At our wholesale trading desk, things are starting to move.

Our real-estate focus is finally paying off. Over the past six months, one of our leading European REITs is up over 68%.

Source: Google Finance

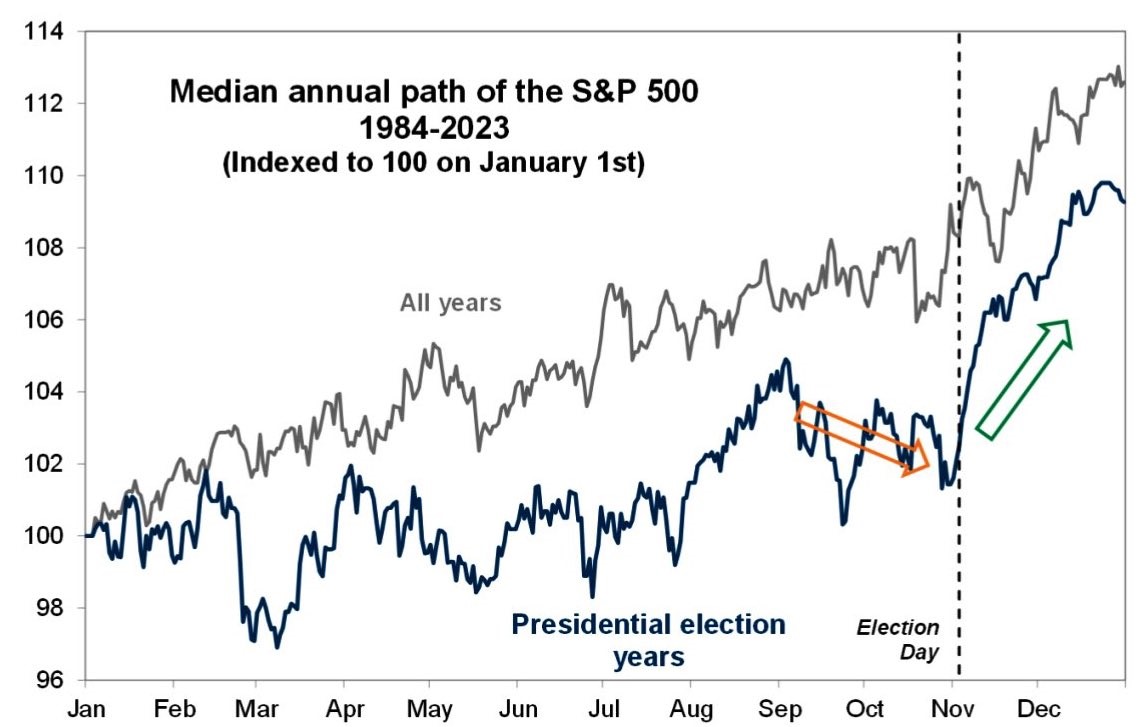

The next few months could represent prime buying opportunity in the markets.

If the last 40 years are anything to go by, the seasonal trend goes like this:

‘See you in November.’ Source: Michael A. Arouet / X

Yes, this is for the US markets. But with 42.5% of the global stock market, they lead the way for other markets.

Back in December 2023, I took a trip up to South Korea.

It was snowing when I dialled in to do our market update.

Source: Supplied / Simon Angelo

There, I reported that the long bear market of 2022-2023 was probably at an end.

That was one of the longest bear markets in history, running some 248 trading days. (Average bear market is 142).

Now, bull markets tend to be a lot more staying. As much as we’d like them to run forever, the average bull market duration since 1932 is 3.8 years.

Given we’ve had a pretty positive year to date; it is my belief we’re at the first phase. With the volatile months of September to November a great chance to buy.

Right now, we’re also at the start of a new liquidity cycle.

This could add further fuel to our focus on real estate and other value stocks over the next 18 months.

Interest rates have been high to squeeze out inflation. This has largely worked without crashing the economy. So far, so good.

Now those interest rates are coming down, providing the liquidity these assets need to grow again.

Last night, the European Central Bank announced its second rate cut of 25 basis points. And next week, we anticipate that the United States Federal Reserve will start cutting its rate by at least 25 basis points as well.

Before this cycle gets fully underway, it could be a golden time to add quality assets to your portfolio.

For our wholesale clients, we are encouraging you to top up funding on your account now. Then we can allocate — or make larger allocations.

Things are moving. With some volatility in which to find value, we’re getting excited.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.