Outside the Italian stock exchange in Milan is this striking sculpture.

The statue is named L.O.V.E.

‘Libertà, Odio, Vendetta, Eternità.’

‘Freedom, Hatred, Revenge, Eternity.’

Source: Delphinidaesy / Flickr

Sculptor Maurizio Cattelan has never disclosed its exact meaning. The accepted interpretations are that it stands as a critique of the Fascist salute and is a protest against finance following the GFC.

In a few months’ time, I will travel to Italy. I will stand by L.O.V.E. for the obligatory photo. And I will visit sites of one of the listed companies we invest in for our wholesale clients.

That Italian real-estate stock is up over 80% in the past six months. I’ll be looking to gauge how much further potential it has.

For me, a truth behind Cattelan’s work is that, increasingly, Western economies do not work for many people.

As the statue may suggest; those who don’t run the system can F off.

You will own nothing, and you will be happy

Source: Michael Arouet / X

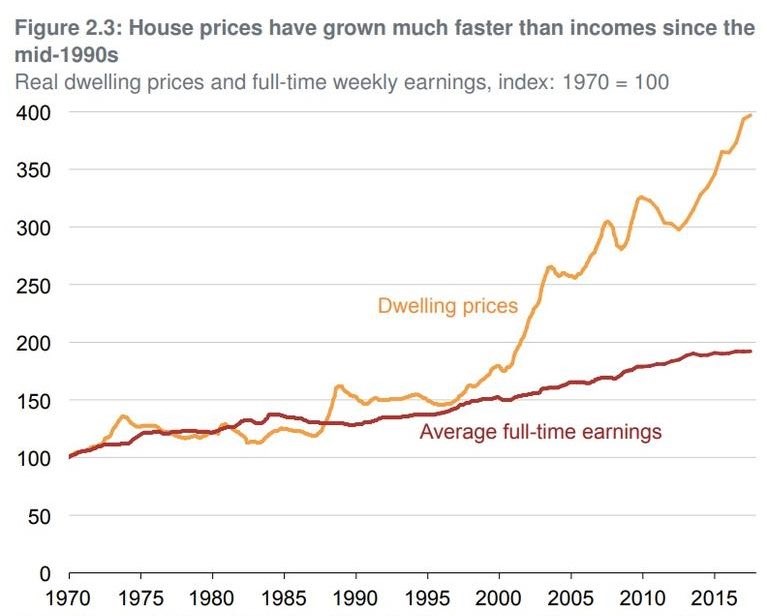

The above is Australia.

It could just as well be New Zealand, the UK, or any other Western country.

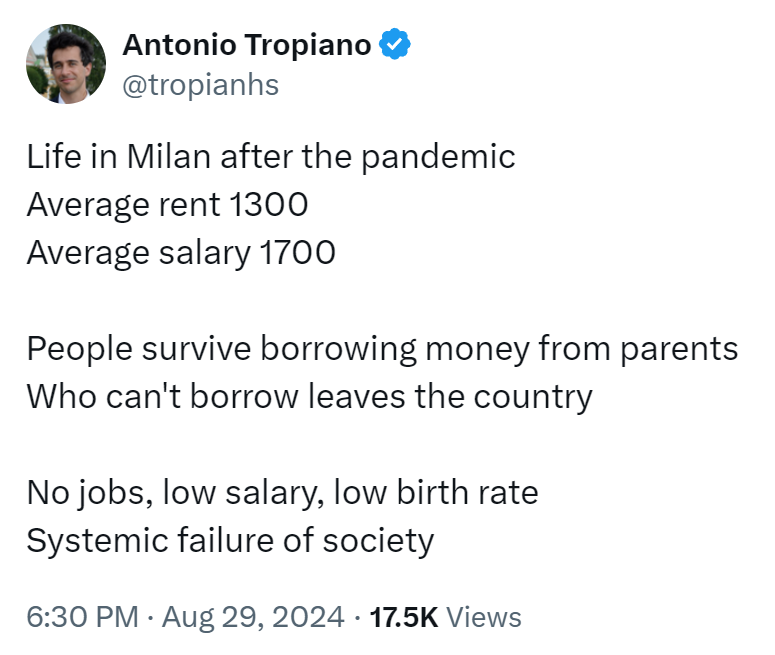

In Italy, Antonio Tropiano puts it like this:

Source: Antonio Tropiano / X

The implication is this: if you don’t have generational wealth to access, you’re going to struggle.

A heartbreaking indictment on capitalist economies!

