I have a vivid and literally shocking memory from my childhood.

When I was about 7 years old, I went to the Hawera A&P Show with my father. Amidst the smell of hot dogs and tomato sauce, the haunted house caught my attention.

Dad bought me a ticket, and in we went. The hallway was dark, and there was something lumpy underfoot. This caused you to grab for the handrail in an instant.

That was when the shock hit like a sharp boot to the ribs. The handrail was electrified!

Well, this was a farming show in the 1980s. Kids like us were quite used to the belt of an electric fence. I’m sure exposure to such risks today would be considered criminal.

But for a haunted house attraction that was otherwise quite lame, this shock set you up for peak fear. The ghosts and ghouls of the remaining rooms took on a new degree of risk. You left the dark house quite terrified. And never the same again.

Now, this is somewhat how I feel, having reviewed The Great Taking by David Rogers Webb. (A high net-worth investor asked me to take a look at this last year.)

Source: eBook cover

It seems, to me, the book is designed to stoke fear. To give you a short, sharp shock on what could go wrong following the financialisation of most paper assets.

I was left with the sense that a plot is in play to confiscate all such assets through nefarious holes in a corrupted system. Even from the wealthy.

This then leads you to the belief that you must now check out of the system. Then what? Will you buy bitcoin, gold, silver, or some other non-financial asset for protection? Will promoters of such use this book as a marketing piece?

But is there some truth in what Rogers Webb is saying?

Well, I can only give an opinion. Some commentary on what I see, having dealt with global securities for over 30 years. Stocks and shares in physical certificated form, direct-registry form, and in nominee accounts.

Rogers Webb begins the work with the resonant truth that isolation has increased due to ‘false news and narrative.’

He also disclaims his work completely with the opening statement:

‘If you prefer, consider this a work of fiction, or the ravings of a madman.’

Certainly, there is a good deal of factual information. But is that, at times, stretched? Why is the author so against the convenience and power of wealth assets?

A former investment management partner, I get the impression he has now moved his wealth out of equities to real property in Sweden.

Here are the key areas I couldn’t agree with…

1) A great depression is on the horizon,

and the velocity of money has begun collapsing

This is exaggerated. Money velocity tends to fall when interest rates are low (as they’ve been for a decade up until now). Low interest rates tend to keep the opportunity cost of holding cash down.

Today, with higher interest rates, velocity appears to be increasing again.

A temporary lower velocity of money is not indicative of a great depression any time soon. No one can really predict crises. Black-swan events that lead to financial crises are seldom predictable.

There is further argument in the book based on the problems with derivatives and asset-backed securities during the GFC. The issues with these instruments are separate from company stocks.

2) Dematerialisation of share certificates

could pave the way to confiscation of collateral

According to the book:

‘There are now no property rights to securities held in book-entry form in any jurisdiction, globally.’

This is incorrect. Here in New Zealand and Australia, many investors buy local shares directly on the register in their own names (without the use of a nominee). Though brokerage can be expensive.

Dematerialisation is the process by which paper certificates for share transactions are converted to electronic records. It enables nominee accounts to be used globally, where a broker-custodian holds your shares for you.

I reject the idea that dematerialisation was some sort of plot to pave the way to confiscate collateral. That makes no sense.

In the old days, it was cumbersome and expensive dealing with physical share certificates. Trading direct on registers was also expensive and slow.

Dematerialistation and broker-custodian-held shares is simpler, cheaper, and opens up a wider range of trading facility — including margin, stop-losses, and smart ordering.

It means that, on registries, you will list large banks or brokers holding the bulk of shares for individual clients as nominees. For example, ‘HSBC nominees’. These nominees are called ‘street names’. That’s the main way through which global shares are bought, held, and sold today.

The book seems to suggest that dematerialised shares held by banks or brokers as nominees could be at risk of debt claims against pooled assets. Segregated accounts within such broker-dealers may not actually be fully segregated.

Failure to segregate accounts would be a serious breach of rules, and financial firms are regularly audited. Brokers are tightly regulated and seldom carry much debt.

Clients have a real owner interest in their shares, which can be proven by trade confirmations, statements, and movement of funds.

SIPC or other backstop mechanisms are not well-covered in the book. SIPC, for example, provides protection in the event of failure of a registered US member broker up to USD $500,000 regardless of the client’s country of residence. Many brokers also carry further insurance.

Much of the discussion that dematerialised shares are up for the taking seems specious. Neither these brokers nor the financial system has any desire or incentive to destroy the very customers they depend on.

I also get the impression, from reading, that brokerage clients of Lehman Brothers Inc. (LBI) lost money or had their assets subverted during the GFC.

This was not the case at all. When Lehman went bankrupt, regulators quickly established that the 83,000 brokerage clients could access their accounts. Then, under the supervision of the SEC and FINRA, Lehman Brothers’ customer accounts were transferred to other brokerage firms for continuation of service; in particular Neuberger Berman and Barclays Capital.

Disruption to either access or trading seems to have been fairly minimal for clients. As noted in Liberty Street Economics: ‘The rapid transfer of customer accounts to rival broker-dealers suggests that opportunity costs to LBI customers were small.’

3) Assets (even of the wealthy) can be taken

when debt exceeds their value

This has always been the case. If the market falls and you hit your margin limits, you will start getting margin calls. Should you not be able to meet those calls, your assets may be sold at a loss. This is why we tend to use minimal debt when buying equities.

Wider discussion around the ‘global financial complex’ represents it as ‘a big perpetuity’, with the prices of all assets being driven by interest rates.

