Never bet against America.

—Warren Buffett

For a while now, I’ve been watching a very unusual group of market traders.

They are bold. They are brash. They have a very particular set of skills.

But how does their track record stack up?

Well, here’s how it looks like:

- In 2020, this group of traders lost USD $242 billion.

- In 2021, they lost another USD $142 billion.

- Then, in 2022, they enjoyed a bounce, making USD $300 billion.

- However, in 2023, they went back to their old pattern, losing USD $195 billion.

- So, all in all, they have ended up losing USD $279 billion over a four-year period. Well, good grief. This is an eye-watering disaster, isn’t it?

Source: Image generated by OpenAI’s DALL-E

These traders are known as short sellers. Their goal? To short the market:

- Here’s a translation into plain English — these folks make their money by profiting from an anticipated market decline.

- So, in theory, if the market goes down by 1%, their profit will go up by 1%. And if they are brave enough to use leveraged derivatives, they can double their gains, triple their gains, or even quadruple their gains.

- But here’s the problem. Over long periods of time, their trading results have gone from bad to worse.

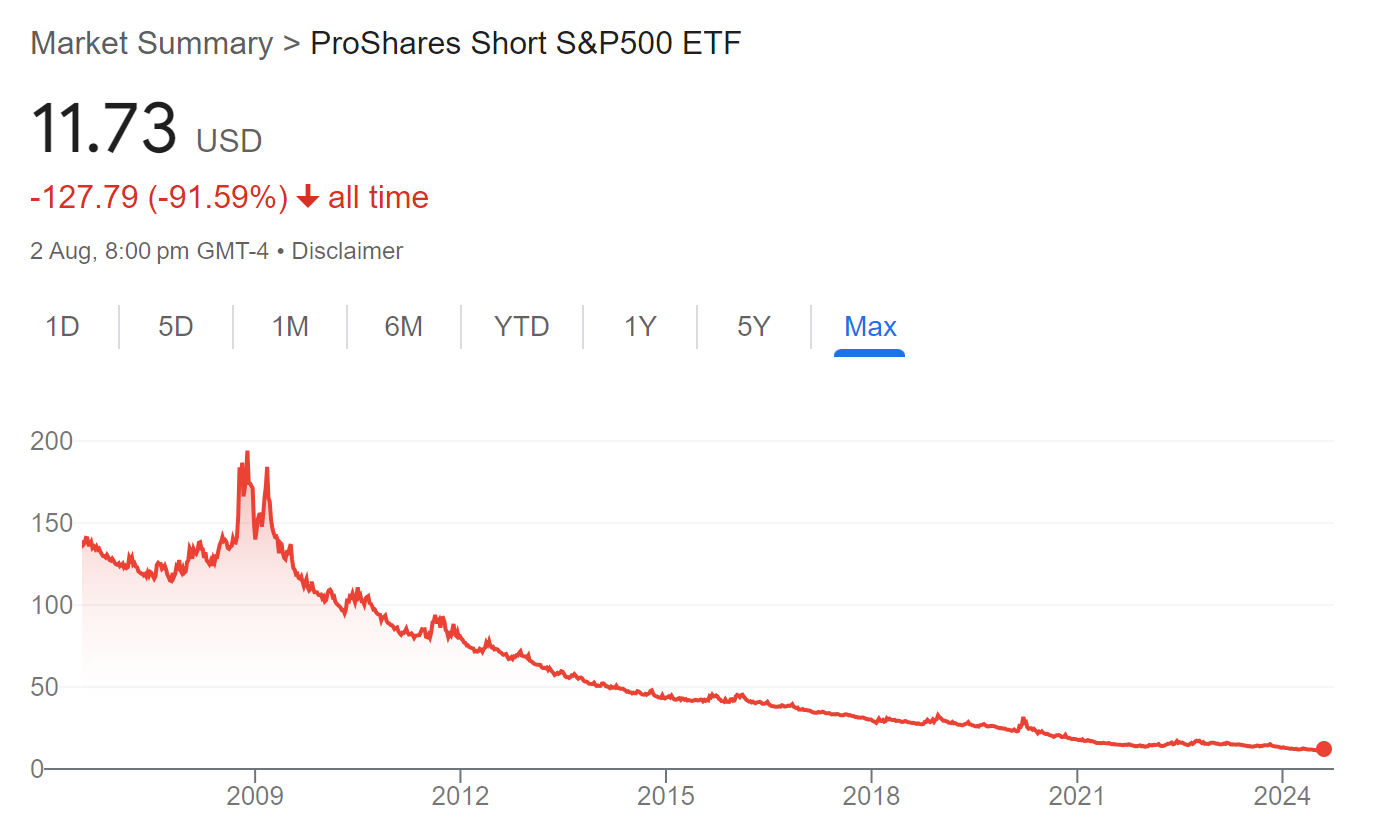

An inverse ETF, designed to bet against the market. This bearish strategy has lost over 90% of its value since June 2006. Source: Google Finance

For example, one popular instrument that they use to bet against the market is the ProShares Short S&P 500 ETF:

- Over an 18-year period, this inverse ETF has lost over 90% of its value.

- To put this into perspective, this means if you had invested an imaginary sum of $100 in this strategy, you would be left with less than $10 today. A near-total wipeout.

- Yes, this ETF experienced a profitable bounce in 2008/2009. This was during the Global Financial Crisis. But over the long-term, that bounce turned out to be just a fleeting blip on the radar. It doesn’t even compare to the avalanche of losses that followed.