But is it?

The problems in Italy stem from education and bureaucracy.

Youth unemployment is over 20%. Two-thirds of 18-to-34-year-olds are still living with their parents.

The education system isn’t focused on the skills demanded by the labour market. There are shortages of STEM graduates, for example.

Further, the tax system discourages business investment. There is a capital gains tax of 26% and all the usual red tape associated with old Europe.

But Italy is starting to turn a corner.

Youth unemployment is down significantly. The economy is growing faster than Germany.

Italian prime minister Giorgia Meloni. Source: Wikimedia Commons

Among the under-35s, Giorgia Meloni’s Brothers of Italy has been the most popular party, helping her to victory in 2022.

The party has variously been described as right-wing and far-right.

Far-right or fed-up?

Meloni’s policies include reducing illegal immigration, cutting tax for entrepreneurs, and incentivising families.

- This year, illegal immigration to Italy has fallen 65%. One commentator was asking for Meloni to be put in charge of the US border.

- Italy now has a 15% flat tax rate for self-employed people earning up to €85,000. This drops to 5% for the first five years, under certain conditions. (Basically when it’s a brand new business and the entrepreneur wasn’t self-employed before).

- Women with at least two children were exempted from social security contributions in the 2023 budget.

While the country is challenged by its debt and deficits, there are now serious inroads to building an economy for productive people.

This, in part, has come from the fed-up younger vote.

Fed-up. Not far-right.

New Zealand’s youth vote leaving the Left?

In the ‘be kind’ pulpit-of-truth days, almost two-thirds of the Kiwi youth vote favoured the Labour Party.

As in Europe, the Left youthquake that once featured is gone. Younger voters are seeing that socialist policies have not worked for them.

Leading up to the last election, Guardian polling found:

Among New Zealand’s 18- to 34-year-olds, just 20% were voting for Labour, the major centre-left party, compared with almost 40% supporting the centre-right National party. Support was not being distributed further left – the Labour-Greens coalition accounted for 34% of millennial votes, compared with a National-Act coalition sitting at close to 50%.

They’re calling time on the left-wing elite. Their days of basking in bureaucratic power are numbered.

But the legacy media has not left the pulpit of truth.

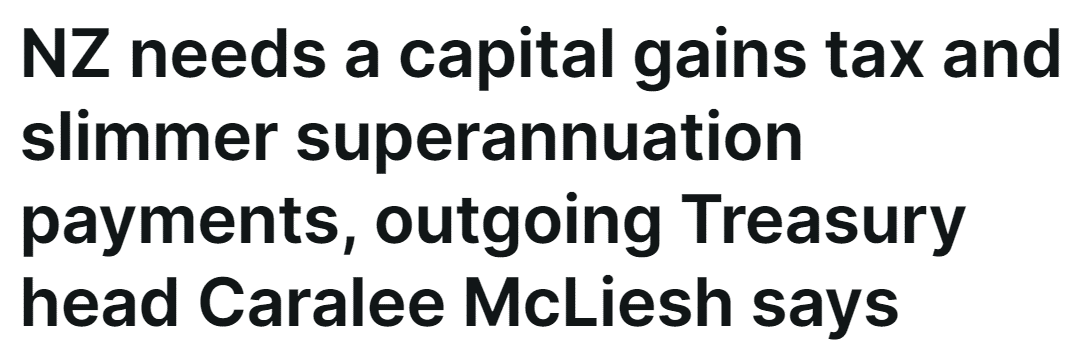

Take this recent example, focusing on the ‘need’ for a capital-gains tax:

Source: NZ Herald

Well, civil-service mandarins are paid by you and me.

Remember — every job is paid for by a business one way or another.

Even jobs in government and nonprofits are paid from taxes on — you guessed it — business.

It seems McLiesh is moving back to Australia, where there are capital-gains taxes.

Meanwhile, we have anecdotal reports of businesspeople choosing New Zealand instead. Especially when it comes to selling businesses and reinvesting.

We need to liberalise wealth generation, not strangle it

A few moments ago, my graph showed how far Australian home prices have moved beyond average earnings.

In Australia — with capital-gains tax, stamp duty, and a top tax rate of 45% — it now has the worst level of home affordability in 30 years.

Here in New Zealand, home affordability is actually increasing. We don’t tax capital.

Our problems, like Italy, came about due to a strangled system.

Back in August, I looked at how the property market could turn. How it could once again favour young families by ‘going for growth’.

