Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

It’s hard to explain what a bear market feels like until you’ve experienced one.

Just as it’s hard to explain what a bungy jump feels like until you’ve done one.

I’ve been through a few dark bear markets. No bungy jumps.

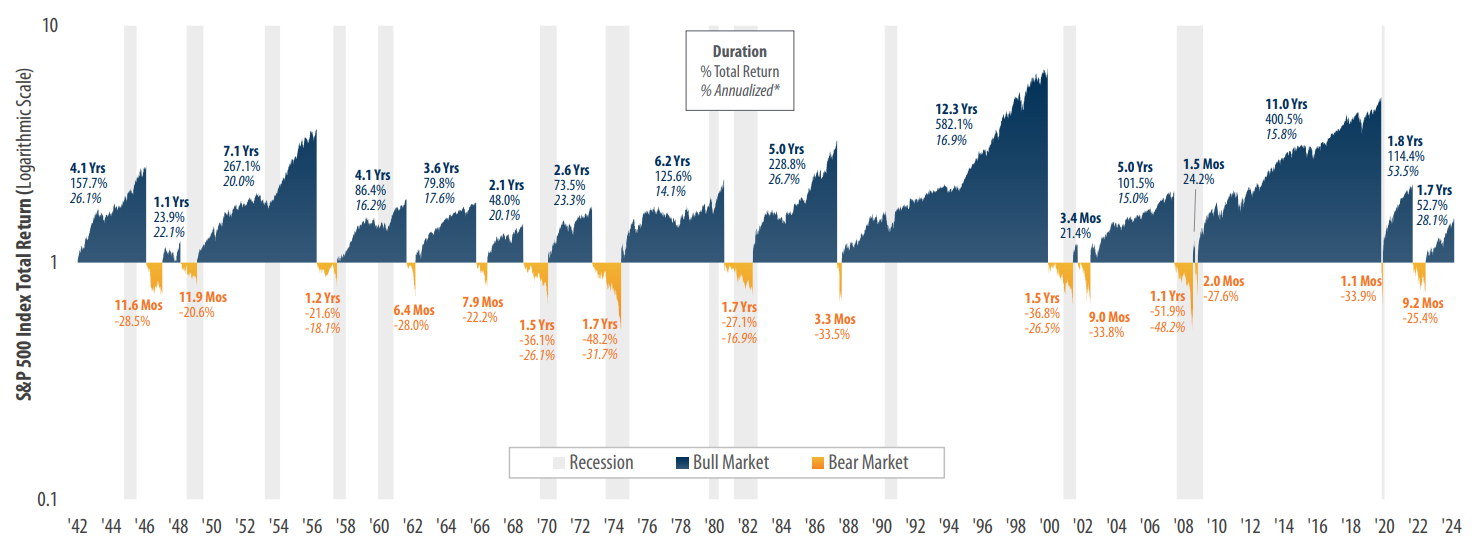

The last bear market kicked off in 2022 with the post-Covid inflationary spiral. It lasted 9.2 months. The longest since 1948. Our focus was on defending wealth and taking advantage of opportunity.

Source: First Trust Portfolios, L.P.

Thank you to our wholesale clients who also had the courage to deploy during this time. You’re now very well-positioned for potential gains.

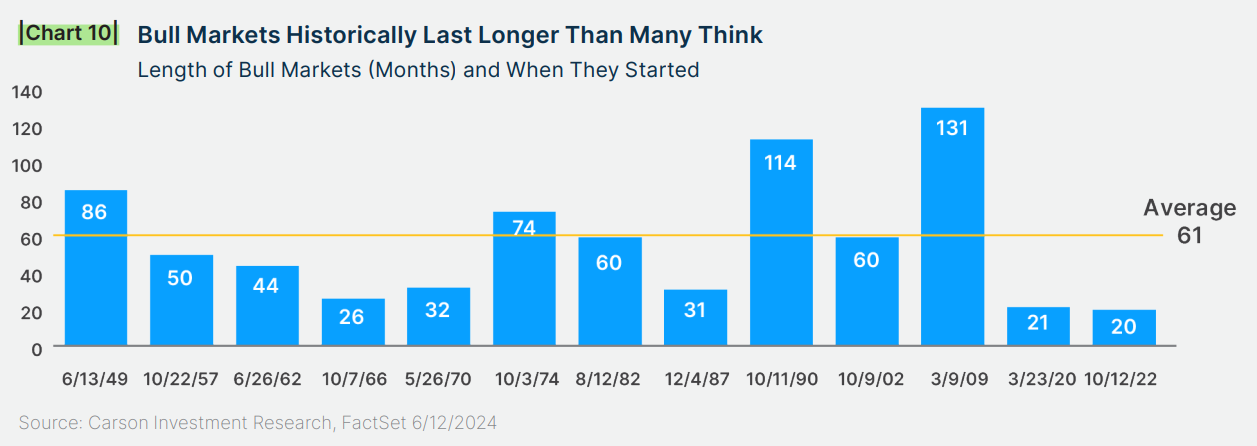

Finally, things are turning, and a meaningful bull market now seems underway. So far, this bull market has had very short legs. It’s been choppy. But as interest rates moderate, things could really warm up.