- As they say, even a broken clock has a chance of being right twice a day. But that doesn’t change the fact that it’s still broken.

In my opinion, short sellers aren’t investors in the traditional sense of the word. I actually think of them as being fear vampires. Indeed, they are addicted to fear:

- They suffer from what’s known as ‘confirmation bias’. They read and absorb all manner of angertainment and angernomics in the media. Just to reinforce their belief that the economy — maybe even civilisation itself — is about to collapse.

- They overdose themselves on a cocktail of terror. Then they place their bets accordingly, hoping to profit on that emotion.

- The results, of course, have been disastrous for them. Since June 2006, the S&P 500 has climbed 300%. Leaving all their bearish strategies in the dust.

Nonetheless, this doesn’t stop the short sellers from continuing to bet against the market:

- For example, a certain economist has been making sensational claims lately. He says that a terrifying crash is about to happen soon. He predicts that the S&P 500 will fall by 86%, while the Nasdaq will fall by 92%.

- The real-estate sector won’t be spared either. He predicts that housing will suffer a drawdown of between 50% to 80%.

- Except…he has been making this exact same prediction for 15 years now.

Of course, this hasn’t been very helpful for the short sellers who have followed his advice:

- You can think of it as being a self-fulfilling prophecy. When traders believe that the market is going to decline and lose money, they start betting against it.

- However, by betting against the market, they actually end up suffering the exact financial loss they were trying to hedge against.

- It’s astonishing, isn’t it?

Now, for the sake of common sense, I’d like to share two important quotes here:

- In the words of Jean de La Fontaine: ‘A person often meets his destiny on the road he took to avoid it.’

- In the words of Peter Lynch: ‘Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.’

