Last night

After dinner, I make tea. We relax in the lounge. My wife catches up on the news via X.

‘Is the market falling tonight?’ she asks.

This takes me by surprise. She doesn’t normally share financial news from X.

I checked in. There it was, all the usual angertainment. This time turned on investors.

Look at this example from @patrickbetdavid [Excerpt from his tweet]:

Japan stock market, the Nikkei 225 is set to post its largest 2 day drop in history. Larger than black Monday crash of 1987.

Bitcoin is down 22% the last week. (10% just today) Ethereum is down 31% for the week (21% for the day).

Some trends showing the increase purchase of military stocks under way. This isn’t fully verified but you can see some patterns.

Talks about Fed reserve considering lowering rates half a point next month to stabilize the massive potential stock market loss in August.

This conflates unrelated events. In fairness, at the end, he does suggest all this could mean nothing, war, or an overdue recession.

In fact, a half-point lowering of rates could give the market quite a boost. This could come sooner rather than later.

Of course, the media had been reporting a market rout all day following the sudden drop in the Japanese exchange. A disorderly retreat in prices moving from Asia to US futures.

Fortunately, I’d already had a conversation with another long-experienced investor that afternoon. He’d brought my attention to a more likely explanation.

The Japanese carry trade

- Traders have been borrowing Japanese yen (JPY) at margin on very low interest rates for a while.

- Many converted JPY to USD to buy US stocks.

- The Bank of Japan is now unexpectedly raising interest rates, and JPY has strengthened significantly against USD.

- Traders on this trade now face much higher interest on their JPY margin.

- They’re likely also facing steep forex losses.

- Some will have to sell positions urgently to cover their margin.

- The result? There’s a lot more selling pressure in the usually slow month of August. This follows a very strong July across markets, rising Middle East war concerns, and political uncertainty in the US.

A historical context?

Source: A Wealth of Common Sense

Of course, it can be so easy to get caught up in our modern news headlines.

They can make us feel that everything is dramatic. Urgent. Critical.

They can play with our emotions. Reality becomes hyperreality. It’s angertainment.

But for the sake of sanity, we should take a breath. We should get a grip. We should study some time-honoured wisdom from the ancient world.

Here’s what Ecclesiastes 1:9 from the Bible has to say:

What has been will be again, what has been done will be done again; there is nothing new under the sun.

