Some years back, we planted several cherry blossom trees in our front yard.

Around September, they bloom and signify the start of a new season.

Source: Author

A week before, the trees were barren.

This year, I’m still waiting for them to bloom after a long winter.

Sharemarkets around the world have also seen protracted winter months. The longest bear market since World War II lasted 10 months through 2022.

Most of us underestimated how much money governments had printed to plaster Covid lockdowns. The ensuing inflation, fuelled by supply disruptions, was vicious.

Only now have central banks battered that down to within striking range of inflation targets. Although markets have been looking up since 2023, the medicine has been harsh. Markets are still tender and nervous.

Of course, this is the dupe of governments. They increase spending to buy votes. There are no free lunches. This must be covered by tax increases, more debt, or money printing. Since tax increases hurt growth and are unpopular, from time to time, we see monetary expansion.

Surprisingly, some politicians now believe they can get away with tax increases because high debt is worrying the electorate.

As I write, Kamala Harris is endorsing increases to capital gains, inheritance, and corporate taxes in the US. This would make the US less competitive than China as a home for capital and investment:

- Wants to hike the current 21% federal corporate-income tax rate to 28%, higher than communist China’s 25% and the EU average of 21%.

- Proposals would increase the top marginal rate on capital gains to over 28%. China’s capital-gain tax rate is 20%.

- Calls for an annual 25% minimum tax on the unrealised gains of individuals with income and assets exceeding $100 million.

In contrast, Trump wants to reduce the federal corporate income-tax rate to 15%.

Better to grow the economy and reduce debt as a proportion.

It’s not hard to guess which candidate would be better for the stock market. Though their tax plans must get through Congress.

The greater impact on markets comes down to this…

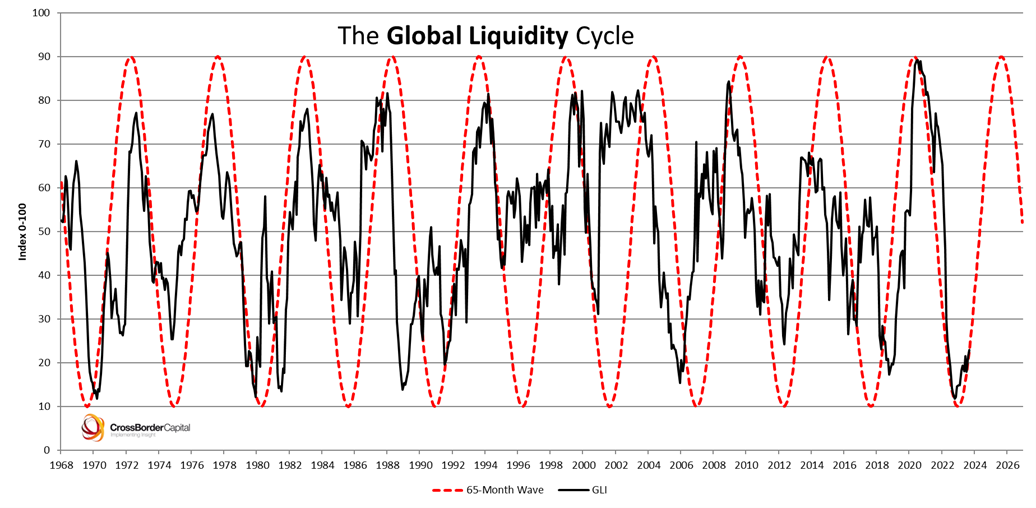

Source: Capital Wars, Michael Howell / Cross Border Capital

Source: Capital Wars, Michael Howell / Cross Border Capital

Liquidity is one of the most closely aligned forces to positive investment performance.

It is also very cyclical. In an era of credit-based monetary supply, the gyrations run in a fairly predictable pattern.

Crises come, such as the GFC in 2008 and the Covid-lockdown fiasco in 2020.

Predictably, governments and central banks respond by injecting liquidity.

They usually overshoot. Then a tightening cycle is needed to choke inflation.

Since the 1960s, liquidity has oscillated on a 65-month wave. Should this pattern continue, we are now set to enter a growing phase of liquidity. This could peak again in late 2025.

The Financial Times estimated that by the end of 2023, global liquidity hit $168.2 trillion — or a 3 % increase on the previous year. This could keep climbing as credit flows expand.

Deployment of all this money washing through global economies should see continued strengthening of sharemarkets.

The question is how to deploy when prices keep going up?

Well, this doesn’t tend to happen in a straight line.

There are still concerns and calamities that rock markets and jolt volatility. One example was the unwinding of the Japanese yen carry trade that saw falls of up to 8% in a few days around August 5.

My approach is to target equities that are still mispriced by the market. For example, there is a discount on their underlying assets, their revenue multiple is sweet, or a wider upside is overlooked.

Source: Brian Feroldi / X

Dollar-cost averaging is one way to capture a spread of prices. You simply keep buying assets you have conviction on through the market cycle.

Sometimes our wholesale clients ask: ‘Why are you buying me this stock again?’

The answer is that nobody knows if the stock will go up or down in the next few days. We buy because we see value at today’s price. In the next few days, we may see value again.

I like to constantly nibble in a stable or rising market. Taking small bites in high-conviction assets.

Then when there is a major dip, like the market rout on August 5; that is when we’ll go beyond nibbling and feast!

Are you looking for a managed investment strategy?

We build diversified and income-rich portfolios for our Eligible and Wholesale Clients.

Do you have previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.