In this present crisis, government is not the solution to our problem; government is the problem.

—Ronald Reagan

The year was 1954.

Bernard Garrett was a businessman in Los Angeles.

He was incredibly ambitious.

He had a talent for buying and developing residential properties in emerging areas. By doing this, he had built up a net worth of USD $1.5 million (the equivalent of USD $17.5 million in today’s money).

But Garrett didn’t plan on stopping there. He had bigger dreams. He wanted to venture into the banking sector. This move promised huge opportunity…but also huge risk.

What’s remarkable about Garrett’s journey is this: he was black, and he was building wealth at a time when Jim Crow laws were still being enforced in America.

So how, exactly, did Garrett get around this problem?

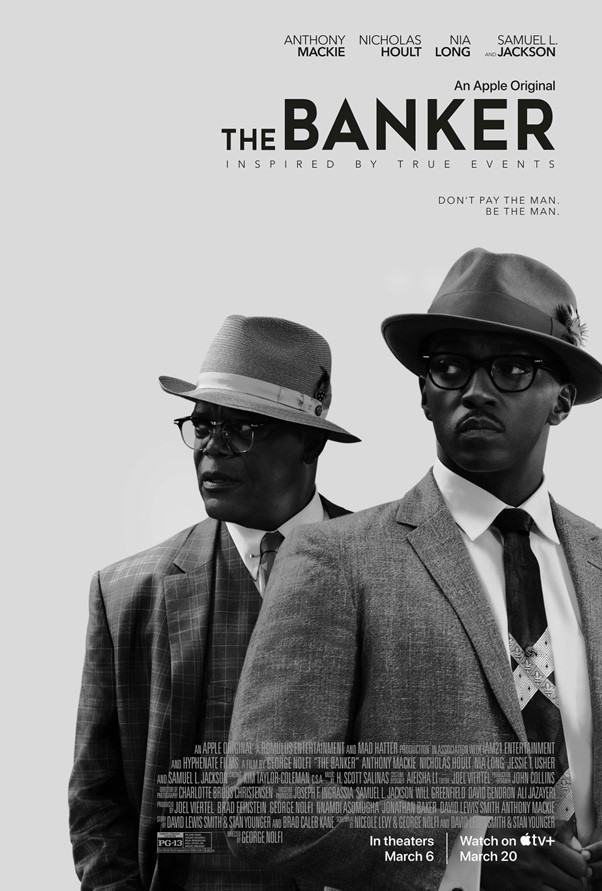

Source: IMDB

Garrett’s story is dramatised in the film The Banker:

- It shows how Garrett sidestepped racial prejudice. Ingeniously, he did it by taking on a white business partner to act as a ‘frontman’. This allowed Garrett to not only do business in Los Angeles, but also to bring about positive change.

- At the time, the black community was segregated. Lacking access to good housing. So, Garrett catered to their needs by buying property in desirable locations, then rented these quality homes to them at fair prices.

- By doing this, Garrett desegregated neighbourhoods, closing the racial gap, levelling the playing field.

Later, in 1964, Garrett would set his sights higher. He wanted to expand his business empire. He did this by buying a bank in Texas:

- Garrett had a very personal reason for making this move. You see, Texas was originally the place of his birth. He had grown up poor there. He had been forced to leave due to a lack of opportunity. But now, he saw a need to return.

- Black people down south were still struggling to buy homes in desirable neighbourhoods. At the time, many banks had a policy of ‘redlining’. Denying loan applications from blacks. Actively blocking them from advancing in society.

- So, what was the solution to this? Well, Garrett strongly felt that acquiring a bank was the first step. He would use it to challenge and reform unfair practices. He would open the market up for black participation.

Unfortunately, Garrett’s idealistic dreams quickly collided with harsh reality:

- Soon enough, he made enemies in Texas, and the ill feelings escalated. The authorities decided that he had violated federal banking laws. They charged him for misapplying $189,000 in bank funds.

- In 1967, Garrett was sentenced to three years in prison. However, in a stroke of good luck, he only served nine months before being pardoned by President Lyndon Johnson.

- This experience was a bitter pill to swallow. Still, it didn’t stop Garrett from doing what he loved most. Upon his release from prison, he would continue to engage in business. Still passionate. Still enthusiastic. Doing his bit to open the market up. As they say, you can’t keep a good man down.

In 1999, Bernard Garrett passed away at the age of 73. He had left his mark as one of the most resilient black entrepreneurs of his generation:

- What was Garrett’s greatest strength? Well, he understood the transformative power of finance. He knew that it could change the African-American experience. Give the oppressed a real shot at uplifting themselves. Allow them to capture long-term wealth.

- He didn’t wait for a government handout. He didn’t virtue-signal. Instead, he saw a need, and he used his entrepreneurial ability to come up with an answer.

- In Garrett’s wise words: ‘The only time a man is really truly rich is when he controls money.’

A lesson for our modern-day problems?

Of course, there’s no hiding it. We live in a time when everyone has strong opinions about the way that our economy should work:

- One of the biggest hot-button issues is poverty. When there’s poverty in our society, it’s natural to feel frustrated. And out of that frustration, people will tend to say, ‘The government should do something about poverty…’

- The assumption here is that social programmes must be devised. Elite bureaucrats must be put in place. Public spending must be ramped up.

- But there’s a catch here. What happens when you give the government a big hammer? Well, chances are, they will spend all their time going around, looking for nails, smashing them down.

- This is a recipe for inefficiency at best, collateral damage at worst. Why? Because the government tends to have lousy aim. Missing most of the time. Hitting the wrong targets.

So, here’s a contrarian idea. Maybe it’s not the government’s role to act as our economic messiah. Maybe our best hope for salvation has been hiding in plain sight all along:

- It’s actually private enterprise — unshackled, uncensored, deregulated — that is the best vehicle to get us from Point A to Point B.

- When you have a free market filled with free entrepreneurs, ever so often, a brilliant mind like Bernard Garrett will emerge. Defying the odds. Being agile. Coming up with real solutions to help his community out of poverty.

- So, as society, I suspect that we might function best if we support — not sabotage — the aspirations of entrepreneurs like Garrett.

- In a world already swimming in so much regulatory red tape, perhaps the last thing we want to do is give the government an even bigger hammer to whack us with.

So, how do you feel about this?

- Is the transformative power of private enterprise the answer to society’s problems with poverty? Is it better than the public service? Am I right? Or am I wrong?

- I’d love to hear your thoughts on this issue. You can reach out to me at [email protected]

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning offers Managed Account Services for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.