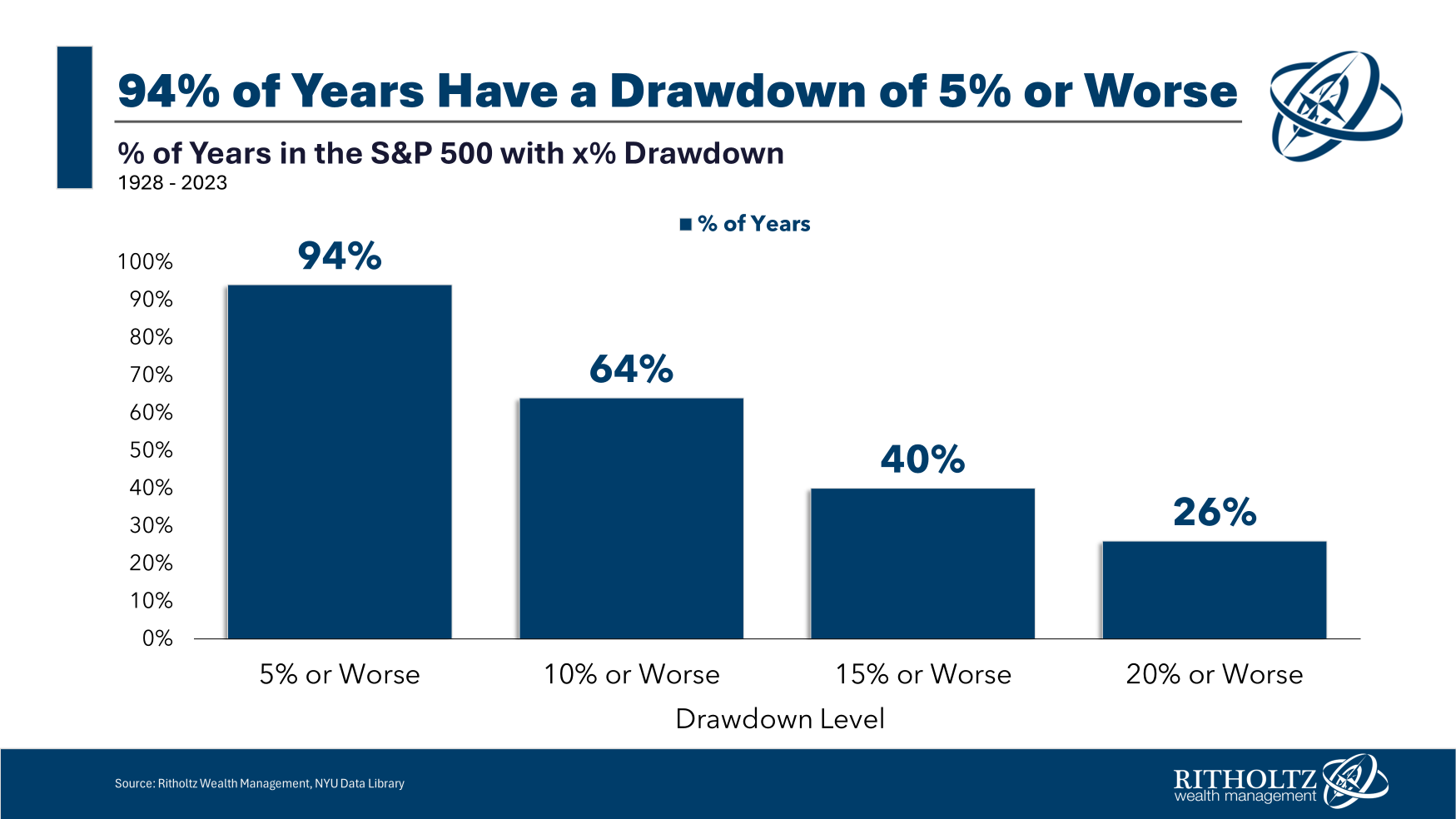

Indeed, history tells us that market drawdowns are totally normal and completely regular.

Even in a bull market, you will tend to see a drawdown of at least 5% almost every year.

A drawdown of at least 10% isn’t that rare either.

In fact, we last saw one in 2023. There was a 10% dip that unfolded during the August-September-October stretch.

Nonetheless, that drawdown didn’t stop the S&P 500 from rebounding, then finishing up strong. It clocked up over 24% for 2023.

Source: Stock Analysis

So, yes, the August-September period has always been a weaker time for stocks. Seasonal volatility is in play. Volumes tend to be lower, magnifying events that would normally cause only a ripple.

Summer has ended in the northern hemisphere, while autumn is setting in. This will affect human behaviour on a subconscious level.

What was true in 2023 still holds true in 2024.

Indeed, I dare say, there’s nothing new under the sun.

What is the upshot?

As value investors, this is likely to be a good opportunity.

Fear and panic in the short-term gives us a window of opportunity to buy high-quality assets at a discount for the long run.

The sort of property-based dividend companies we focus on — particularly in Australia and Europe — have very little to do with the Japanese carry trade.

We don’t know whether there will be another sell-off. As I write from the trading desk tonight, it is starting to dissipate. Today, US futures are heading back up.

But this does look like a great opportunity to take advantage of some temporary mispricing. We will continue watching and deploying as strong value becomes evident.

This is how we grow portfolios with quality assets at sharp prices for the long run.

Yes, it’s always unnerving to see share prices drop. But over the long run, it’s about buying quality companies at great prices. For that, we welcome these opportunities.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.