Civilisations die from suicide, not by murder.

—Arnold Toynbee

When it comes to investing, we focus mainly on Western developed markets.

No market is perfect. But here you get a relatively high degree of trust. Transparent accounting standards. A developed regulatory framework.

When you’re planning for financial freedom, passive income, and some margin of safety; this helps build a secure strategy.

Occasionally, I’ll put some more speculative money in an emerging market.

There, we experienced a fraud event in one of the companies. A sudden hike in the corporate tax rate. And more volatility – though a very high dividend (over 10%).

Is the West in danger?

Spend any time on social media and you come to feel that the West is in decline.

That the values, institutions, and systems that gave it security are now under threat.

Empires decay and fall. But renaissance can follow. Source: Flickr / Storm Crypt

The Roman Empire fell on inflation, inept government, and an influx of barbarians.

Some compare that to modern monetary erosion, the out-of-touch ‘uniparty’, and uncontrolled mass migration.

The more governments serve their own interests, rather than the needs of the people, the more likely you’re going to see decline.

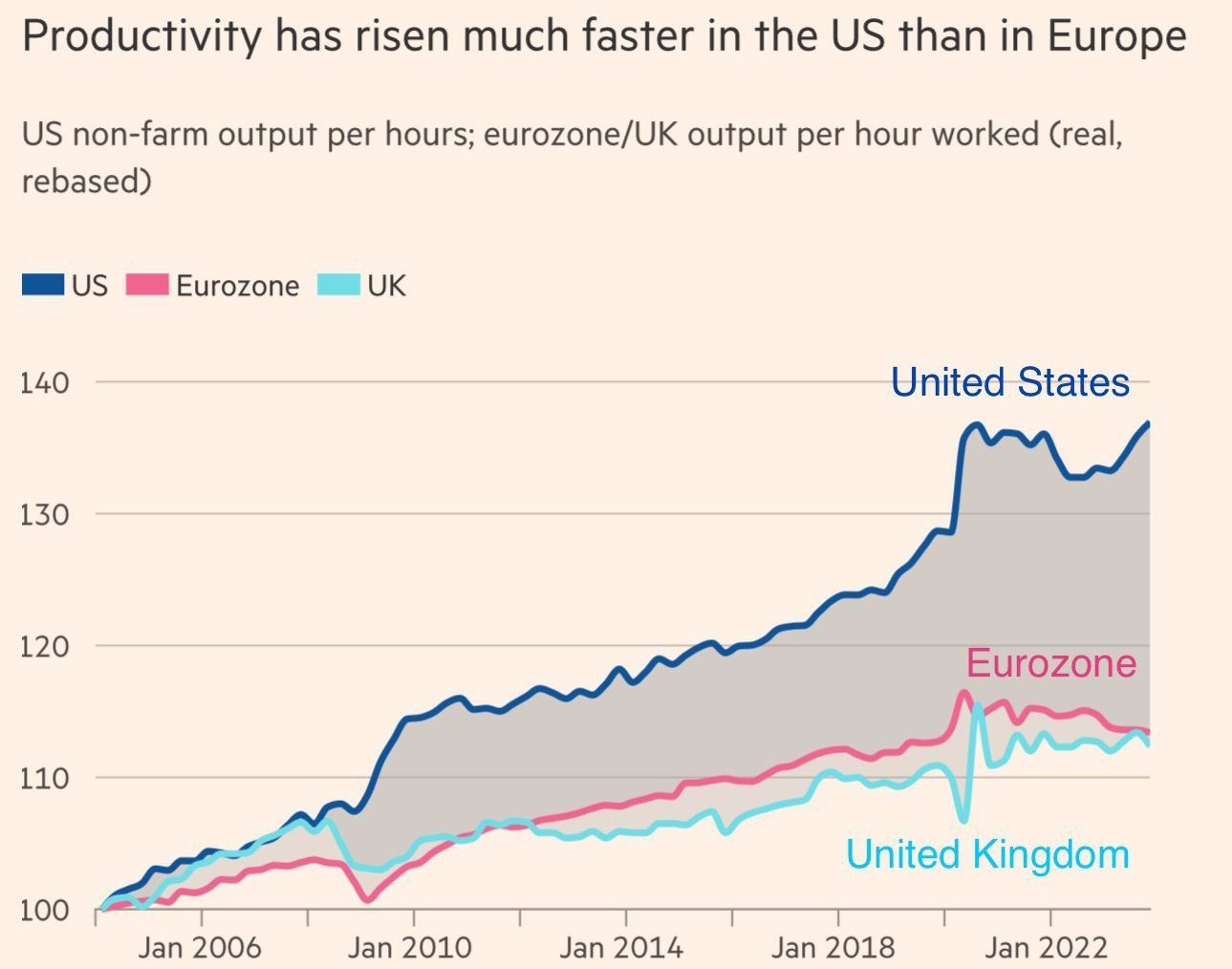

Europe appears a case in point.

