A friend called the other day while I was making coffee.

He is an experienced investor, and we often discuss the markets.

‘Now, here’s a question for you,’ he said. ‘One that I’m wondering over, and many of your readers and clients likely will be too.’

I frothed the milk.

He asked, ‘When is the best time to get out of your term deposit and put the money into something more meaningful?’

I poured the hot milk over the espresso. ‘Four weeks ago,’ I said.

OK, I’m biased. I’m a share-market guy who believes in productive assets. To my way of thinking — and this is general opinion and commentary (not advice):

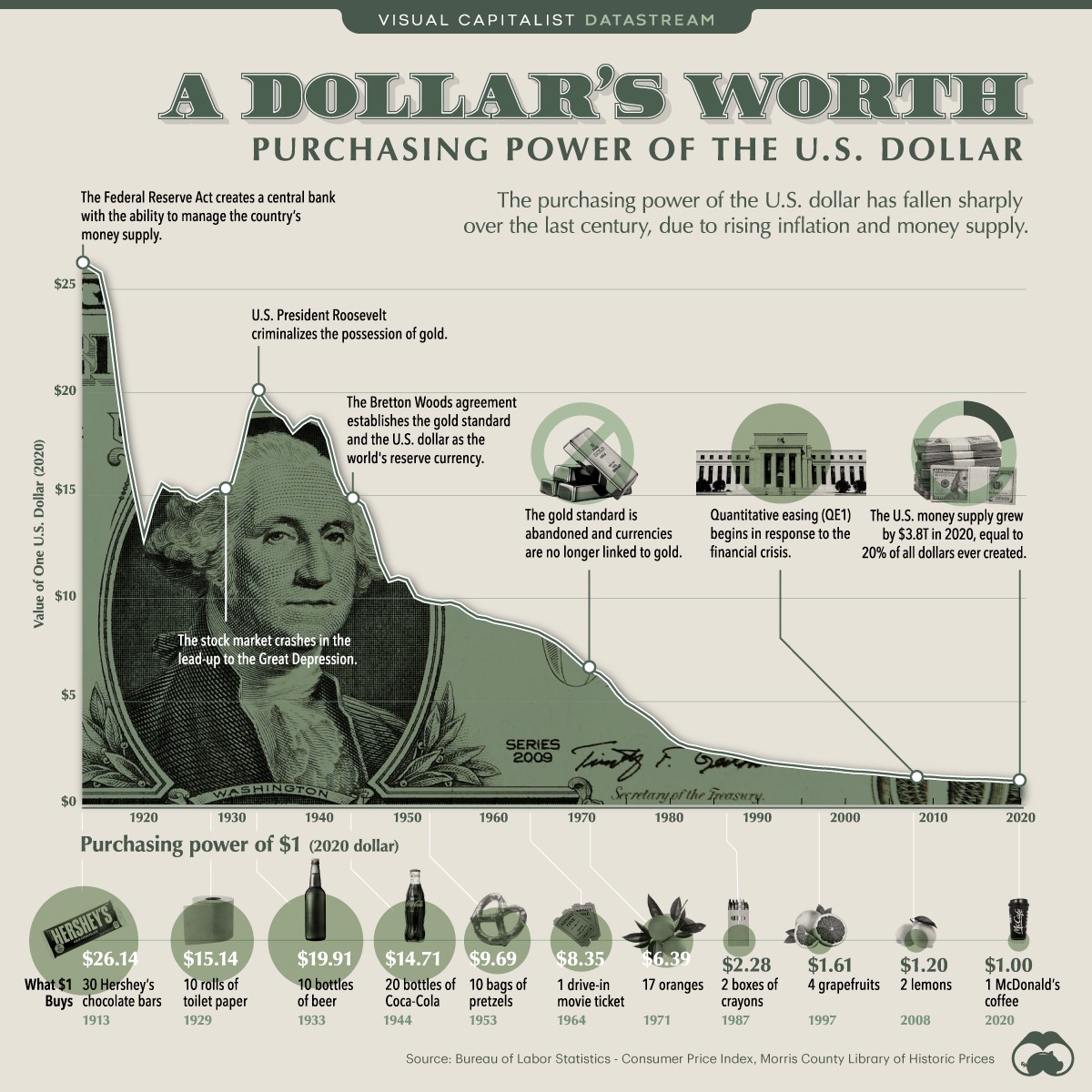

- Cash erodes with persistent (at times pernicious) inflation.

