Oil is the world’s most strategic commodity.

—Henry Kissinger

Let me ask you an honest question.

Have you been reading the fearful headlines about the Middle East?

Are you concerned that the situation between Iran and Israel will escalate?

Are you worried that this will cause fuel prices to surge, causing a financial bloodbath?

Source: Image generated by OpenAI’s DALL-E

Well, if you’re feeling nervous, I don’t blame you. The media coverage has been scary. But has the fear been exaggerated, Covid-style? Well, let’s dig deeper:

- In 2023, Iran produced 3.99 million barrels of oil per day. Because of this, it’s been suggested that if we experienced a sudden disruption in supply, it could be enough to push the global economy over the edge. Send us into a terrifying downward spiral.

- But hold on. Wait a minute. Is that perception actually true? Well, maybe it’s wise to put things into perspective. In 2023, the entire world produced 101.81 million barrels of oil per day.

- So, Iran’s 3.99 million barrels isn’t actually big number at all. In fact, it only represents 4% of global oil output. That’s a relatively small.

- This suggests to me that while oil prices might prove to be volatile in the short-term, there’s actually room for the market to smooth things out over the longer-term.

Frankly, you should be paying closer attention to Saudi Arabia. Why? Well, because it’s a far more important player than Iran in the region:

- In 2023, Saudi Arabia produced 11.13 million barrels of oil per day — or 11% of the global total. As the most powerful country in OPEC, Saudi Arabia is known as a ‘swing producer’. It has the ability to scale up or scale down, which has a significant impact on market stability.

- For this reason, the Saudis have indicated that they are prepared to increase the production of crude oil from December 2024 onwards. They certainly have the spare capacity to make up for any supply shortfalls. In theory, this should provide a cushion for prices in the long run.

Mind you, the Saudis are not doing this out of charity. They are doing this out of pure self-interest:

- If you know anything about the region, then you already know that there’s been a long-standing rivalry between Saudi Arabia and Iran. This is a competition based on religious ideology, as well as political influence.

- So, when it comes to oil, if the Saudis can capture more market share at the expense of the Iranians, well, I suspect they might just seize the chance to do it.

- Also, it’s no secret that Saudi Arabia’s crown prince — Mohammed bin Salman — has been looking to cultivate a more Western-friendly image. Boosting oil production might just help him achieve that goal. Ultimately, it’s good optics for him.

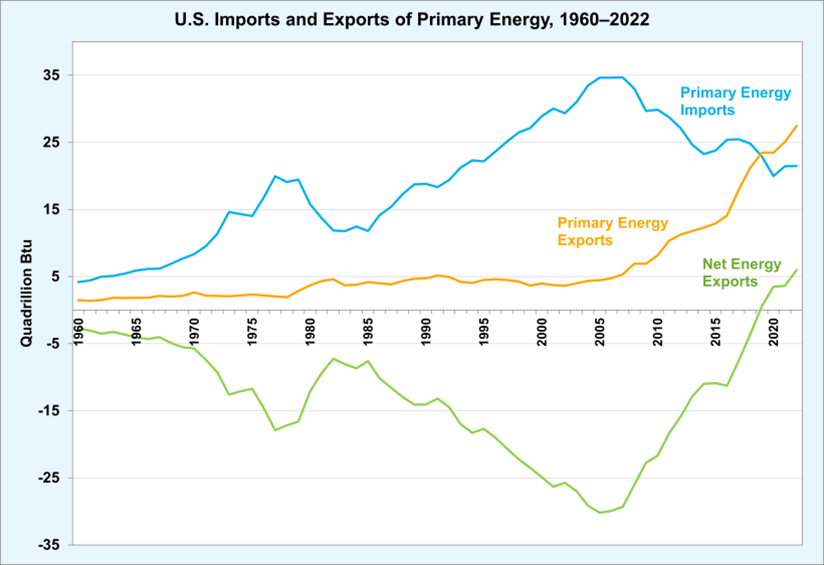

Source: Department of Energy

Meanwhile, if you look beyond the Middle East, you will see another important trend emerging. This has to do with the role of the United States:

- For over 60 years, America was a net importer of energy. Mostly, it got its oil and gas from three sources: Canada, Mexico, and Saudi Arabia.

- However, in 2019, America suddenly switched gears. The country became a net exporter of energy.

- In 2023, America was the world’s largest producer of oil, putting out 21.91 million barrels a day — or 22% of the world total.

- Also, in 2023, America was the world’s largest producer of natural gas, putting out 1.35 trillion cubic metres of it — or 33% of the world total.

- Now, in 2024, the US presidential election is fast-approaching. The issue of energy security is more important than ever. Here’s why you need watch this urgent development…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.