Watch your thoughts, for they will become actions.

Watch your actions, for they’ll become habits.

Watch your habits, for they will forge your character.

Watch your character, for it will make your destiny.

—Margaret Thatcher

You already know this: human beings are driven by circumstance.

For example, a child who grows up during an economic boom is going to have a very different outlook from a child who grows up during an economic recession.

Similarly, an investor who starts investing during a market upswing is going to have a very different experience from an investor who starts investing during a market downswing.

Source: Image generated by OpenAI’s DALL-E

Of course, you might argue that optimism and pessimism are simply opposite sides of the same coin:

- Perhaps some people tend to be optimistic because their formative experiences have been positive. They have enjoyed a measure of good fortune. So, they tend to see life through rose-tinted glasses.

- Maybe the reverse is true for the folks who tend to be pessimistic. Life has dealt them a bad hand early on. So, from that point on, they start to see only doom and gloom.

- Call it fate. Call it luck. Call it providence. But, certainly, there is a direct link between someone’s personal experience *and* their personal outlook.

- Psychologists call this the ‘anchoring effect’. People will usually make judgments based on their emotional baseline.

Now, regarding pessimism, there’s also another factor to consider, which is the role of our media:

- These days, we are being bombarded with negative messaging. Around the clock. On every device imaginable.

- The headlines are rage-baiting. They play with our emotions. Making us edgy. Making us agitated.

So, how bad is it, exactly? Well, there’s this anecdotal story about American shock jock Howard Stern. It goes like this:

- The average person who likes Stern will listen to his radio show for one hour and 20 minutes every day.

- Meanwhile, the average person who hates Stern will listen to his radio show for two hours and 30 minutes every day.

- Well, good grief. If they hate Stern, why do they listen to him so much? Well, the most common answer is this: ‘I want to see what he’ll say next.’

Looking beyond emotion?

Yes, of course, angertainment is addictive. But it’s also deceptive. Rationally speaking, here’s what you need to consider:

- The bad things that happen in our world are actually exaggerated. They take place mostly in the short-term.

- Meanwhile, the good things that happen in our world are actually undervalued. They take place mostly in the long-term.

