What happens when infatuation turns to obsession?

And what happens when obsession becomes murderous intent?

This is exactly what took place in the spring of 1981. The lives of three people would tragically collide, becoming forever intertwined.

Source: Michael Evans / Wikimedia Commons

The first person was Ronald Reagan:

- He was a former actor and television presenter who had developed a reputation for being a passionate anti-communist. This led him into politics, and he had served as the governor of California for two terms. Now, at the age of 70, he was taking up the mantle as the 40th president of the United States.

The second person was Jodie Foster:

- She was a child model-turned-actress who had found fame in movies such as Tom Sawyer and Taxi Driver. Now, at the age of 18, she was taking time off from her career to attend Yale University to study literature.

The third person was John Hinckley Jr:

- Unlike Reagan and Foster, he had found no success in show business. He was a failed songwriter with a history of depression. Now, at the age of 26, he had developed an unhealthy obsession with Jodie Foster after watching her in the movie Taxi Driver. He wrote love letters to her and called her on the phone — but she had rebuffed him.

Desperate, Hinckley decided that he needed to become famous to gain Foster’s approval. In his mind, the assassination of a public figure felt like the best way to do it:

- So, during 1980 presidential election, Hinckley began stalking Jimmy Carter — the serving president at the time — as he travelled from state to state. Reportedly, at one point, Hinckley got as close as 20 feet to Carter during a campaign rally in Dayton, Ohio.

- Eventually, Hinckley eventually ran afoul of the law in Nashville, Tennessee. That’s when police arrested him for trying to board a flight with three handguns in his luggage. Because Hinckley had no prior convictions, the authorities went easy on him. They simply confiscated his weapons, fined him, and released him.

But Hinckley was undeterred. He would set his sights on Reagan next. To him, this felt like the logical choice, especially after Reagan had defeated Carter during the presidential election:

- So, in March 1981, Hinckley ambushed Reagan as he was leaving the Hilton Hotel in Los Angeles. Hinckley simply walked right up to the president’s entourage. Firing all six rounds from his .22 revolver in quick succession.

- Several people were hit — including Reagan, who received a bullet under the left armpit. The projectile grazed his rib, lodging itself in his lung, narrowly missing his heart.

- The president began coughing up blood and was rushed to hospital. He spent over two hours in urgent surgery — while the nation reeled in shock.

How did the stock market react? Well, here’s how The New York Times reported on the aftermath. This is taken directly from their archives, dated March 31, 1981:

The stock market closed slightly lower yesterday in a trading session abbreviated by the assassination attempt upon President Reagan in Washington. Prices had been moderately higher until it was confirmed that the President had been wounded in the attack.

The New York Stock Exchange stopped trading at 3:17 P.M. and the American Stock Exchange one minute later, just after it was announced officially that the President had been shot in the chest after leaving a downtown Washington hotel. The regional stock exchanges and the over-the-counter market stopped trading shortly thereafter.

Yes, the trading session was suspended in light of the shooting. To give everyone a breather. A chance to pause and reflect. The Dow Jones fell slightly, closing the day down by 0.26%.

- However, what is striking is what happened in the day after, on April 1, 1981. The Dow Jones staged a sharp rally, climbing 1.18%.

- The market not only recovered its losses, but it even approached its best level for the year. It would go on to climb over 7% in the days that followed.

Of course, Reagan not only survived the attempt on his life, but he would come out stronger from it:

- In the immediate aftermath of the shooting, Reagan’s approval ratings would soar by eight points, reaching almost 70%.

- He would oversee the ending of the Cold War, as well as shepherding the American economy to ever greater heights. His legacy is beyond question.

- Meanwhile, John Hinckley Jr — Reagan’s would-be assassin — would be held in psychiatric confinement for over 40 years. He was only released in 2022. He lives in relative obscurity, performing music to limited audiences. He has never achieved the fame and attention he so desperately sought.

- Finally, Jodie Foster would find growing success in her career as an actor and director. However, the trauma of the assassination attempt did leave its mark on her. In an interview published in June 2024, she admitted that her memories of university would forever be tainted by Hinckley’s dark actions.