Source: Michael A. Arouet / X

For years, Europeans have voted for socialist governments.

But you can’t build prosperity by redistributing someone else’s work and wealth. No, you cannot multiply wealth by dividing it.

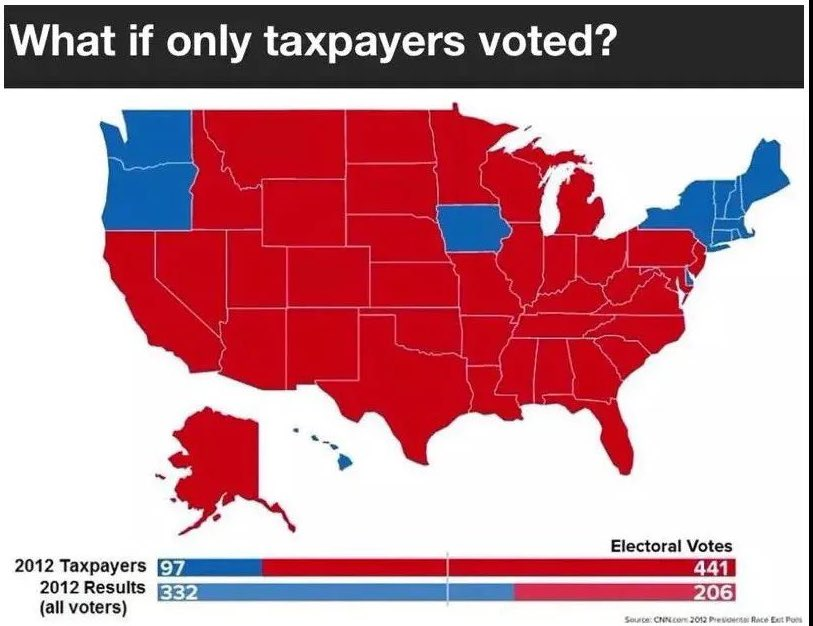

In fact, we might be wealthier and more productive if we restricted voting only to those who actually pay for the state. That would end the sort of excesses we saw in Ancient Rome.

Analysis of the 2012 US Presidential election shows the result would have been very different under that scenario:

Source: Michael A. Arouet / X

In that election, Republican candidate Romney had laid out a plan to cut income tax rates by 20% and cut the corporate tax rate by 29%.

It will be interesting to watch this play out again in November. From what we’ve seen; Trump seeks to reduce government size. Harris seeks to expand it.

This time could be very different from 2012. Covid has been a circuit-breaker. Many people are waking up to how economics work.

So, from where I sit, the West does not face an existential threat.

In fact, it could be on the cusp of a renaissance.

As it has been before.

The wider story of Western history is not one of decline. When freedom and diversity is unlocked, renaissance can follow.

This was certainly the case following an even worse pandemic; the Black Death of 1346 to 1353.

A renaissance in wealth and culture occurred in the centuries after.

Renaissance in freedom and economic growth

Recent elections in Italy, Argentina, and New Zealand saw younger people turf out command-and-control type governments.

Endorsed by Elon Musk, defenders of Western values like Giorgia Meloni and Javier Milei are being celebrated.

Italy is experiencing record economic growth and record-low unemployment. Argentina is turning around its damaging inflation story.

Legacy media once controlled the narrative, often in lockstep with command-and-control governments.

Now they’ve found themselves increasingly irrelevant against a vast array of direct sources online.

The lessons of the pandemic have become clear to many. When the people become sheep, the government become wolves.

They are questioning the levers of control. For example:

- The climate changes, but deindustrialisation and the disruption of every facet of life will not help people flourish.

- Immigration should serve the need for skills in an economy, not an open-border apologist agenda.

- Education should teach the basics, with lessons from history. Not indoctrinate.

- Practical solutions need to be sought over ideology.

- The bloating of an unelected, bureaucratic class threatens productivity.

Perhaps many are still caught by what Elon Musk has termed ‘the woke mind virus.’