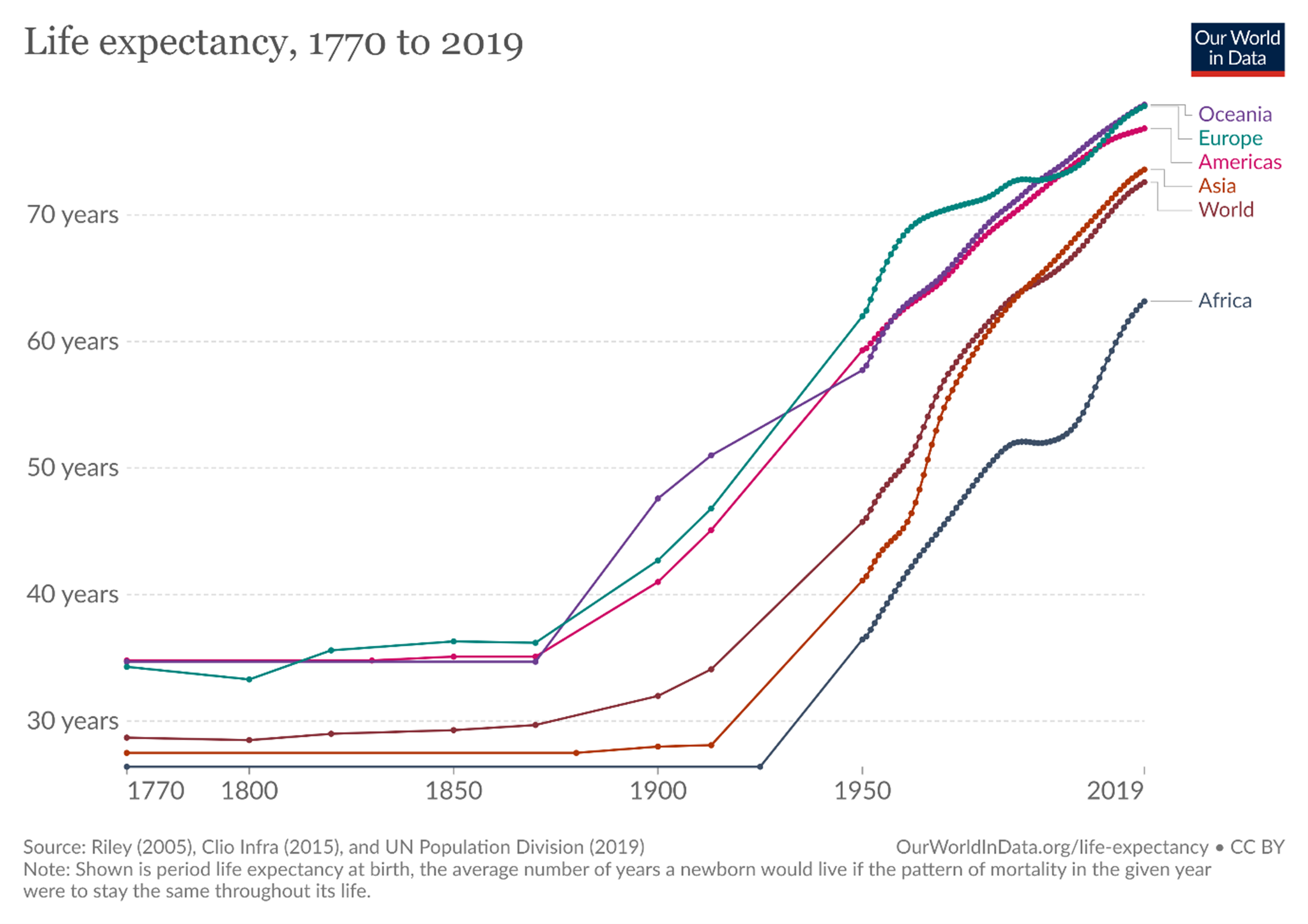

Source: Our World in Data

For example, let’s talk about the nature of human life itself:

- As recently as 1900, the average life expectancy globally was 32 years.

- Today, that figure is well over 70. More than double. This is astonishing progress.

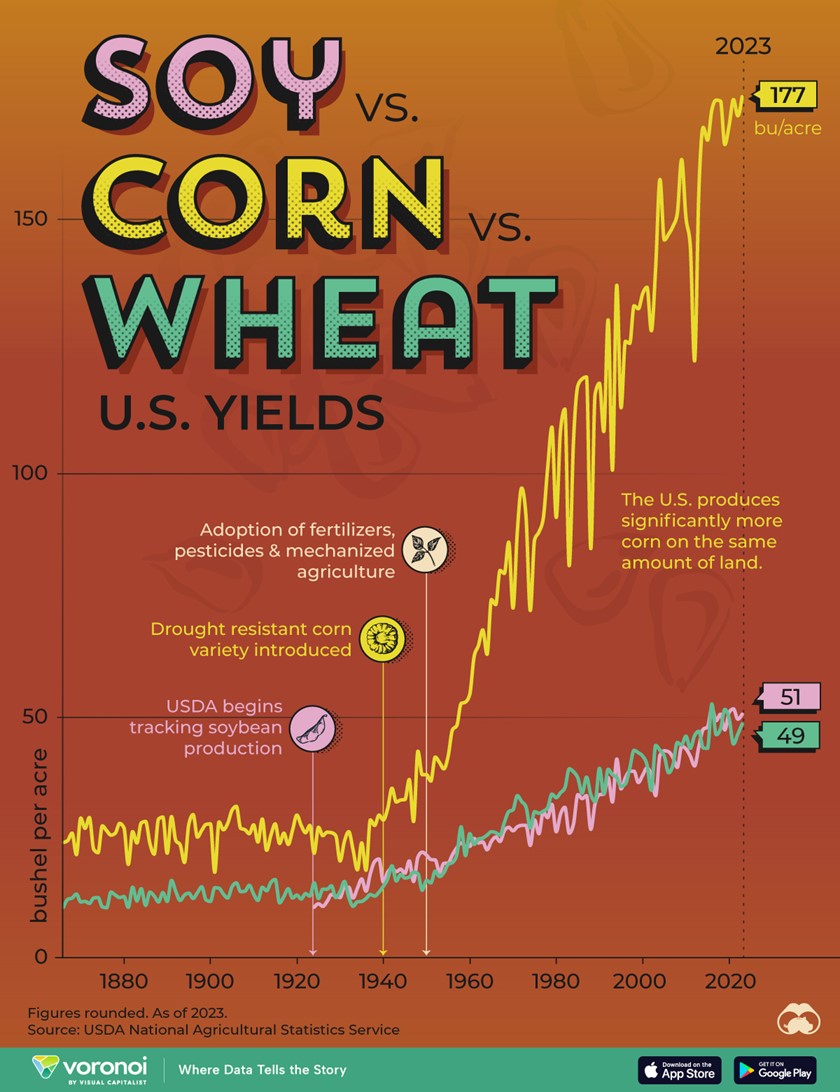

Source: Visual Capitalist

So, why exactly are people living longer? Well, the availability of food and nutrition is a key factor:

- In 1923, the corn yield is America was range-bound. It was about 27 bushels per acre.

