force-multipliers. Running businesses. Creating products. Solving problems.

- For the most part, these people remain hidden away in the background. Unreported. Uncelebrated. But their efforts at creating prosperity are compounding, even if the general public has zero awareness of such progress.

- Indeed, the media will tell you about what has gone wrong in today’s world — but they won’t tell you about what has gone right. This means there’s a huge blind spot that needs to be addressed.

So, in the interest of understanding the true nature of our economy, I’m inviting you to come join us for our new Coffee & Capital event. We’ll be talking about the latest trends we’re seeing:

- What is the outlook for the global economy and New Zealand?

- Are interest-rate cuts tracking for a soft landing and robust bull market?

- How is the real-estate cycle changing?

- What resources see supply-and-demand imbalances forming?

- Could this market still be overlooking some high-quality businesses?

- How will new waves of global prosperity change the world?

COFFEE & CAPITAL

Friday, 8 November, 2024

12:00pm to 1:00pm

❌ This Event Is Now Sold Out

Pickles Café — Function Room

1 Antares Place, Rosedale, Auckland

$30 per person / limited spaces

Includes any lunch menu item, coffee

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.