- Gold is good but is unproductive and depends on someone willing to pay more than you for the last ounce. Ditto Bitcoin. While both are up significantly this past year — so too are stock indexes.

- Property is good too, but only if it’s large-scale enough to produce a decent yield and the location can ensure swift capital growth. Inevitably, this often means it’s better bought inside listed businesses.

- Quality businesses on the stock market bought at key intervals below their intrinsic value make the most sense to me.

If you don’t believe me on how much cash erodes (even when earning the best interest rate of the day), take a look at this:

Source: Visual Capitalist

If that doesn’t encourage you to invest, I’m not sure what will.

Of course, going into the market involves some risk. There is the ever-present risk of a black swan. Some sort of crash you can’t see coming.

Then again — as my colleague John Ling pointed out — there are far more white swans than black swans. In fact, with interest-rate cuts coming, term-deposit holders will likely see a snip in due course, while equity holders get a boost.

For our wholesale account clients, a lot of the investing we do is not chasing the latest high-risk growth story. Rather, we seek margin of safety by buying stocks that are undervalued. We do our homework. If a black swan does come, we should be in a relatively defensive position.

Value investing often has a preference for dividends. Certainly, I do. Regular payment of dividends from a quality business is an ongoing sign of its good health and strong cash-generative power. Further, these dividend payments tend to keep ahead of inflation.

Though, fair warning; they can be cut in tough times. For example, many property companies did have to suspend dividends due to the pandemic. Yet most of these have now been reinstated, providing excellent yields on those who bought the pain.

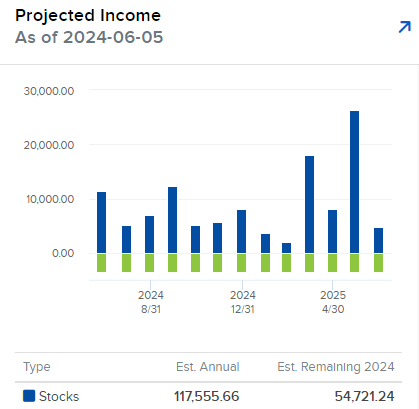

The key to financial freedom is to build a regular source of passive income. Our wholesale managed accounts have a very useful feature. It’s called ‘Projected Income’. Here is an anonymous example from one of the wholesale portfolios we manage:

Yes, this portfolio is expected to earn almost $120,000 in dividend income this year. That reflects an approximate yield of over 6.7%.

Now, this investor didn’t begin with that yield (or this level of funds). Yields probably averaged around 5% to begin with. But the dividends grew ahead of inflation. The investor now has the pleasing position of assets enjoying both capital growth and passive income. That’s a sweet spot.

Yes, 2024 has been a good year for the reinstatement and growth of dividends. And it would be remiss not to point out that these were probably halved during the pandemic. There are no absolute guarantees.

There are also some advantages with this individually managed-account situation

It is invested globally, so diversified in a wider array of countries and industries. Away from the problems facing New Zealand.

While most fund investors (and KiwiSaver) are subject to PIE tax — for example, at 28% on earnings — global investments come under the FIF regime. It’s outside our scope to get into that here. Suffice to say that a well-yielding portfolio may enjoy possible tax benefits.

Cash is not always king. Good quality assets rule. Especially those that can produce reliable passive income.

Are you looking for someone to stand up for you?

Here at Wealth Morning, we run a night-trading desk focused on global markets. We aim to build up defensive and income-rich portfolios for our Eligible and Wholesale Clients.

Have you previous experience in investing?

Are you a sophisticated investor?

Or have you built significant wealth?

All these characteristics could qualify you as an Eligible or Wholesale Investor for a managed account under our strategy. The assets remain in your name, and you retain full ownership and custody of your assets.

We are currently offering free consultations on this opportunity. I encourage you to reach out at this pivotal time.

You’ll always miss 100% of the shots you don’t take.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Please contact a licensed Financial Advice Provider to discuss your personal situation. Past performance does not indicate the future and dividend income is not guaranteed. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.