Source: Carson Investment Research

With our real-estate focus, we aim to catch the later stages of this bull market and generate wealth. Growth — with good income — while we wait.

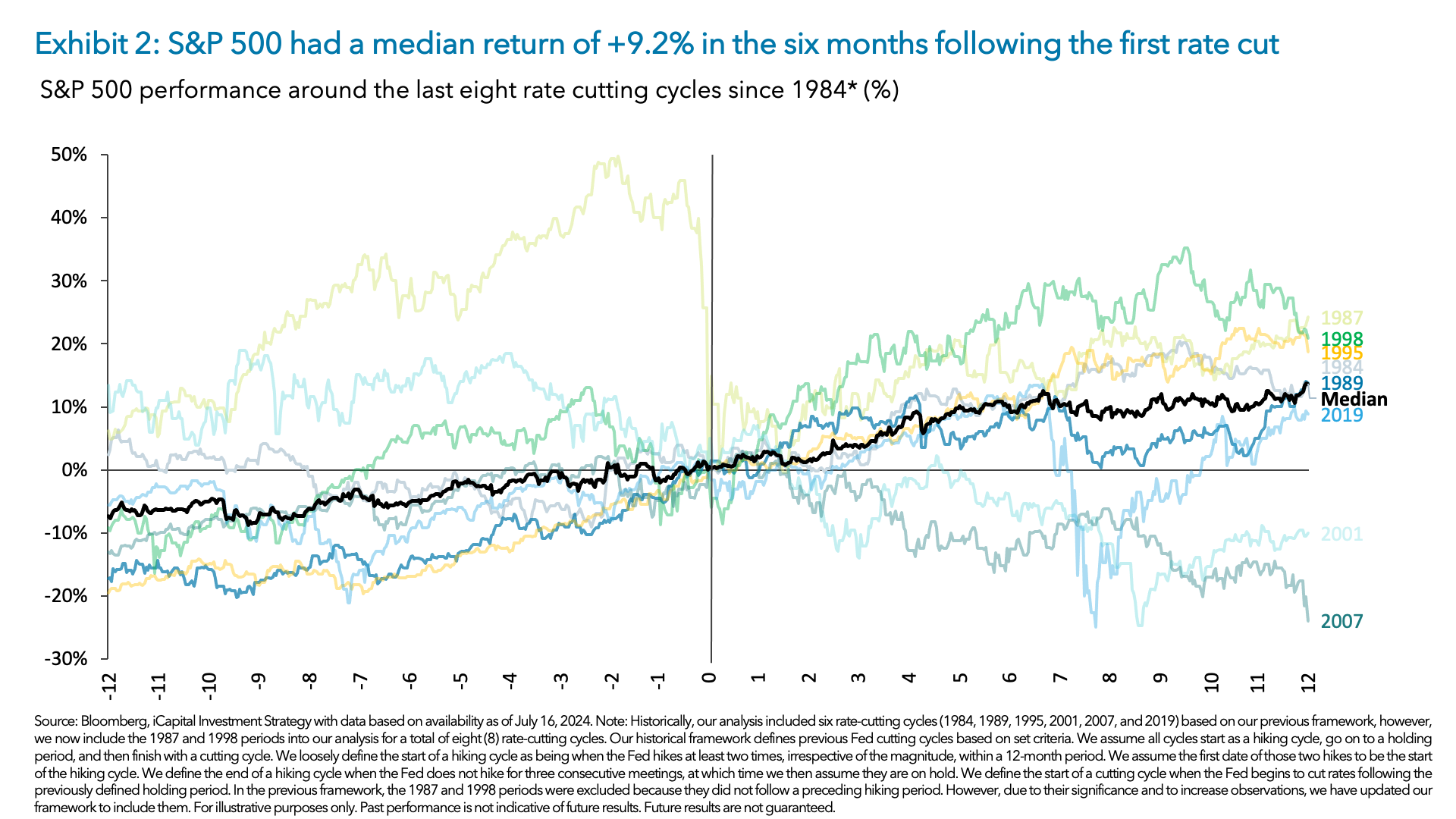

This is one of the best times to invest in such assets, since coming rate cuts fuel the entire stock market. (Particularly for real estate).

Source: iCapital Market Pulse

Portfolios are up meaningfully this month.

Dividends are growing, with some long-standing accounts seeing income yields over 6%.

We’ve got through the longest bear market since 1948.

While there are no guarantees in markets (events can happen), we’re riding what now appears to be the early stage of a very opportune cycle.

Managed Account performance*

For the month of July 2024, we were up 7.90% across the composite portfolio (total aggregate TWR return across all portfolios following the strategy).

Our MSCI EAFE benchmark was up 2.41%.

Our YTD performance is 11.20% (January to June 2024), or 19.20% on an annualised basis.

Our average annualised return since inception is 14.29% p.a.

Please see our performance chart for more details.

The next stage of the cycle?

It’s still early days.

The windows remains open for now.

It’s a great time to invest.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.