Work is underway to open things up and create opportunity. You will own things.

We need to incentivise productive business. Not red-tape tax czars.

So, here’s what Milan’s L.O.V.E. statue means to me:

‘Here at the stock exchange, we build wealth. Here is the engine of investment, jobs, and opportunity. All people, through thrift and hard work, can access that. And if you don’t like that…’

Now you know why the finger points outward.

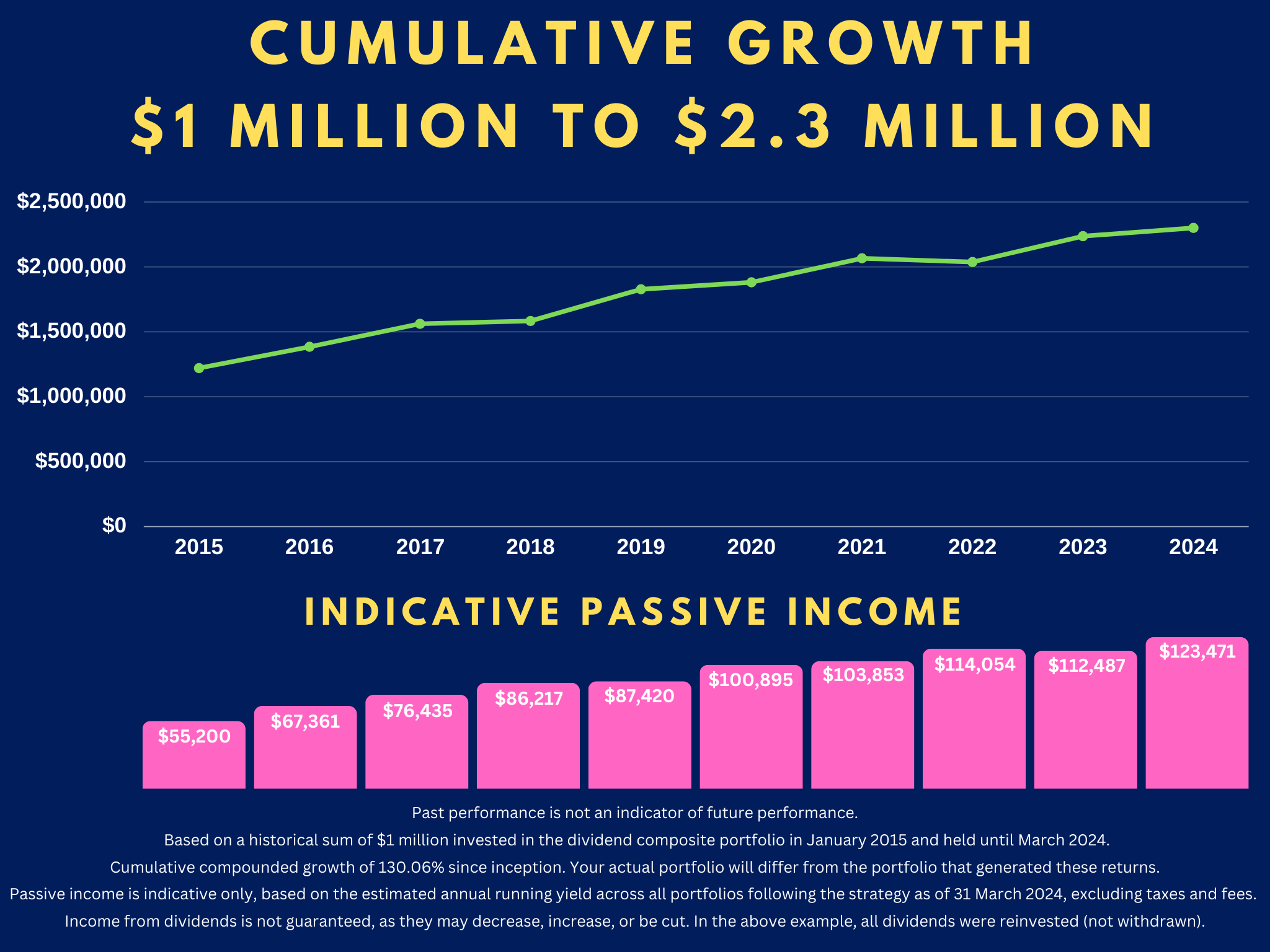

Are you looking to build wealth in New Zealand?

We build portfolios for Eligible and Wholesale Clients to protect and grow their wealth.

Do you have previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

These characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.