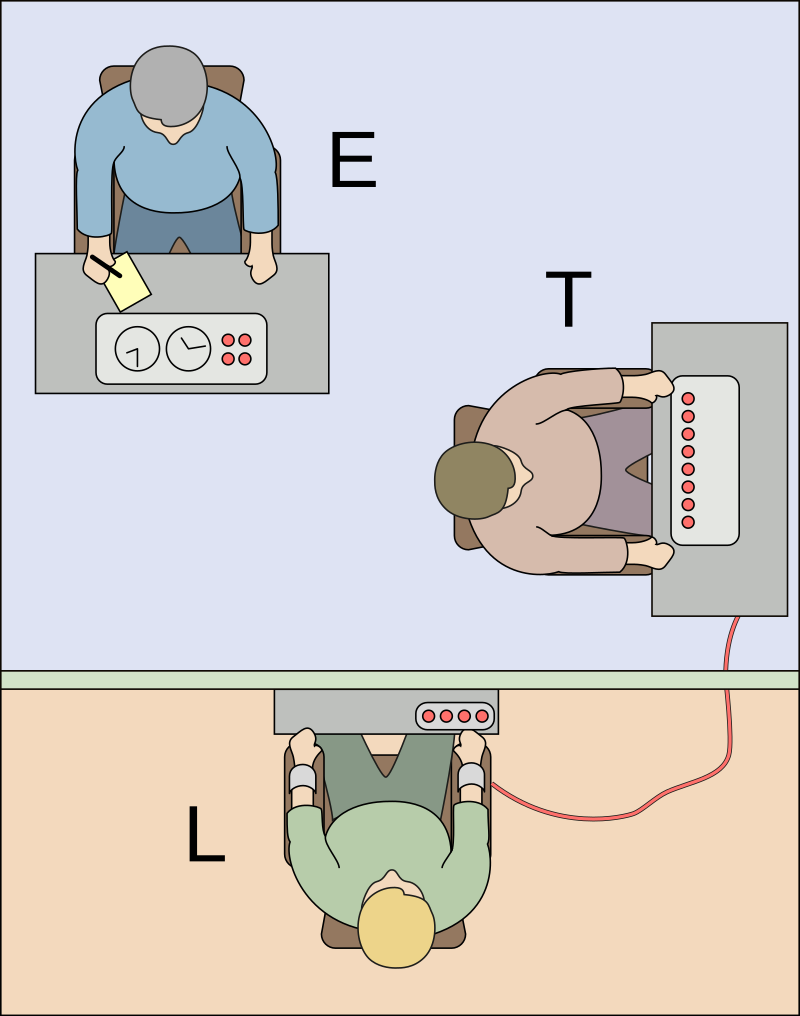

The Milgram experiments. An experimenter (E), orders the teacher (T) to give painful electric shocks to a learner (L).

The shocks were actually fake. Source: Wikipedia

Experiments by Stanley Milgram show that when an idea is presented authoritatively, many people will follow it without question. In those experiments, a supervisor asked teachers to administer higher and higher voltage electric shocks to learners. Even when the learners (who were actually actors) screamed in agony, people still blindly followed the supervisor.

But Covid has brought awareness, at least to a good part of the population.

Were those extended and economically crushing lockdowns entirely necessary?

Was the government-induced cure worse than the disease itself?

Why did we elect high-school prefects to spend our money on expanding their power?

New media has emerged to question the narrative and encourage critical thinking.

Renaissance in manufacturing due to reshoring

Analysts following Western industrial firms point to reshoring and friendshoring trends underway.

Dependency was a key lesson of the pandemic. No firm or government wants to be dependent on foreign manufacturing. Especially not for critical components and supplies.

We predict that the impetus for returning manufacturing to home markets, or closer to those markets, will only gather steam.

Geopolitics has moved. Mercantilism and trade manipulation is no longer accepted. Governments are incentivising local production. Firms themselves are seeking market protection in key areas like vehicle manufacture.

