By the time you reach the average New Zealand life expectancy of 83 years old, you’ll have lived about 4,300 weeks.

I don’t know about you, but my weeks go by fast. Every week is different, especially at a trading desk.

But consider spending each week as a dollar out of a bank account of about $4,300. The cash is steadily depleting.

So, in these strange days when life is complex and time is running out, how do you make the best use of your time?

A question of time

Source: AI image generated by Freepik

‘The Happiest Man in the World’ is an opinion piece by Lance Oppenheim that appeared in The New York Times in 2018.

It profiles Mario Salcedo, a burnt-out American businessman who sought a time sea change. Quite literally.

In 1997, he made a decision to take control of his time and pursue a lifelong goal: ‘To travel around the world, without leaving home.’

He was 47 at the time. And had already spent more than 1,000 weeks in a whistle-stop corporate job as director of international finance for a multinational.

By 2018, ‘Super Mario’ had been at sea with Royal Caribbean Cruises for over 1,000 weeks. By all accounts, he was living the dream. Finally free of trifling things in life, like cleaning, laundry, or taking out the bin. He’d also become something of an unofficial ambassador for Royal Caribbean — and to the press.

Yet Oppenheim, who joined Mario for five days on the Enchantment of the Seas, discovered the freedom dream was not as portrayed. It was a facade that had taken on a reality of its own.

As tourists and crew come and go, you may well imagine that a Super Mario-type life soon becomes lonely and repetitive.

Which brings me to the real value of time.

Time becomes much more valuable when it is synchronised with the time of others that you have meaningful relationships with.

An hour on Monday morning when nobody is around is far less valuable than an hour on Sunday when friends and family are available to do things with.

This is why we have weekends and public holidays. And very much why — when you go to the beach on a holiday weekend — even Aucklanders seem more happy and friendly.

Time, unlike money, has the highest value when it is linked to meaningful involvement with others. With so much focus today on FIRE goals — (Financial Independence, Retire Early) — it can pay to keep this in mind. And invest your time where it may count even more.

A question of money

Unlike time, money never sleeps.

It is a terrible master, but when managed well, an excellent servant.

What’s really important to understand is the time value of money.

This simple financial concept holds that the value of a dollar today is worth more than the value of a dollar in the future.

That means money you have now can be invested for a financial return. It also means that the impact of inflation will reduce the future value of your money.

So, it’s your job as an investor to try and protect the value of your money as best you can. To my way of thinking, this means investing in productive assets — and potentially leveraging to do so when the return outweighs the risks and costs.

