Old friends.

It’s easy and comfortable.

You share similar values, nothing is off-limits, and an evening at the Italian restaurant is well-spent.

Source: Author

Well, the other week, my friend was in very good spirits.

The Reserve Bank has cut the OCR 25 basis points. He has wholesale lending of around $14 million. Each 0.25% cut saves him $35,000 a year.

That’s money he can enjoy and put into new investments. In particular, his burgeoning stock portfolio.

After a main course of scallops, he went on to order the tiramisu!

This is the sort of scenario that is happening all over the world. After a couple of hard years of mean monetary tightening, central banks are now opening up liquidity.

Those who survived the lean years, like my friend, become used to holding on. They become used to the ‘reach-outs’ by their bankers. Now they’re poised for opportunity.

Of course, the hard part is that money is releasing all at once. With markets constantly looking ahead, we’re already in a bull market.

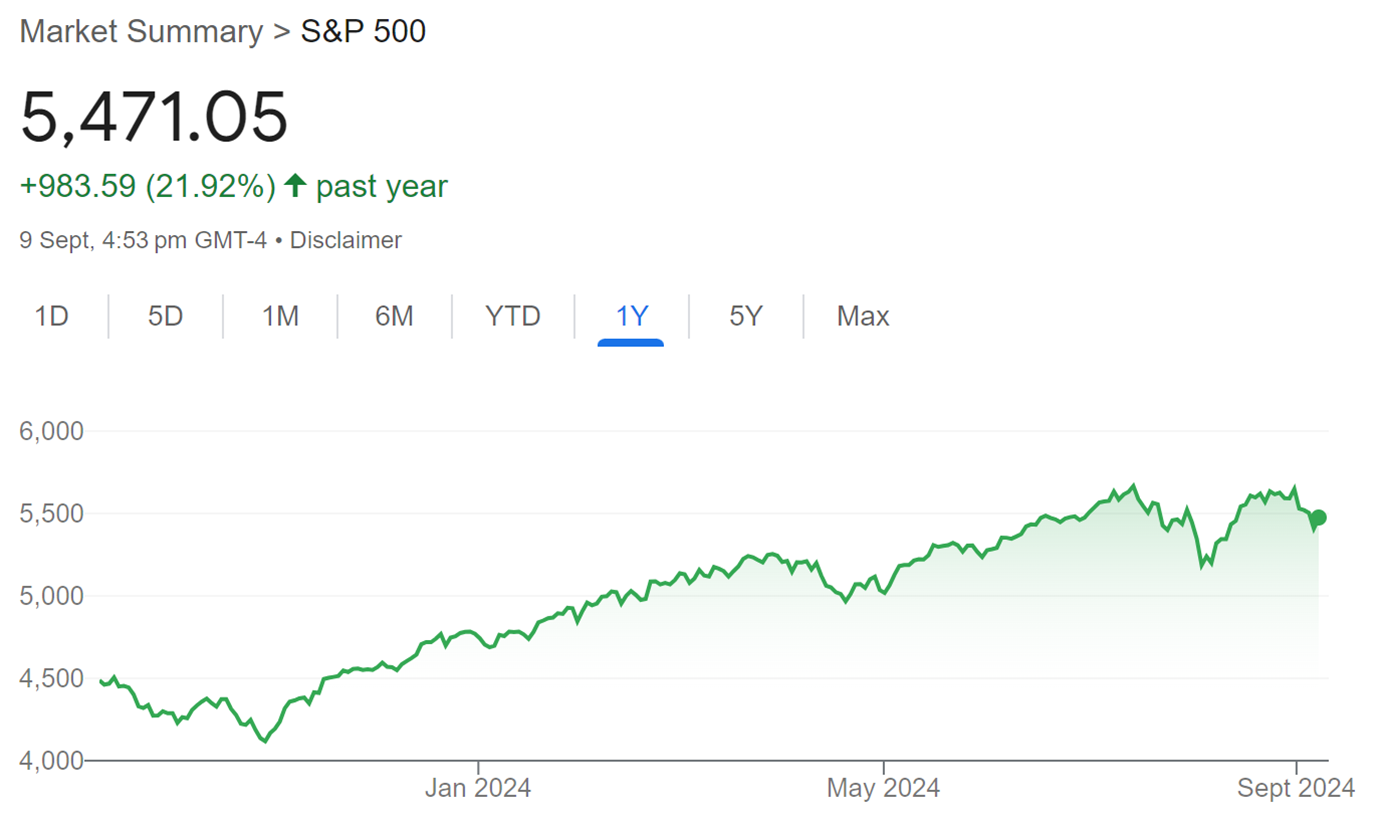

Look at the S&P 500 over the last year:

Source: Google Finance

Compound this sort of growth by the Rule of 72, and you could be doubling your money every 3.3 years!

Now, this is all very positive. But for value investors, it also becomes harder to find untapped value.

So, in this news article, we’ll be exploring where value may still be evident in the bowels of the bull market.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.