The almighty US dollar is softening somewhat. Traders now see an 89% chance of a rate cut in September.

While the 2% inflation war has not yet been won, the Fed’s battleground is looking successful. Meanwhile, the S&P 500 is up over 18% since the start of the year.

Much of these gains have come from leading tech stocks.

Are these now getting too toppy? The Fed seems to think so, warning last week that ‘valuations are high relative to fundamentals in major asset classes.’

Of course, a rate cut could fuel technology even further, at least in the short-run. Meanwhile, a cheaper US dollar could provide an opportunity for buying.

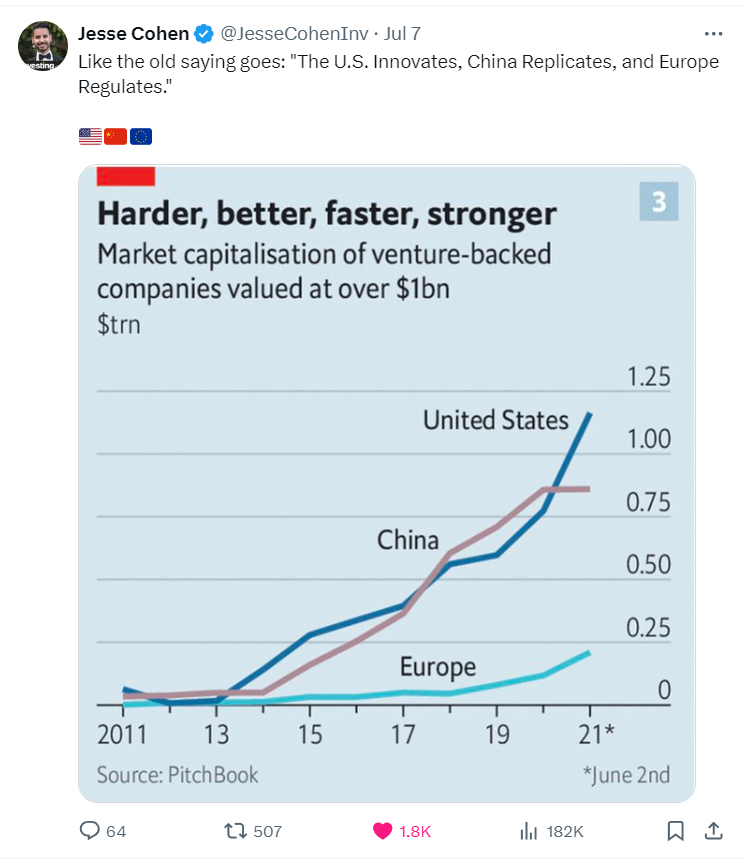

Today, the US is the most important investment destination for innovation:

Source: Jesse Cohen / X

Some of the venture-backed companies referenced above could soon make their way to public markets via IPOs and SPACs (special purpose acquisition companies).

Meanwhile, amongst existing market listings, innovation in technology continues to lead the market.

Invesco’s QQQ ETF is one fund focused on providing ‘exposure to companies at the forefront of innovation across a diverse range of sectors…’

It tracks the Nasdaq-100 index — the 100 largest non-financial companies listed on the Nasdaq.

This year, it is up almost 23% — around 5% ahead of the S&P 500.

But is it due for correction?

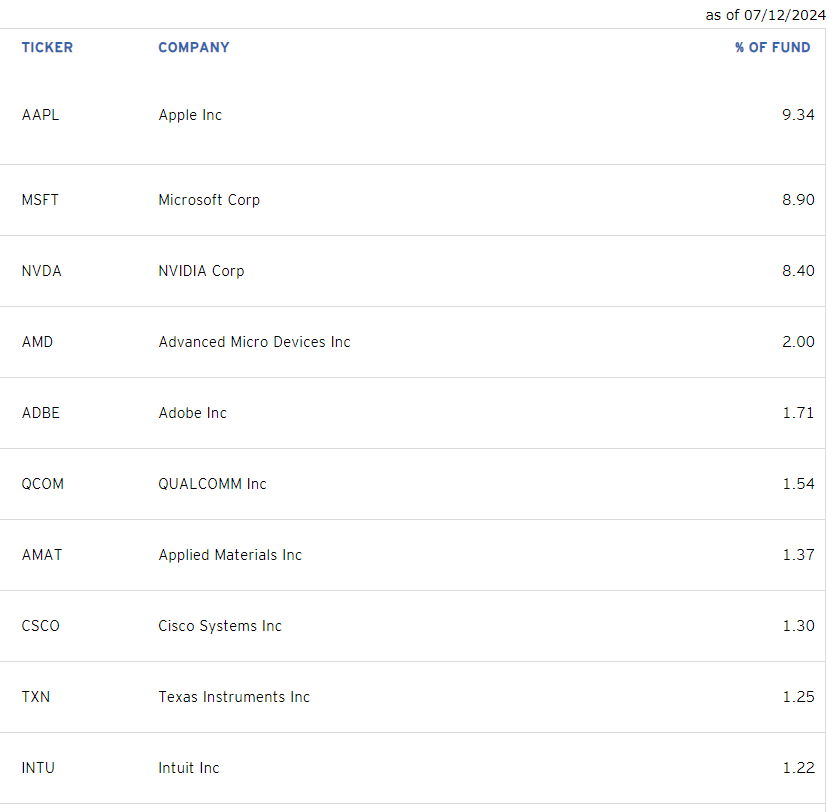

Here are the current top-10 holdings which have driven the bulk of the return:

Source: Invesco QQQ as of 12 July, 2024

These top-10 holdings have transitioned from earlier this year to now have a 50% focus on semiconductors.

Nvidia [NVDA] and Broadcom [AVGO] both have a P/E of over 70. As we’ve mentioned before, this looks high. Even risky, given potential competition from other players trading at cheaper multiples.

Overall, the QQQ fund has an average P/E of over 34, and a dividend yield of less than 0.5%.

In other words: this set of businesses is expected to grow very rapidly — ideally 50% or more. Otherwise, they might look pretty overvalued.

I’m interested in which businesses have already dropped out of the top 10. In fact, in March 2024, one top-10 business had a history of driving a lot of return. Then, in April, its value was slashed dramatically when it disappointed the market.

It is now on a tear again, with the promise of a renaissance in the innovation it is known for.

Is this the world’s smartest company?

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.