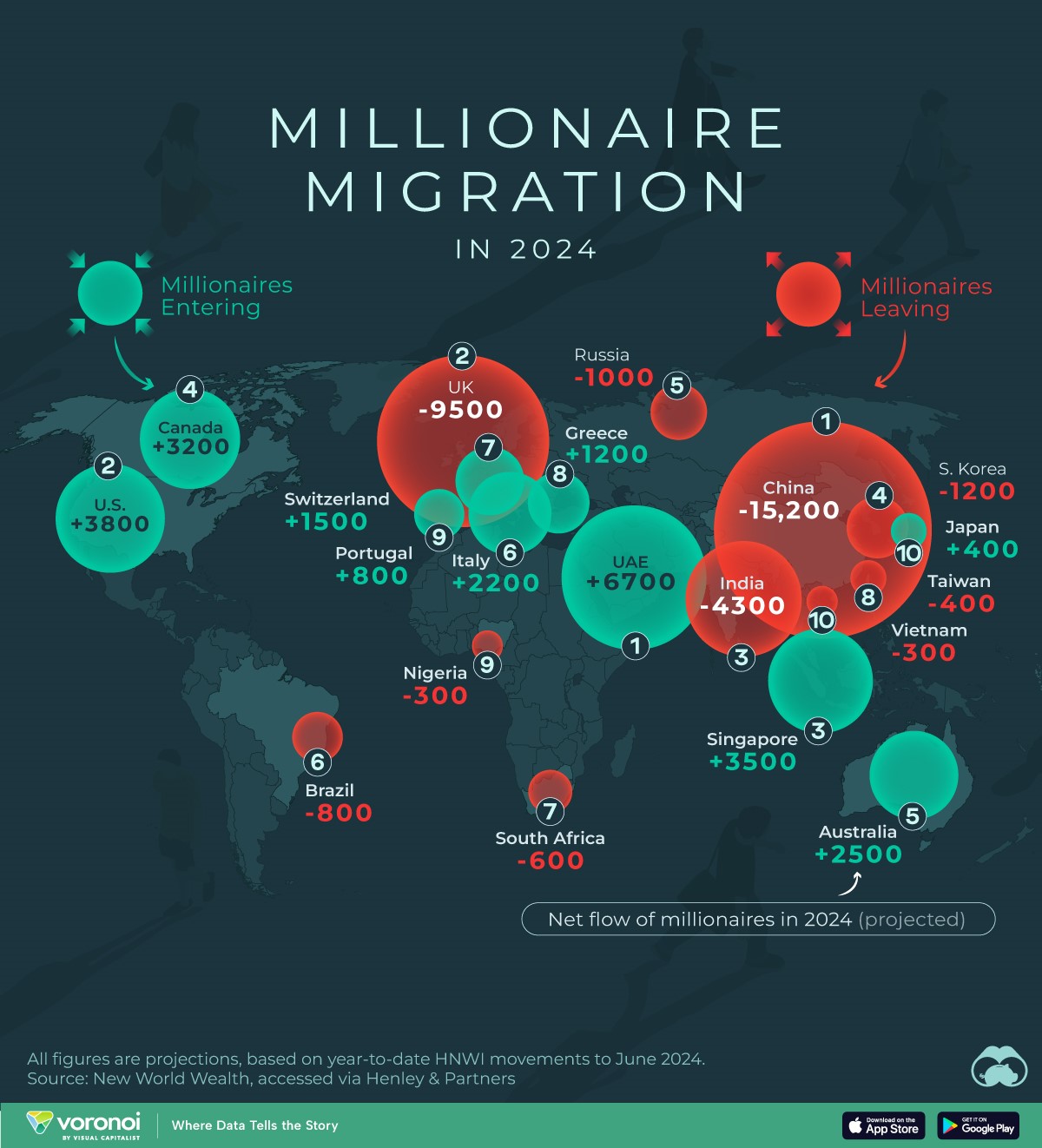

Renaissance in skilled and millionaire migration

Source: Visual Capitalist

Wealthy and skilled migrants are moving to countries that offer them opportunity with economic freedom.

For example, the non-dom tax regime is to be abolished in the UK in 2025. Italy is already a beneficiary. Their special tax regime allows wealthy people to move there by paying a flat tax of €100,000 per year.

Of course, people leave countries for a variety of reasons. Ostensible crackdowns on free speech in the UK will be providing further tailwinds. As will the reported plans to raise taxes on wealth.

On Britain’s upcoming October budget, Keir Starmer is reported as saying that it will be particularly painful for those ‘with the broadest shoulders’.

Well, the broad shouldered are on the move globally, Sir Starmer.

In markets, risk gets priced…

As with the parimutuel betting system, prices change as more money migrates to favoured locations and positions.

A blind horse is not expected to succeed. But there are many horses in Western markets, and on their periphery, that might be overlooked. They may not be as hobbled as some assume. They are ready for growth and renaissance.

That presents considerable opportunity in my book.

Are you looking to find value in Western markets?

We build diversified and income-rich portfolios for our Eligible and Wholesale Clients.

Do you have previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.