The Fed is blamed for creating the ‘Everything Bubble’ when interest rates were lowered to fight the GFC. These interest rates have now been increased, threatening the bubble.

Actually, devaluations in asset prices have not been especially severe. In the case of many property companies, occupancy and rents have held up reasonably well.

On one hand, the book predicts deflation, but then notes the Fed has not yet lowered interest rates despite bank failures. If he’s right on deflation, interest rates would then come down again.

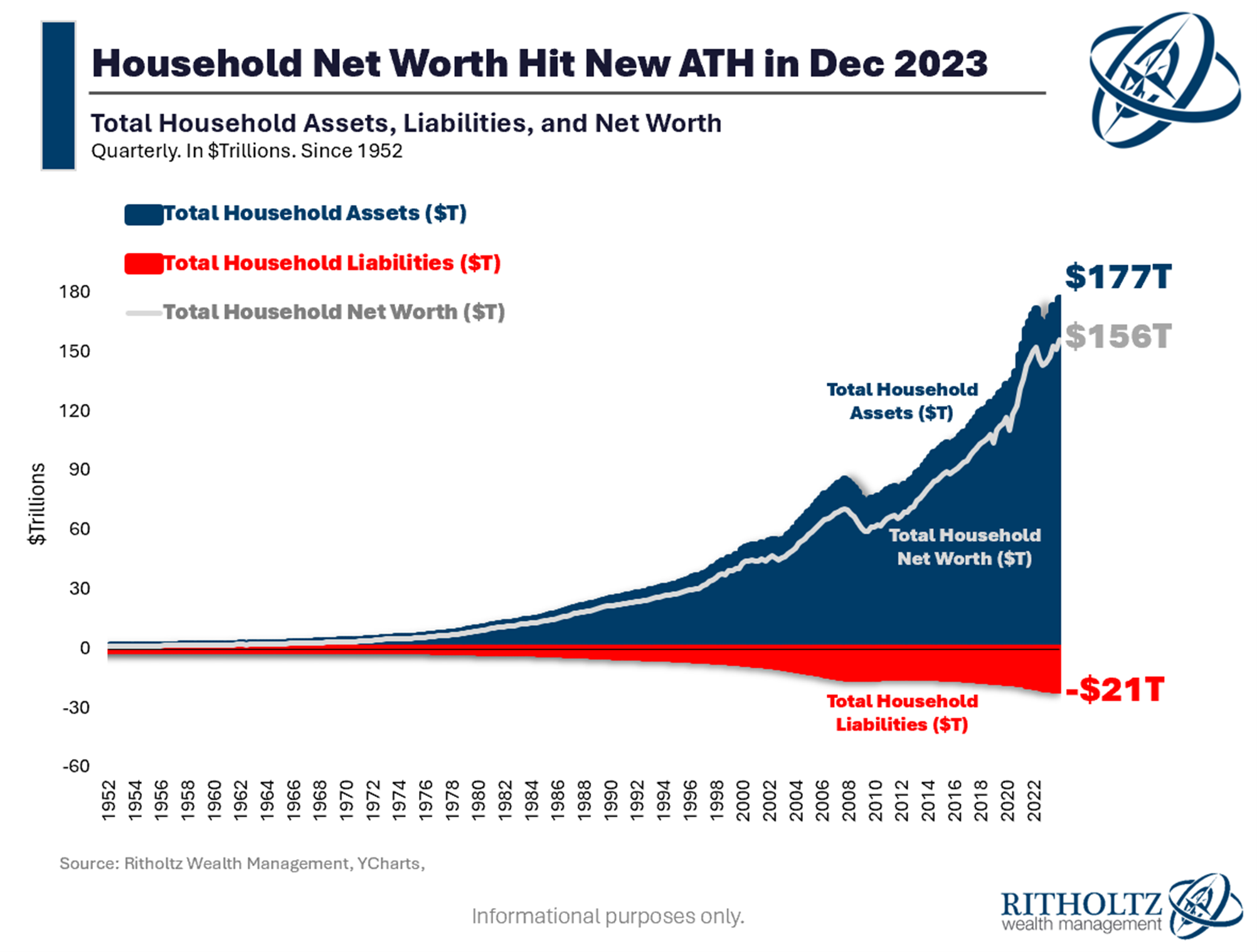

Finally, this graph disproves pretty much his entire premise:

Source: A Wealth of Common Sense

The value of assets people own has increased at a far greater pace than any of the debt that may be supporting them.

Perhaps the author has missed the forest, because he’s too fixated on the trees.

The bottom line

There’s a tone, an undercurrent in The Great Taking, of existential fear and loss.

Real financial commentary, discussion, and even advice should not try to scare you. Nor should it offer direct predictions. Instead, it should offer perspective.

In my view, The Great Taking verges on fearmongering, with some degree of fact.

It is an entertaining read and is well-written. Even enjoyable to escape into a world of cataclysmic fear. But from where I’m sitting, the work tends toward catastrophising. It is not accurate.

I’m sure many will come away with yet another sense that the world is in trouble due to overleveraging. Hence, such readers may conclude that it’s time to leave the system altogether.

But these slivers of threat are not the truth. Every company and situation are different. Today, the average person in the developed world has better and more reliable access to financial markets than ever before. Those markets are generally well-ordered and regulated.

Actually, they present great opportunity for the prudent.

Are you looking for someone to stand up for you?

Here at Wealth Morning, we run a night-trading desk focused on global markets. We aim to build up defensive and income-rich portfolios for our Eligible and Wholesale Clients.

Have you previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity. I encourage you to reach out at this pivotal time.

You’ll always miss 100% of the shots you don’t take.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.