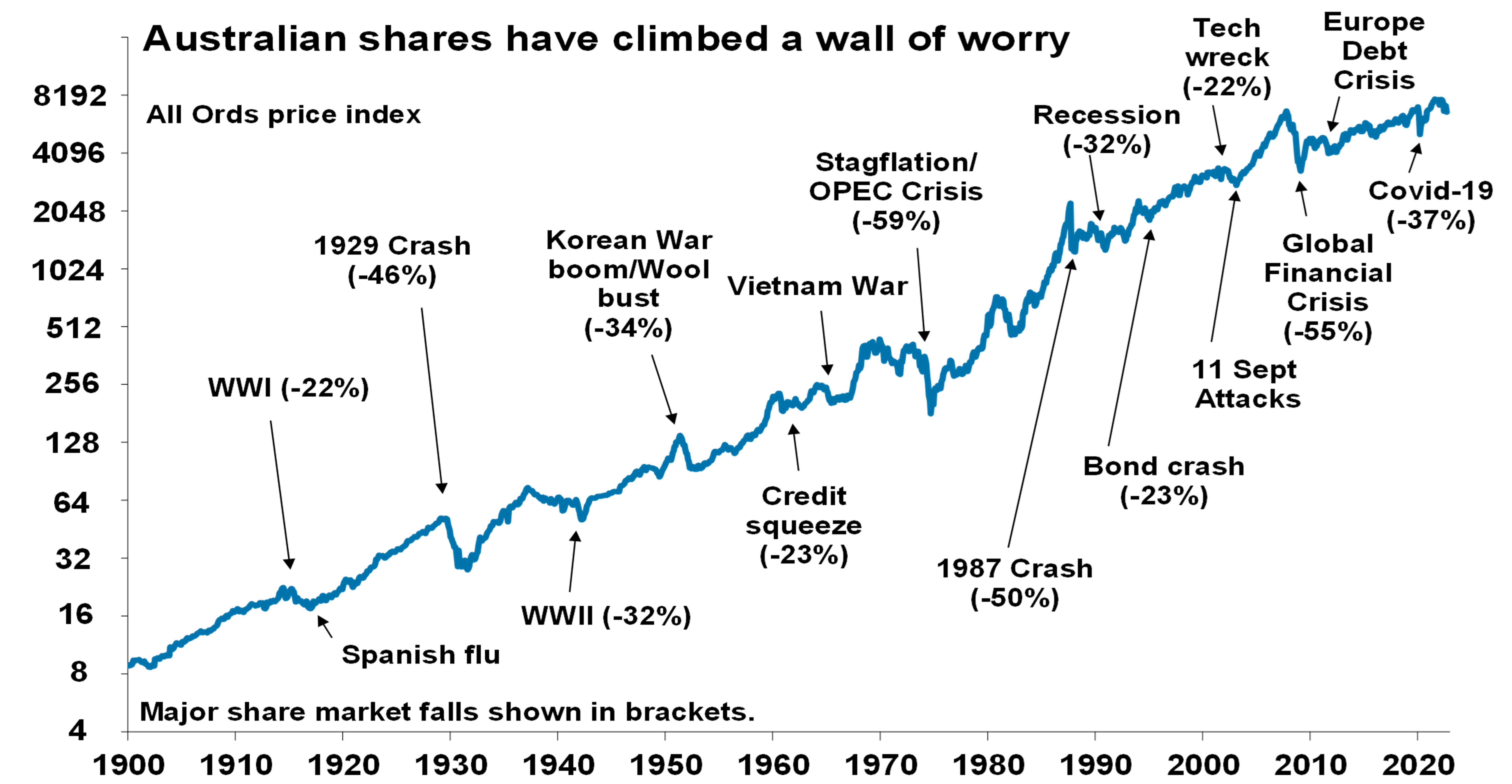

Source: AMP

Historically, there has always been a tug-of-war between pessimists and optimists:

- Fortunately, on the balance of probabilities, it is not the negative people who have the greatest impact on the market’s performance. Rather, it is actually the positive people who will continue to drive the market onward and upward.

- Why? Well, because positive people have the courage to start new businesses. They have the resilience to invent new products. They have the imagination to keep on dreaming.

- For this reason, I believe that long-term progress in the market will continue to overcome short-term jitters. Yes, the fear vampires may use short-selling to exploit fleeting gaps in the market. But, no, they will never beat human courage and resilience.

Ultimately, here are some classic words from Theodore Roosevelt:

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better.

The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.