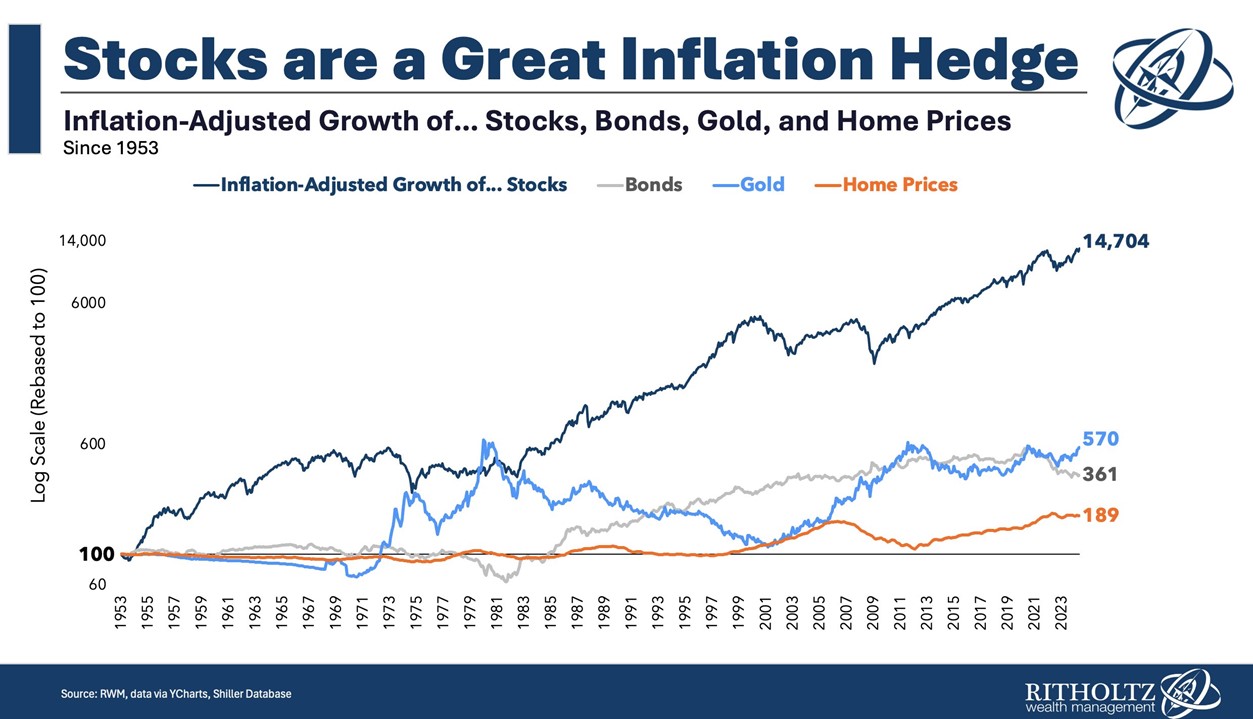

According to Barry Ritholtz, CIO of Ritholtz Wealth Management, the best hedge against inflation is equities:

‘When Inflation drives prices higher, that shows up in Revenues and Profits too. Higher revs & net income mean higher equity prices.’

Source: Barry Ritholtz / X

Sadly, most people won’t use their time or money that effectively. Because to do so requires courage and a degree of fortune. Though, on the latter, fortune does tend to favour the brave.

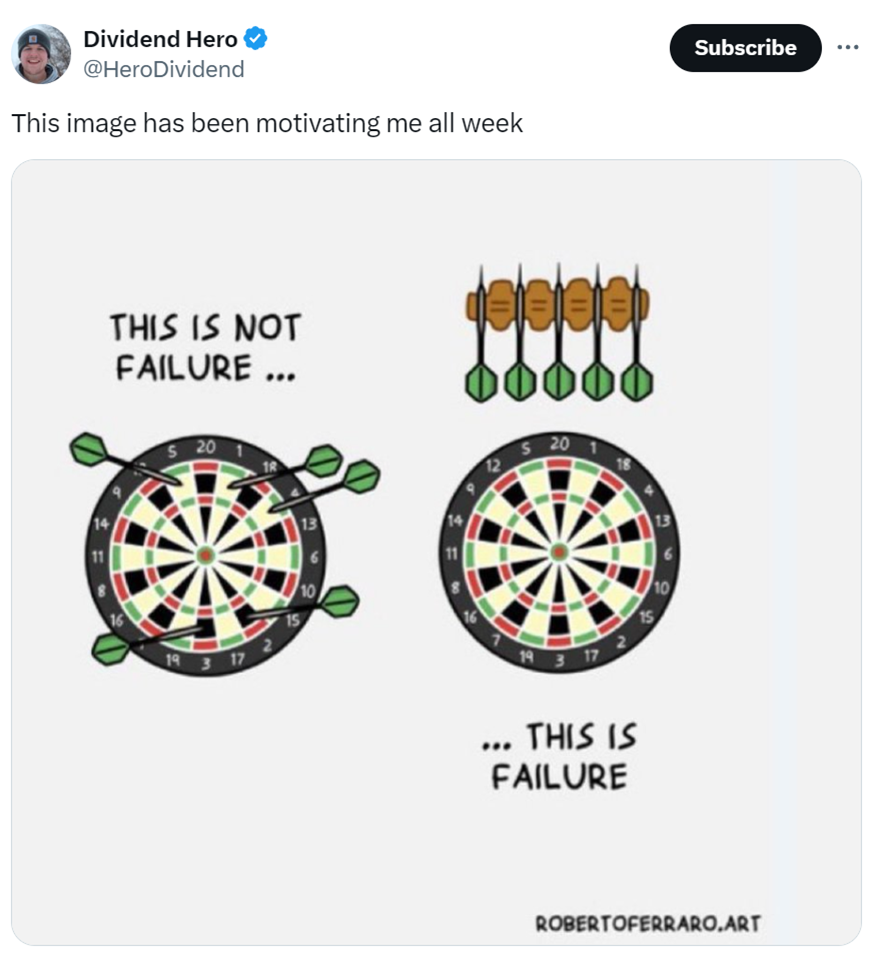

Indeed, the main stumbling block is fear.

In finance, I’m drawn by the Black Swan Effect. This means that the most consequential events cannot be predicted. You cannot time the market. Basing decisions on fear of the unknown is largely pointless.

Fear is a conspiracy theory about yourself.

It’s much better to give that up. And take aim at your targets with good faith.

Source: Dividend Hero / X

Are you looking for some help with your targets?

Here at Wealth Morning, we run a night-trading desk focused on global markets. We aim to build up defensive and income-rich portfolios for our Eligible and Wholesale Clients.

Have you previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity. I encourage you to reach out at this pivotal time.

You’ll always miss 100% of the shots you don’t take.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.