- However, by 2023, the corn yield has soared to around 177 bushels per acre. That’s a leap of over 500%.

- The introduction of drought-resistant crop in 1940s was a game changer. So, too, was the introduction of fertilisers and machines in the 1950s.

The availability of modern healthcare has also been decisive. Here’s what Morgan Housel says in his book The Psychology of Money:

Consider the progress of medicine. Looking at the last year will do you little good. Any single decade won’t do much better. But looking at the last 50 years will show something extraordinary.

For example, the age-adjusted death rate per capita from heart disease has declined more than 70% since 1965, according to the National Institute of Health. A 70% decline in heart-disease death is enough to save something like half a million American lives per year. Picture the population of Atlanta saved every year.

But since that progress happened so slowly, it captures less attention than quick, sudden losses like terrorism, plane crashes, or natural disasters.

We could have a Hurricane Katrina five times a week, every week—imagine how much attention that would receive—and it would not offset the number of annual lives saved by the decline in heart disease in the last 50 years.

Finally, Ben Carlson from A Wealth of Common Sense puts a few historical facts into perspective:

- Early in the 19th century, 12% of the world could read and write. Today it’s 83%.

- Just 200 years ago, 85% of the world’s population lived in extreme poverty. 20 years ago it was 29%. Today only 9% live in extreme poverty while the majority of people (75%) around the globe live in middle-income countries.

- 1,000 years after Jesus walked the earth the world was barely any richer. It took 500 years for income to double from there. Then between 1820 and 1900, the world’s income tripled. It tripled again in a little more than 50 years. It took only 25 years for it to triple again, and another 33 years to triple yet again.

- In 1905, a Vermont doctor and his chauffeur were the first to successfully drive a car across country from San Francisco to New York. It took them 63 days. Today you can fly cross country in a matter of hours while using wireless Internet.

What’s the big picture?

