‘You know what I’ve noticed? Nobody panics when things go according to plan. Even if the plan is horrifying.

‘If, tomorrow, I tell the press that a gang banger will get shot — or a truckload of soldiers will be blown up — nobody panics. Because it’s all part of the plan.

‘But when I say that one little old mayor will die, well, then everyone loses their minds!’

—The Joker

Do you like superhero movies?

Well, if you do, then you already know that there’s a single film that stands head and shoulders above the rest.

Source: IMDB

Christopher Nolan’s interpretation of the Batman-versus-Joker legend is raw and unflinching:

- From the first scene in, the film grabs you by the throat. It refuses to let you go for the next 152 minutes.

- The acting. The cinematography. The score. The tone. The pacing. The Dark Knight is more than the sum of its parts, which is why fans have called it one of the greatest superhero movies ever made.

Yes, I’m inclined to agree that this is an outstanding film. However, I do have a contrarian opinion. I think the reason The Dark Knight works as well as it does is because it’s not really a superhero story at all:

- Look a bit closer. You’ll find that it’s actually a gritty crime drama. It’s grounded in a kind of street-level reality. It asks some pretty tough questions. What is the line that separates order from chaos? Sanity from madness? Civilisation from the jungle?

- The main theme of the movie is this: our state of mind is more fragile than we might assume. And what’s the worst thing? Well, our perception of fear — indeed, our reaction to fear — is often misguided. And that makes it the most destructive force of all.

- As the Joker says, people can accept horrible things happening in society if it’s part of the plan. But what happens if you deviate sharply from the established narrative? Well, people will freak out and go crazy.

The state of fear in our media

What is true in The Dark Knight is also true in the real world. In fact, one of the biggest problems with our news today is that ‘broadcasting’ no longer exists. What we have now is known as ‘narrowcasting’:

- There’s no longer a reasonable attempt to appeal to the centre. For all intents and purposes, the centre has been atomised and vaporised.

- So, what we have now are media platforms that are mostly designed to provoke and polarise. So much so that it can be hard to tell what is actually reasonable and what is actually Joker-style angertainment.

Source: Liberty Street Economics

Here’s a recent example of this:

- For a while now, social-justice warriors have been talking about the potential rise of China and BRICS. You already know how the story goes. China is pushing for de-dollarisation. Their plan is gaining speed. The United States is about to be dethroned. Uh-oh. This sounds bad, doesn’t it?

- Well, what I’ve noticed is that the keyboard warriors who keep spreading these stories seem to be pretty smug. They gain a strange kind of satisfaction. Because it’s fashionable to be anti-American these days, isn’t it?

But hold on. Here’s the problem. Their gossip is completely false:

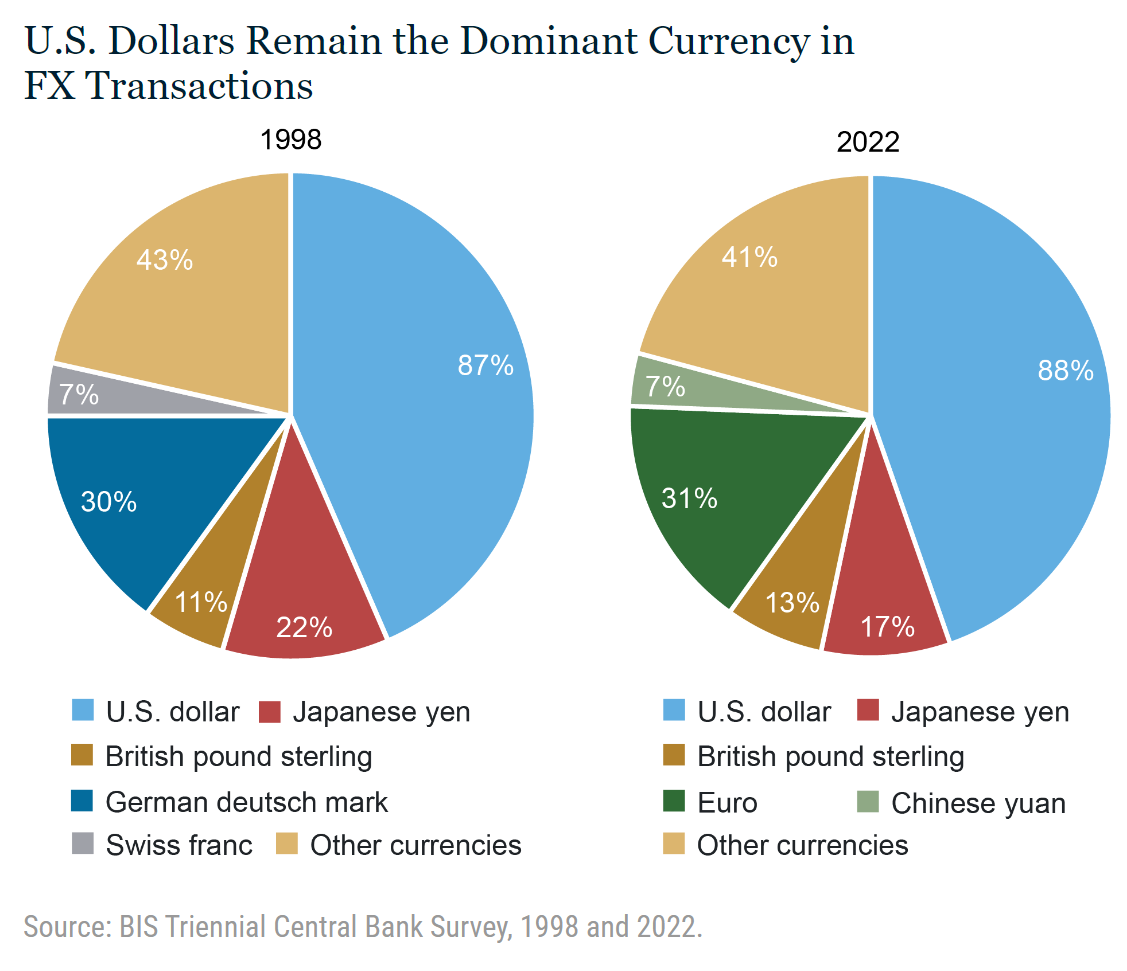

- You need to take a closer look at the facts. The share of daily forex transactions remains heavily skewed in favour of the US dollar. In fact, the popularity of the dollar has barely changed in 40 years. The dollar continues to be used in almost 90% of transactions worldwide.

- Meanwhile, the Chinese yuan is only used in roughly 7% of transactions. This is shockingly small. And yet the social-justice warriors continue to be strangely obsessed with the yuan. Maybe they are just shills for the Chinese Communist Party?

Now, here’s the important thing to keep in mind. When people keep talking about the Chinese yuan being the biggest threat to our present world order, it immediately becomes part of our established narrative:

- Certainly, it doesn’t actually matter if the story is true or not. What matters is that the mythology has become entrenched in our popular imagination. Therefore, it becomes comfortable. It becomes familiar.

- So, you know how some people ride rollercoasters for a jolt of adrenaline? Meanwhile, other people watch horror movies for the jump scares?

- Well, in same the way, these keyboard warriors seem to get a perverse thrill when they gossip about the downfall of the US dollar. Of course, it’s fake news. Still, when has that ever stopped anyone?

But watch out. Remember what the Joker said about deviating from the plan:

- While everyone was so busy focusing on China, they seemed to forget about another Asian country with a far stronger presence on the currency market: Japan.

- Indeed, the Japanese yen is used in around 17% of daily forex transactions. So, in hindsight, it’s obvious that the carry trade would unwind at some point.

So, here’s where the messaging in the media was flawed:

- When their narrative suddenly switched from China to Japan, it left everyone with a sense of whiplash. Like the carpet had been pulled out from under everyone’s feet.

- To make things worse, the media seemed to treat the carry trade as something sinister and unusual. However, it was nothing of the sort. The Japanese yen has always been traded more than the Chinese yuan. It’s just that the media has never bothered to report on this fairly and rationally in the first place.

Well, that’s the problem with news headlines, isn’t it? There tends to be a ‘spotlight effect’, which might mislead you into thinking an issue is more urgent than it actually is:

- Indeed, the media is not optimised for truth. It’s optimised for engagement. For this reason, they tend to shine a spotlight on issues that are emotionally provocative.

- But this spotlight is fleeting at best. Already, you can see that the news cycle appears to have moved on. The Japanese yen carry trade was in the headlines for a very short time. Then it melted away into obscurity.

So, what’s the key lesson here? Well, it’s about importance of keeping a good head on your shoulders:

- After all, there’s no denying it. We live in a world that’s become increasingly impulsive. You can blame narrowcasting and angertainment for this. They have made us more jittery than we ever have been.

- However, as value investors, we must learn to insulate ourselves from the noise. We must look at the longer time horizon. We must not be distracted from our mission.

- Because, ultimately, I believe that the race is not to the swift, nor the battle to the strong. Instead, investment success may very well come down to just one question: who has the steadiest pair of hands?

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.