Source: Bloomberg

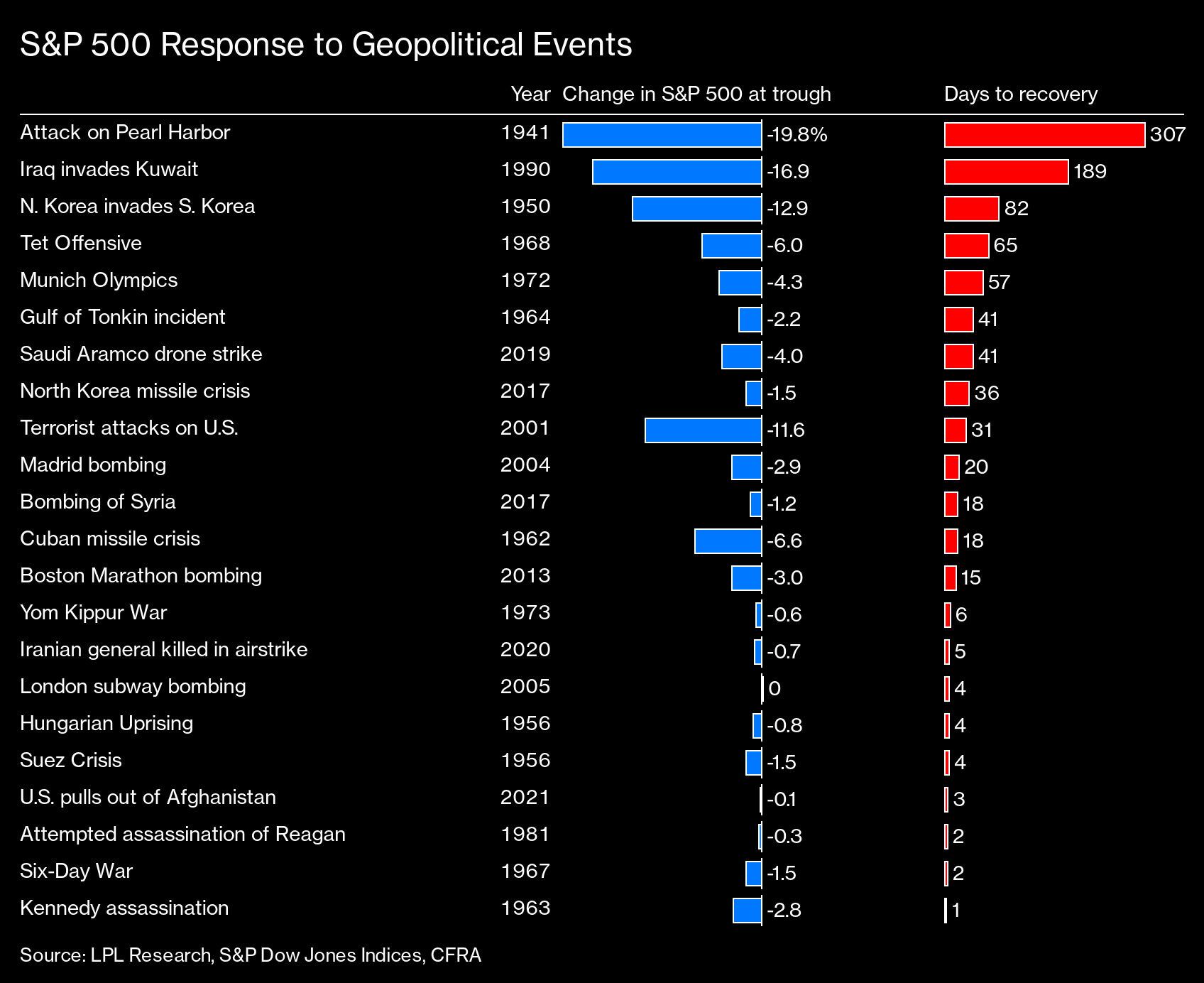

So, as investors, what lessons can we learn from Reagan’s assassination attempt in 1981?

- Well, for one thing, history tells us that geopolitical news doesn’t sway the market for very long. This is because the market has this uncanny ability to digest all available information, then immediately price ahead and move forward. This tends to happen quicker than most people think.

- Most individual companies aren’t affected during an assassination attempt. If anything, stocks related to a presidential candidate’s election chances may actually receive a boost in the aftermath.

- Indeed, in the short-term, geopolitics is simply a blip on the radar. In the longer term, the market is actually more concerned with strategic issues — corporate earnings, inflationary pressure, and interest rates. Certainly, moving forward, this is what will drive the agenda for most investors.

- So, when it comes to the stock market, emotions are best kept in check. The temptation to click ‘SELL’ during a crisis may be strong. But fund manager Peter Lynch believes it’s the wrong move. He says: ‘Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.’

- It’s important to note that all storms — even the most turbulent ones — eventually pass, giving way to brighter days ahead. The trick is to look beyond the fear.

Are you still feeling concerned?

- Well, if you are, you can always reach out to me at cs@wealthmorning.com

- I can’t give you personal financial advice. However, I’m always happy to have a chat with you about the state of the world.

- Meanwhile, stay resilient. Continue investing. This is the name of the game.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

Subscribe Now

Subscribe Now Login

Login Managed Accounts

Managed Accounts Quantum Wealth

Quantum Wealth

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.