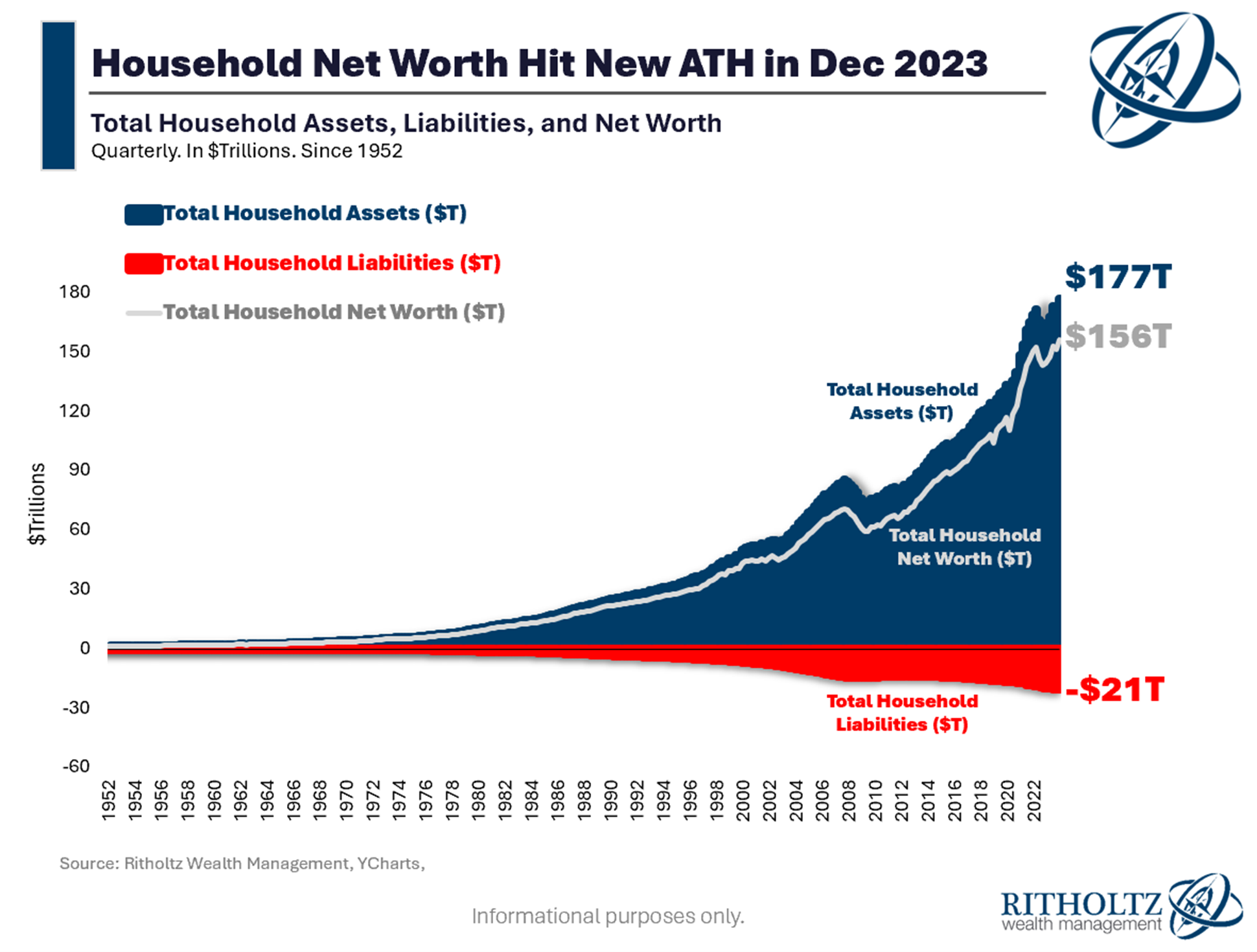

Source: A Wealth of Common Sense

I can’t tell you the number of times that I’ve heard pessimistic comments:

- ‘This is the worst time in history to be living in.’

- ‘Things can only get worse from here on out.’

- ‘Life sucks.’

Is such negativity justified? Well, I don’t believe so. Here’s why:

- I look back on the long tail of history. And, indeed, what I find profound is the history of my own family. We have gone from peasants to refugees; from working-class to middle-class; all in the space of just four generations.

- Now, here’s a humbling fact: it wasn’t that long ago that my great-grandparents had to endure famine. In the early 20th century, when they migrated from China to Malaya, they did so with the threat of starvation hanging over them. Their only motivation? To have enough to eat. They weren’t hoping for very much.

- Frankly, my great-grandparents could never have imagined the luxuries of the 21st century. For example, they would have been astonished by the presence of refrigerators in every home, stocked with food, keeping them fresh. This would have felt like a divine miracle.

- Science-fiction author Arthur C. Clarke once said: ‘Any sufficiently advanced technology is indistinguishable from magic.’

- That’s so true, isn’t it? When I reflect upon the long tail of history, I can see upward mobility for my family. Rising prosperity. A quantum leap forward.

So, here’s the strange thing about us as human beings:

- We tend not to notice the compounding nature of health and wealth. Because they usually happen in the background. Snowballing over decades, across generations.

- But make no mistake about it: even if we don’t appreciate the power of compounding, it’s still there. Doing its magic. Transforming destinies. Improving quality of life.

Join us for our Coffee & Capital event

Source: Image by Engin Akyurt from Pixabay

Ultimately, investing is about optimism. It’s about looking forward. It’s about believing that steady progress is always happening:

- For example, here’s a fascinating statistic. There are over 580 million entrepreneurs on Earth. They make up just 7% of the world’s population — but these folks have an outsized impact, stretching far beyond their small numbers.

- These people act as force-multipliers. Running businesses. Creating products. Solving problems.

- For the most part, these people remain hidden away in the background. Unreported. Uncelebrated. But their efforts at creating prosperity are compounding, even if the general public has zero awareness of such progress.

- Indeed, the media will tell you about what has gone wrong in today’s world — but they won’t tell you about what has gone right. This means there’s a huge blind spot that needs to be addressed.

So, in the interest of understanding the true nature of our economy, I’m inviting you to come join us for our new Coffee & Capital event. We’ll be talking about the latest trends we’re seeing:

- What is the outlook for the global economy and New Zealand?

- Are interest-rate cuts tracking for a soft landing and robust bull market?

- How is the real-estate cycle changing?

- What resources see supply-and-demand imbalances forming?

- Could this market still be overlooking some high-quality businesses?

- How will new waves of global prosperity change the world?

COFFEE & CAPITAL

Friday, 8 November, 2024

12:00pm to 1:00pm

❌ This Event Is Now Sold Out

Pickles Café — Function Room

1 Antares Place, Rosedale, Auckland

$30 per person / limited spaces

Includes any lunch menu item, coffee

This will be a great session!

It will be an opportunity to mingle, share, and reflect.

We look forward to seeing you at our first Coffee & Capital event.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.